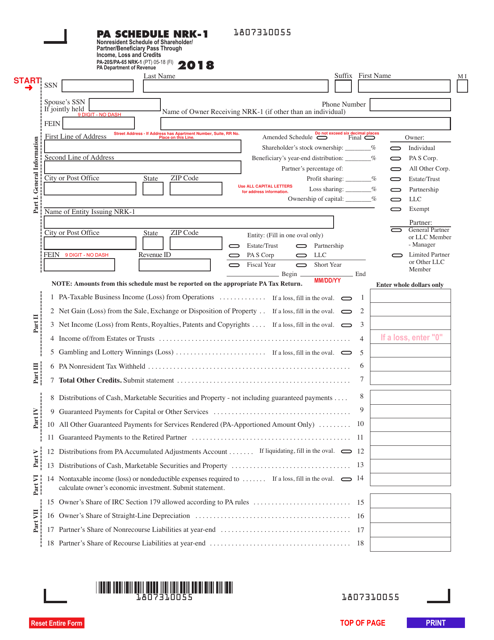

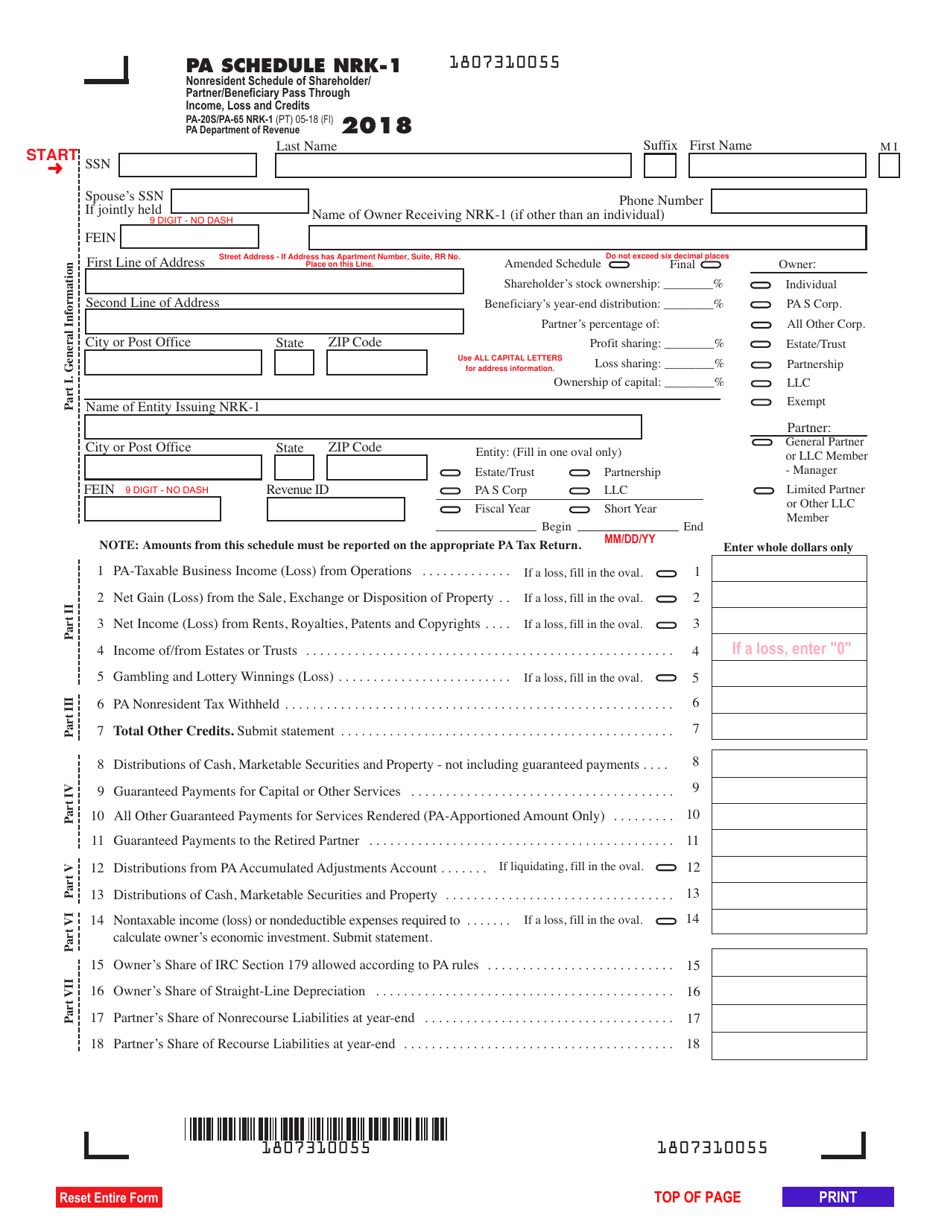

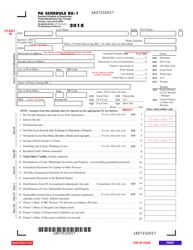

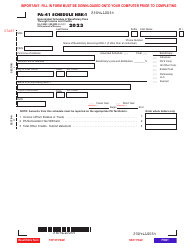

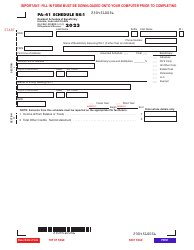

Form PA-20S (PA-65 NRK-1) Schedule NRK-1 Nonresident Schedule of Shareholder / Partner / Beneficiary Pass Through Income, Loss and Credits - Pennsylvania

What Is Form PA-20S (PA-65 NRK-1) Schedule NRK-1?

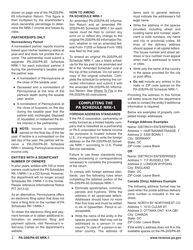

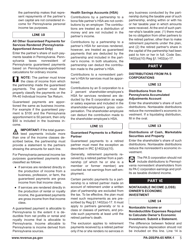

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 NRK-1)?

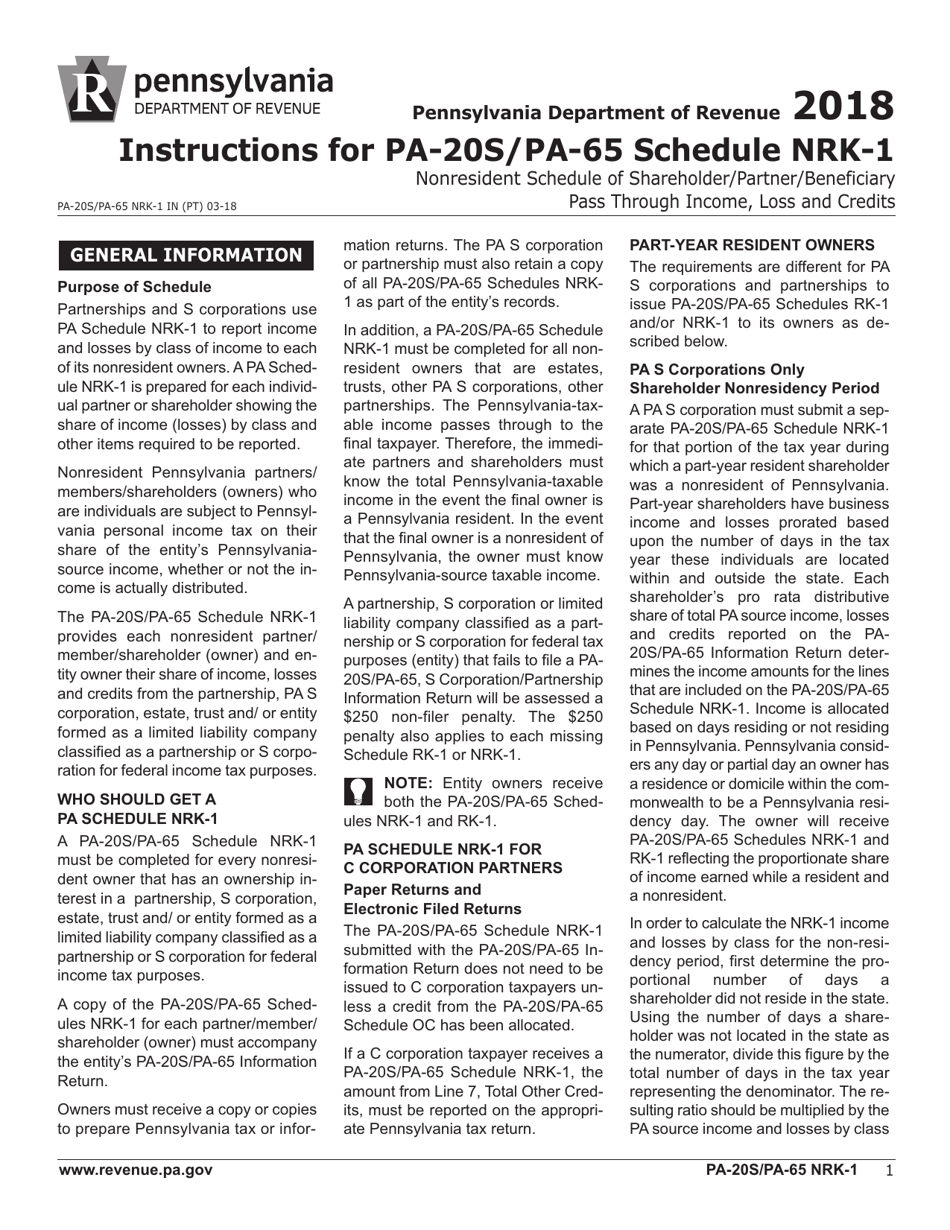

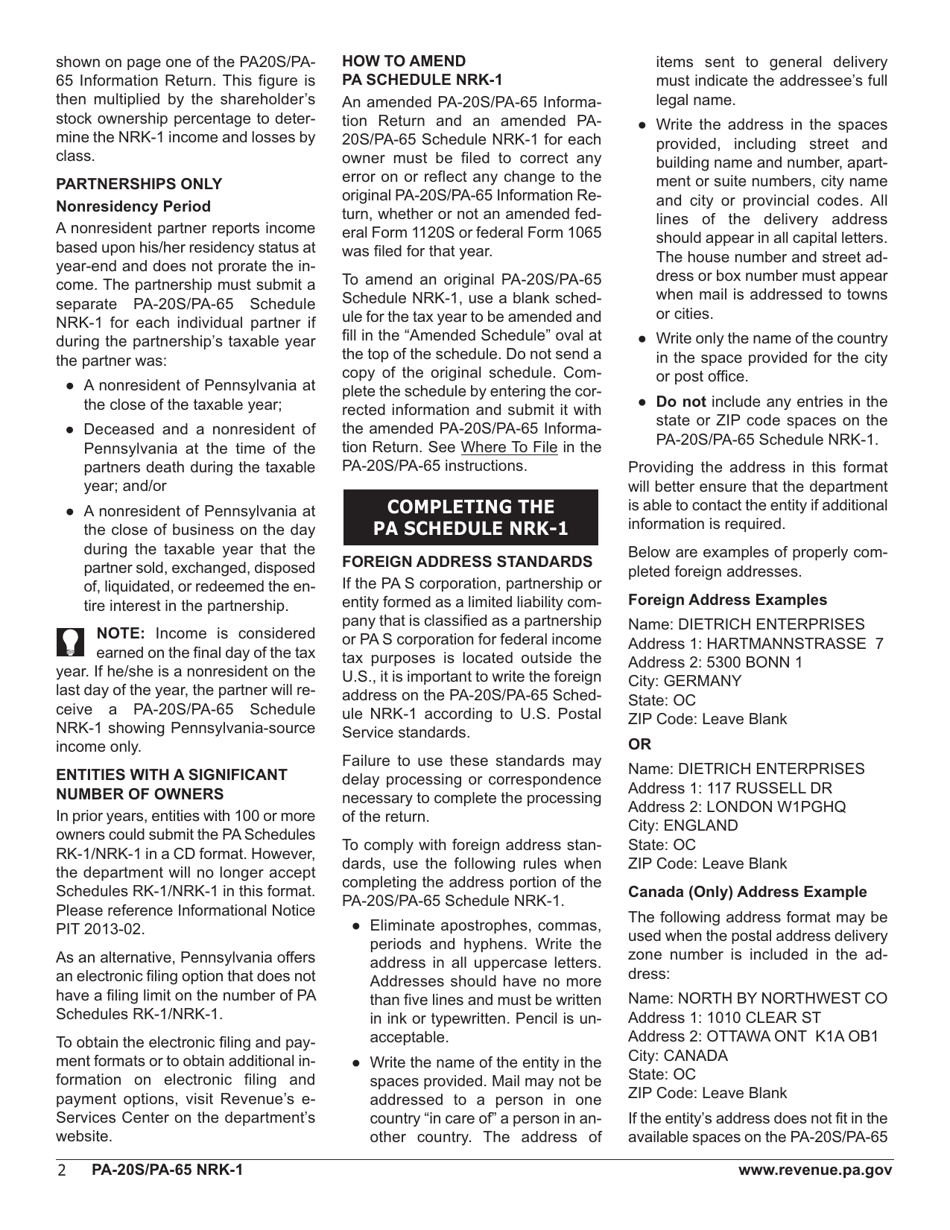

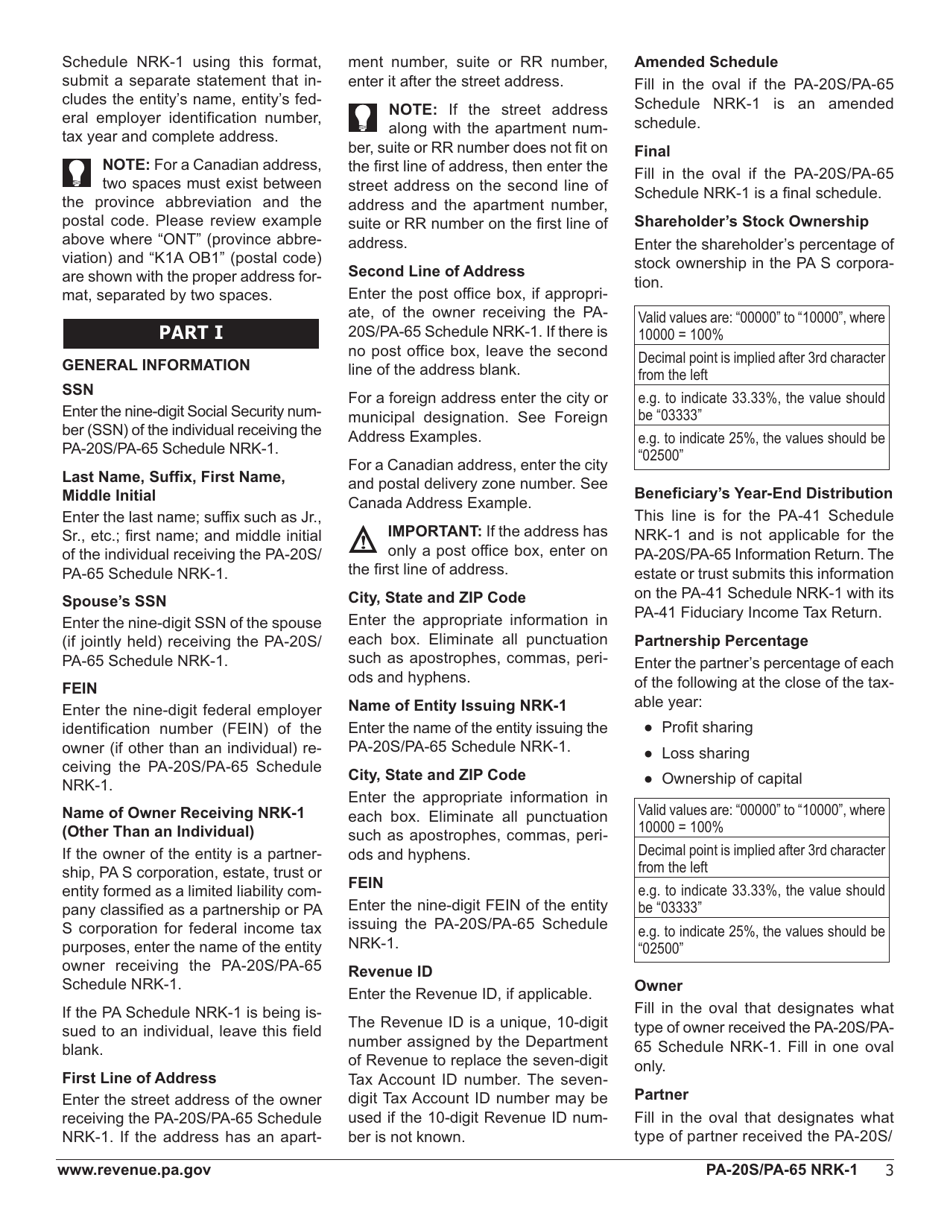

A: Form PA-20S (PA-65 NRK-1) is a schedule used in Pennsylvania for reporting nonresident shareholder/partner/beneficiary pass-through income, loss, and credits.

Q: Who needs to file Form PA-20S (PA-65 NRK-1)?

A: Nonresident shareholders, partners, or beneficiaries who received income, loss, or credits from pass-through entities in Pennsylvania need to file Form PA-20S (PA-65 NRK-1).

Q: What information does Schedule NRK-1 report?

A: Schedule NRK-1 reports the nonresident's share of pass-through income, loss, and credits from partnerships, S corporations, estates, or trusts.

Q: When is the deadline to file Form PA-20S (PA-65 NRK-1)?

A: The deadline to file Form PA-20S (PA-65 NRK-1) is usually April 15th or the same date as the federal tax return deadline.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 NRK-1) Schedule NRK-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.