This version of the form is not currently in use and is provided for reference only. Download this version of

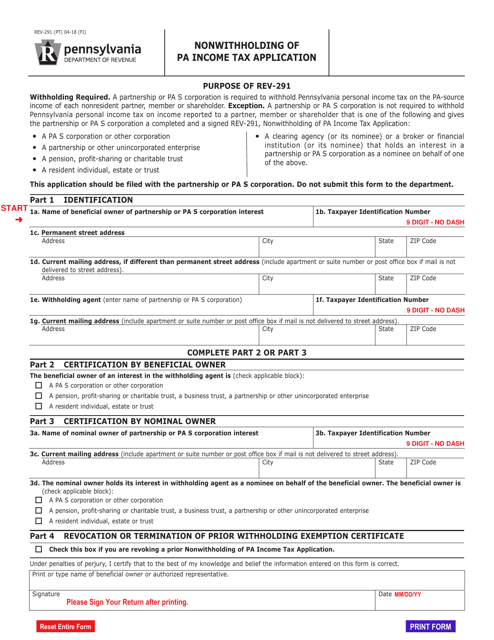

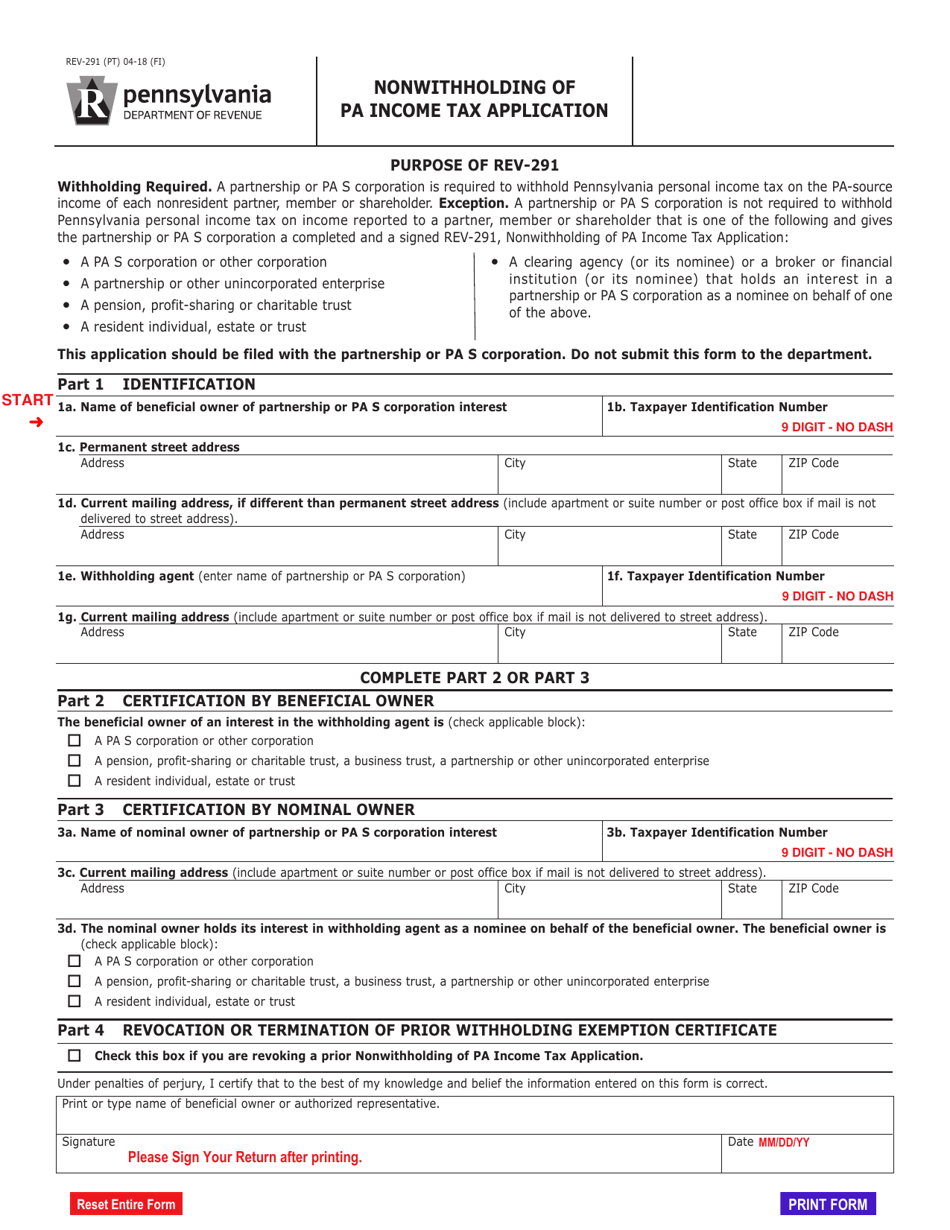

Form REV-291

for the current year.

Form REV-291 Nonwithholding of Pa Income Tax Application - Pennsylvania

What Is Form REV-291?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-291?

A: Form REV-291 is the Nonwithholding of PA Income Tax Application for residents of Pennsylvania.

Q: Who needs to fill out Form REV-291?

A: Residents of Pennsylvania who wish to apply for nonwithholding of PA income tax need to fill out Form REV-291.

Q: What is the purpose of Form REV-291?

A: The purpose of Form REV-291 is to request nonwithholding of PA income tax from an individual's wages.

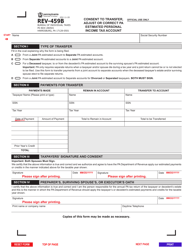

Q: What information do I need to provide on Form REV-291?

A: On Form REV-291, you will need to provide your personal information, employer information, and the reason for requesting nonwithholding of PA income tax.

Q: Is there a deadline for submitting Form REV-291?

A: There is no specific deadline for submitting Form REV-291, but it is recommended to submit it as soon as possible to ensure timely processing.

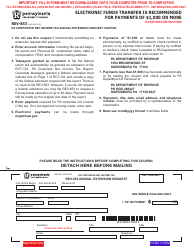

Q: Can I file Form REV-291 electronically?

A: Currently, Form REV-291 cannot be filed electronically. It must be completed manually and submitted via mail or in person.

Q: Is there a fee for filing Form REV-291?

A: No, there is no fee for filing Form REV-291.

Q: What if I have additional questions about Form REV-291?

A: If you have additional questions about Form REV-291, you can contact the Pennsylvania Department of Revenue for further assistance.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-291 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.