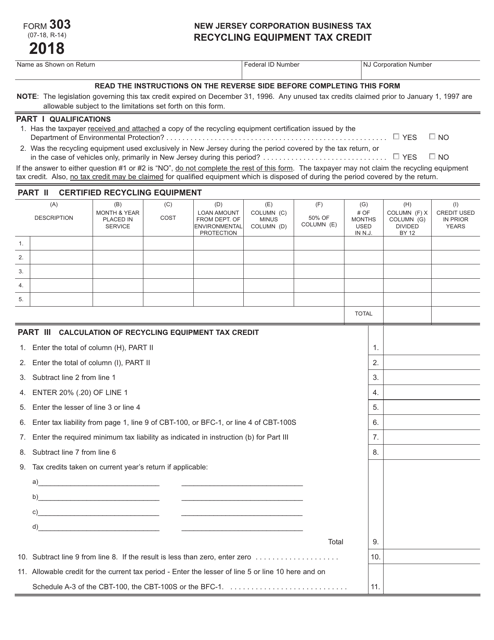

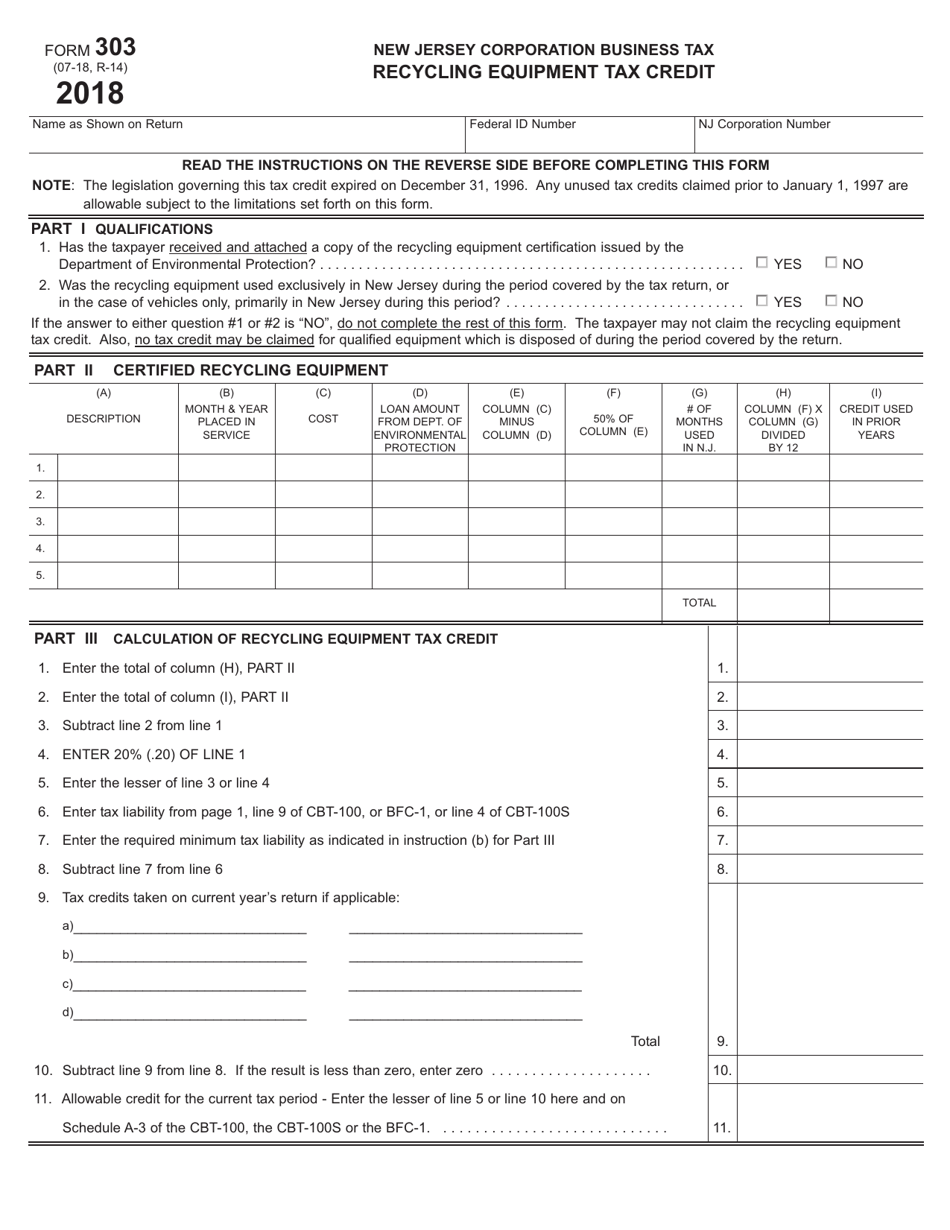

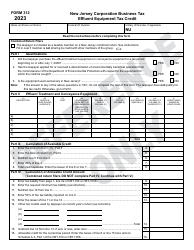

Form 303 Recycling Equipment Tax Credit - New Jersey

What Is Form 303?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 303?

A: Form 303 is a specific form used for claiming the Recycling Equipment Tax Credit in New Jersey.

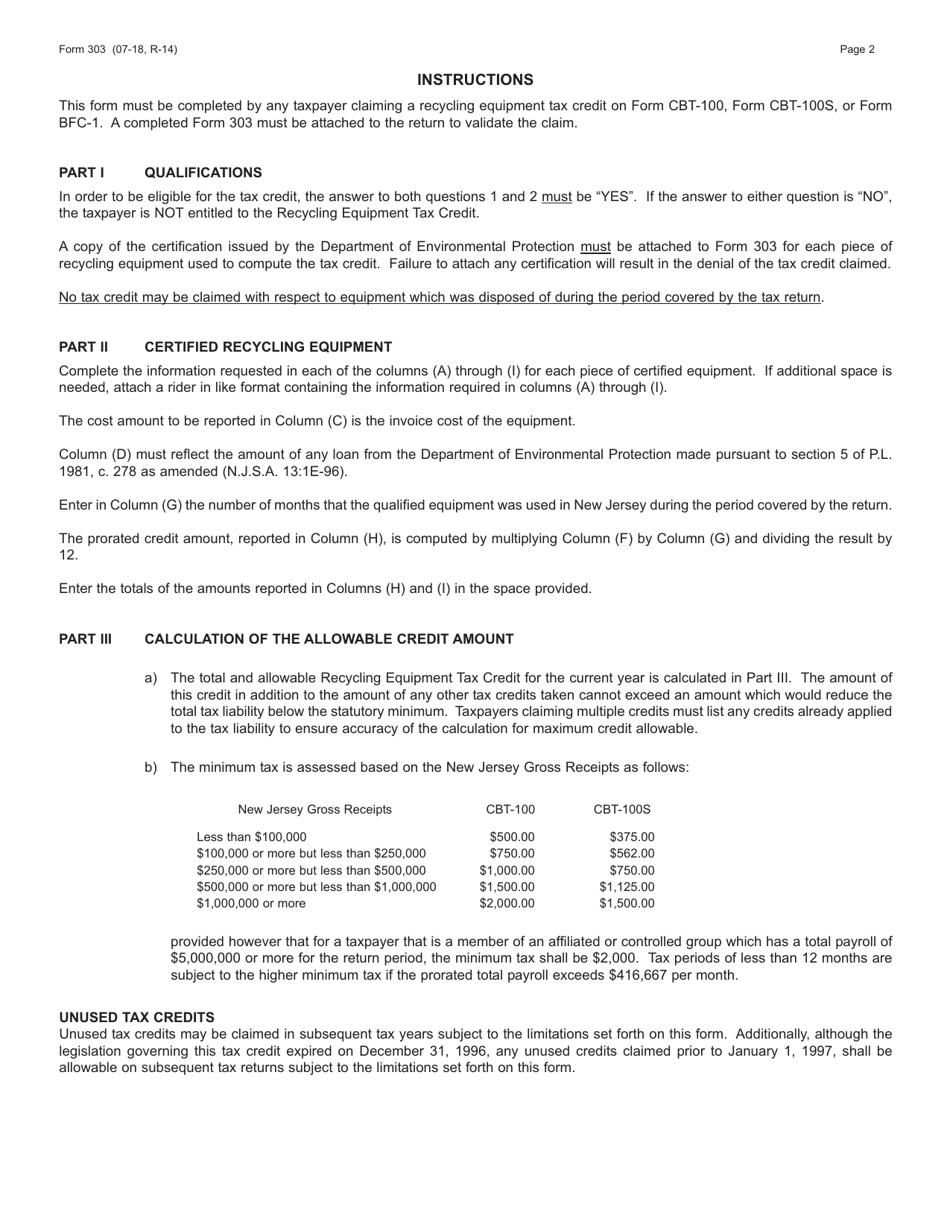

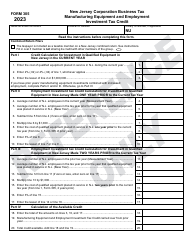

Q: What is the Recycling Equipment Tax Credit?

A: The Recycling Equipment Tax Credit is a tax credit available to businesses in New Jersey that purchase qualifying recycling equipment.

Q: Who is eligible for the Recycling Equipment Tax Credit?

A: Businesses in New Jersey that purchase qualifying recycling equipment are eligible for the tax credit.

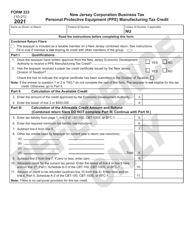

Q: What is considered qualifying recycling equipment?

A: Qualifying recycling equipment includes machinery, equipment, or devices used exclusively for collecting, separating, processing, storing, or transporting recyclable materials.

Q: How much is the Recycling Equipment Tax Credit?

A: The tax credit is equal to 10% of the purchase price of qualifying recycling equipment, up to a maximum credit of $500,000 per taxpayer per year.

Q: Are there any limitations on claiming the tax credit?

A: Yes, the tax credit cannot exceed the taxpayer's liability for the tax year. Any unused credit can be carried forward for up to seven tax years.

Q: How do I claim the Recycling Equipment Tax Credit?

A: To claim the tax credit, businesses must complete Form 303 and include it with their New Jersey tax return.

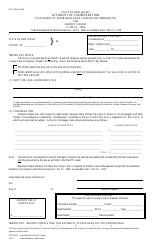

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 303 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.