This version of the form is not currently in use and is provided for reference only. Download this version of

Schedule IT NOL

for the current year.

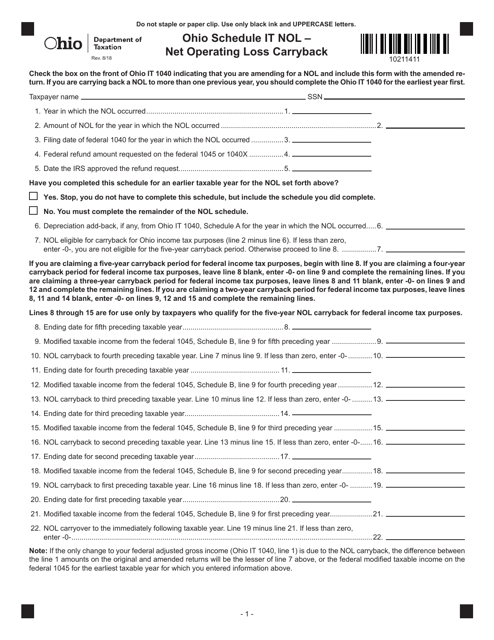

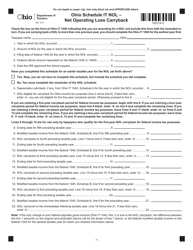

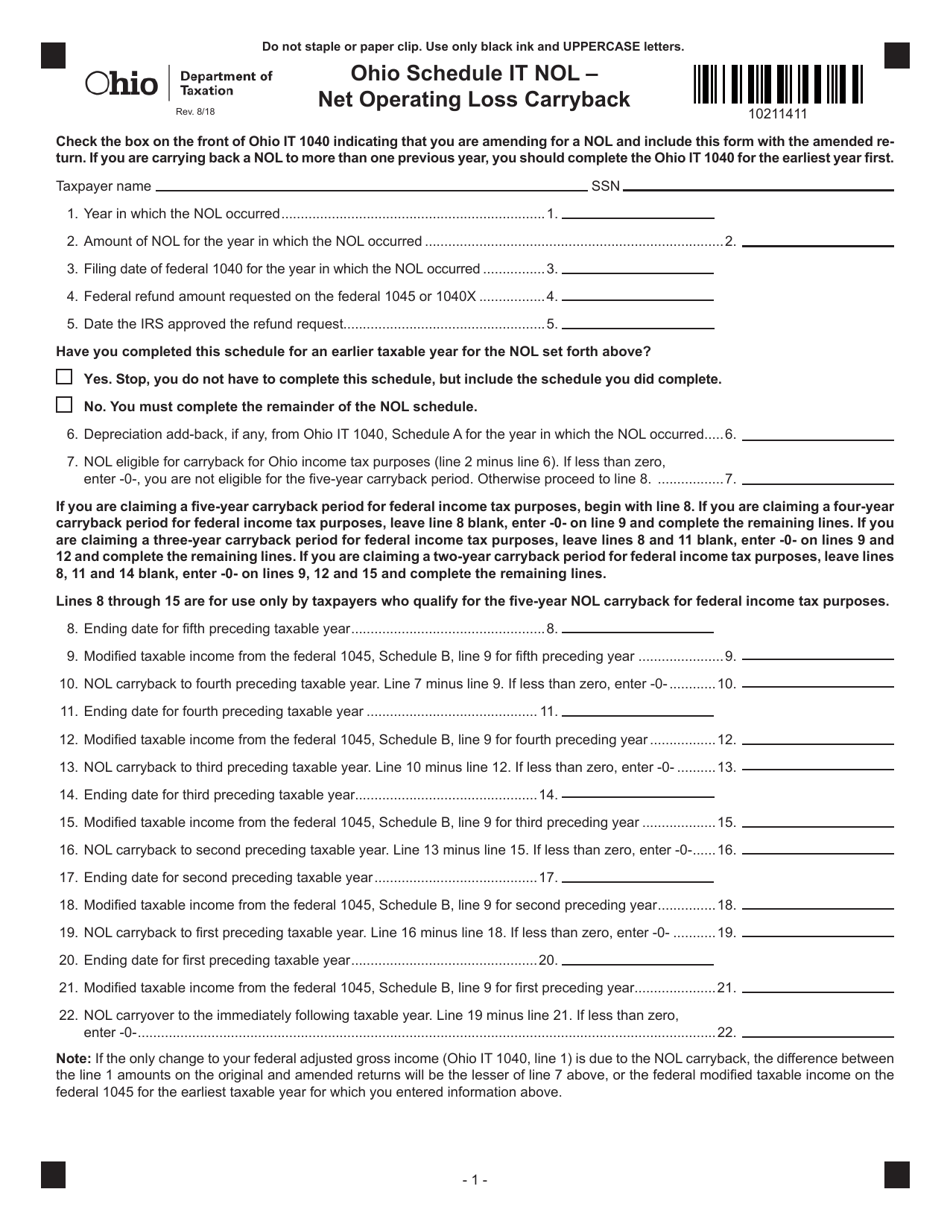

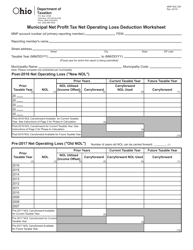

Schedule IT NOL Net Operating Loss Carryback - Ohio

What Is Schedule IT NOL?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

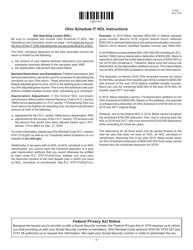

Q: What is Schedule IT NOL Net Operating Loss Carryback?

A: Schedule IT NOL Net Operating Loss Carryback is a form used by taxpayers in Ohio to carry back a net operating loss (NOL) incurred in a certain tax year to a prior tax year for a tax refund or credit.

Q: Who can use Schedule IT NOL Net Operating Loss Carryback?

A: Taxpayers in Ohio who have incurred a net operating loss (NOL) and want to carry it back to a prior tax year for a refund or credit can use Schedule IT NOL Net Operating Loss Carryback.

Q: How does Schedule IT NOL Net Operating Loss Carryback work?

A: Schedule IT NOL Net Operating Loss Carryback allows taxpayers to apply a net operating loss (NOL) from a certain tax year to a prior tax year in order to obtain a tax refund or credit for the amount of the NOL.

Q: What is a net operating loss (NOL)?

A: A net operating loss (NOL) occurs when a taxpayer's deductions exceed their income in a certain tax year. It can be carried back to a prior tax year to offset taxable income and potentially result in a tax refund or credit.

Q: What is the purpose of carrying back a net operating loss (NOL)?

A: The purpose of carrying back a net operating loss (NOL) is to offset taxable income in a prior tax year, which can result in a tax refund or credit for the taxpayer.

Q: Are there any limitations or restrictions on carrying back a net operating loss (NOL)?

A: Yes, there may be limitations or restrictions on carrying back a net operating loss (NOL) depending on the tax laws and regulations of the specific jurisdiction. It is important to consult the relevant tax authorities or a tax professional for guidance.

Q: Is Schedule IT NOL Net Operating Loss Carryback applicable in other states?

A: No, Schedule IT NOL Net Operating Loss Carryback is specific to Ohio. Other states may have their own forms and procedures for carrying back net operating losses (NOLs).

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule IT NOL by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.