This version of the form is not currently in use and is provided for reference only. Download this version of

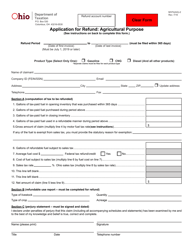

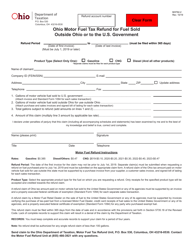

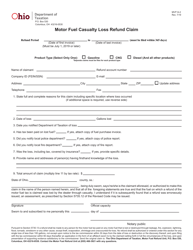

Form MVF-4(AG)

for the current year.

Form MVF-4(AG) Application for Refund - Agricultural Purpose - Ohio

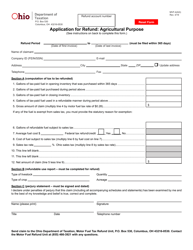

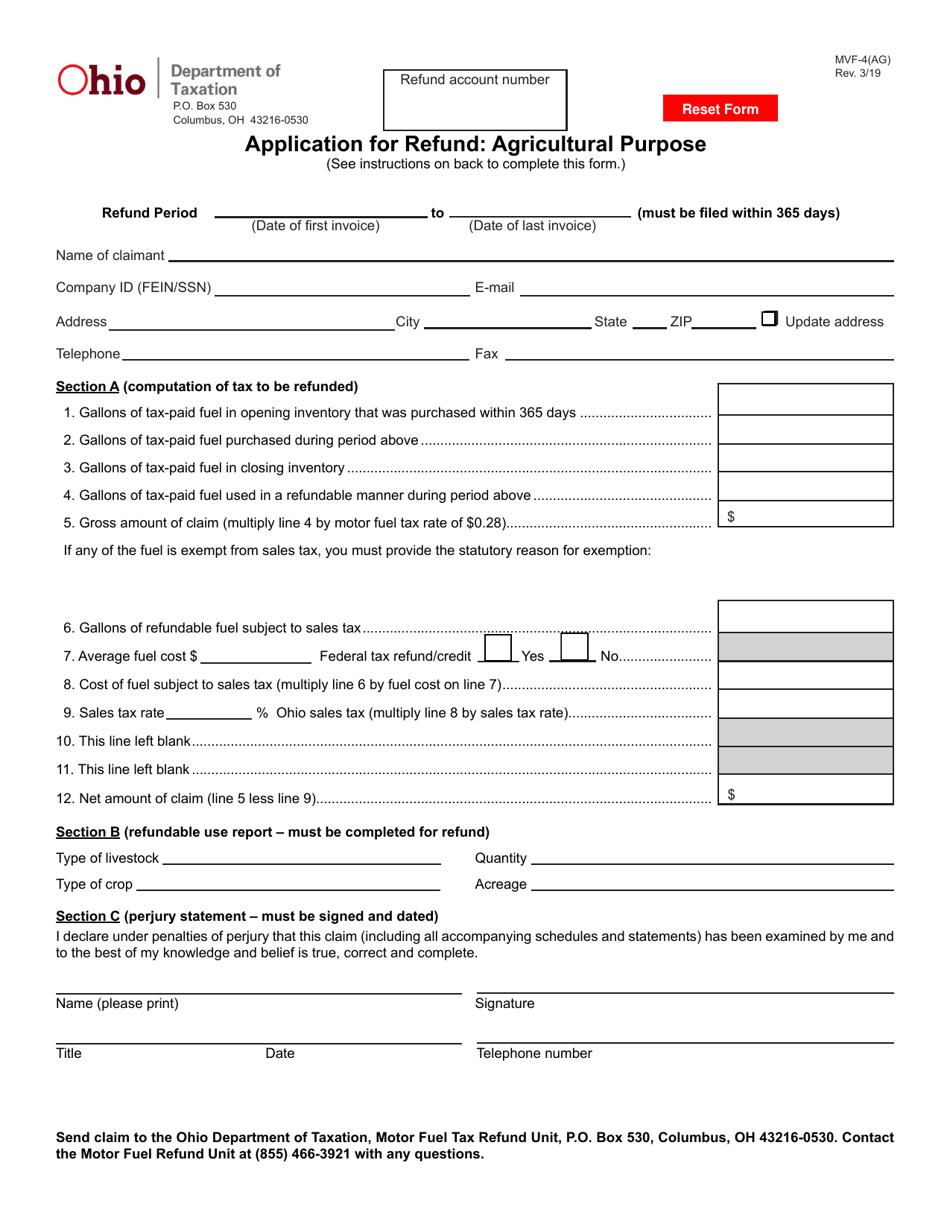

What Is Form MVF-4(AG)?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

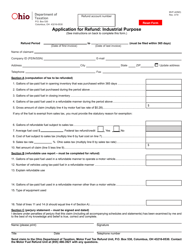

Q: What is Form MVF-4(AG)?

A: Form MVF-4(AG) is the Application for Refund - Agricultural Purpose in Ohio.

Q: What is the purpose of Form MVF-4(AG)?

A: The purpose of Form MVF-4(AG) is to apply for a refund on qualifying purchases made for agricultural purposes in Ohio.

Q: Who can use Form MVF-4(AG)?

A: Farmers and individuals engaged in agricultural activities in Ohio can use Form MVF-4(AG).

Q: What purchases qualify for a refund with Form MVF-4(AG)?

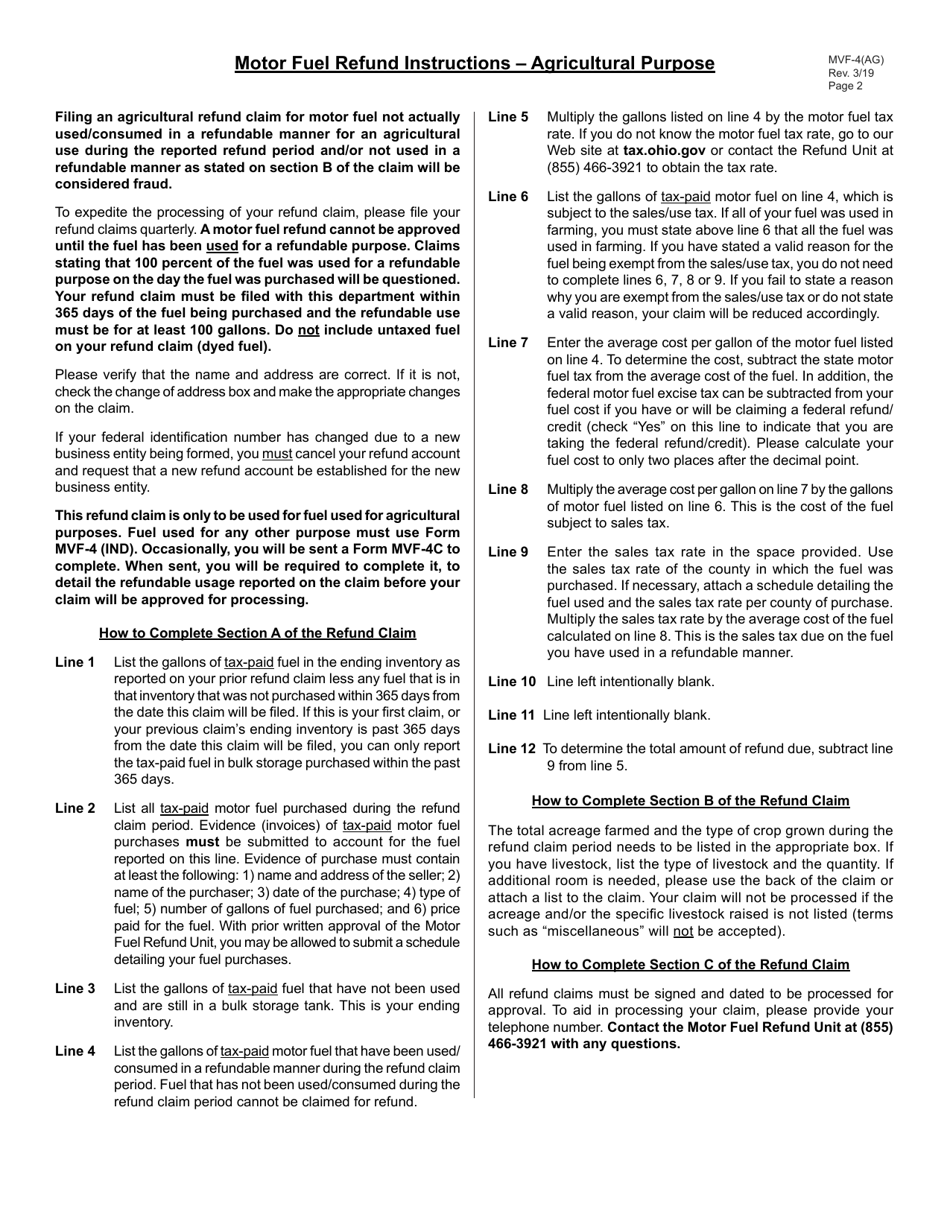

A: Qualifying purchases for agricultural purposes in Ohio may include equipment, machinery, and certain supplies.

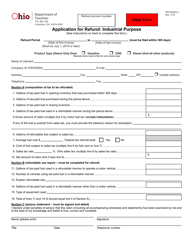

Q: What documentation do I need to include with Form MVF-4(AG)?

A: You will need to include proof of eligible purchases, such as receipts or invoices, along with Form MVF-4(AG).

Q: When should I file Form MVF-4(AG)?

A: Form MVF-4(AG) should be filed within three years from the date of purchase.

Q: Is there a deadline to submit Form MVF-4(AG)?

A: Yes, Form MVF-4(AG) must be submitted by the deadline specified by the Ohio Department of Taxation.

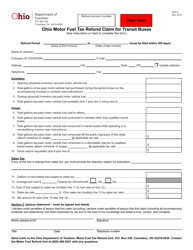

Q: Can I apply for a refund for purchases made outside of Ohio?

A: No, Form MVF-4(AG) is specifically for purchases made for agricultural purposes in Ohio.

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form MVF-4(AG) by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.