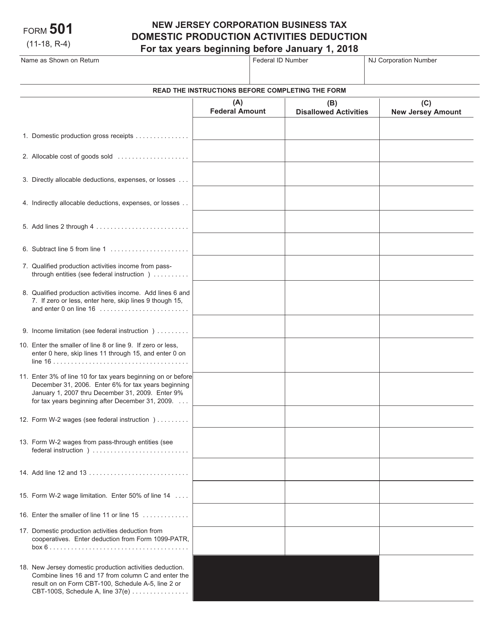

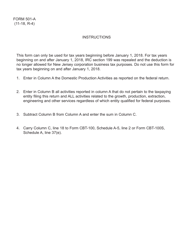

Form 501 Domestic Production Activities Deduction - New Jersey

What Is Form 501?

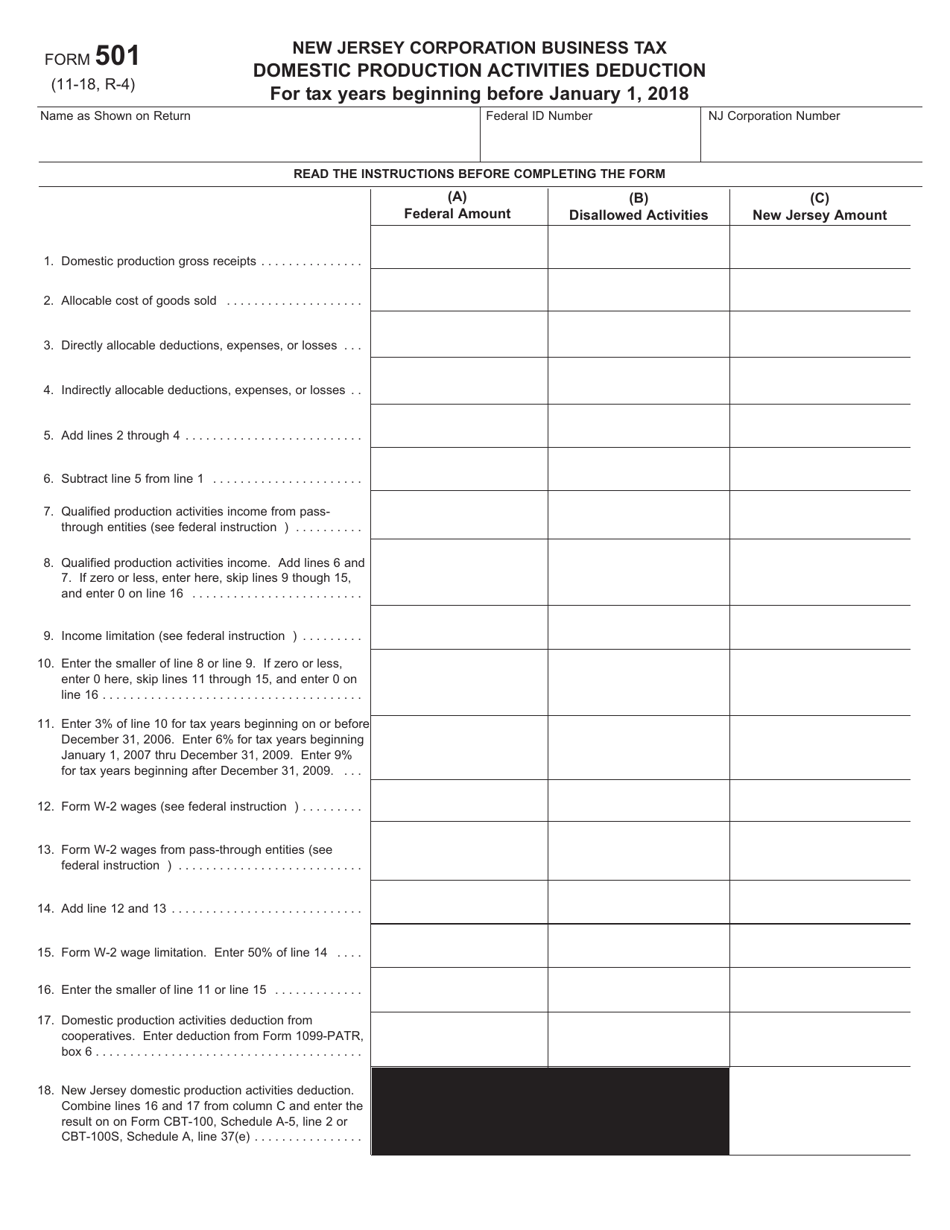

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 501?

A: Form 501 is used to claim the Domestic Production Activities Deduction.

Q: What is the Domestic Production Activities Deduction?

A: The Domestic Production Activities Deduction is a tax incentive for businesses that produce goods in the United States.

Q: Who can claim the Domestic Production Activities Deduction?

A: Businesses engaged in activities such as manufacturing, construction, engineering, and software development may be eligible to claim this deduction.

Q: What is the purpose of Form 501?

A: Form 501 is used to calculate and report the amount of the Domestic Production Activities Deduction that a business is eligible for.

Q: Is Form 501 specific to New Jersey?

A: No, Form 501 is a federal tax form that is used by businesses nationwide to claim the Domestic Production Activities Deduction.

Form Details:

- Released on November 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 501 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.