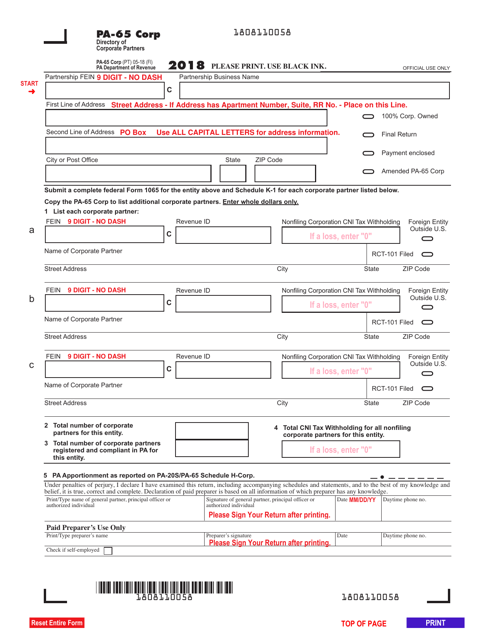

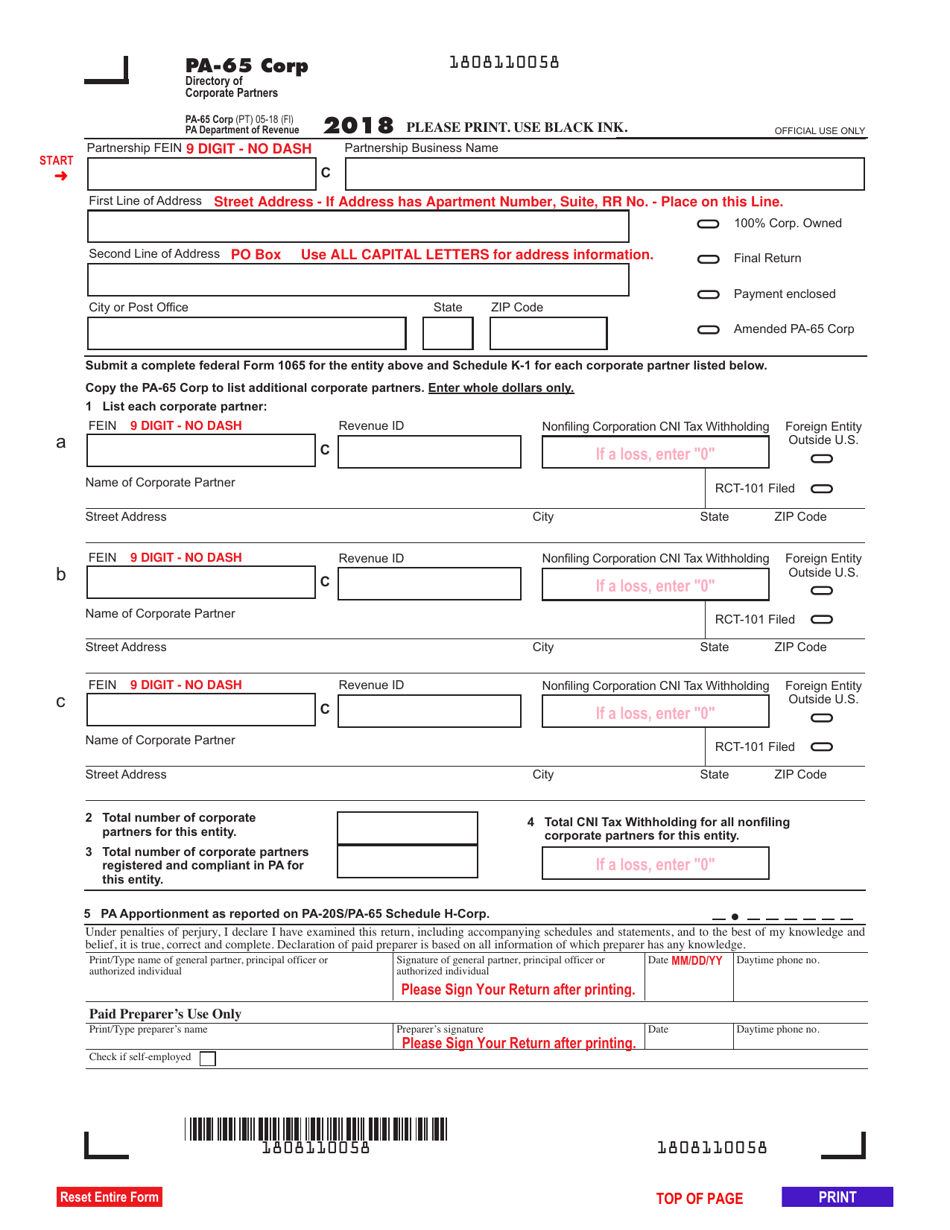

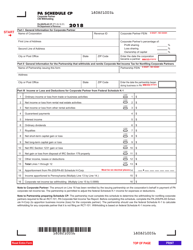

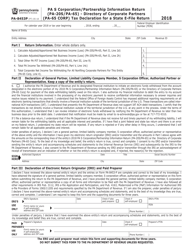

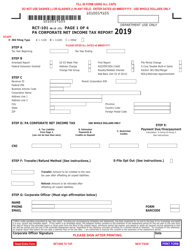

Form PA-65 CORP Directory of Corporate Partners - Pennsylvania

What Is Form PA-65 CORP?

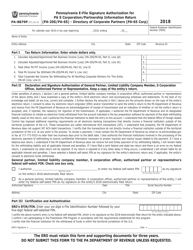

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-65 CORP?

A: Form PA-65 CORP is a directory of corporate partners in Pennsylvania.

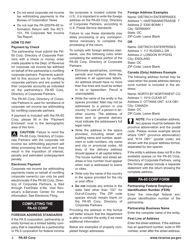

Q: Who is required to file Form PA-65 CORP?

A: Corporations that have elected to be classified as partnerships for federal income tax purposes and have Pennsylvania-source income are required to file Form PA-65 CORP.

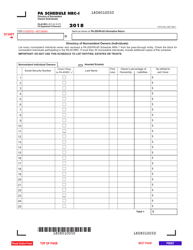

Q: What information is included in Form PA-65 CORP?

A: Form PA-65 CORP includes the names and addresses of corporate partners in Pennsylvania.

Q: Is there a filing deadline for Form PA-65 CORP?

A: Yes, Form PA-65 CORP must be filed by the 15th day of the fourth month following the close of the corporation's taxable year.

Q: Are there any penalties for not filing Form PA-65 CORP?

A: Yes, there may be penalties for failure to file or for filing an incomplete or inaccurate form.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

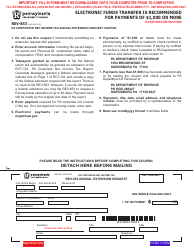

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-65 CORP by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.