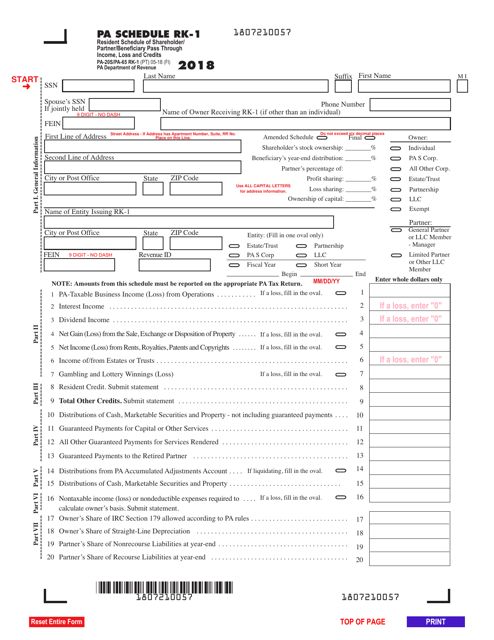

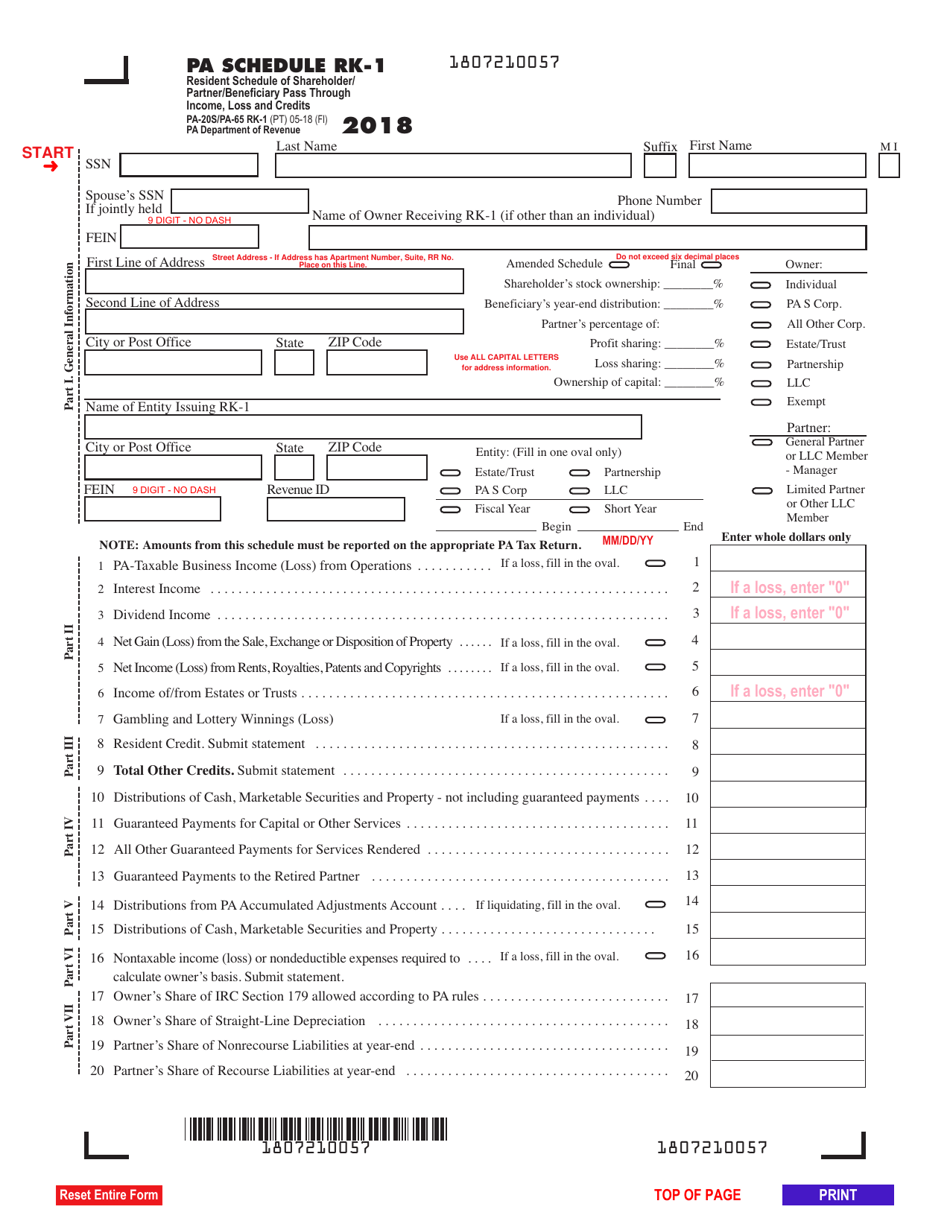

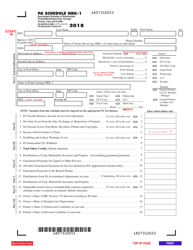

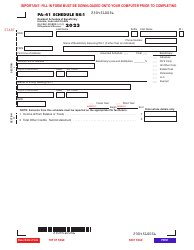

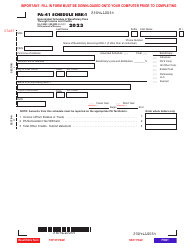

Form PA-20S (PA-65 RK-1) Schedule RK-1 Resident Schedule of Shareholder / Partner / Beneficiary Pass Through Income, Loss and Credits - Pennsylvania

What Is Form PA-20S (PA-65 RK-1) Schedule RK-1?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 RK-1)?

A: It is a schedule used in Pennsylvania for reporting pass-through income, loss and credits.

Q: Who needs to fill out Form PA-20S (PA-65 RK-1)?

A: Shareholders, partners, and beneficiaries of pass-through entities need to fill out this form.

Q: What information is reported on Form PA-20S (PA-65 RK-1)?

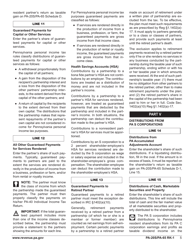

A: The form reports the share of income, loss and credits that a shareholder, partner or beneficiary received from a pass-through entity.

Q: When is Form PA-20S (PA-65 RK-1) due?

A: The form is generally due on the same date as the pass-through entity's tax return, which is typically April 15th.

Q: Are there any penalties for not filing Form PA-20S (PA-65 RK-1)?

A: Yes, penalties may apply for not filing the form or filing it late. It is important to submit the form on time to avoid penalties.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 RK-1) Schedule RK-1 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.