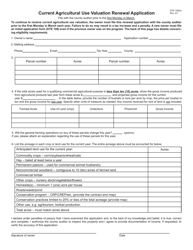

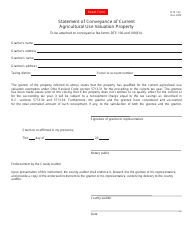

This version of the form is not currently in use and is provided for reference only. Download this version of

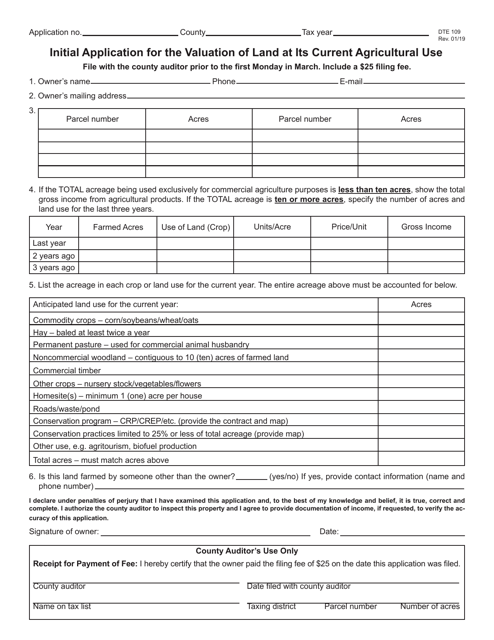

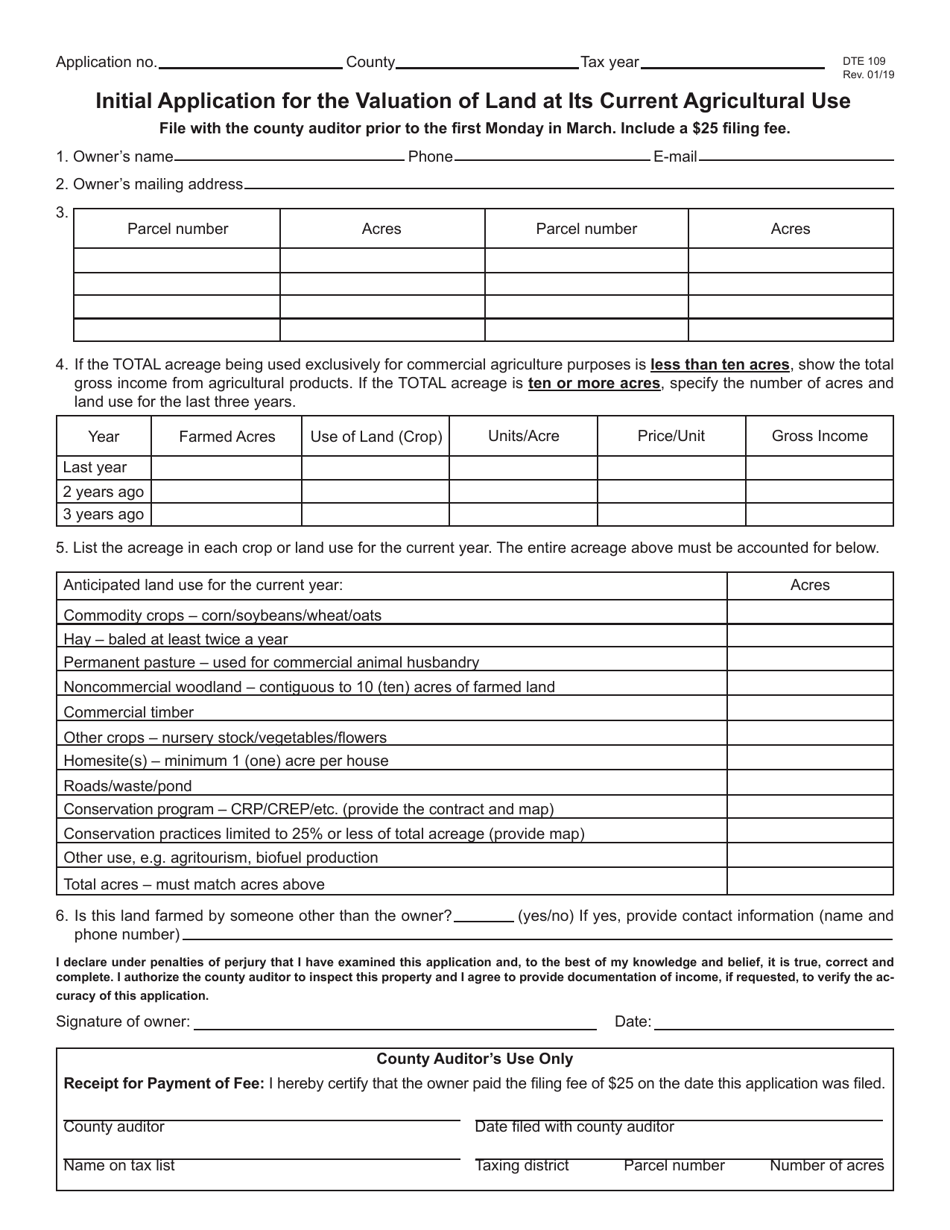

Form DTE109

for the current year.

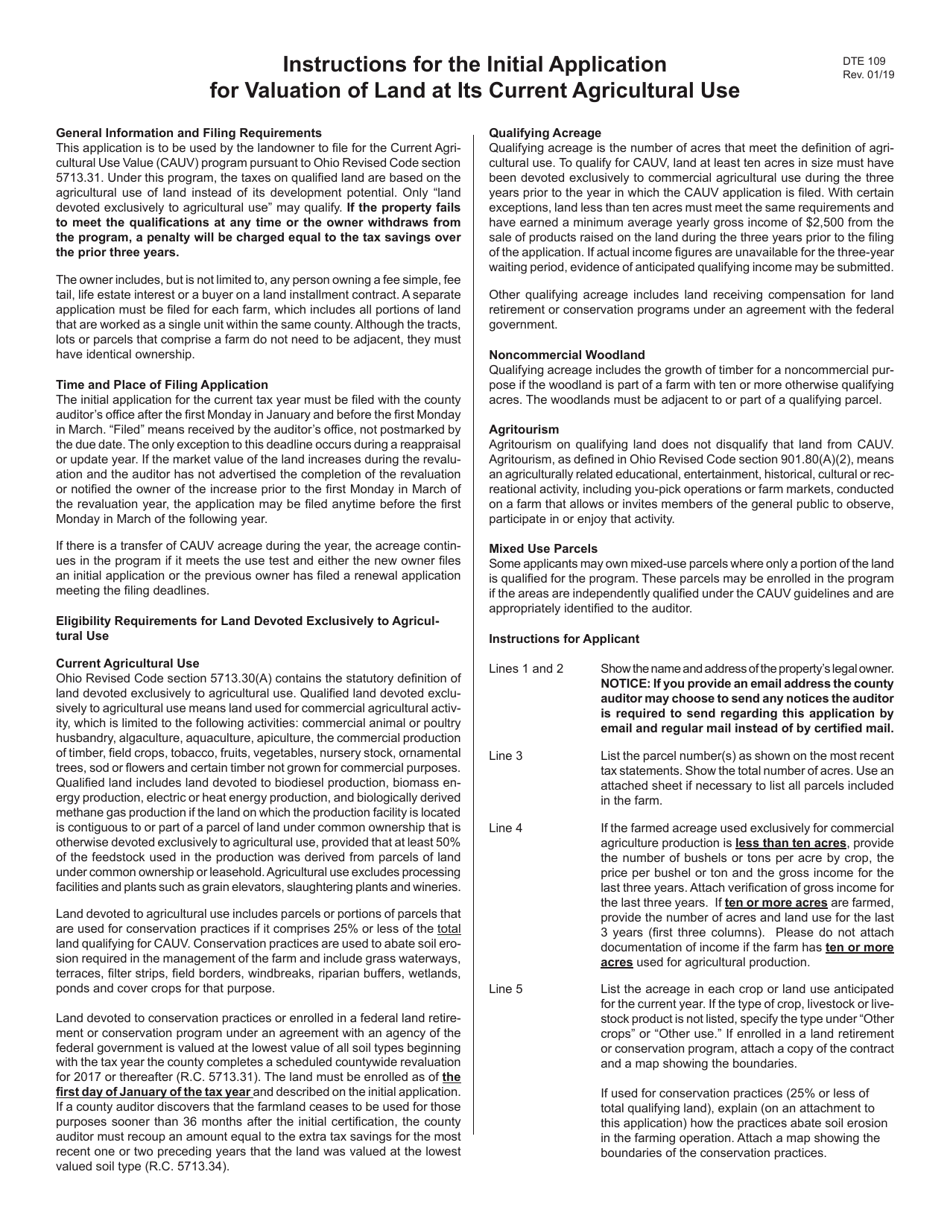

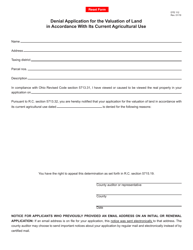

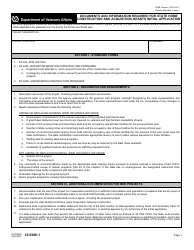

Form DTE109 Initial Application for the Valuation of Land at Its Current Agricultural Use - Ohio

What Is Form DTE109?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE109?

A: Form DTE109 is the Initial Application for the Valuation of Land at Its Current Agricultural Use in Ohio.

Q: Who needs to fill out Form DTE109?

A: Form DTE109 needs to be filled out by landowners in Ohio who want to have their land valued at its current agricultural use.

Q: What is the purpose of Form DTE109?

A: The purpose of Form DTE109 is to apply for a reduced valuation on agricultural land in Ohio.

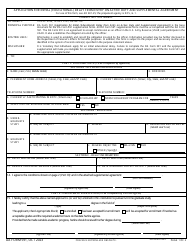

Q: What information is required on Form DTE109?

A: Form DTE109 requires information such as the property owner's name, contact information, parcel number, acreage, and details about the agricultural activities conducted on the land.

Q: When should I submit Form DTE109?

A: Form DTE109 should be submitted to the county auditor's office between the dates of the first Monday in January and the first Monday in March of each year.

Q: Are there any fees associated with submitting Form DTE109?

A: There are no fees associated with submitting Form DTE109.

Q: What happens after I submit Form DTE109?

A: After you submit Form DTE109, the county auditor's office will review your application and determine if your land qualifies for the reduced agricultural valuation.

Q: Can I appeal if my application is denied?

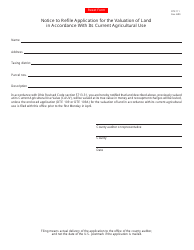

A: Yes, you can appeal a denial by contacting your county board of revision within the prescribed time frame.

Q: How long is the reduced agricultural valuation in effect?

A: The reduced agricultural valuation is in effect for the tax year in which the application was filed and remains in effect until the property changes ownership or no longer qualifies for the reduced valuation.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE109 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.