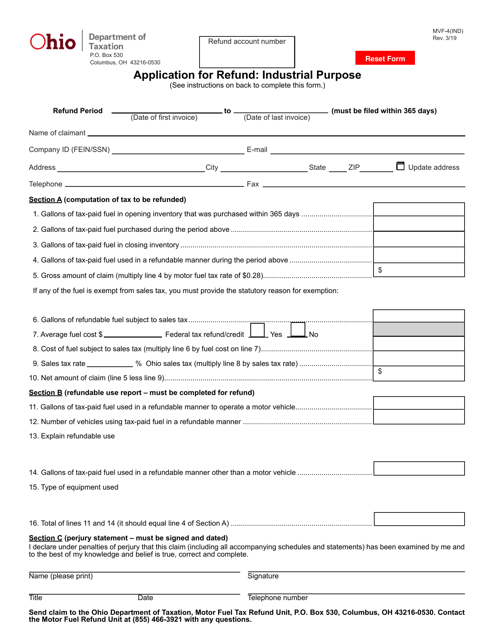

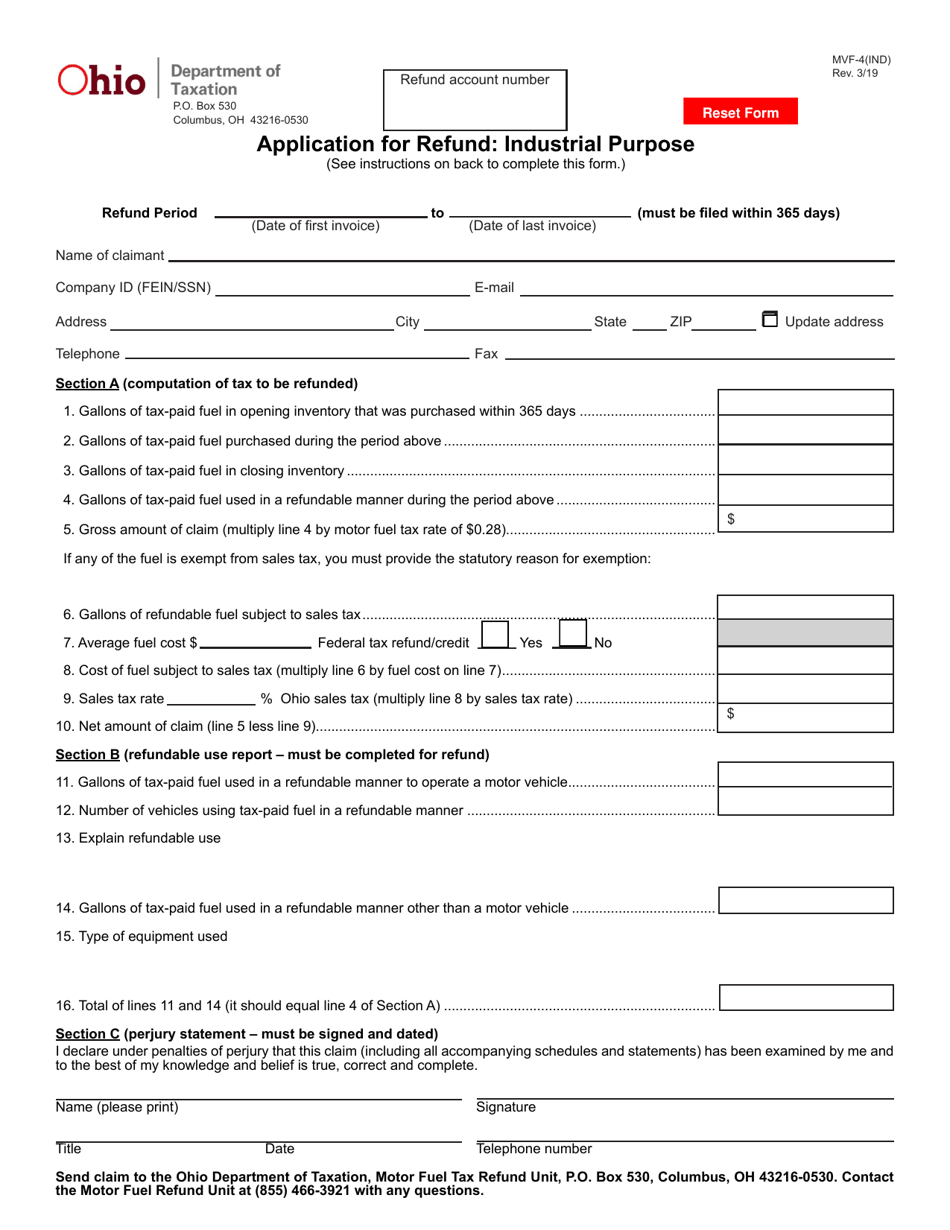

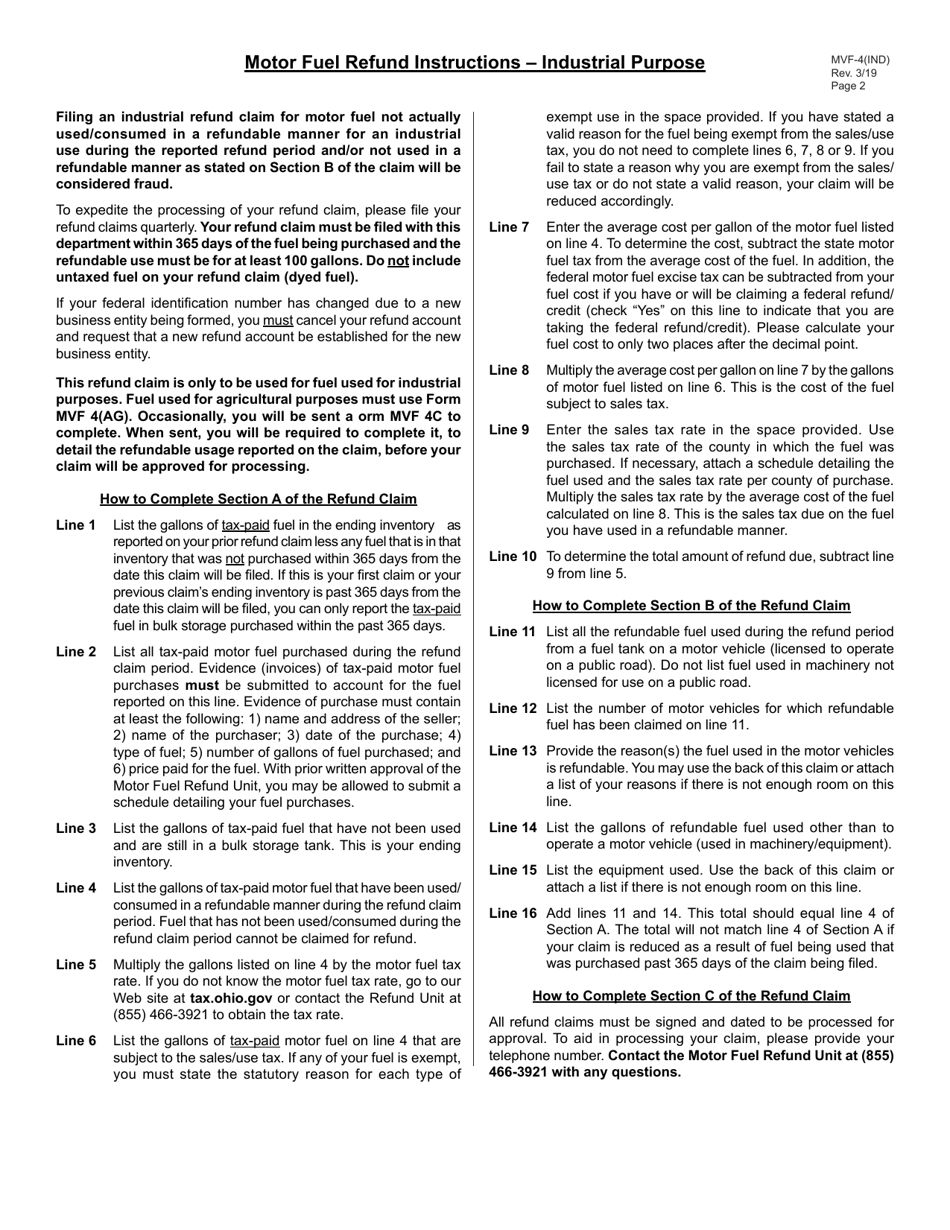

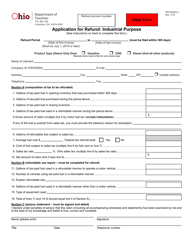

Form MVF-4(IND) Application for Refund: Industrial Purpose - Ohio

What Is Form MVF-4(IND)?

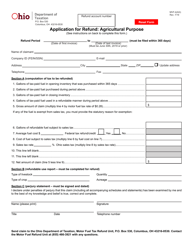

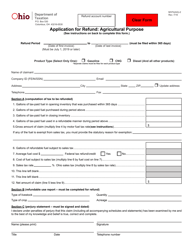

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form MVF-4(IND)?

A: Form MVF-4(IND) is an application for refund for industrial purposes in Ohio.

Q: Who can use Form MVF-4(IND)?

A: Form MVF-4(IND) can be used by individuals or businesses that have paid sales or use tax on qualifying items used for industrial purposes.

Q: What is the purpose of using Form MVF-4(IND)?

A: The purpose of using Form MVF-4(IND) is to apply for a refund of sales or use tax paid on qualifying items used for industrial purposes.

Q: What are qualifying items for industrial purposes?

A: Qualifying items for industrial purposes include machinery, equipment, and supplies that are used directly in an industrial production process.

Q: Is there a deadline for filing Form MVF-4(IND)?

A: Yes, Form MVF-4(IND) must be filed within four years from the date of the original purchase.

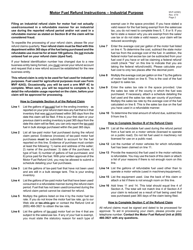

Q: Are there any supporting documents required with Form MVF-4(IND)?

A: Yes, you must include copies of invoices or receipts showing the amount of sales or use tax paid on the qualifying items.

Q: How long does it take to process the refund?

A: The processing time for the refund varies, but you can expect to receive your refund within a few weeks of filing the application.

Q: Can I file Form MVF-4(IND) electronically?

A: No, Form MVF-4(IND) must be filed by mail or in person.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MVF-4(IND) by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.