This version of the form is not currently in use and is provided for reference only. Download this version of

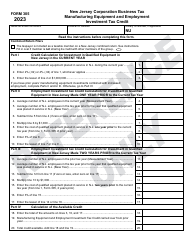

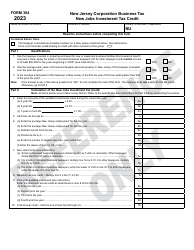

Form 301

for the current year.

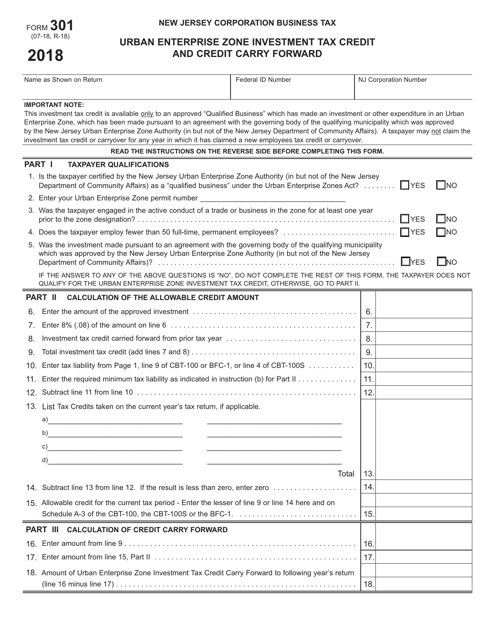

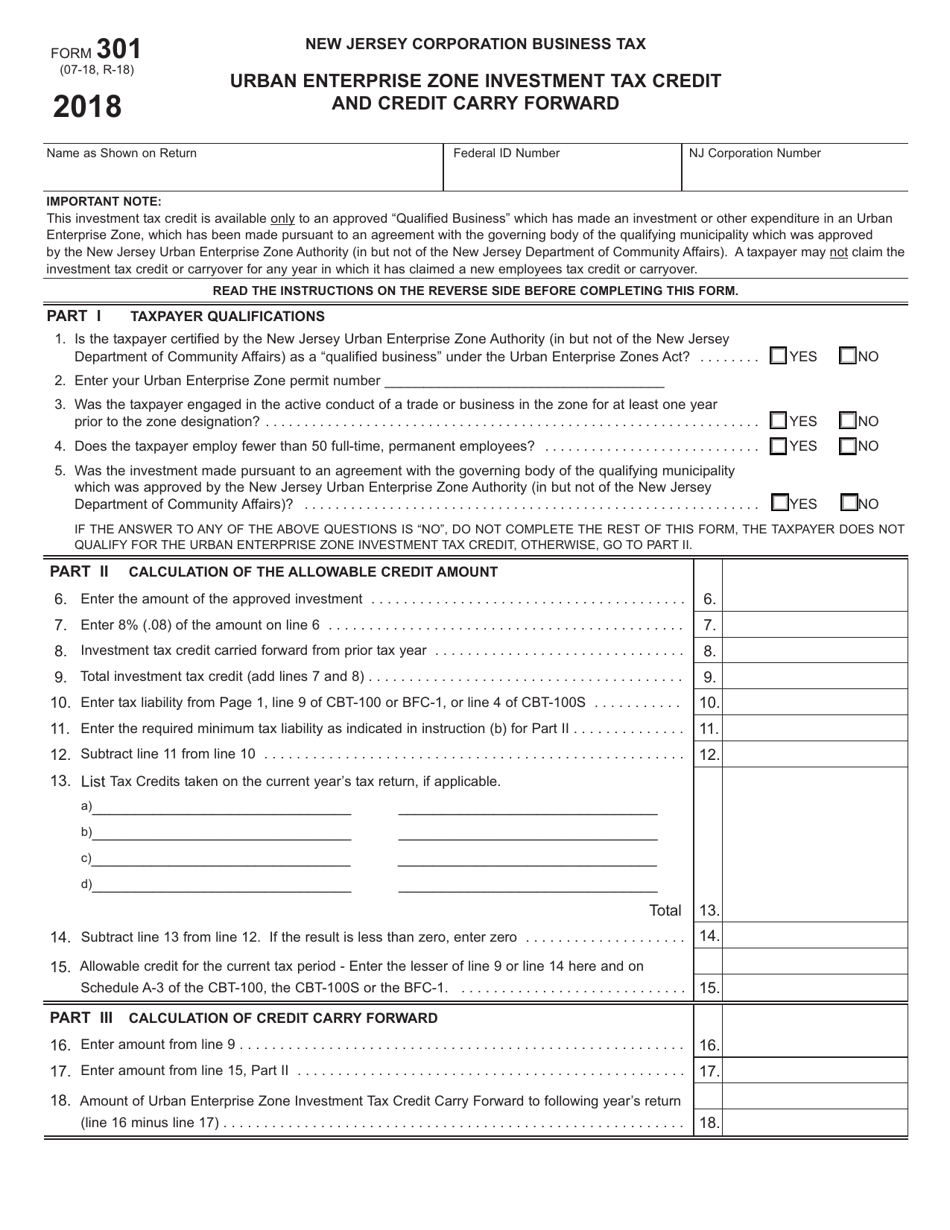

Form 301 Urban Enterprise Zone Investment Tax Credit and Credit Carry Forward - New Jersey

What Is Form 301?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

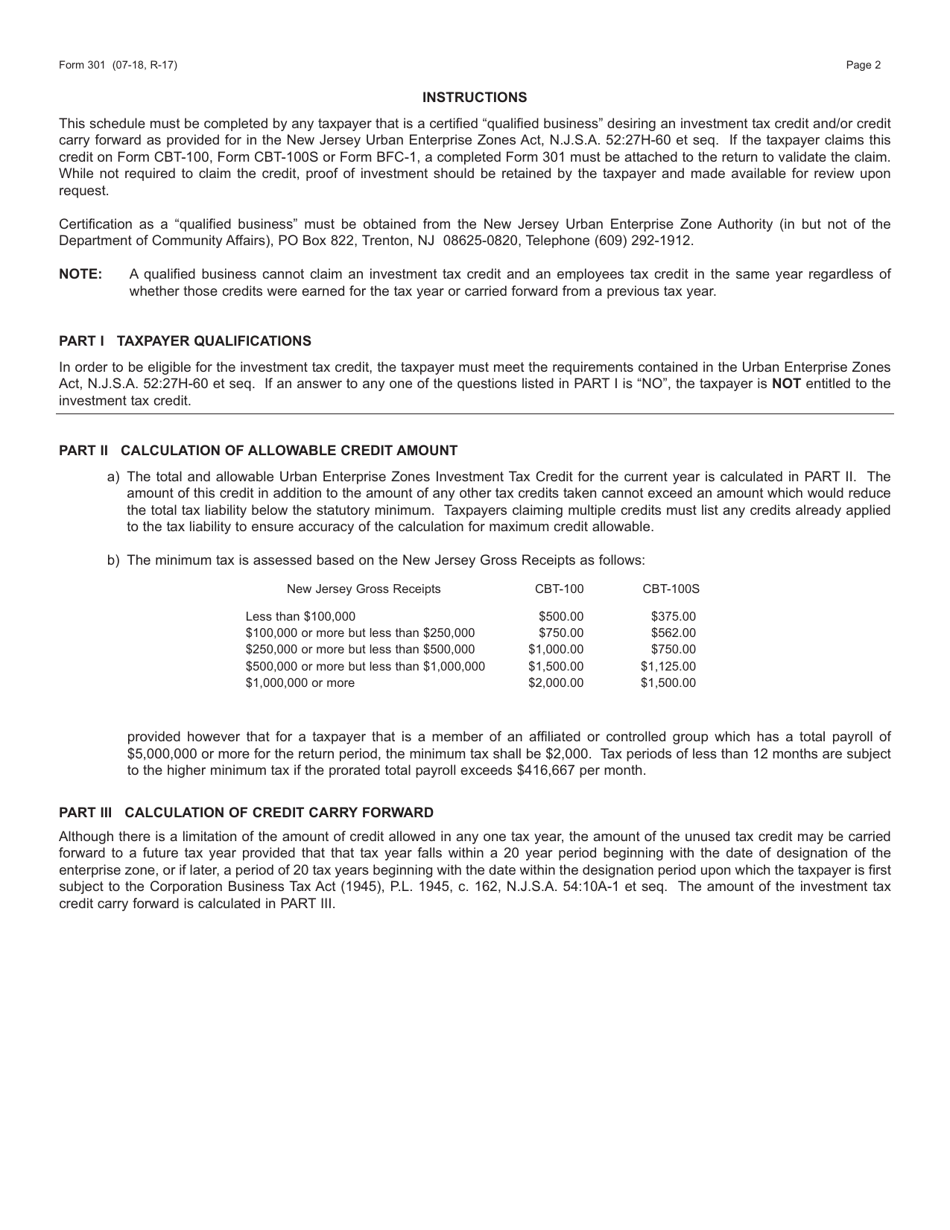

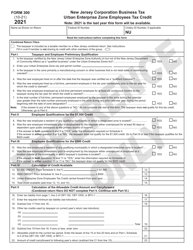

Q: What is the Form 301 Urban Enterprise ZoneInvestment Tax Credit and Credit Carry Forward?

A: Form 301 is a tax form used in New Jersey to calculate and claim the Urban Enterprise Zone Investment Tax Credit and Credit Carry Forward.

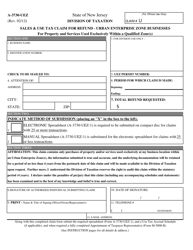

Q: Who is eligible to use Form 301?

A: Businesses located in a designated Urban Enterprise Zone in New Jersey are eligible to use Form 301.

Q: What is the purpose of the Urban Enterprise Zone Investment Tax Credit?

A: The purpose of the tax credit is to encourage businesses to invest in designated Urban Enterprise Zones and stimulate economic growth in those areas.

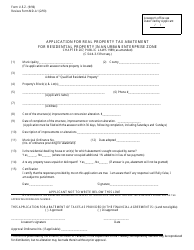

Q: What expenses are eligible for the tax credit?

A: Expenses related to the acquisition, construction, or improvement of qualified real property or tangible personal property in the Urban Enterprise Zone may be eligible for the tax credit.

Q: How is the tax credit calculated?

A: The tax credit is equal to a percentage of the eligible expenses incurred by the business.

Q: What is the Credit Carry Forward?

A: The Credit Carry Forward allows businesses to carry forward any unused tax credits from one tax year to future years.

Q: How do I file Form 301?

A: Form 301 must be filed with the New Jersey Division of Taxation along with your business tax return.

Q: Are there any deadlines for filing Form 301?

A: Yes, Form 301 must be filed by the statutory due date of the business tax return, usually the 15th day of the fourth month following the close of the tax year.

Q: Can I claim the tax credit if my business is not located in an Urban Enterprise Zone?

A: No, only businesses located in designated Urban Enterprise Zones are eligible to claim the tax credit.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 301 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.