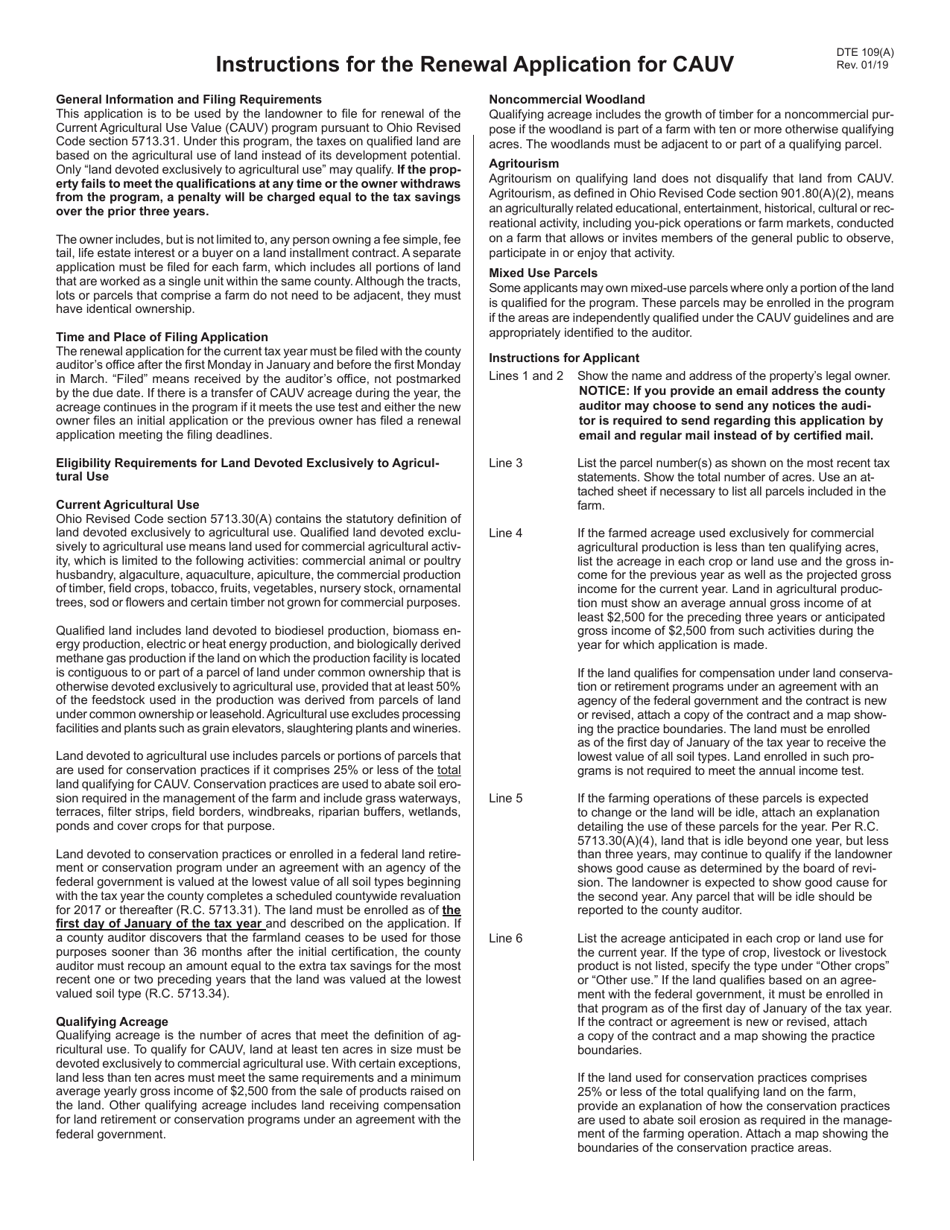

This version of the form is not currently in use and is provided for reference only. Download this version of

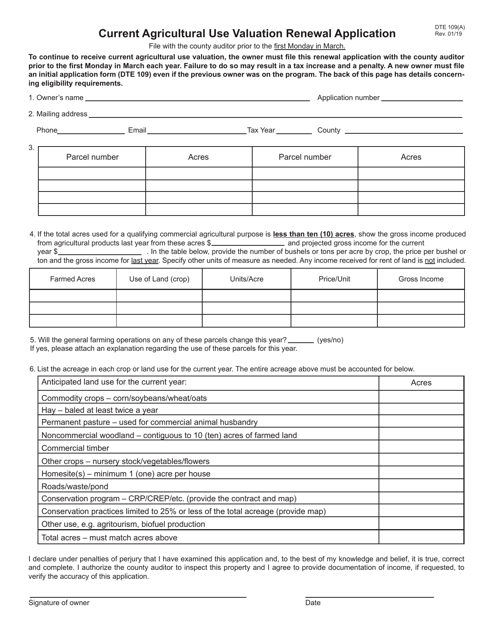

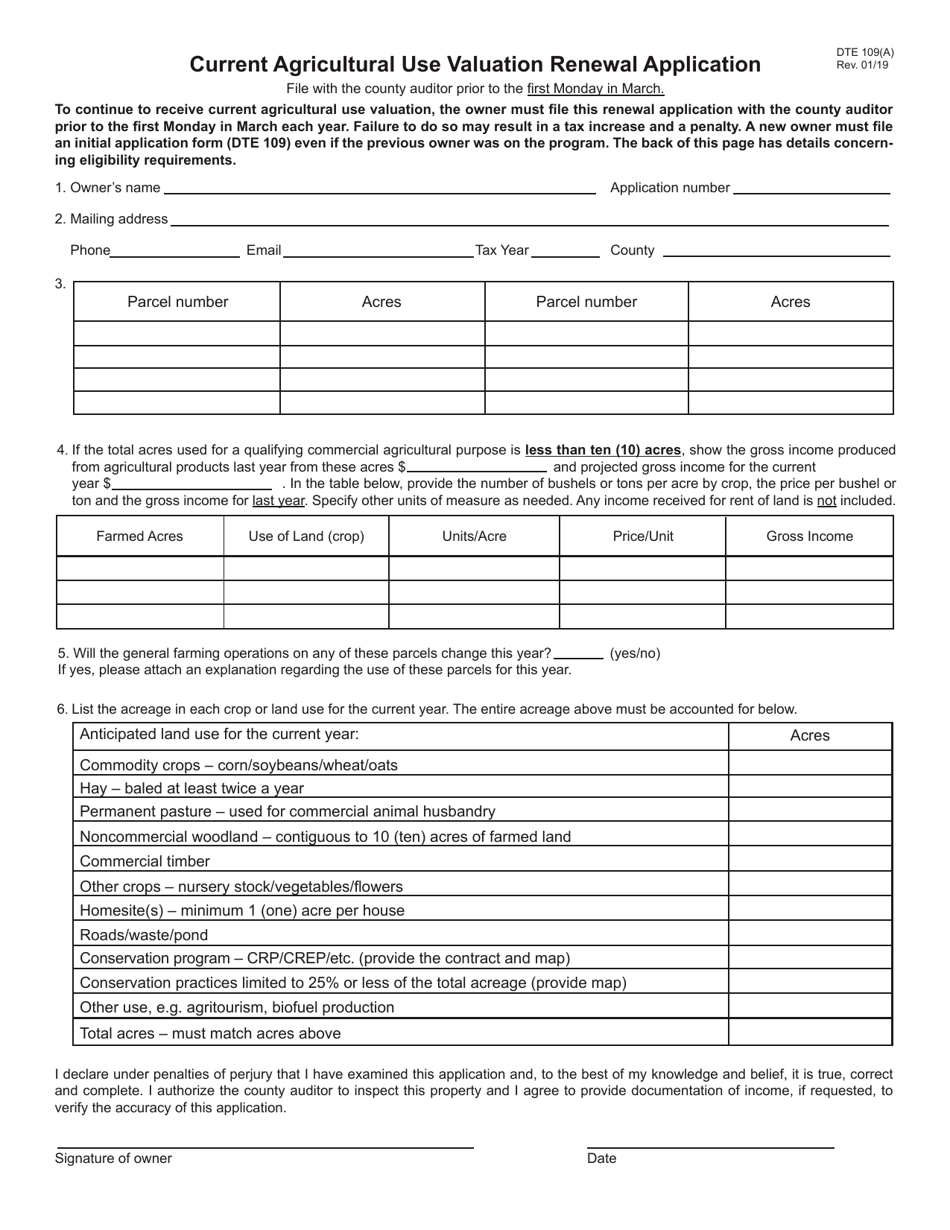

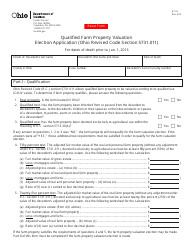

Form DTE109(A)

for the current year.

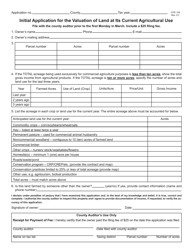

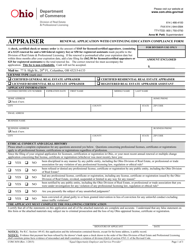

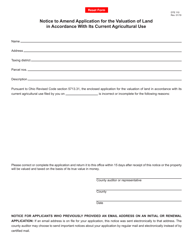

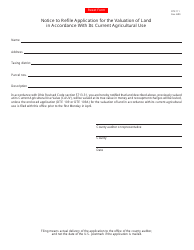

Form DTE109(A) Current Agricultural Use Valuation Renewal Application - Ohio

What Is Form DTE109(A)?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DTE109(A) Current Agricultural Use Valuation Renewal Application?

A: The DTE109(A) is an application form used in Ohio for renewing the Current Agricultural Use Valuation (CAUV).

Q: Who needs to fill out the DTE109(A) form?

A: Property owners in Ohio who currently have their agricultural land valued under the CAUV program and wish to renew their valuation need to fill out the DTE109(A) form.

Q: What is the purpose of the Current Agricultural Use Valuation (CAUV) program?

A: The CAUV program provides property tax relief to qualifying agricultural landowners by valuing their land based on its agricultural use rather than its market value.

Q: What information is required on the DTE109(A) form?

A: The DTE109(A) form requires information such as the property owner's name, contact details, legal description of the property, and details about the agricultural activities conducted on the land.

Q: Is there a deadline for submitting the DTE109(A) form?

A: Yes, the DTE109(A) form must be submitted to the county auditor's office by the first Monday in March.

Q: What happens if I don't renew my CAUV valuation?

A: If you do not renew your CAUV valuation, your property will be assessed at its market value rather than the lower agricultural value, resulting in higher property taxes.

Q: Are there any eligibility requirements to qualify for the CAUV program?

A: Yes, there are specific requirements related to the size, use, and income associated with the agricultural land in order to qualify for the CAUV program. These requirements can vary by county.

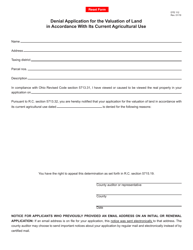

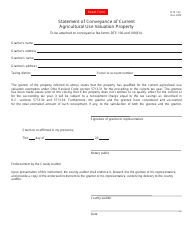

Q: Can I appeal if my CAUV valuation is denied or changed?

A: Yes, you have the right to appeal the decision regarding your CAUV valuation to the county board of revision.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE109(A) by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.