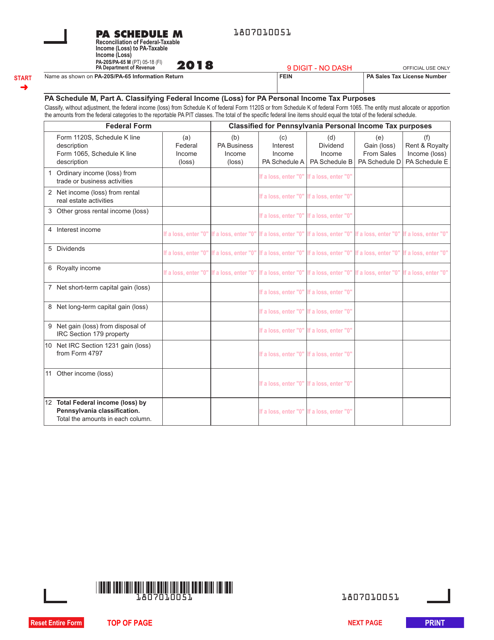

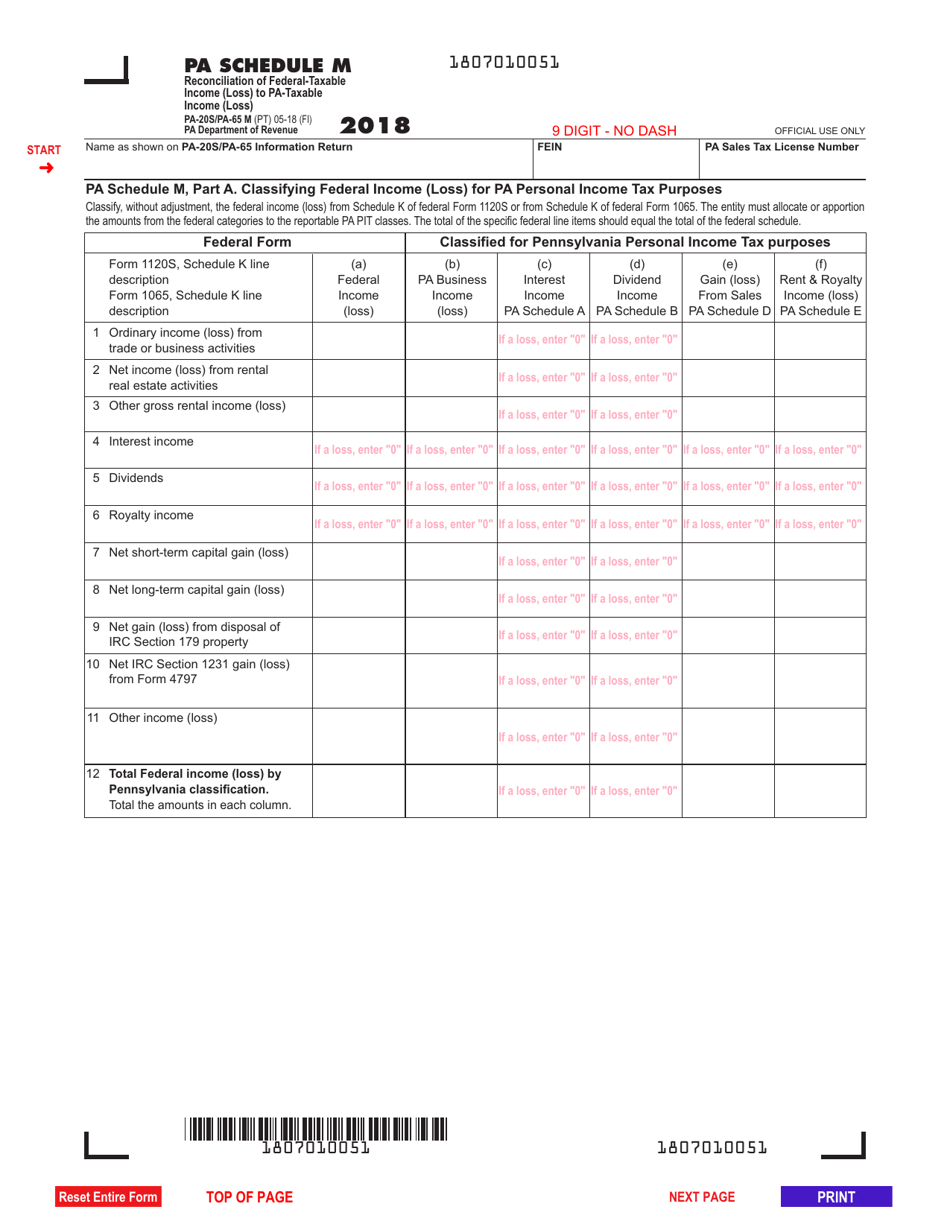

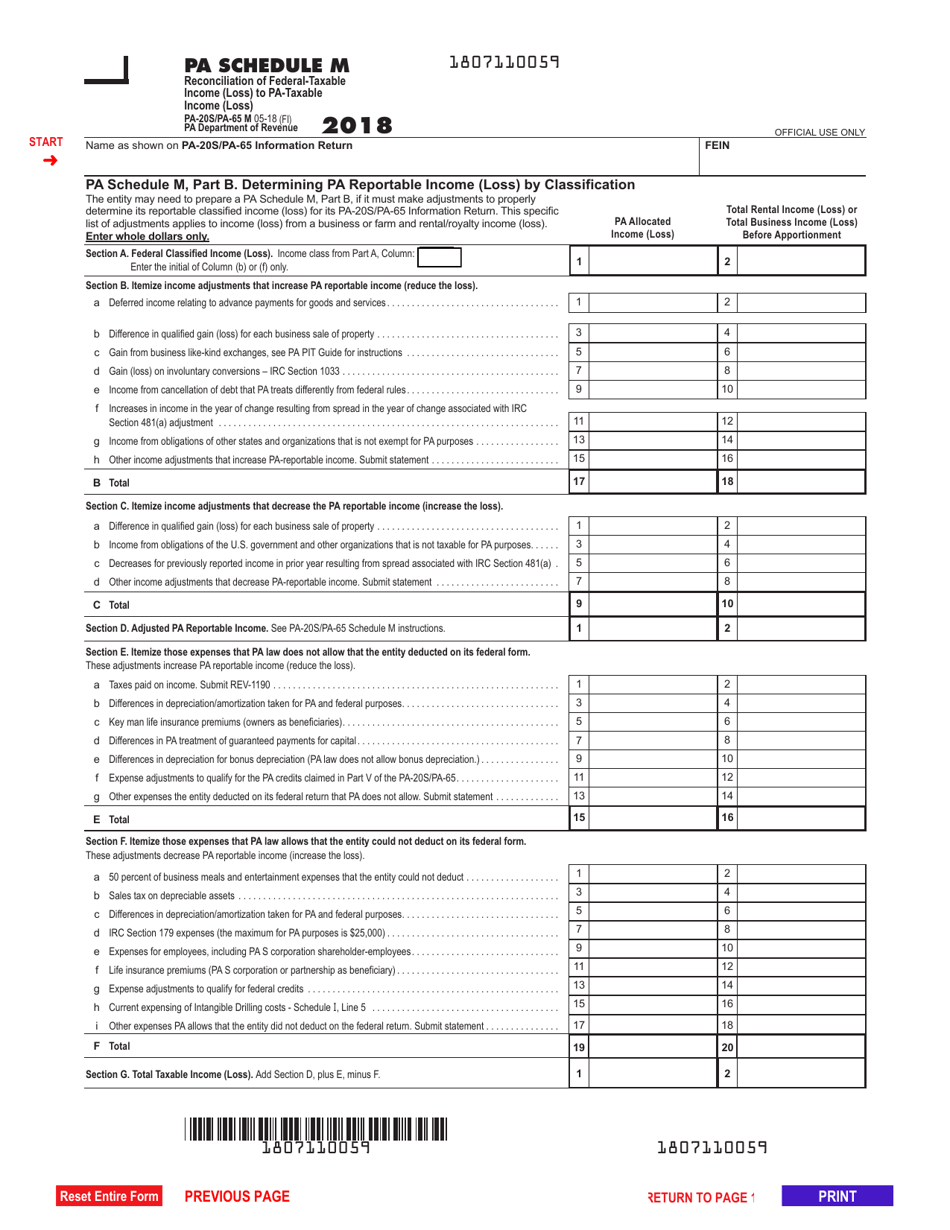

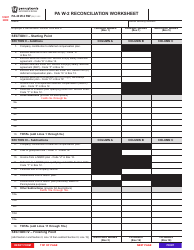

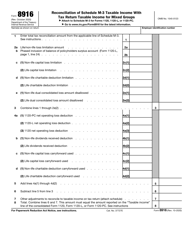

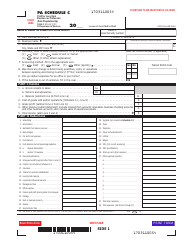

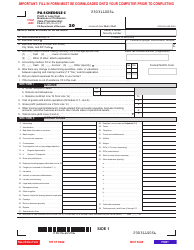

Form PA-20S (PA-65 M) Schedule M Reconciliation of Federal-Taxable Income (Loss) to Pa-Taxable Income (Loss) - Pennsylvania

What Is Form PA-20S (PA-65 M) Schedule M?

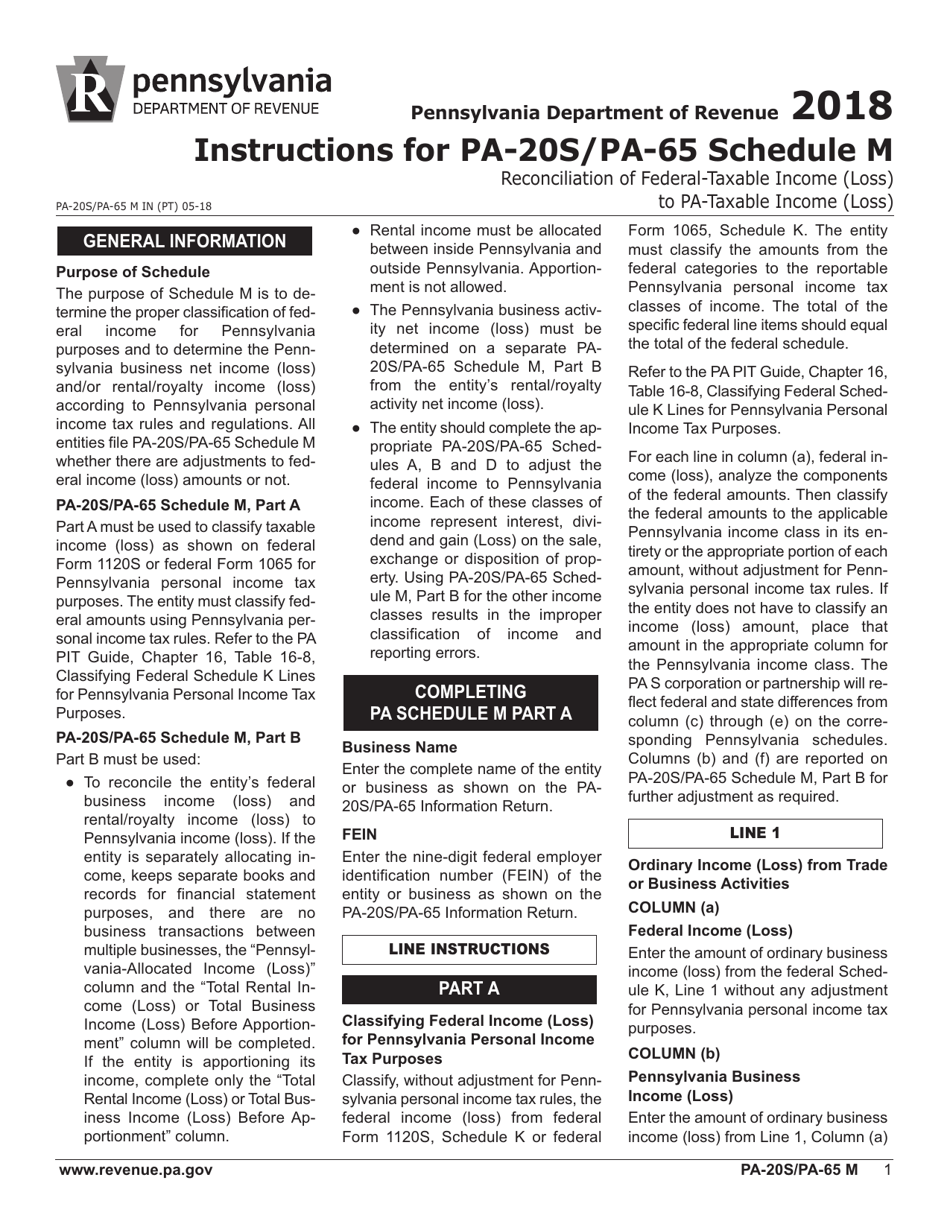

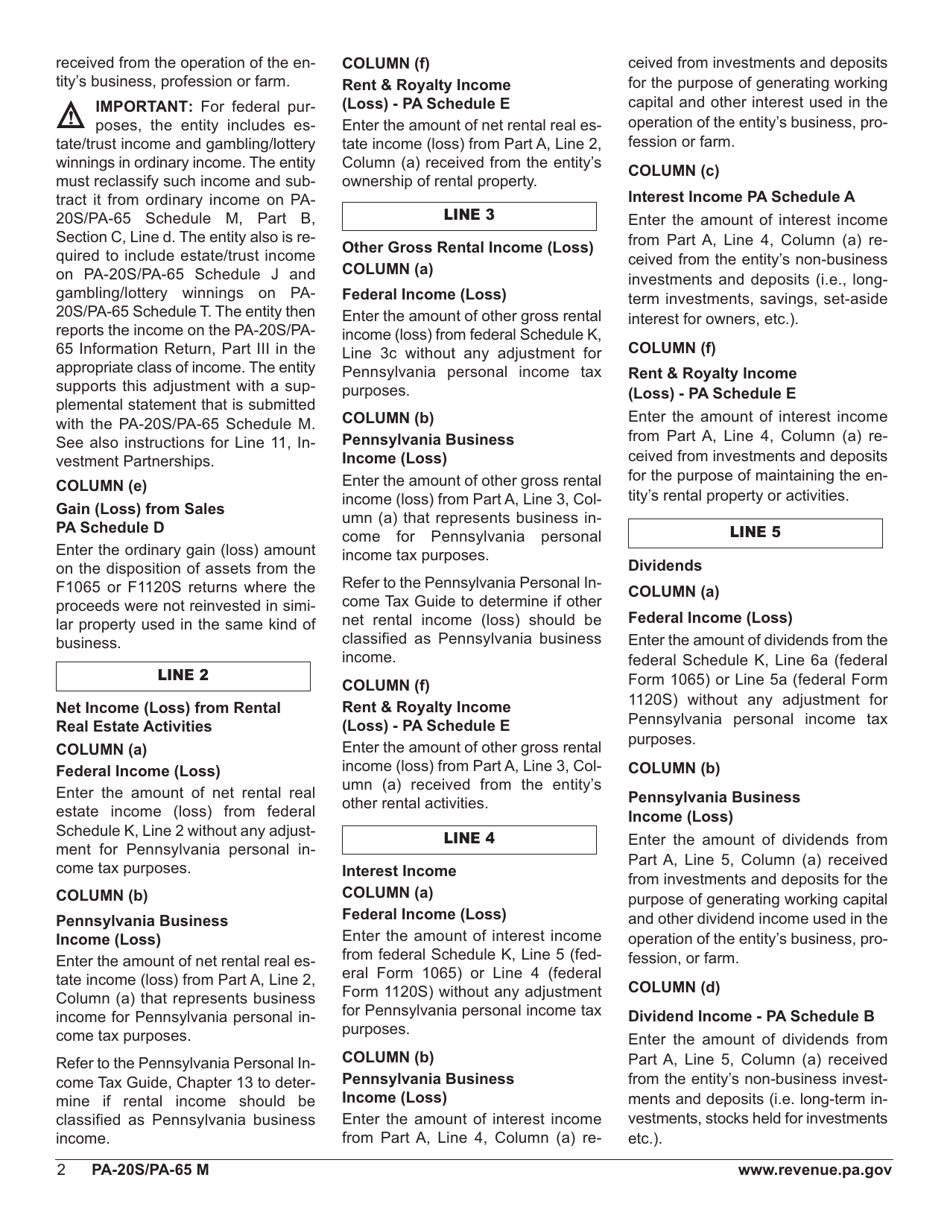

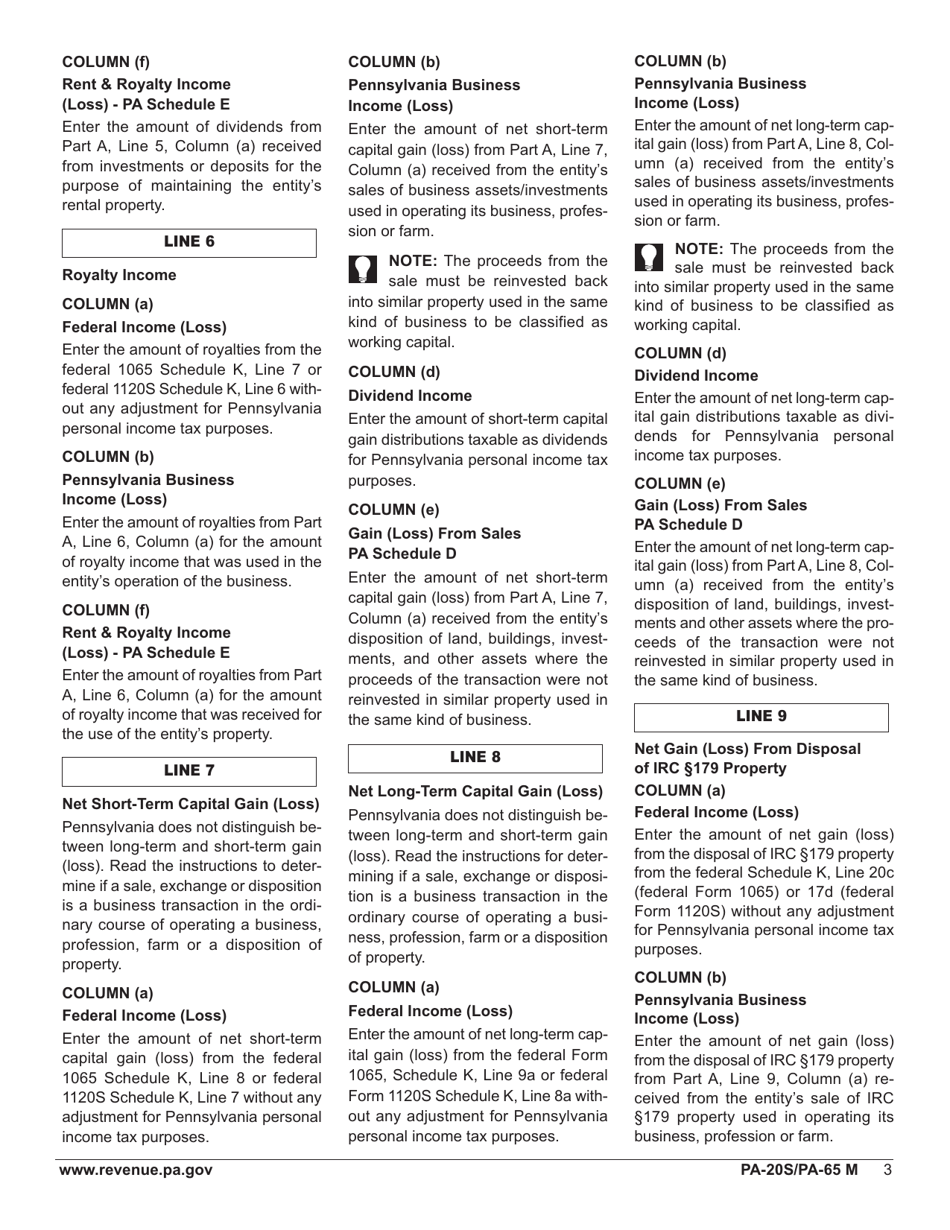

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule M?

A: Schedule M is a form used in Pennsylvania to reconcile federal-taxable income (loss) to PA-taxable income (loss).

Q: Who needs to file Schedule M?

A: Partnerships and S corporations in Pennsylvania need to file Schedule M as part of their tax return.

Q: What is the purpose of Schedule M?

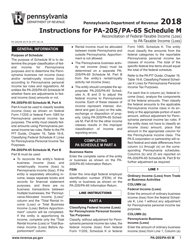

A: The purpose of Schedule M is to calculate Pennsylvania taxable income (loss) by making adjustments to the federal-taxable income (loss) based on Pennsylvania-specific rules and regulations.

Q: What does Schedule M include?

A: Schedule M includes adjustments to federal-taxable income such as add-backs, subtractions, and modifications required by Pennsylvania tax laws.

Q: Is Schedule M required for individuals?

A: No, Schedule M is not required for individuals. It is specifically used by partnerships and S corporations.

Q: When is Schedule M due?

A: Schedule M is typically due on the same date as the partnership or S corporation tax return, which is usually March 15th for calendar year filers.

Q: What happens if I don't file Schedule M?

A: Failure to file Schedule M when required may result in penalties or additional taxes owed to the state of Pennsylvania.

Q: Can I e-file Schedule M?

A: Yes, Schedule M can be electronically filed along with the partnership or S corporation tax return using the appropriate tax software or through a tax professional.

Q: Are there any specific instructions for filling out Schedule M?

A: Yes, the Pennsylvania Department of Revenue provides instructions and guidance for filling out Schedule M, which should be followed carefully to ensure accurate reporting of income (loss).

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 M) Schedule M by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.