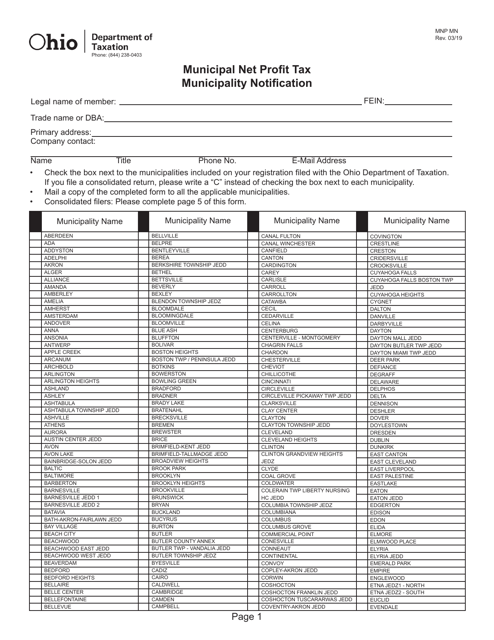

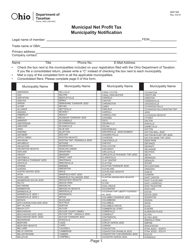

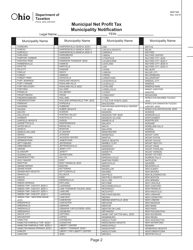

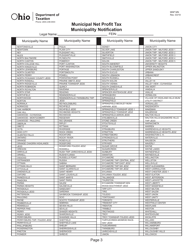

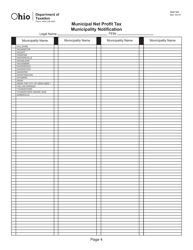

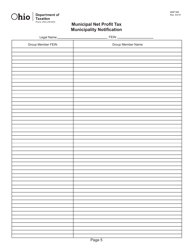

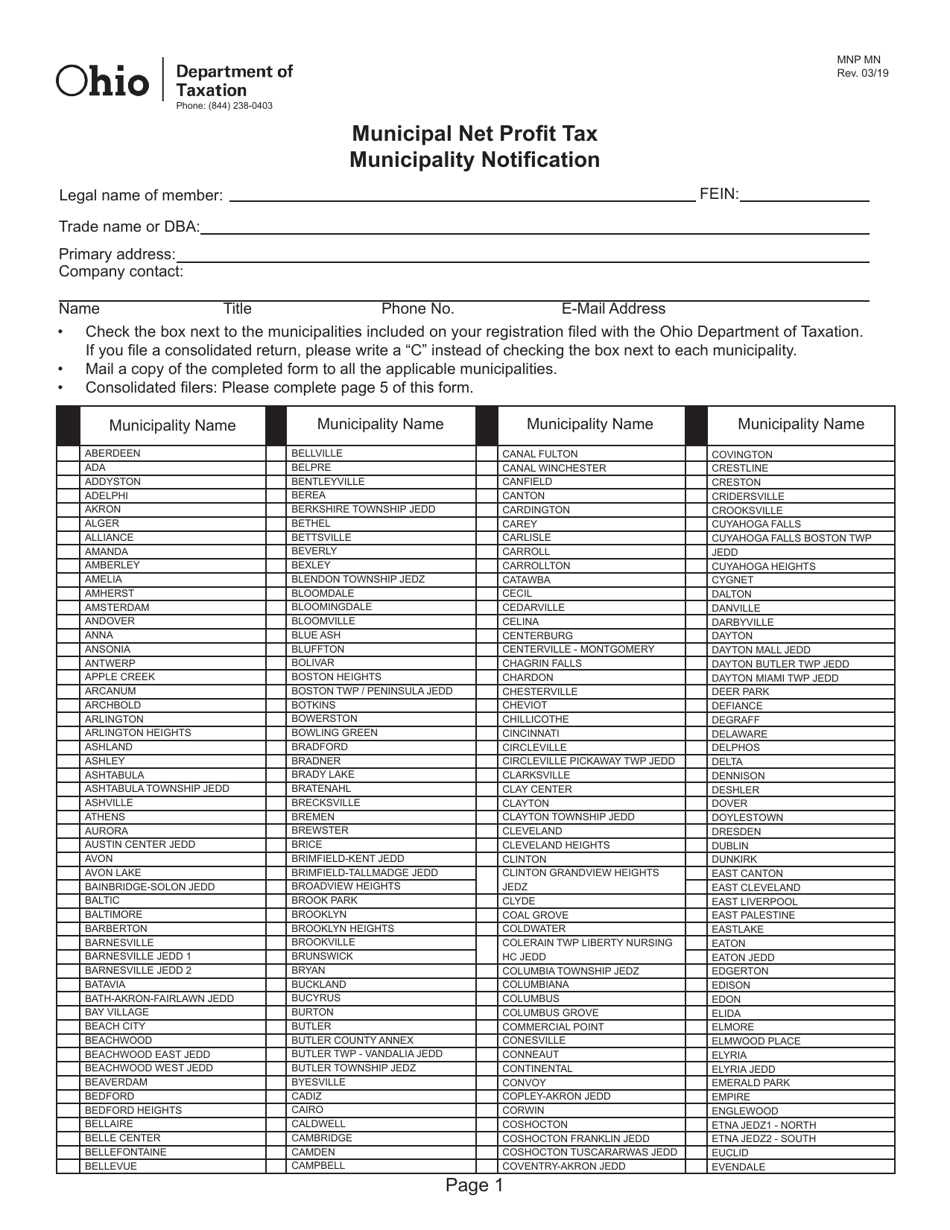

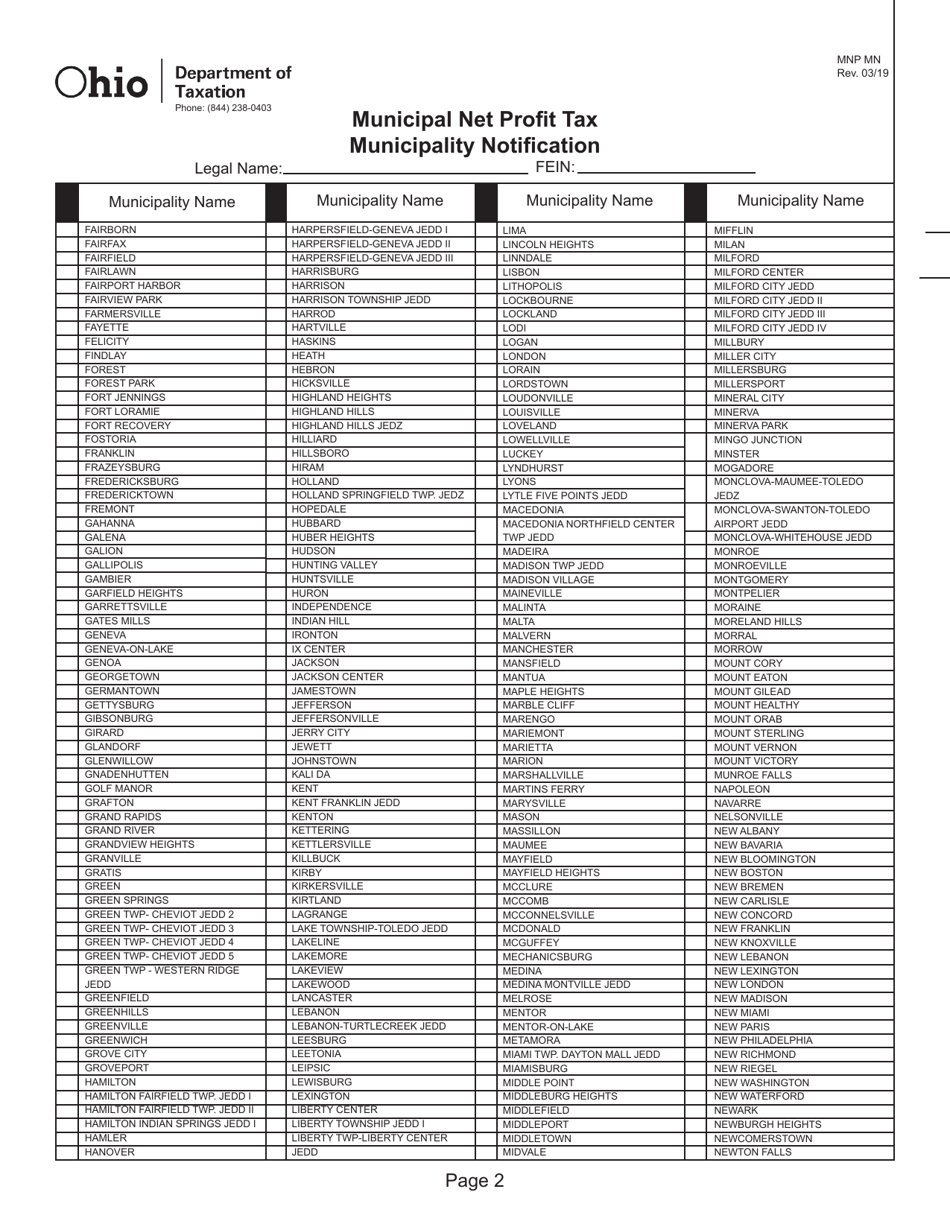

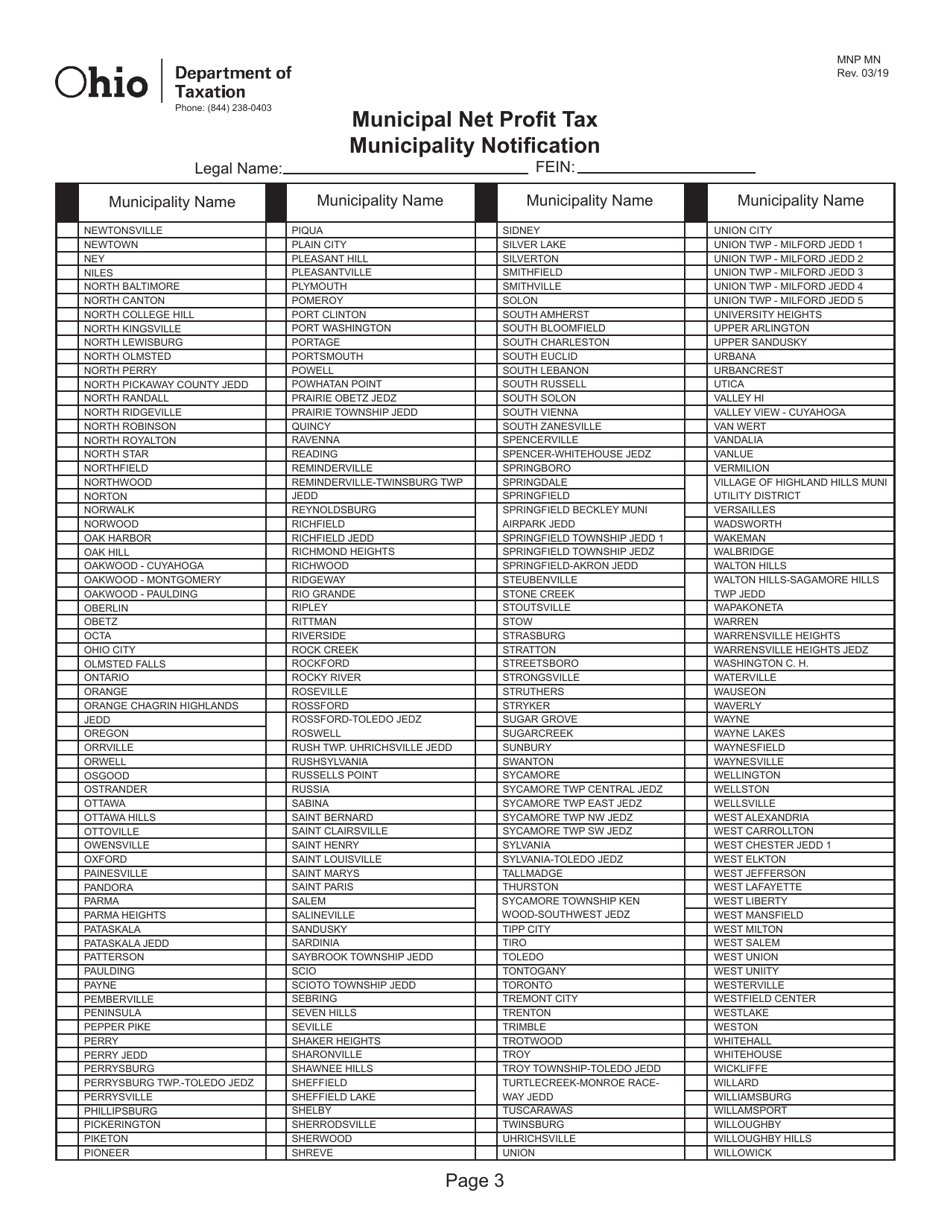

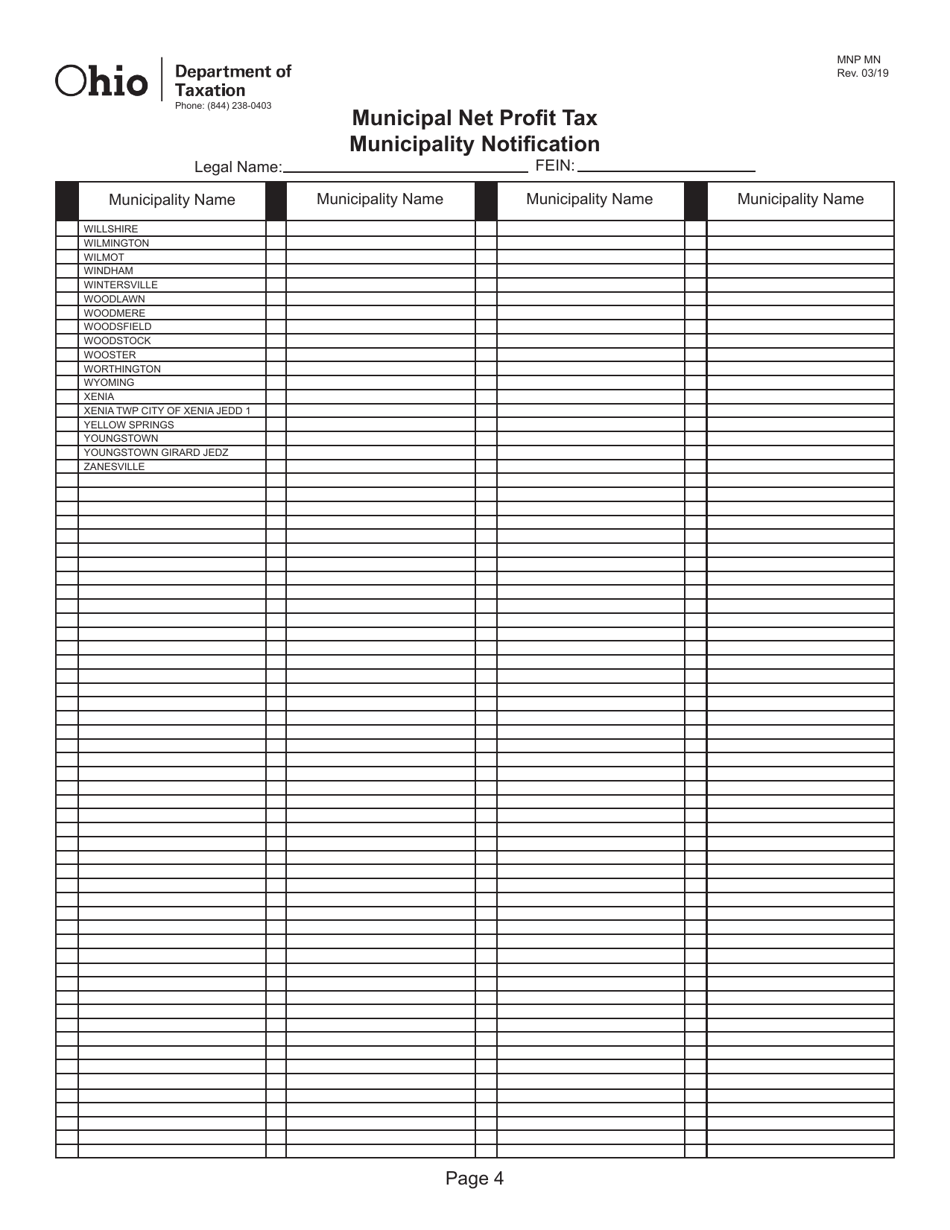

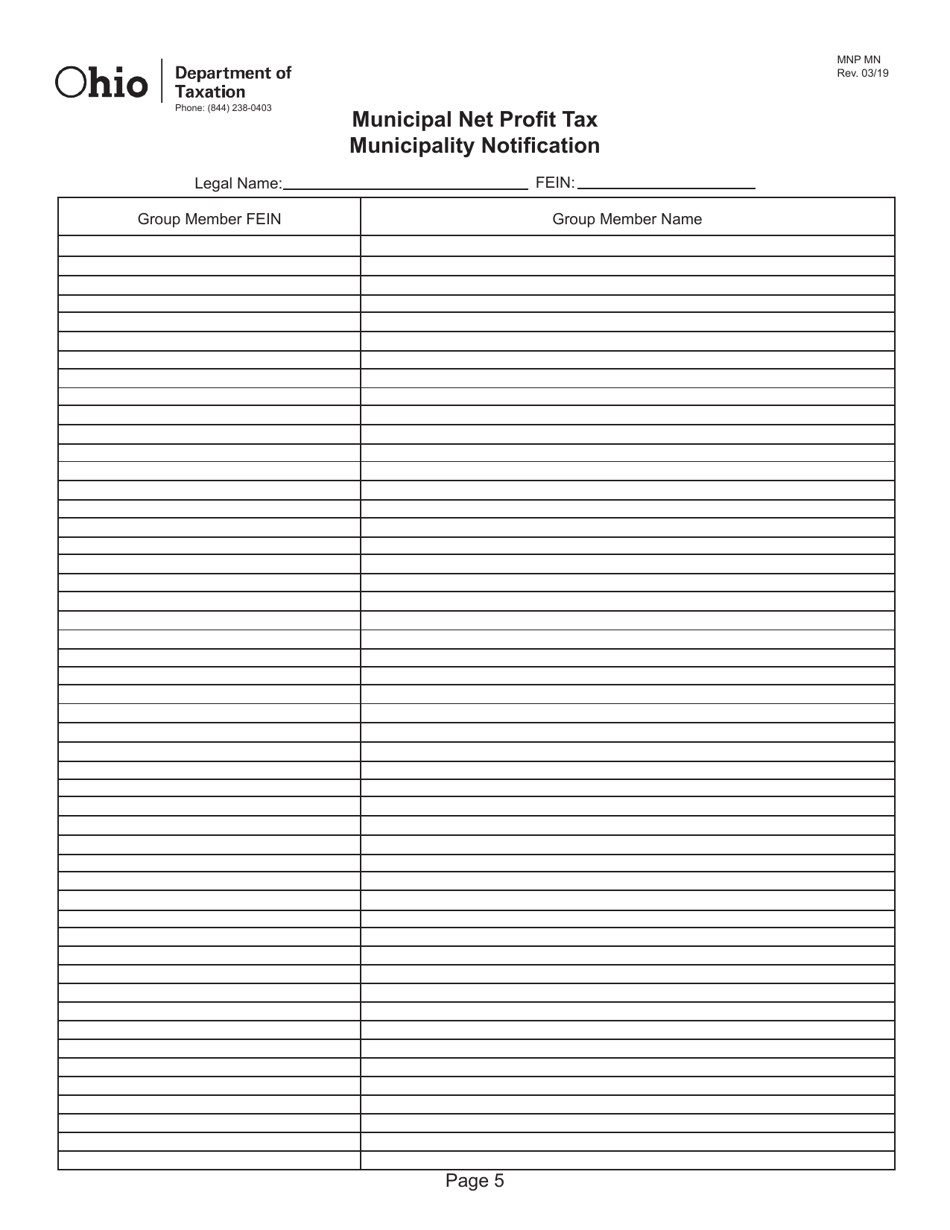

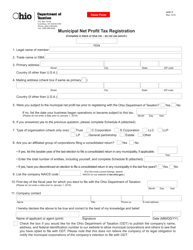

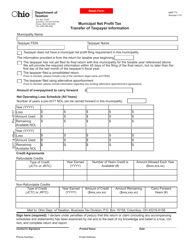

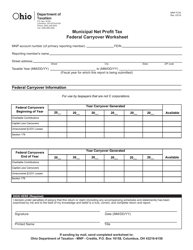

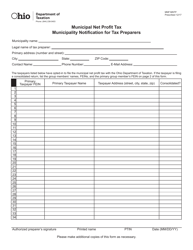

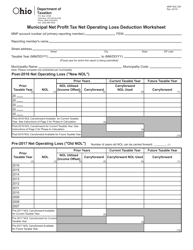

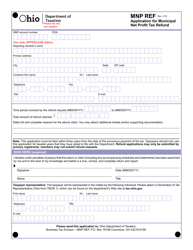

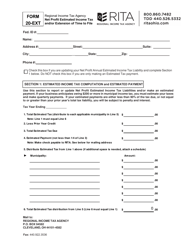

Form MNP MN Municipal Net Profit Tax Municipality Notification - Ohio

What Is Form MNP MN?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MNP?

A: MNP stands for Municipal Net Profit Tax.

Q: What is MN Municipal Net Profit Tax?

A: The MN Municipal Net Profit Tax is a tax imposed on the net profit of businesses operating in municipalities in Ohio.

Q: What is Form MNP?

A: Form MNP is a notification form that businesses need to file to report their net profit and pay the MN Municipal Net Profit Tax.

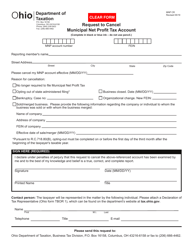

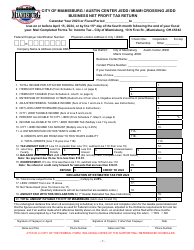

Q: Who needs to file Form MNP?

A: Businesses operating in municipalities in Ohio need to file Form MNP.

Q: What information do I need to provide on Form MNP?

A: You need to provide information about your business, such as its name, address, and federal employer identification number (EIN), as well as details about your net profit.

Q: When is Form MNP due?

A: Form MNP is typically due by the 15th day of the fourth month following the end of your fiscal year.

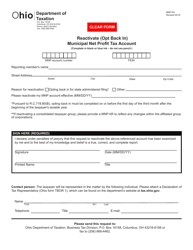

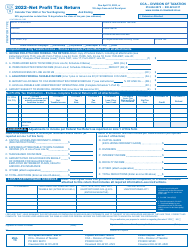

Form Details:

- Released on March 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MNP MN by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.