This version of the form is not currently in use and is provided for reference only. Download this version of

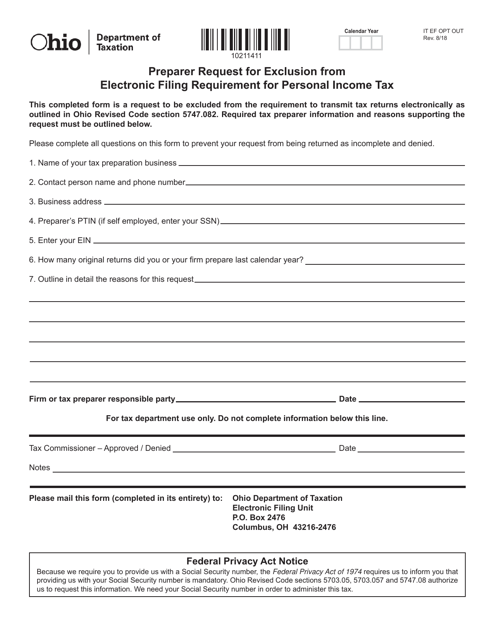

Form IT EF OPT OUT

for the current year.

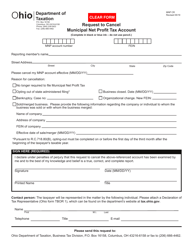

Form IT EF OPT OUT Preparer Request for Exclusion From Electronic Filing Requirement for Personal Income Tax - Ohio

What Is Form IT EF OPT OUT?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form IT EF OPT OUT?

A: Form IT EF OPT OUT is a request for exclusion from the electronic filing requirement for personal income tax in Ohio.

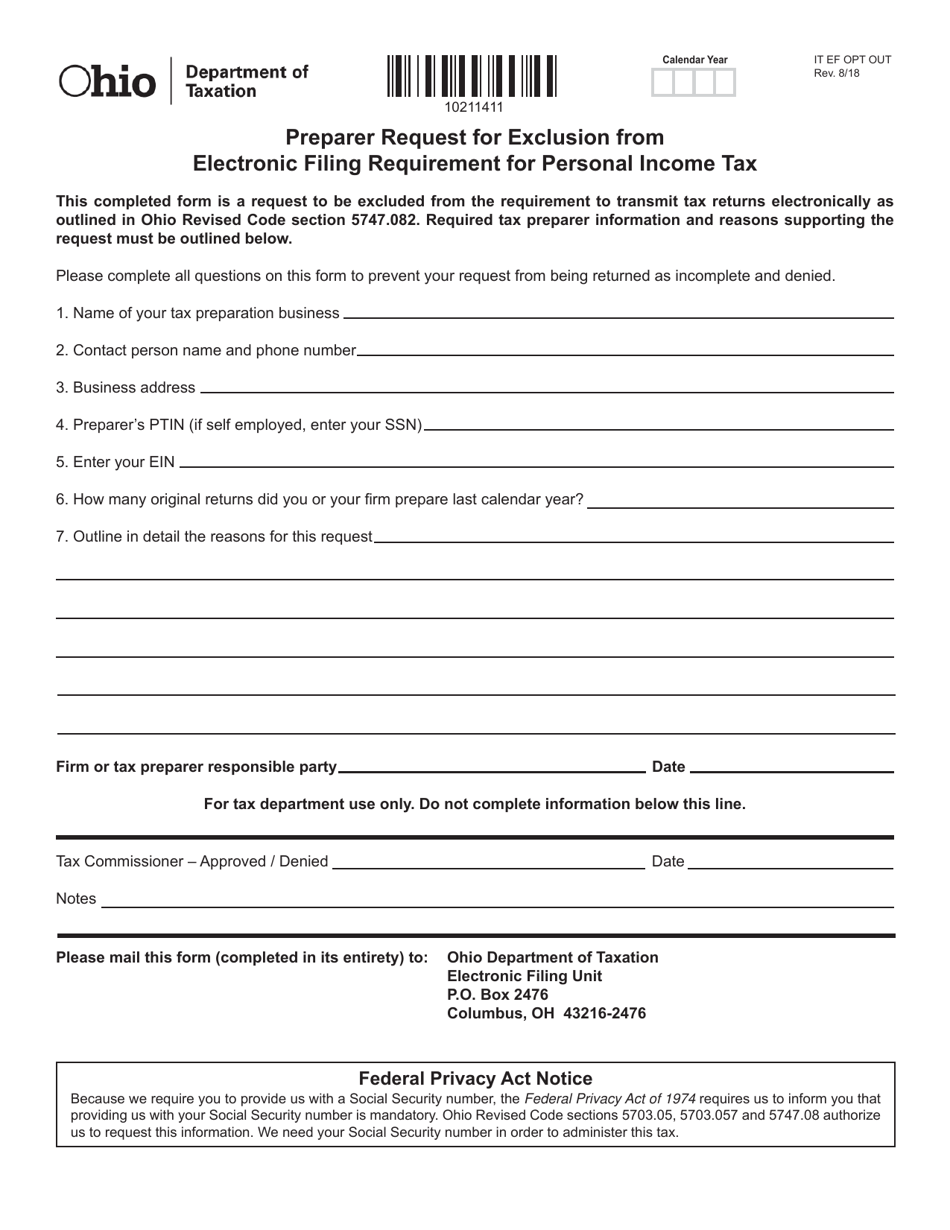

Q: Who can use the Form IT EF OPT OUT?

A: Any individual who wants to opt out of electronically filing their personal income tax in Ohio.

Q: Why would someone want to opt out of electronic filing?

A: There could be various reasons, such as personal preference or lack of access to the necessary technology.

Q: How can I request exclusion from electronic filing?

A: You can request exclusion by filling out the Form IT EF OPT OUT and submitting it to the appropriate tax authorities in Ohio.

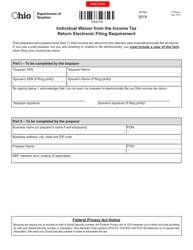

Q: Is there a deadline for submitting the Form IT EF OPT OUT?

A: Yes, the form must be submitted by the tax filing deadline for the applicable tax year.

Q: What happens after I submit the Form IT EF OPT OUT?

A: If your request is approved, you will be exempt from the electronic filing requirement for personal income tax in Ohio.

Q: Can I change my mind and opt back into electronic filing?

A: Yes, you can opt back into electronic filing at any time by notifying the tax authorities in Ohio.

Q: Are there any consequences for opting out of electronic filing?

A: No, there are no penalties or consequences for opting out of electronic filing for personal income tax in Ohio.

Form Details:

- Released on August 1, 2018;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form IT EF OPT OUT by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.