This version of the form is not currently in use and is provided for reference only. Download this version of

Form 306

for the current year.

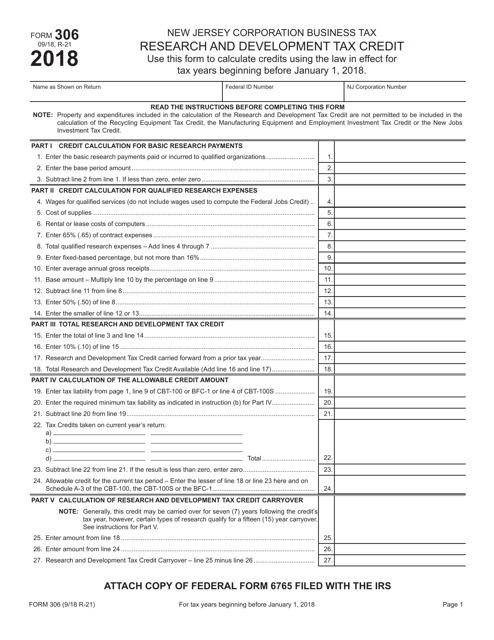

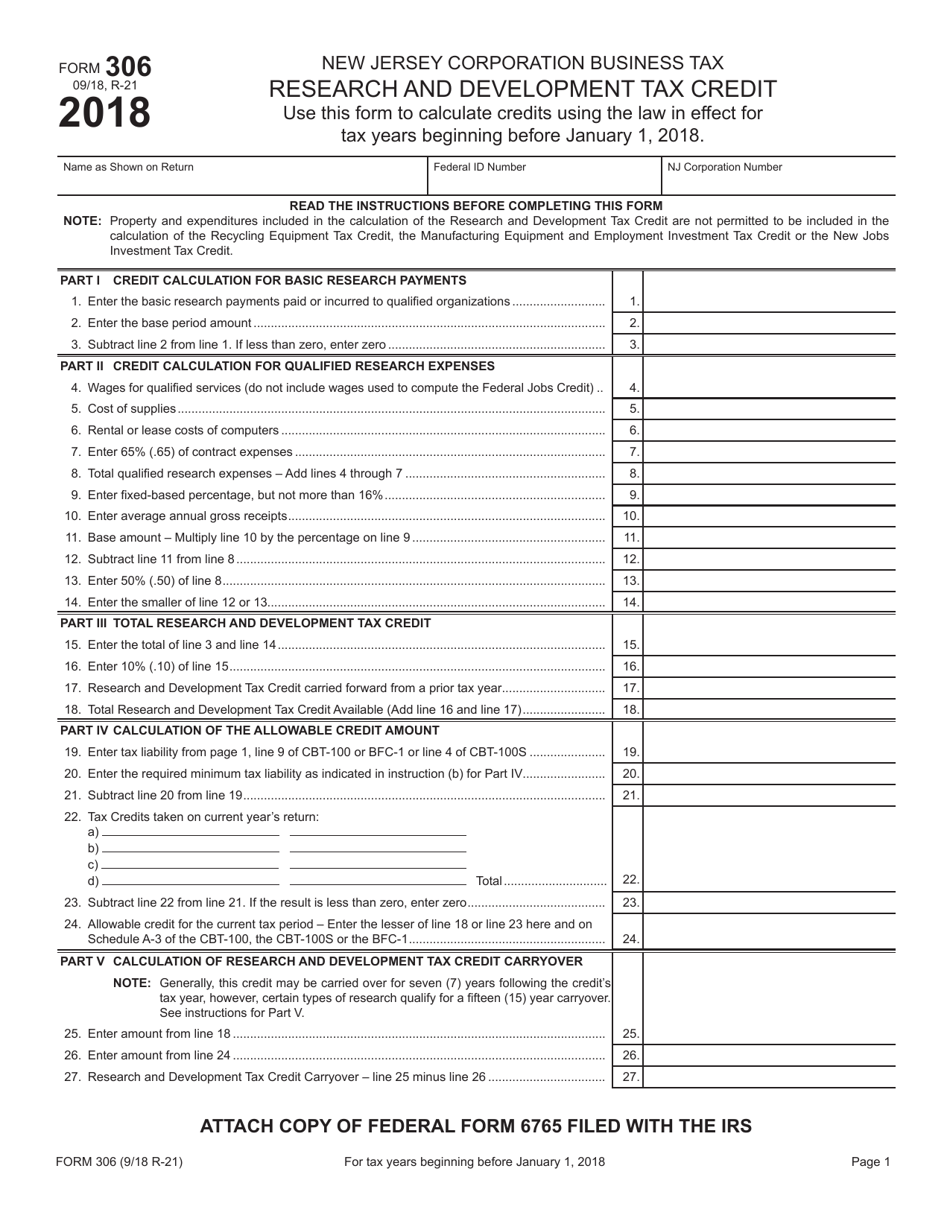

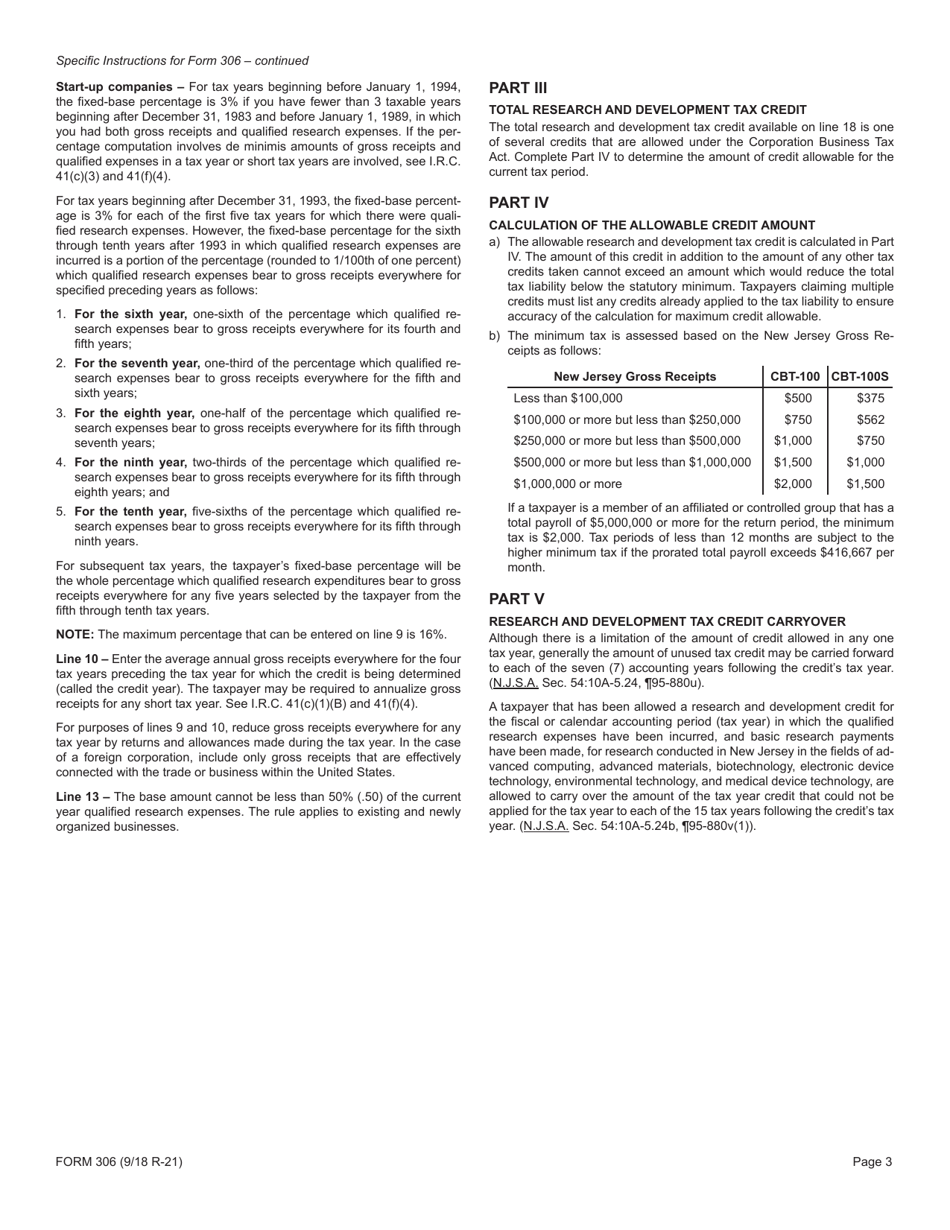

Form 306 Research and Development Tax Credit - New Jersey

What Is Form 306?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 306?

A: Form 306 is the Research and Development Tax Credit form for New Jersey.

Q: What is the Research and Development Tax Credit?

A: The Research and Development Tax Credit is a tax incentive offered by the state of New Jersey to encourage businesses to invest in research and development activities.

Q: Who is eligible to claim the Research and Development Tax Credit?

A: Businesses that conduct qualified research and development activities in New Jersey may be eligible to claim the tax credit.

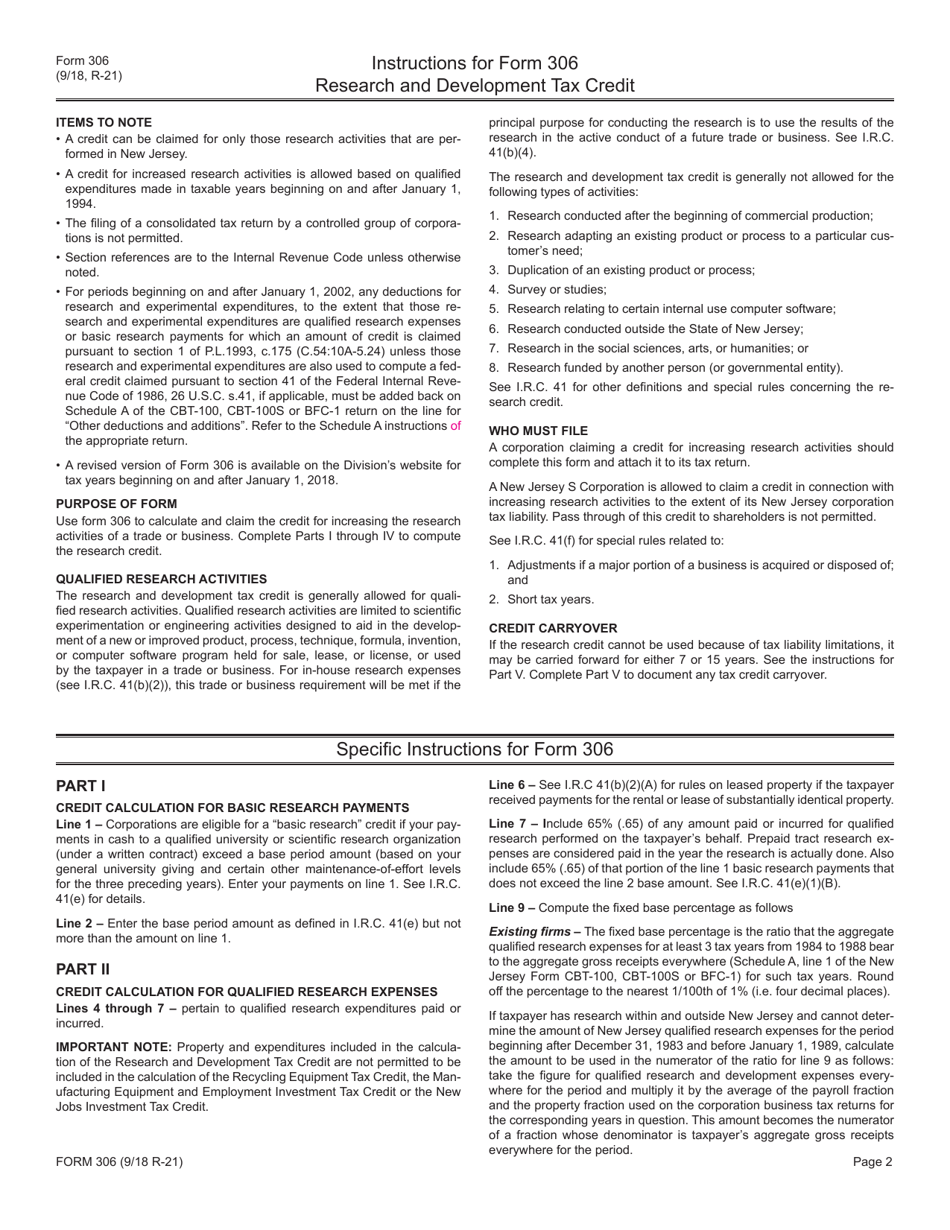

Q: What qualifies as research and development activities?

A: Qualified research and development activities typically involve the development or improvement of new products, processes, or technologies.

Q: What information is required on Form 306?

A: Form 306 requires information about the business, details of the research activities, and documentation to support the claimed expenses.

Q: When is Form 306 due?

A: Form 306 is generally due on the same day as the business' annual tax return, which is usually on or around April 15th.

Q: Are there any limitations or restrictions on the Research and Development Tax Credit?

A: Yes, there are limitations and restrictions on the Research and Development Tax Credit, including a cap on the total amount of credit that can be claimed and requirements for documentation and substantiation of expenses.

Q: Can I claim the Research and Development Tax Credit if I am a sole proprietor or an individual?

A: No, the Research and Development Tax Credit is only available to businesses, not individuals or sole proprietors.

Q: Is the Research and Development Tax Credit refundable?

A: No, the Research and Development Tax Credit in New Jersey is non-refundable, meaning it can only be used to offset taxes owed and cannot result in a cash refund.

Form Details:

- Released on September 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 306 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.