This version of the form is not currently in use and is provided for reference only. Download this version of

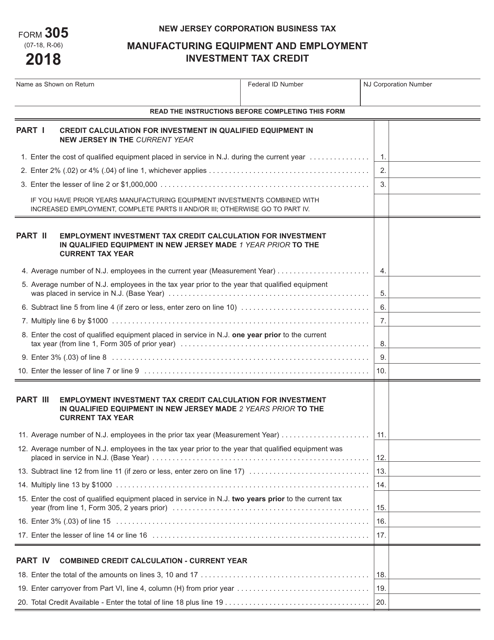

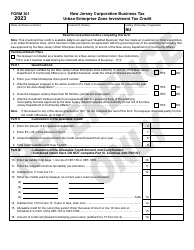

Form 305

for the current year.

Form 305 Manufacturing Equipment and Employment Investment Tax Credit - New Jersey

What Is Form 305?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 305?

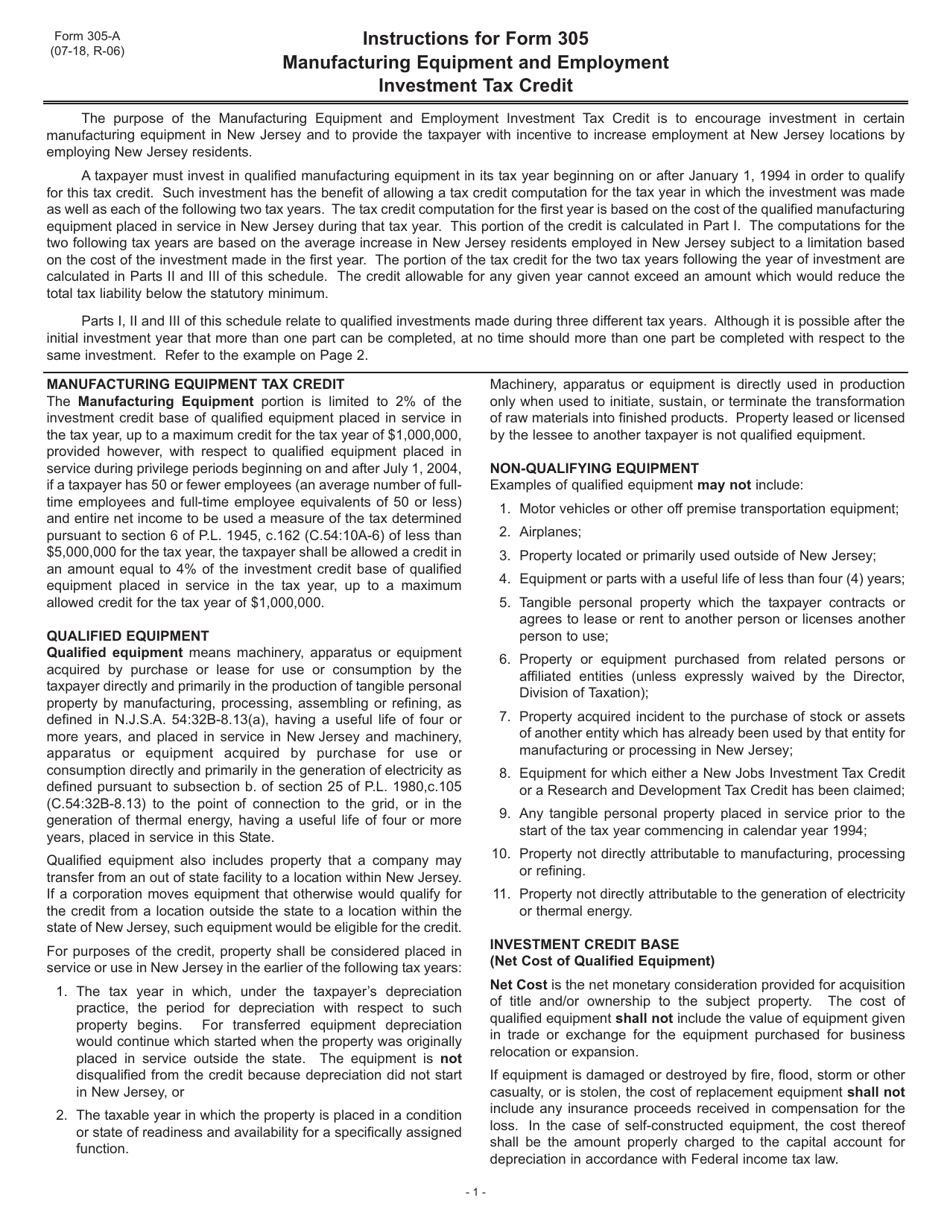

A: Form 305 is a tax form used in New Jersey for the Manufacturing Equipment and Employment Investment Tax Credit.

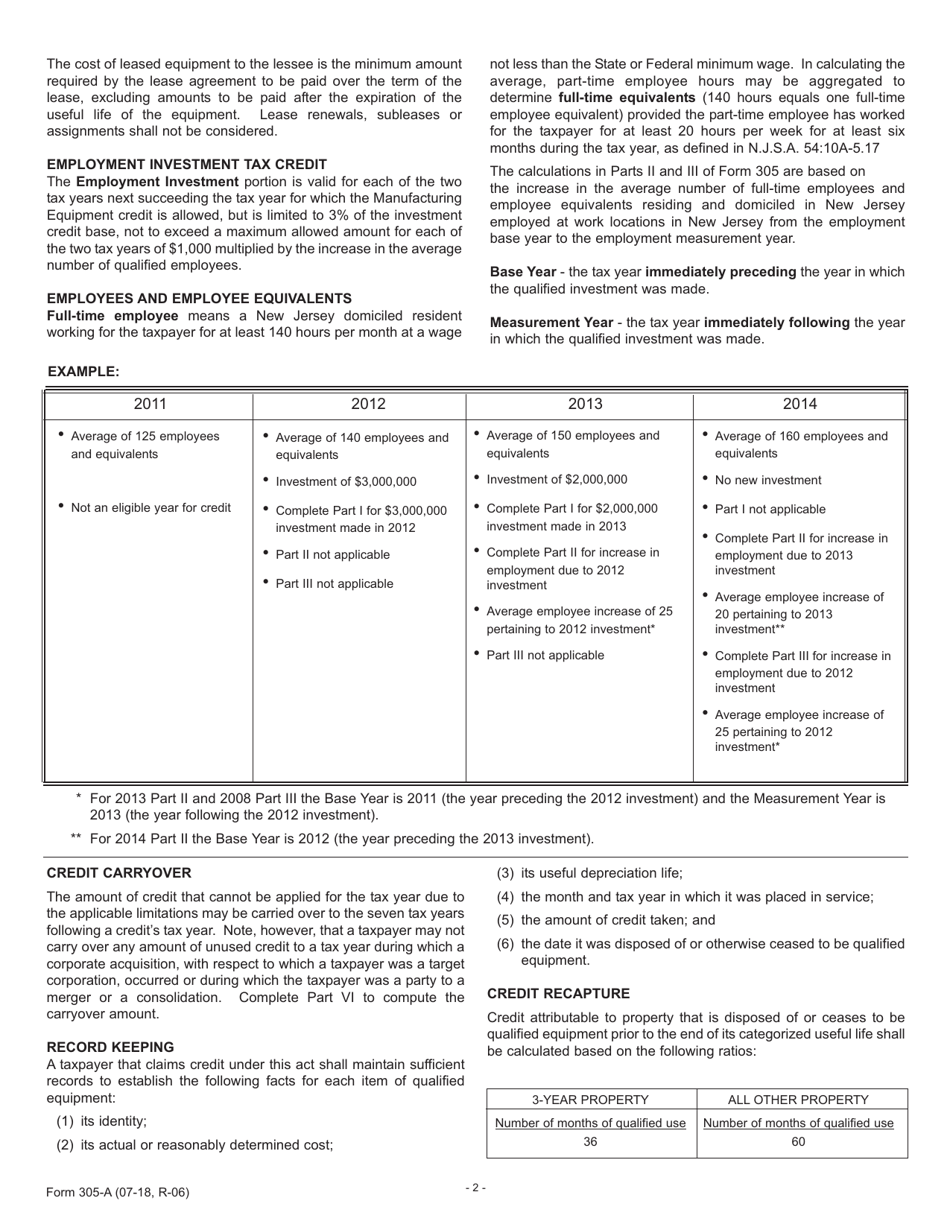

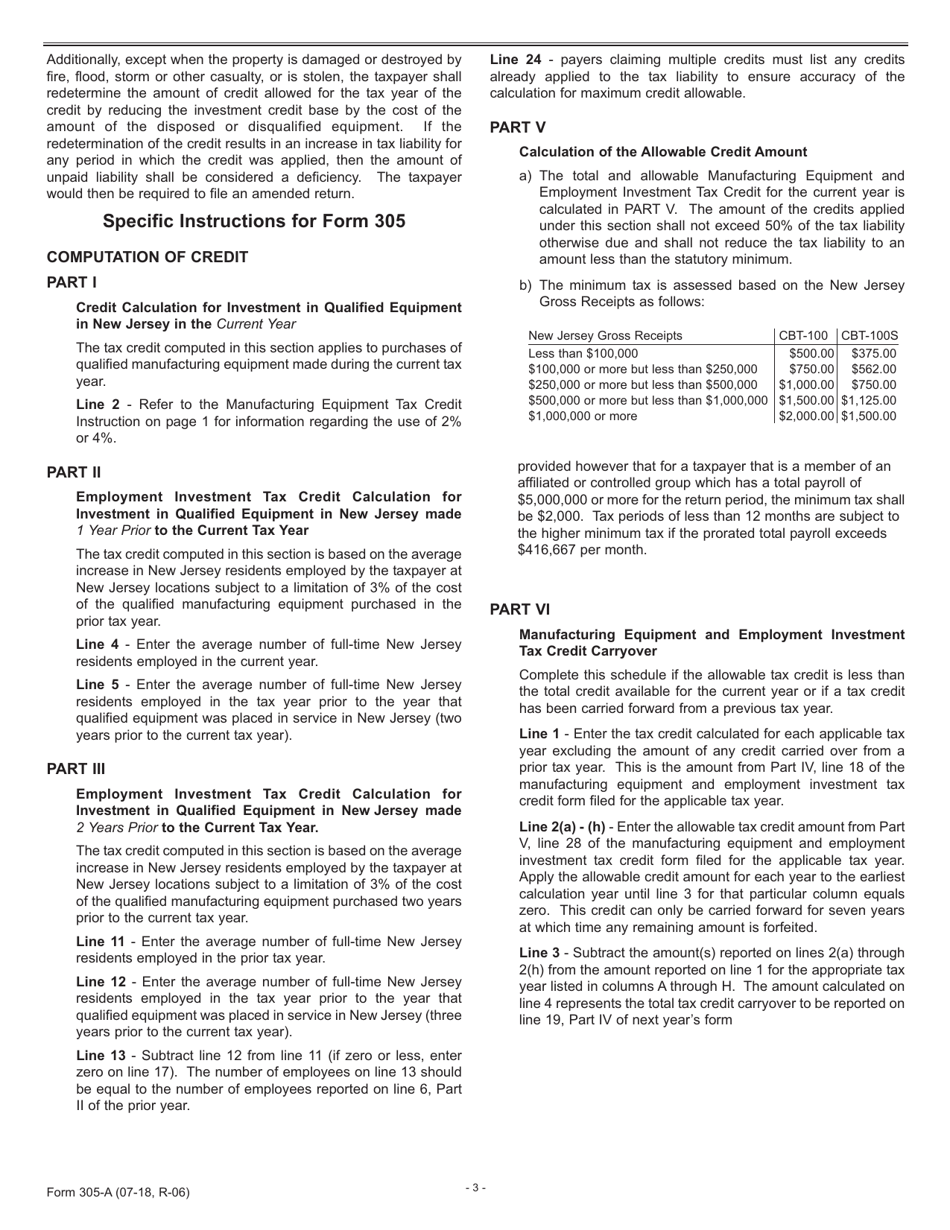

Q: What is the Manufacturing Equipment and Employment Investment Tax Credit?

A: The Manufacturing Equipment and Employment Investment Tax Credit is a tax credit available for businesses in New Jersey that invest in manufacturing equipment and create jobs.

Q: Who is eligible for the tax credit?

A: Businesses in New Jersey that invest in manufacturing equipment and create jobs are eligible for the tax credit.

Q: What is the purpose of the tax credit?

A: The purpose of the tax credit is to encourage businesses to invest in manufacturing equipment and create jobs in New Jersey.

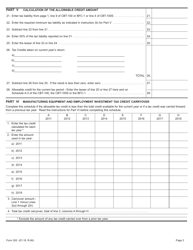

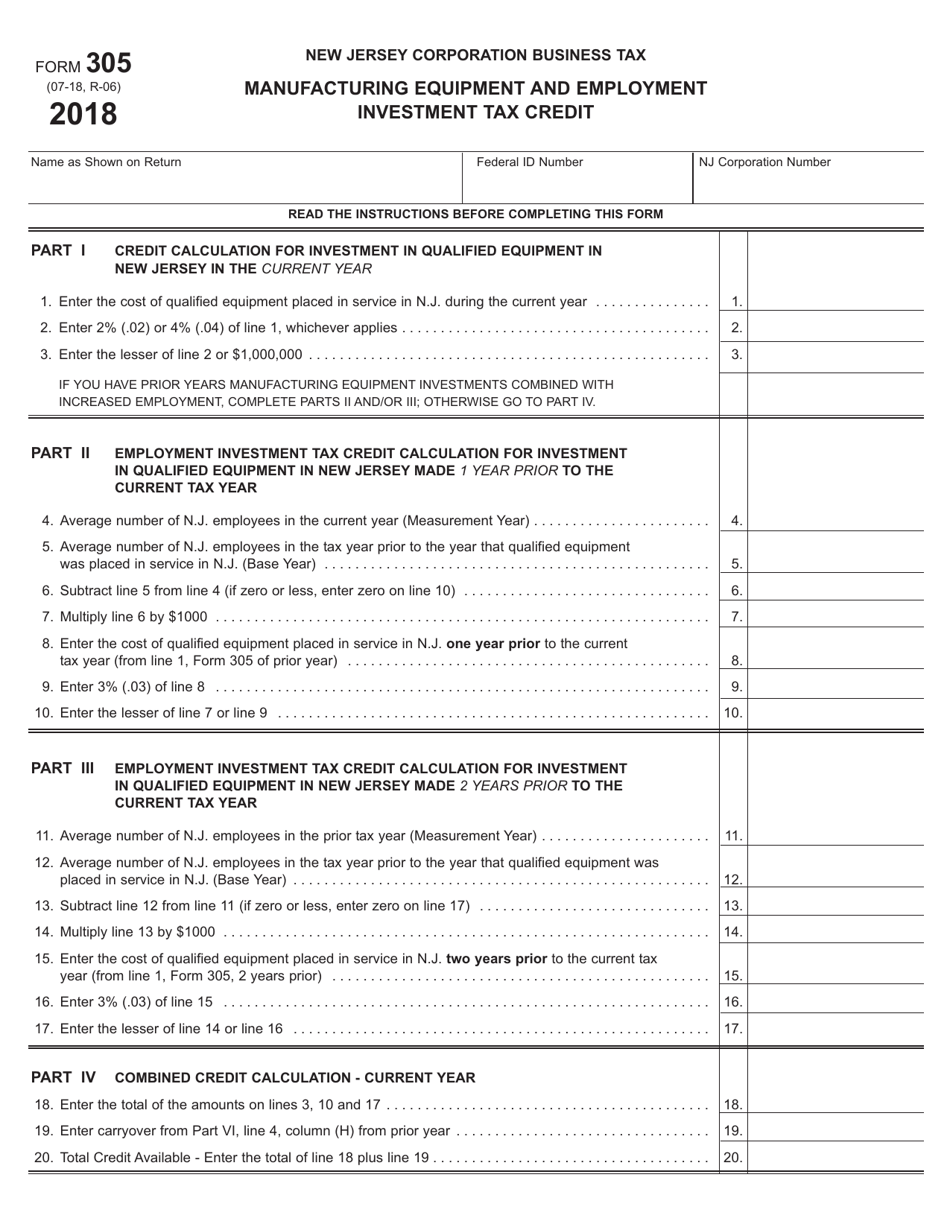

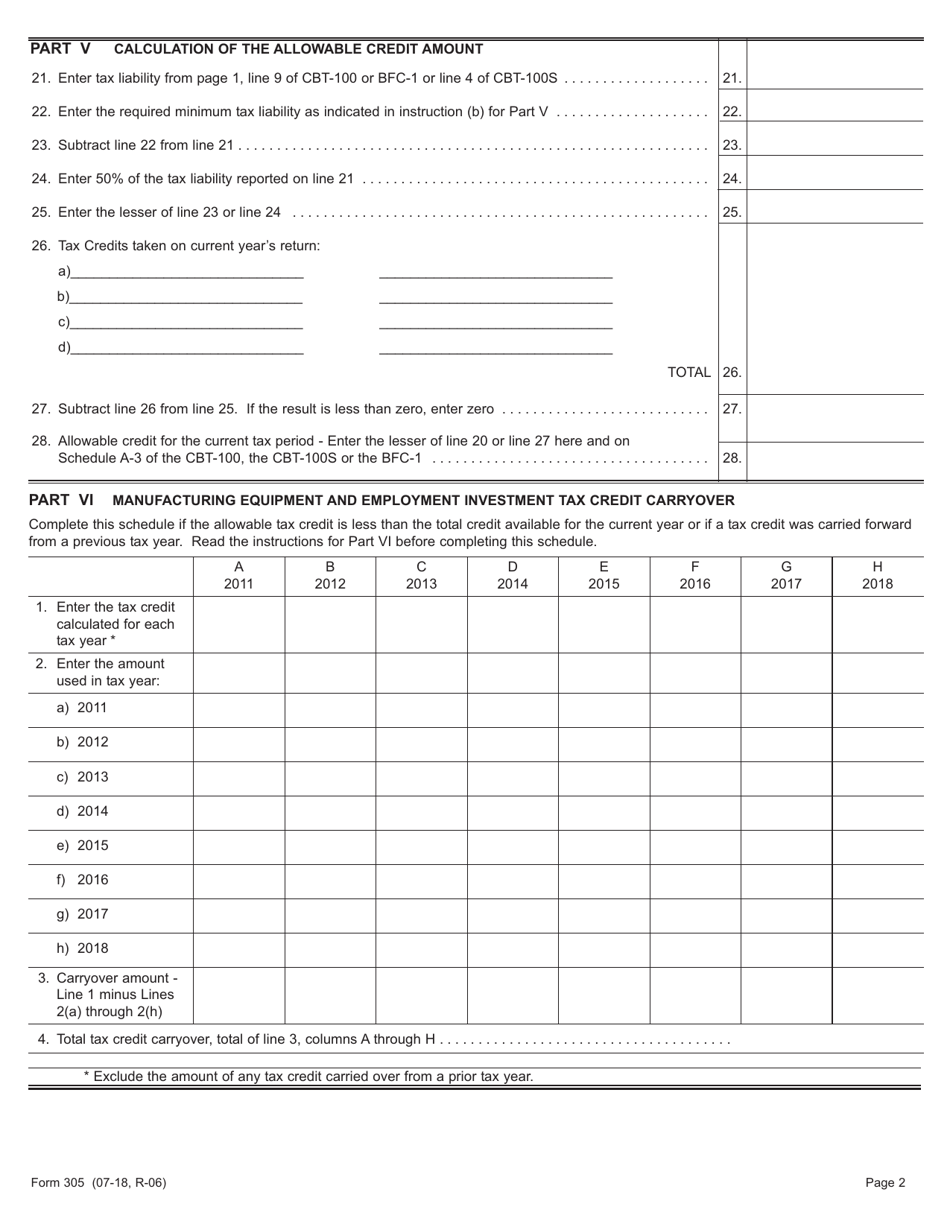

Q: How do I fill out Form 305?

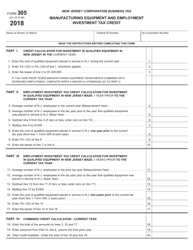

A: To fill out Form 305, you will need to provide information about your business, the manufacturing equipment you have purchased, and the jobs you have created.

Q: Is there a deadline for filing Form 305?

A: Yes, Form 305 must be filed by the due date of the taxpayer's return, including extensions.

Q: Is the tax credit refundable?

A: No, the tax credit is non-refundable. However, any unused credit can be carried forward for up to seven years.

Q: Are there any limitations or restrictions on the tax credit?

A: Yes, there are limitations on the amount of the tax credit that can be claimed and restrictions on which businesses are eligible.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 305 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.