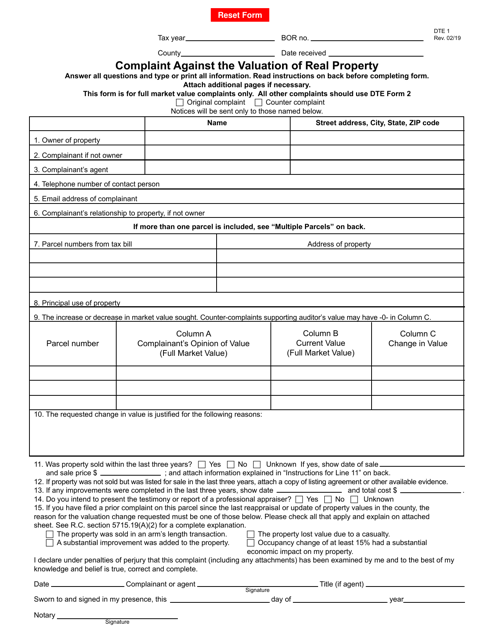

This version of the form is not currently in use and is provided for reference only. Download this version of

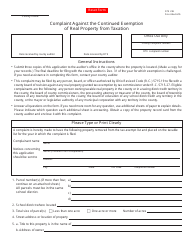

Form DTE1

for the current year.

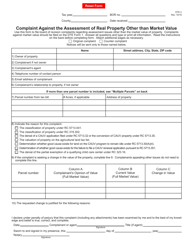

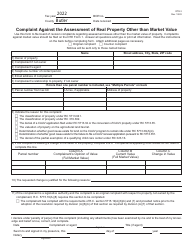

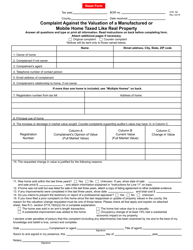

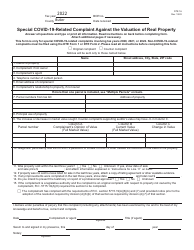

Form DTE1 Complaint Against the Valuation of Real Property - Ohio

What Is Form DTE1?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

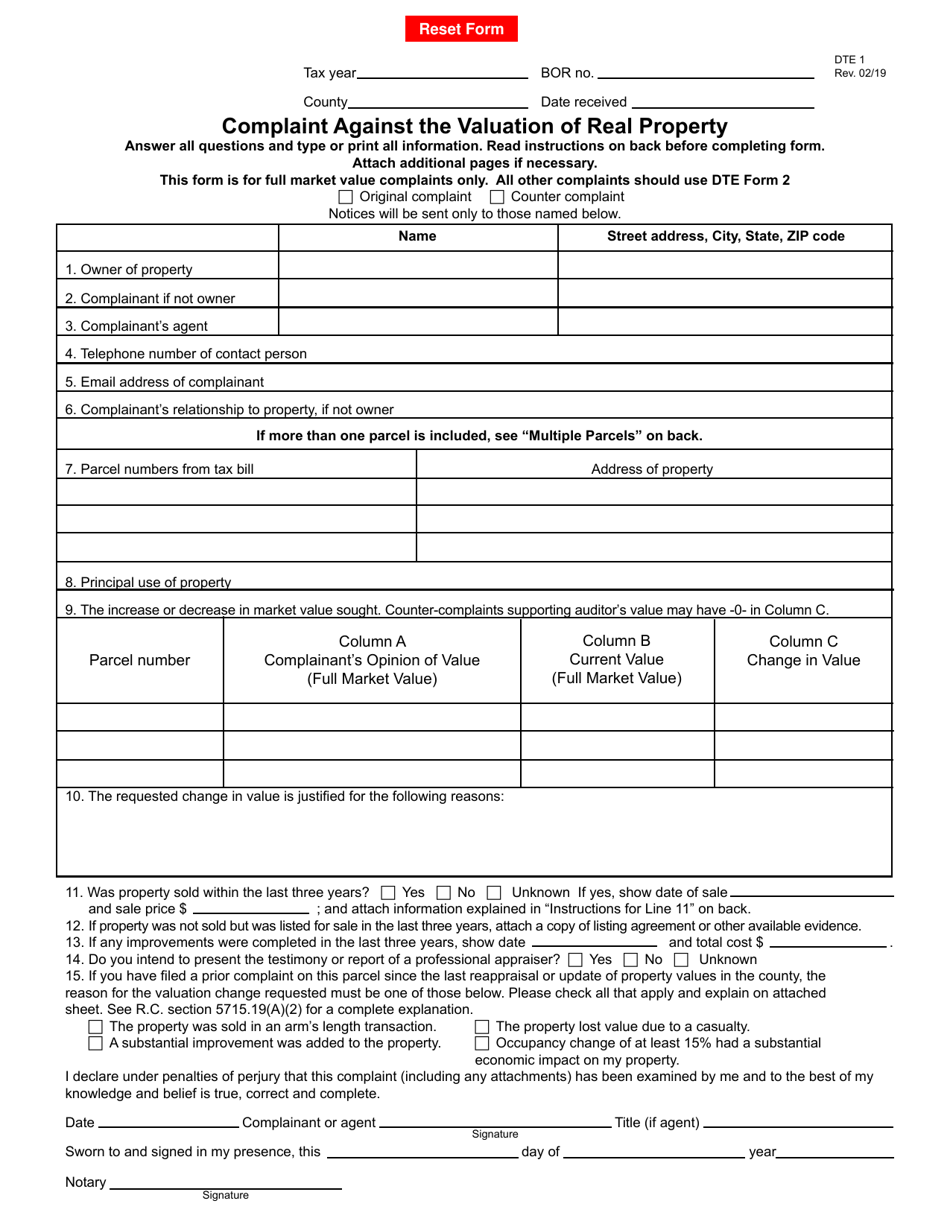

Q: What is a DTE1 complaint?

A: A DTE1 complaint is a form that allows property owners in Ohio to dispute the valuation of their real property.

Q: How can I file a DTE1 complaint?

A: To file a DTE1 complaint, you need to complete the form and submit it to the Ohio Board of Tax Appeals.

Q: Who can file a DTE1 complaint?

A: Any property owner in Ohio who disagrees with the valuation of their real property can file a DTE1 complaint.

Q: What is the purpose of filing a DTE1 complaint?

A: The purpose of filing a DTE1 complaint is to challenge the assessed value of your real property and potentially reduce your property taxes.

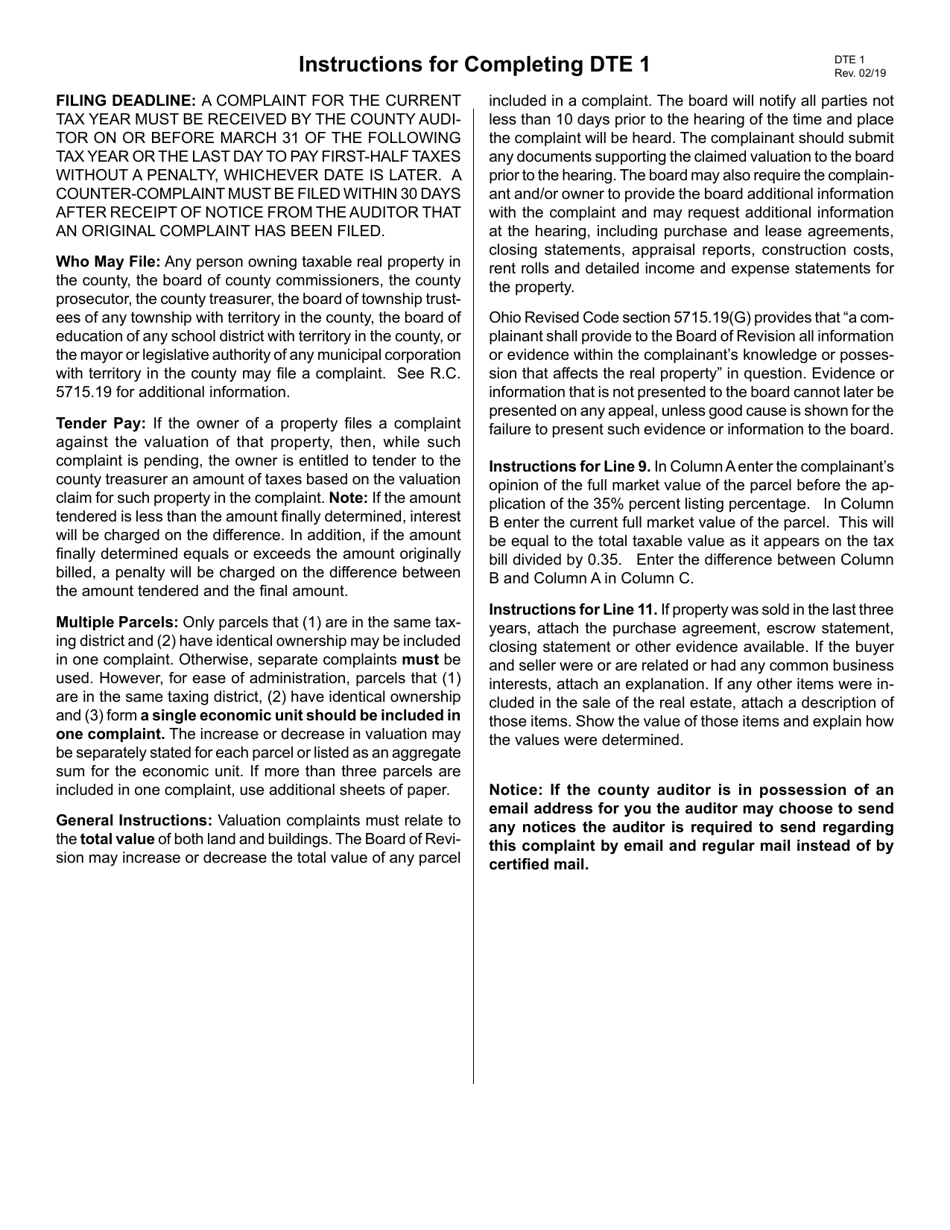

Q: Are there any deadlines for filing a DTE1 complaint?

A: Yes, there are specific deadlines for filing a DTE1 complaint. You should check with the Ohio Board of Tax Appeals for the current deadline.

Q: Do I need to provide evidence when filing a DTE1 complaint?

A: Yes, it is recommended to provide supporting evidence, such as recent appraisals or sales data, to strengthen your case when filing a DTE1 complaint.

Q: What happens after I file a DTE1 complaint?

A: After you file a DTE1 complaint, a hearing will be scheduled, and you will have the opportunity to present your case to the Ohio Board of Tax Appeals.

Q: Can I hire an attorney to help me with my DTE1 complaint?

A: Yes, you can choose to hire an attorney to assist you with your DTE1 complaint, but it is not required.

Q: What if my DTE1 complaint is successful?

A: If your DTE1 complaint is successful, the assessed value of your real property may be reduced, potentially leading to lower property taxes.

Q: What if my DTE1 complaint is unsuccessful?

A: If your DTE1 complaint is unsuccessful, you still have the option to appeal the decision to the Ohio courts, but additional steps may be required.

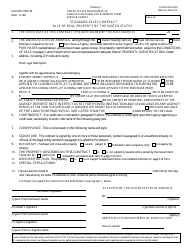

Form Details:

- Released on February 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE1 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.