This version of the form is not currently in use and is provided for reference only. Download this version of

Form NJ-1040 Schedule NJ-COJ

for the current year.

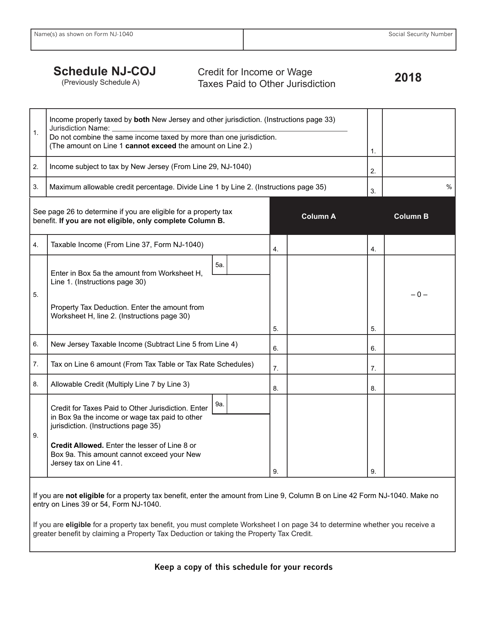

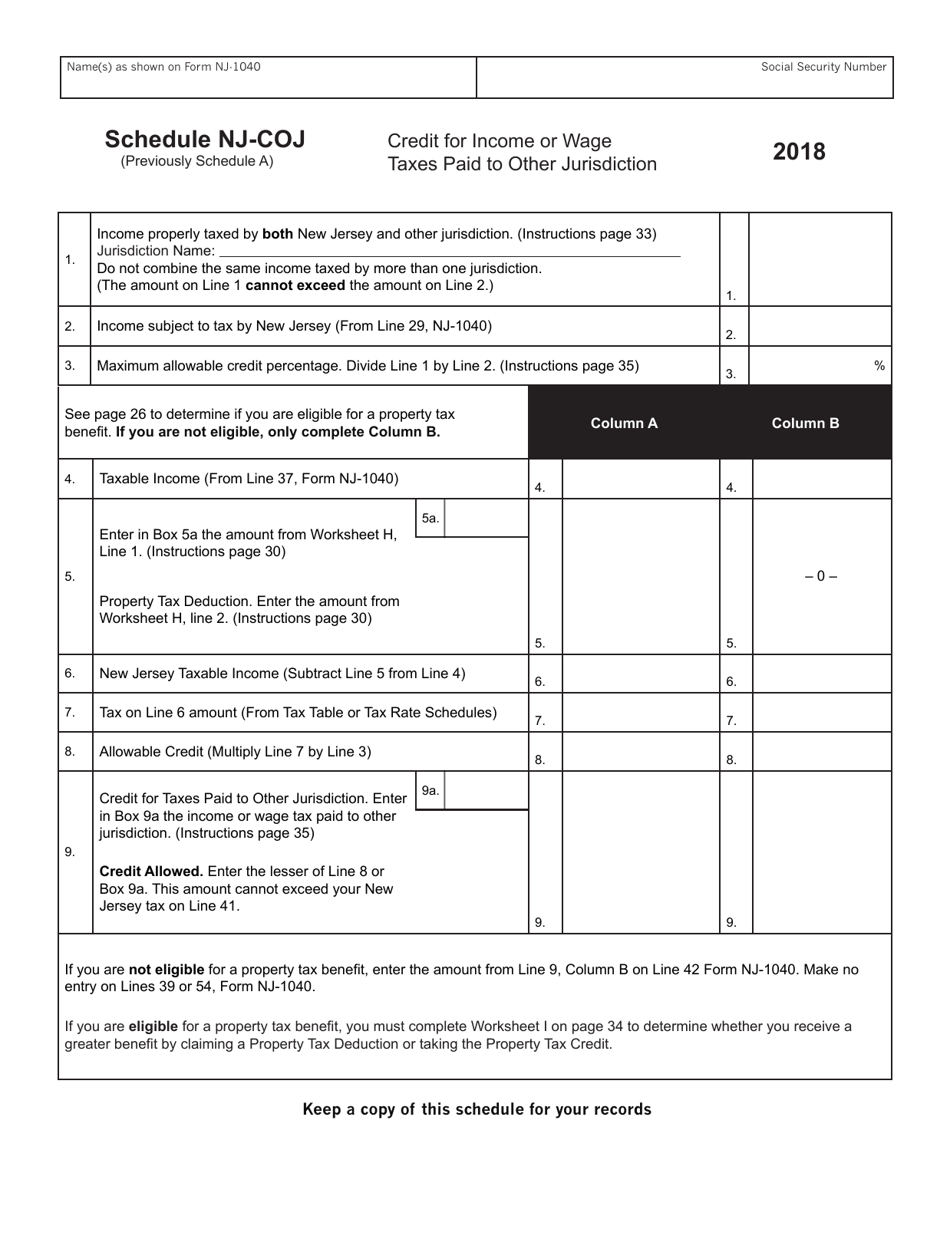

Form NJ-1040 Schedule NJ-COJ Credit for Income or Wage Taxes Paid to Other Jurisdiction - New Jersey

What Is Form NJ-1040 Schedule NJ-COJ?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form NJ-1040, Resident Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1040 Schedule NJ-COJ?

A: Form NJ-1040 Schedule NJ-COJ is a tax form used by residents of New Jersey to claim a credit for income or wage taxes paid to another jurisdiction.

Q: Who should file Form NJ-1040 Schedule NJ-COJ?

A: Residents of New Jersey who have paid income or wage taxes to another jurisdiction may need to file Form NJ-1040 Schedule NJ-COJ.

Q: What is the purpose of Form NJ-1040 Schedule NJ-COJ?

A: The purpose of Form NJ-1040 Schedule NJ-COJ is to allow taxpayers in New Jersey to claim a credit for income or wage taxes paid to another jurisdiction, reducing their overall tax liability.

Q: What information is required on Form NJ-1040 Schedule NJ-COJ?

A: Form NJ-1040 Schedule NJ-COJ requires taxpayers to provide details about the taxes paid to another jurisdiction, including the name of the jurisdiction, the type of tax paid, and the amount paid.

Q: How do I file Form NJ-1040 Schedule NJ-COJ?

A: Form NJ-1040 Schedule NJ-COJ should be filed along with Form NJ-1040, the New Jersey resident income tax return.

Q: Is there a deadline for filing Form NJ-1040 Schedule NJ-COJ?

A: Form NJ-1040 Schedule NJ-COJ should be filed by the same deadline as the New Jersey resident income tax return, usually April 15th.

Q: Are there any limitations or restrictions for claiming the credit on Form NJ-1040 Schedule NJ-COJ?

A: Yes, there are limitations and restrictions for claiming the credit on Form NJ-1040 Schedule NJ-COJ. Taxpayers should refer to the instructions provided with the form for specific details.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 Schedule NJ-COJ by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.