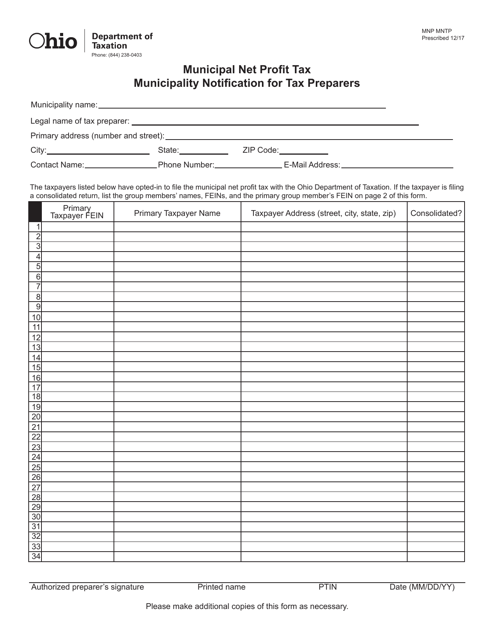

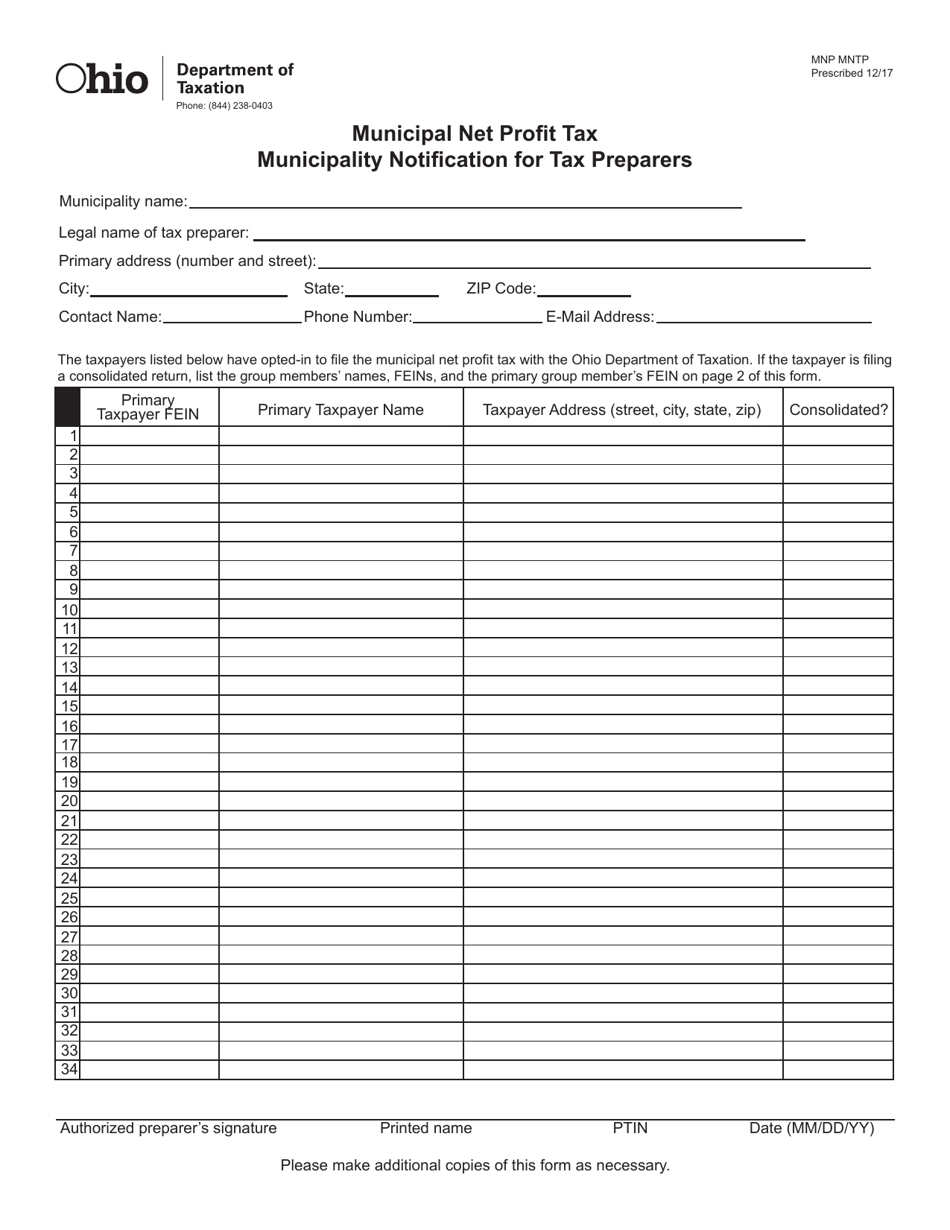

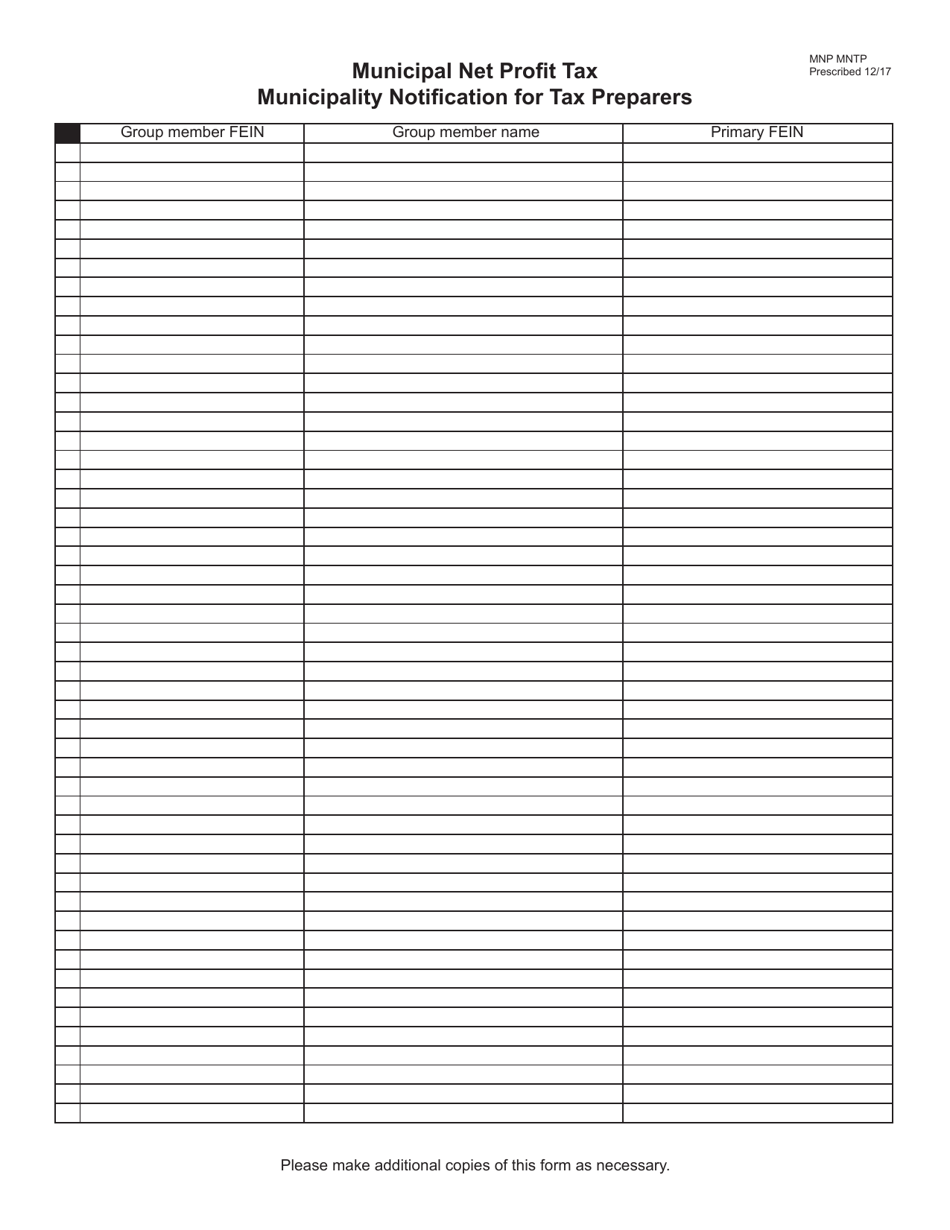

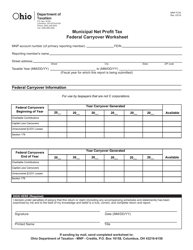

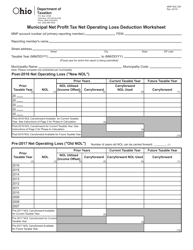

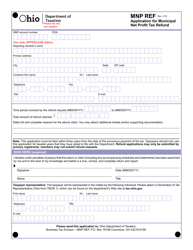

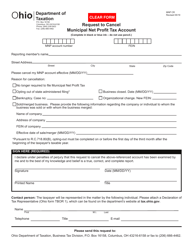

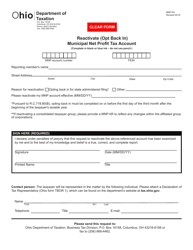

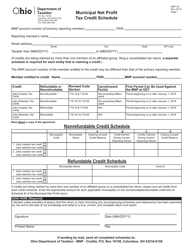

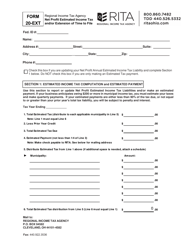

Form MNP MNTP Municipal Net Profit Tax Municipality Notification for Tax Preparers - Ohio

What Is Form MNP MNTP?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is MNP?

A: MNP stands for Municipal Net Profit Tax.

Q: What is MNTP?

A: MNTP stands for Municipality Notification for Tax Preparers.

Q: What does MNP/MNTP refer to in Ohio?

A: It refers to the tax regulations related to municipal net profit tax in Ohio.

Q: Who is affected by MNP/MNTP?

A: Tax preparers in Ohio are affected by MNP/MNTP.

Q: What is the purpose of MNTP?

A: The purpose of MNTP is to notify tax preparers about changes in municipal net profit tax regulations.

Q: What is the significance of municipal net profit tax?

A: Municipal net profit tax is a tax imposed on the net profit of businesses or individuals within a municipality in Ohio.

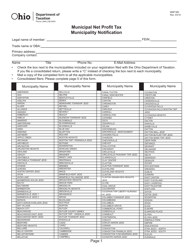

Q: Are all municipalities in Ohio subject to the same municipal net profit tax regulations?

A: No, each municipality in Ohio can have its own specific regulations regarding municipal net profit tax.

Q: Are there any penalties for non-compliance with municipal net profit tax regulations?

A: Yes, there can be penalties for non-compliance with municipal net profit tax regulations, such as fines or legal consequences.

Q: Is MNP/MNTP applicable only to businesses or also to individuals?

A: MNP/MNTP can be applicable to both businesses and individuals, depending on the specific regulations of each municipality in Ohio.

Form Details:

- Released on December 1, 2017;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form MNP MNTP by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.