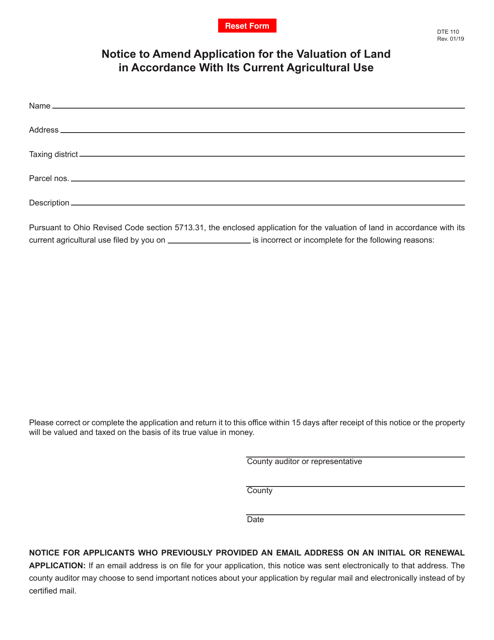

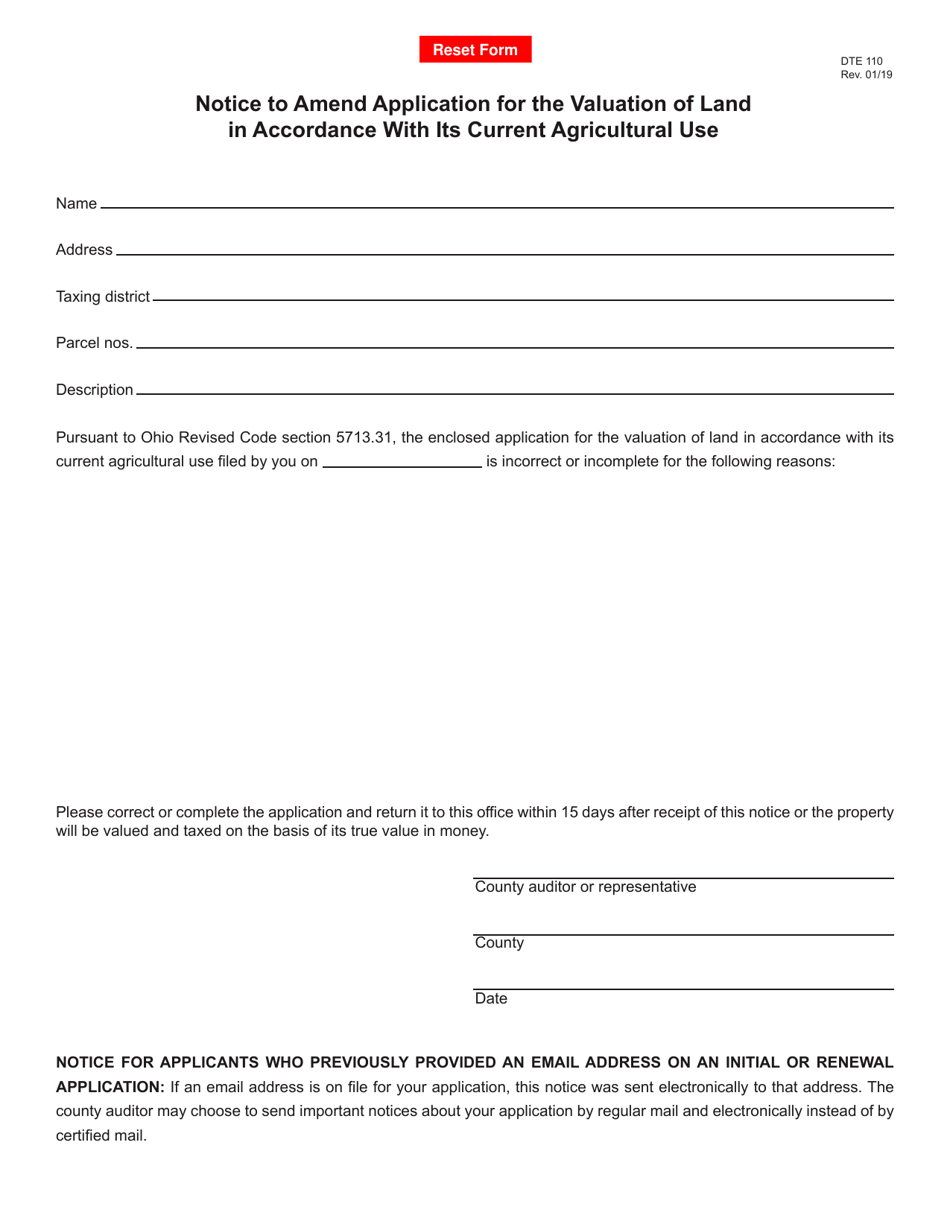

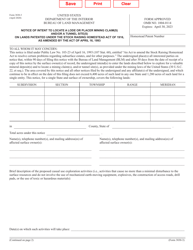

Form DTE110 Notice to Amend Application for the Valuation of Land in Accordance With Its Current Agricultural Use - Ohio

What Is Form DTE110?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

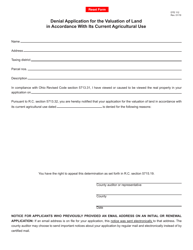

Q: What is Form DTE110?

A: Form DTE110 is a notice to amend application for the valuation of land in accordance with its current agricultural use in Ohio.

Q: What is the purpose of Form DTE110?

A: The purpose of Form DTE110 is to update the application for the valuation of agricultural land in Ohio based on its current use.

Q: Who needs to use Form DTE110?

A: Property owners in Ohio who have agricultural land and want to update the valuation of their land based on its current use need to use Form DTE110.

Q: How do I submit Form DTE110?

A: Form DTE110 can be submitted by mail or in person to the local county auditor's office.

Q: What information is required on Form DTE110?

A: Form DTE110 requires information such as the property owner's name and address, parcel number, agricultural use details, and any supporting documentation.

Q: Are there any fees associated with submitting Form DTE110?

A: There are no fees associated with submitting Form DTE110.

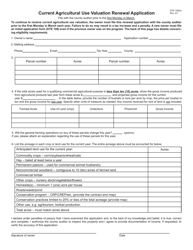

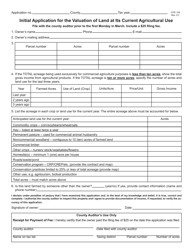

Q: When is the deadline to submit Form DTE110?

A: The deadline to submit Form DTE110 is generally the first Monday in March, but it varies by county. It is recommended to contact the local county auditor's office for the specific deadline.

Q: Can I amend my application for the valuation of land after the deadline?

A: Amendments to the application for the valuation of land can generally be made after the deadline, but it may result in penalties or delayed processing. It is best to contact the local county auditor's office for guidance.

Q: What happens after I submit Form DTE110?

A: After submitting Form DTE110, the local county auditor's office will review the updated information and determine the revised valuation of the agricultural land.

Q: Can I appeal the revised valuation of my agricultural land?

A: Yes, property owners can appeal the revised valuation of their agricultural land if they disagree with it. The process for appealing varies by county, and it is advisable to consult with the local county auditor's office for more information.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE110 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.