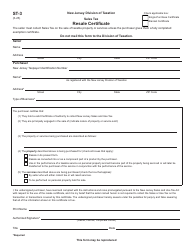

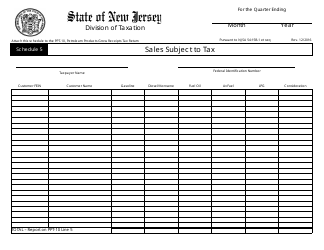

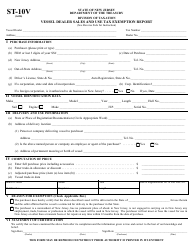

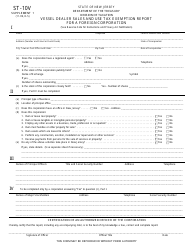

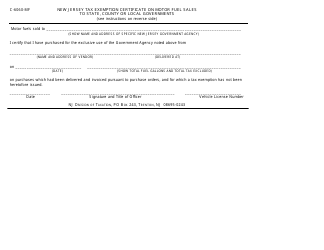

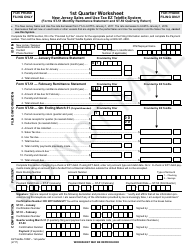

Form ST-50-EN Sales and Use Tax Energy Return - New Jersey

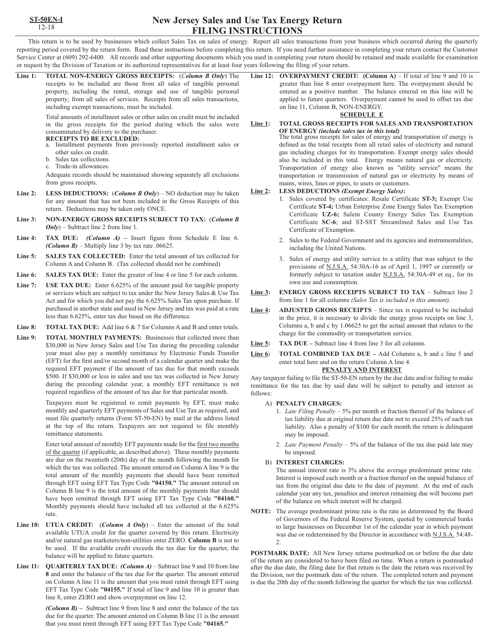

What Is Form ST-50-EN?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-50-EN?

A: Form ST-50-EN is a Sales and Use Tax Energy Return specific to New Jersey.

Q: What is the purpose of Form ST-50-EN?

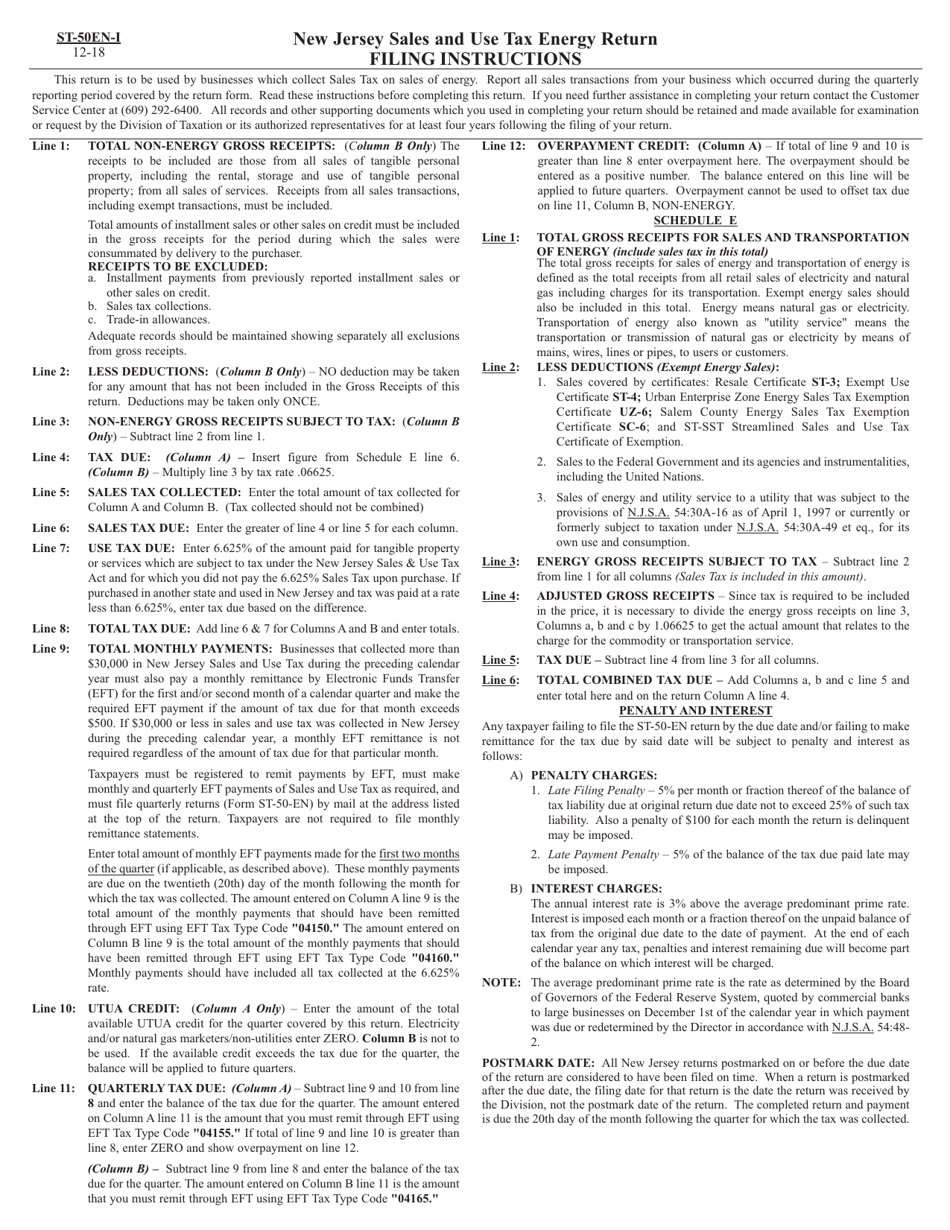

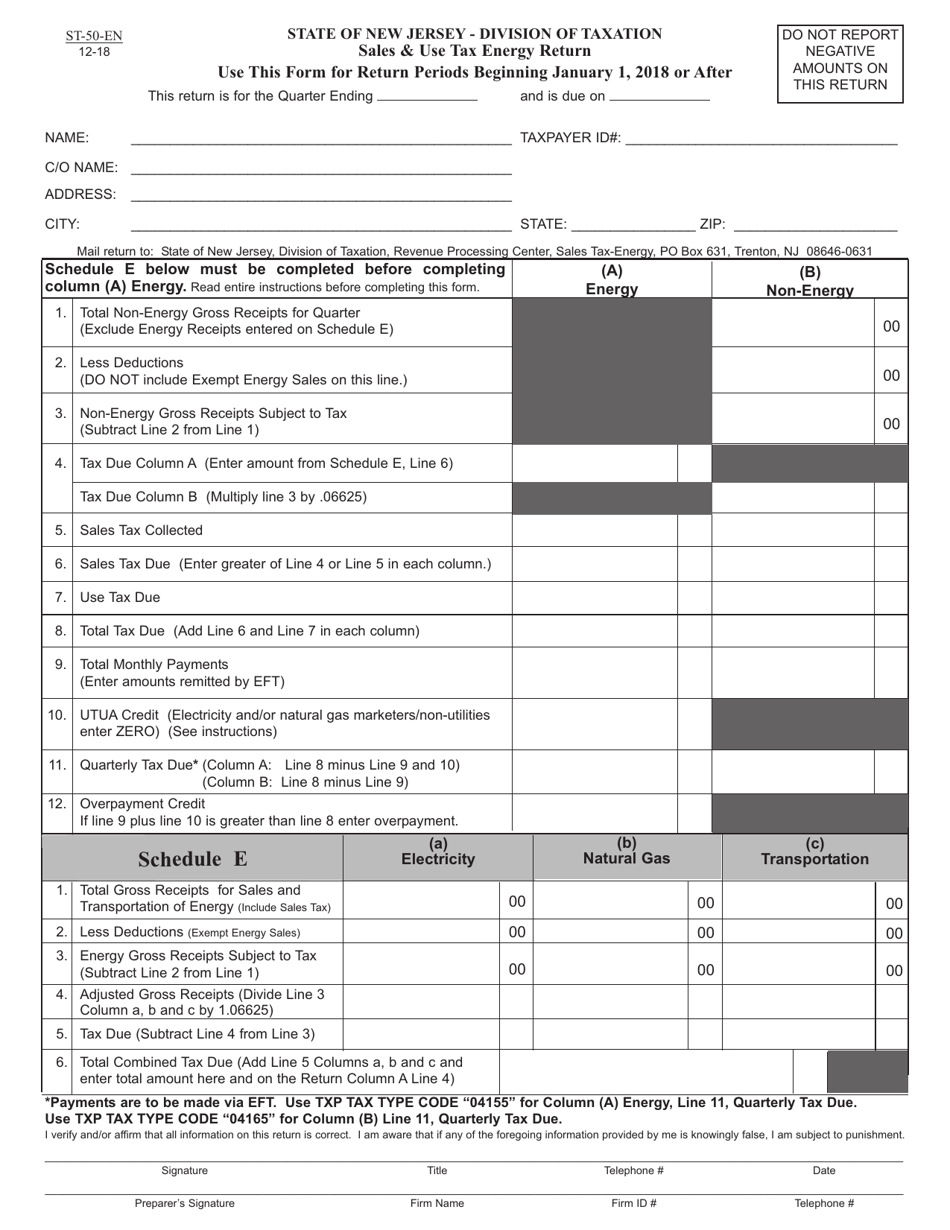

A: The purpose of Form ST-50-EN is to report and pay sales and use tax on certain energy-related purchases in New Jersey.

Q: Who needs to file Form ST-50-EN?

A: Businesses in New Jersey that purchase energy-related products or services subject to sales and use tax must file Form ST-50-EN.

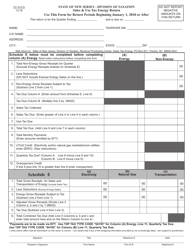

Q: What should be reported on Form ST-50-EN?

A: Form ST-50-EN should be used to report taxable purchases of energy-related products or services, such as electricity and natural gas.

Q: When is Form ST-50-EN due?

A: Form ST-50-EN is generally due on a quarterly basis, with specific due dates provided by the New Jersey Division of Taxation.

Q: Are there any penalties for not filing Form ST-50-EN?

A: Yes, failure to file Form ST-50-EN or pay the required sales and use tax on energy purchases may result in penalties and interest.

Form Details:

- Released on December 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-50-EN by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.