This version of the form is not currently in use and is provided for reference only. Download this version of

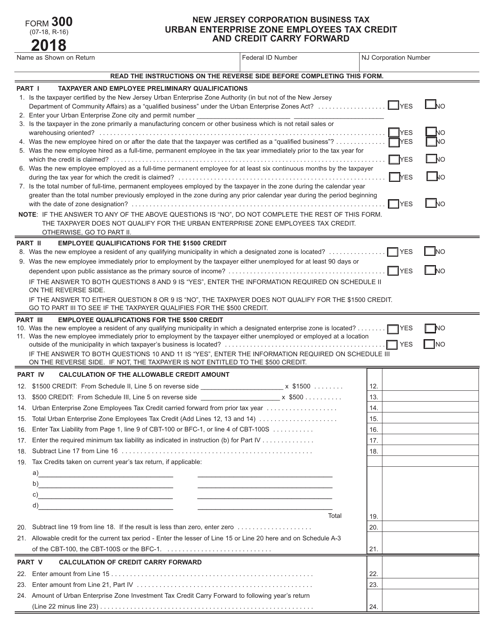

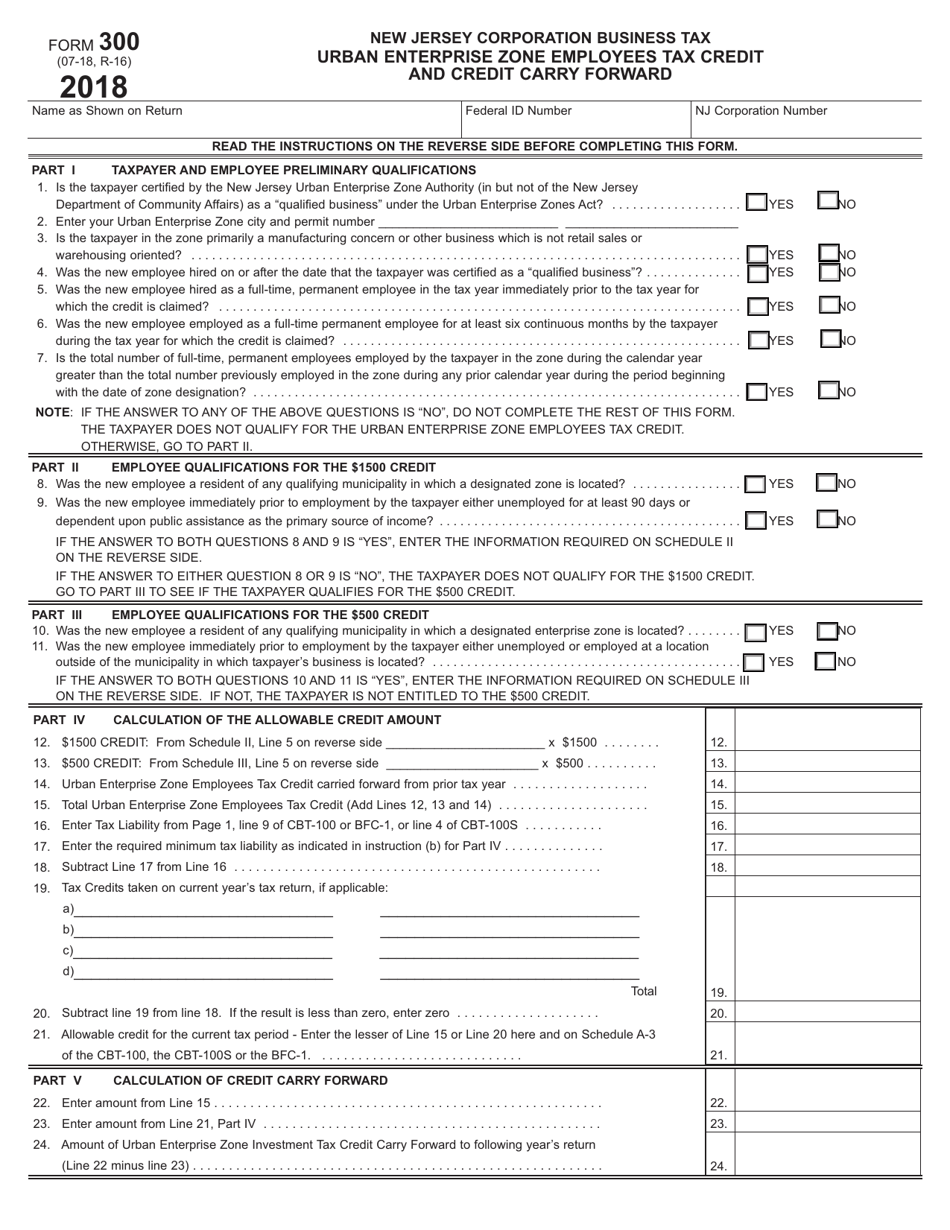

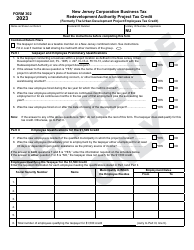

Form 300

for the current year.

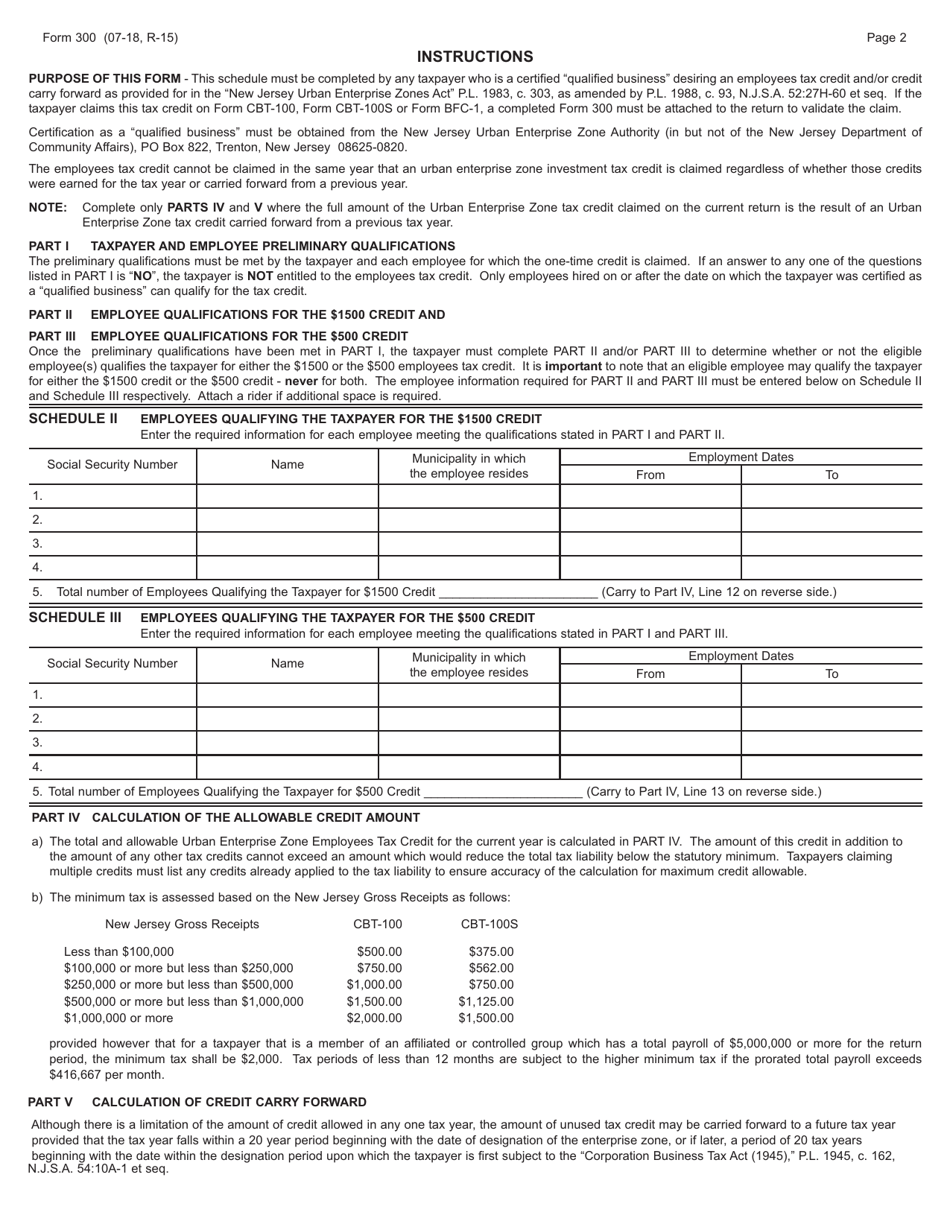

Form 300 Urban Enterprise Zone Employees Tax Credit and Credit Carry Forward - New Jersey

What Is Form 300?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 300 Urban Enterprise ZoneEmployees Tax Credit and Credit Carry Forward?

A: Form 300 is a tax form in New Jersey that is used to claim the Urban Enterprise Zone Employees Tax Credit and Credit Carry Forward.

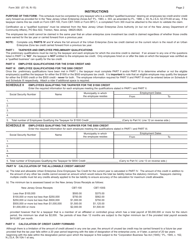

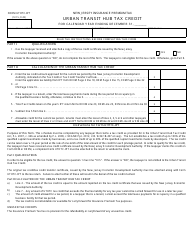

Q: What is the Urban Enterprise Zone Employees Tax Credit?

A: The Urban Enterprise Zone Employees Tax Credit is a tax credit that businesses can claim for hiring eligible employees in designated Urban Enterprise Zones.

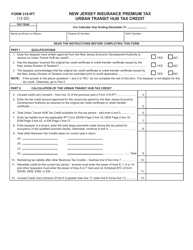

Q: What is the Credit Carry Forward?

A: The Credit Carry Forward allows businesses to carry forward any unused tax credits to future tax years.

Q: Who is eligible for the Urban Enterprise Zone Employees Tax Credit?

A: Businesses that hire eligible employees who work at least 35 hours per week in designated Urban Enterprise Zones are eligible for the tax credit.

Q: How much is the tax credit?

A: The tax credit is 1% of the wages paid to eligible employees.

Q: How long can businesses carry forward unused tax credits?

A: Businesses can carry forward unused tax credits for up to 20 years.

Q: What is an Urban Enterprise Zone?

A: An Urban Enterprise Zone is a designated area in New Jersey that aims to stimulate economic growth and create jobs by providing various tax incentives and other benefits to businesses.

Form Details:

- Released on July 1, 2018;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 300 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.