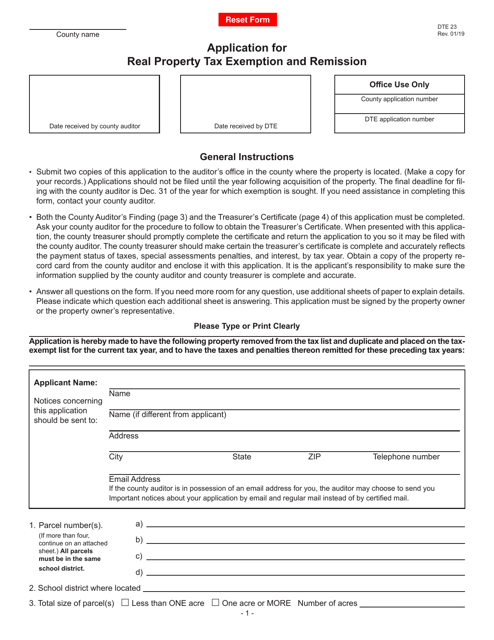

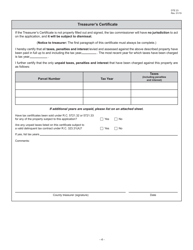

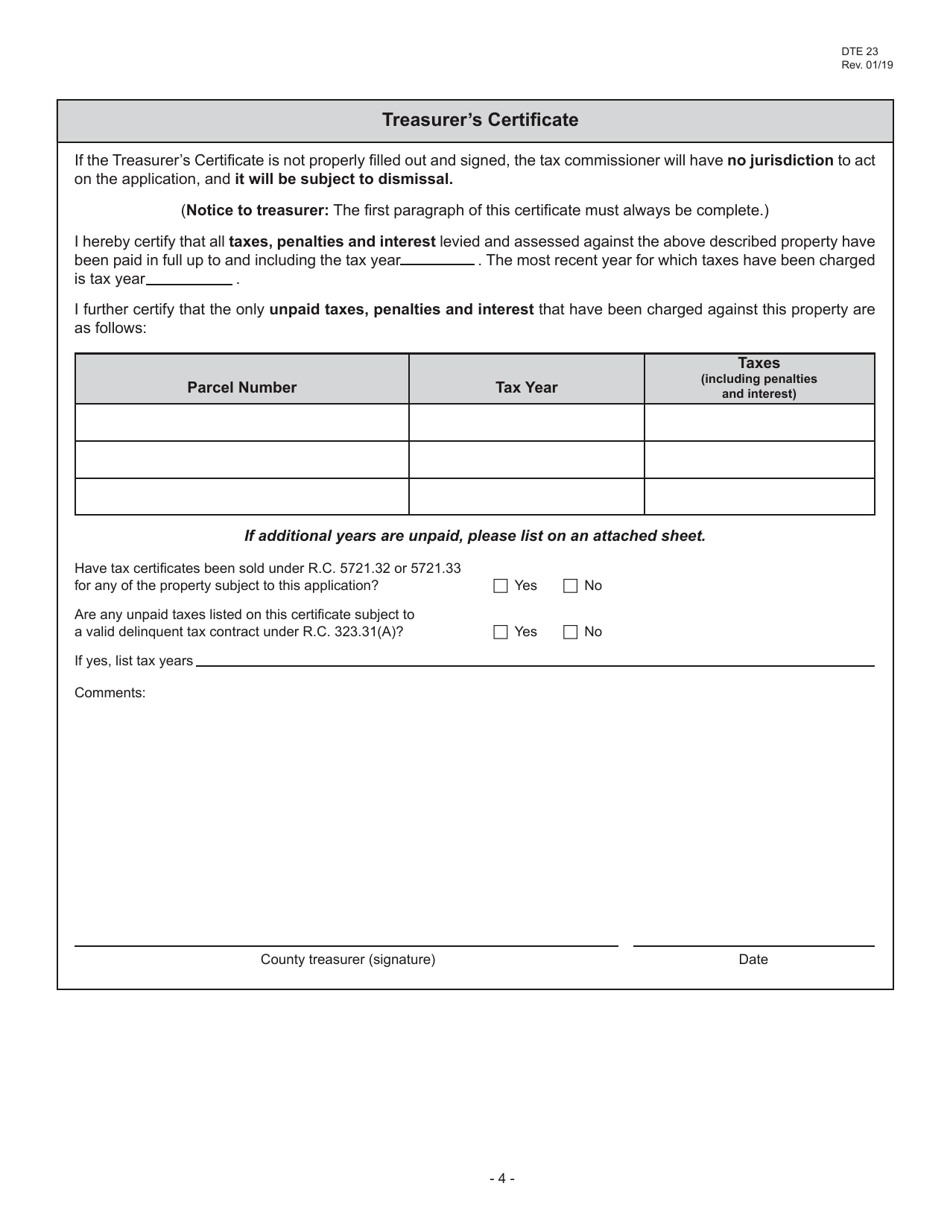

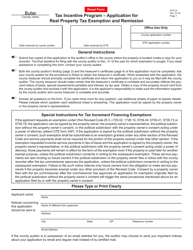

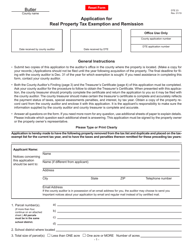

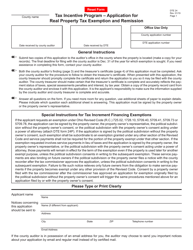

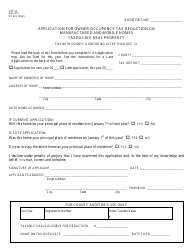

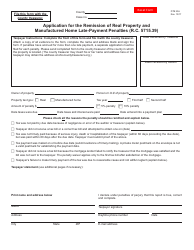

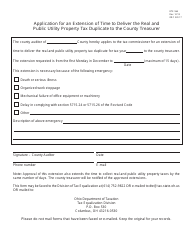

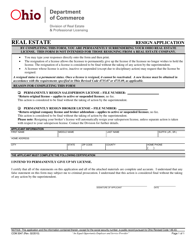

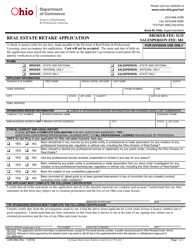

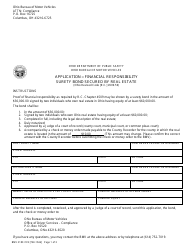

Form DTE23 Application for Real Property Tax Exemption and Remission - Ohio

What Is Form DTE23?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DTE23 form?

A: The DTE23 form is the Application for Real Property Tax Exemption and Remission in Ohio.

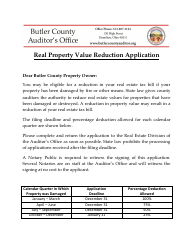

Q: Who can use the DTE23 form?

A: Property owners in Ohio who are seeking tax exemption or remission can use the DTE23 form.

Q: What is the purpose of the DTE23 form?

A: The DTE23 form is used to apply for exemption from or remission of real property taxes in Ohio.

Q: What are the eligibility requirements for tax exemption or remission?

A: The eligibility requirements for tax exemption or remission vary depending on the specific program or circumstance. It is best to consult the instructions provided with the DTE23 form or contact your county auditor's office for guidance.

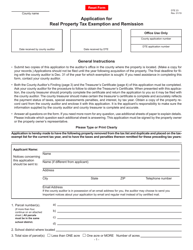

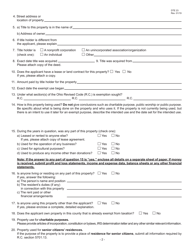

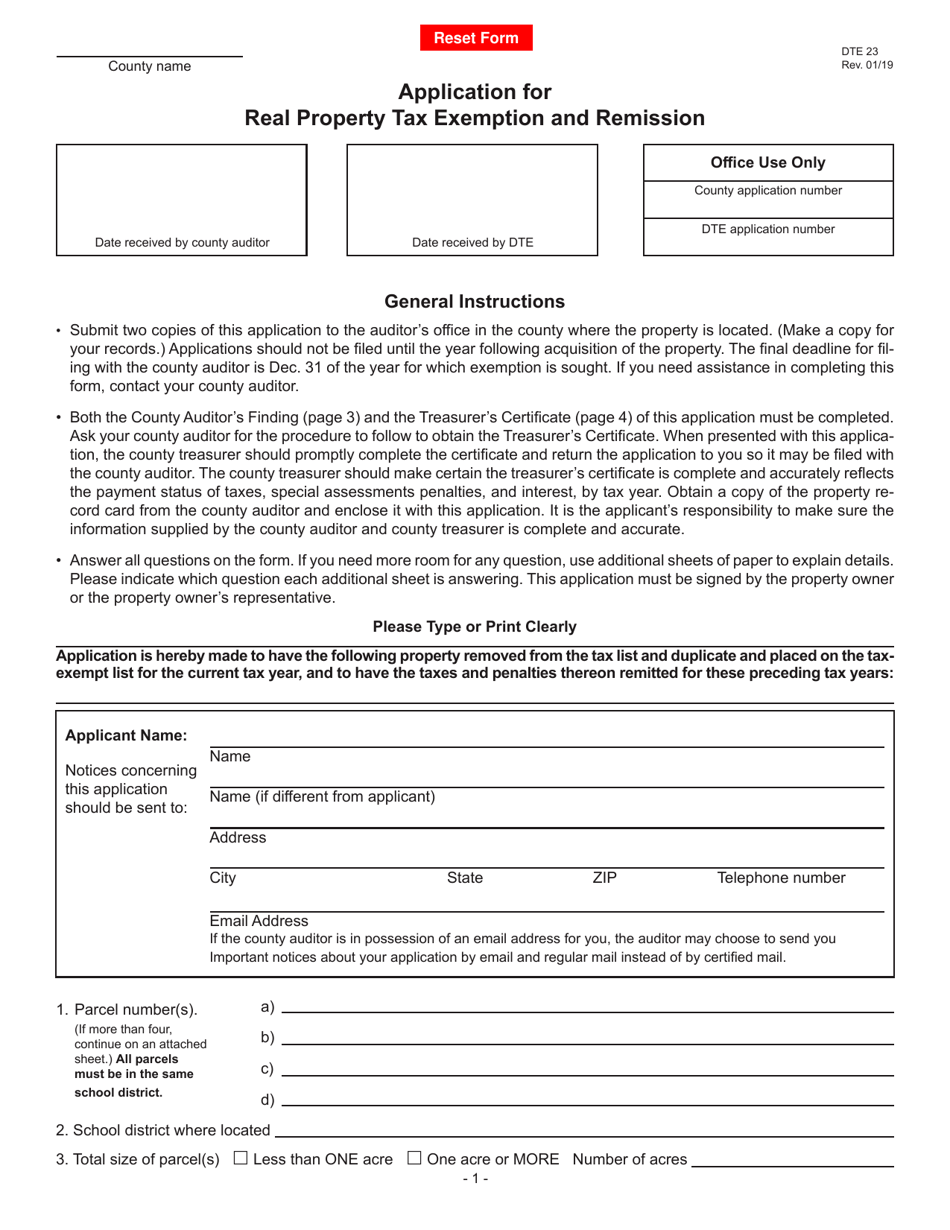

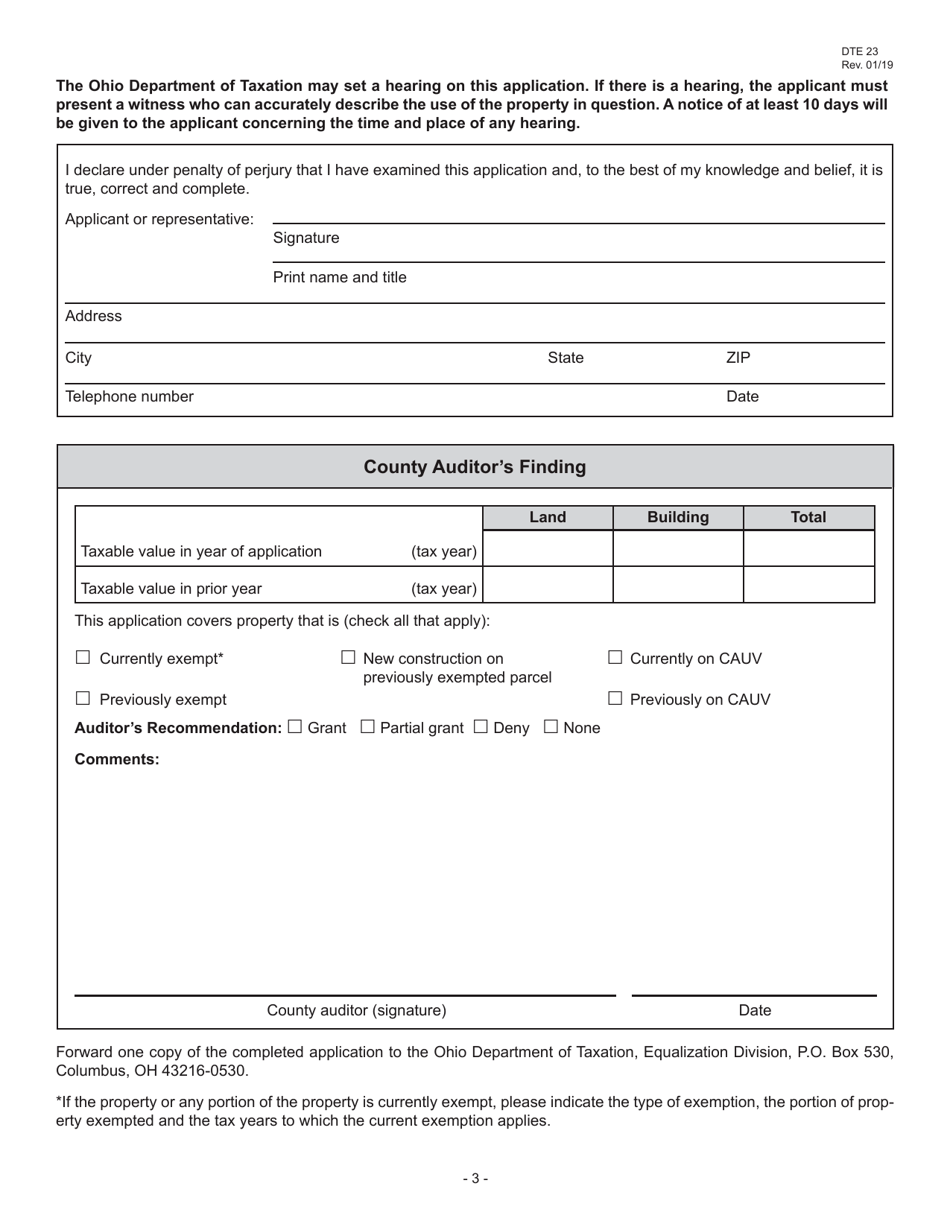

Q: What documents do I need to submit with the DTE23 form?

A: The specific documents required may vary depending on the type of exemption or remission being sought. Generally, you will need to provide documentation that supports your eligibility, such as proof of ownership, income and financial information, and any required supporting forms or certifications.

Q: When should I submit the DTE23 form?

A: It is recommended to submit the DTE23 form well in advance of the deadline specified by your county auditor's office. The exact deadline may vary depending on the tax year and program.

Q: Can I submit the DTE23 form electronically?

A: The availability of electronic submission may vary depending on your county auditor's office. You should check with your county auditor for their preferred submission method.

Q: Are there any fees associated with the DTE23 form?

A: There may be fees associated with the DTE23 form, such as processing fees or recording fees. The specific fees and payment instructions will be provided in the instructions accompanying the form.

Q: How long does it take to process the DTE23 form?

A: The processing time for the DTE23 form may vary depending on the workload of the county auditor's office and the specific circumstances of your application. It is best to contact your county auditor's office for an estimate of the processing time.

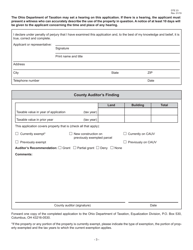

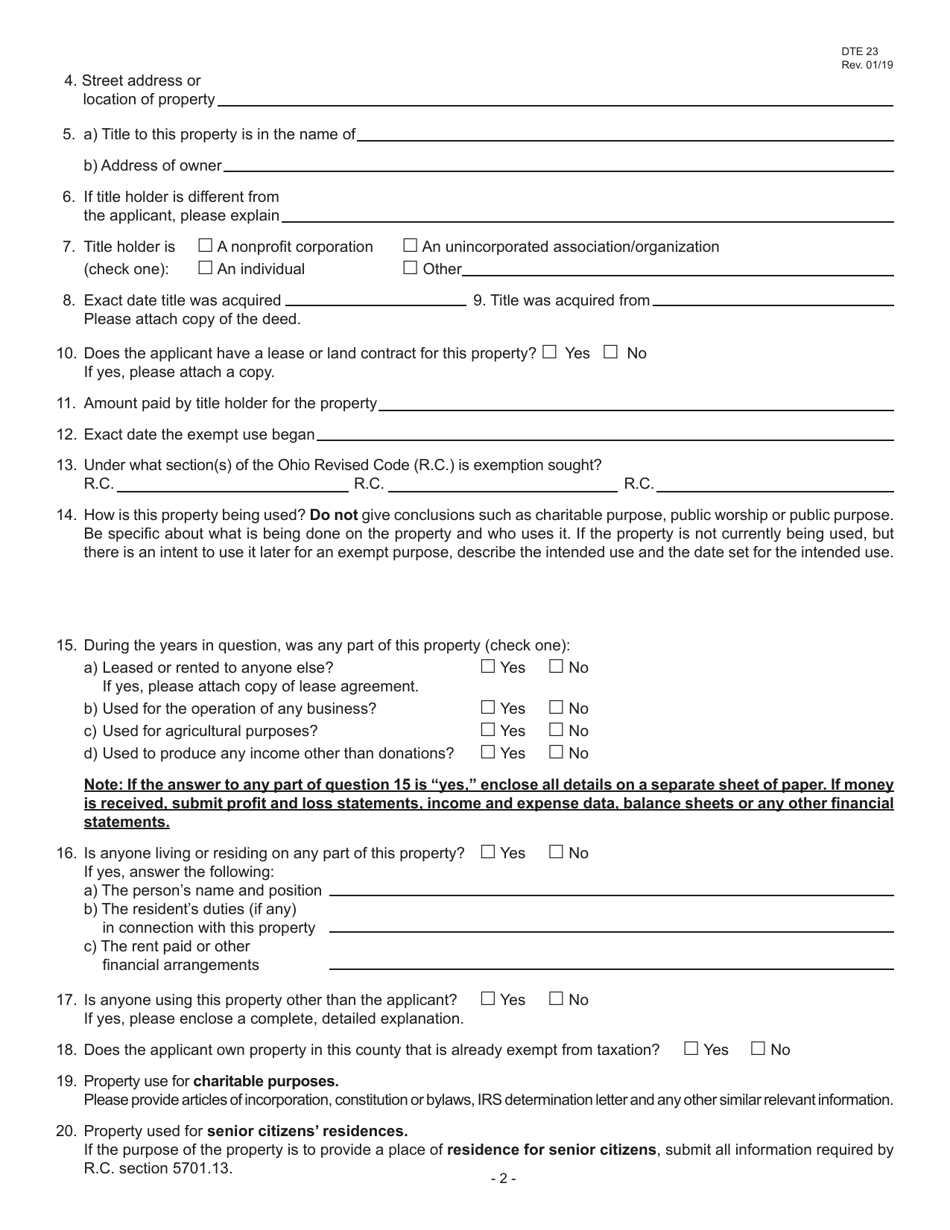

Q: What happens after the DTE23 form is processed?

A: Once the DTE23 form is processed, you will receive notification from your county auditor's office regarding the status of your application. If approved, you may receive a tax exemption or remission for the applicable tax year.

Q: Can I appeal if my DTE23 form is denied?

A: If your DTE23 form is denied, you may have the right to appeal the decision. The process for appealing a denial will vary depending on the program and county. You should consult the instructions provided with the denial notification or contact your county auditor's office for guidance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE23 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.