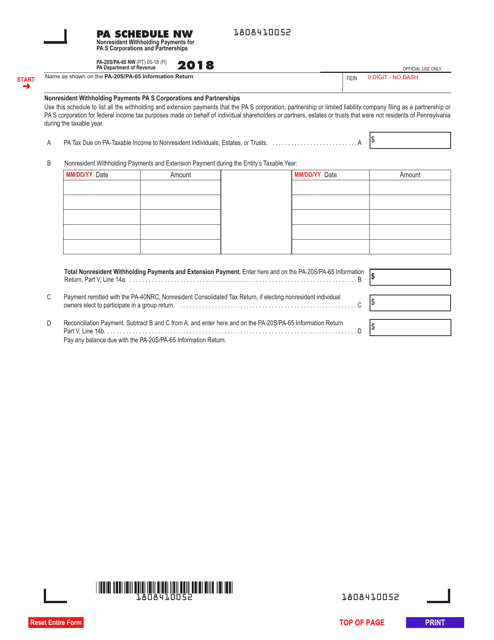

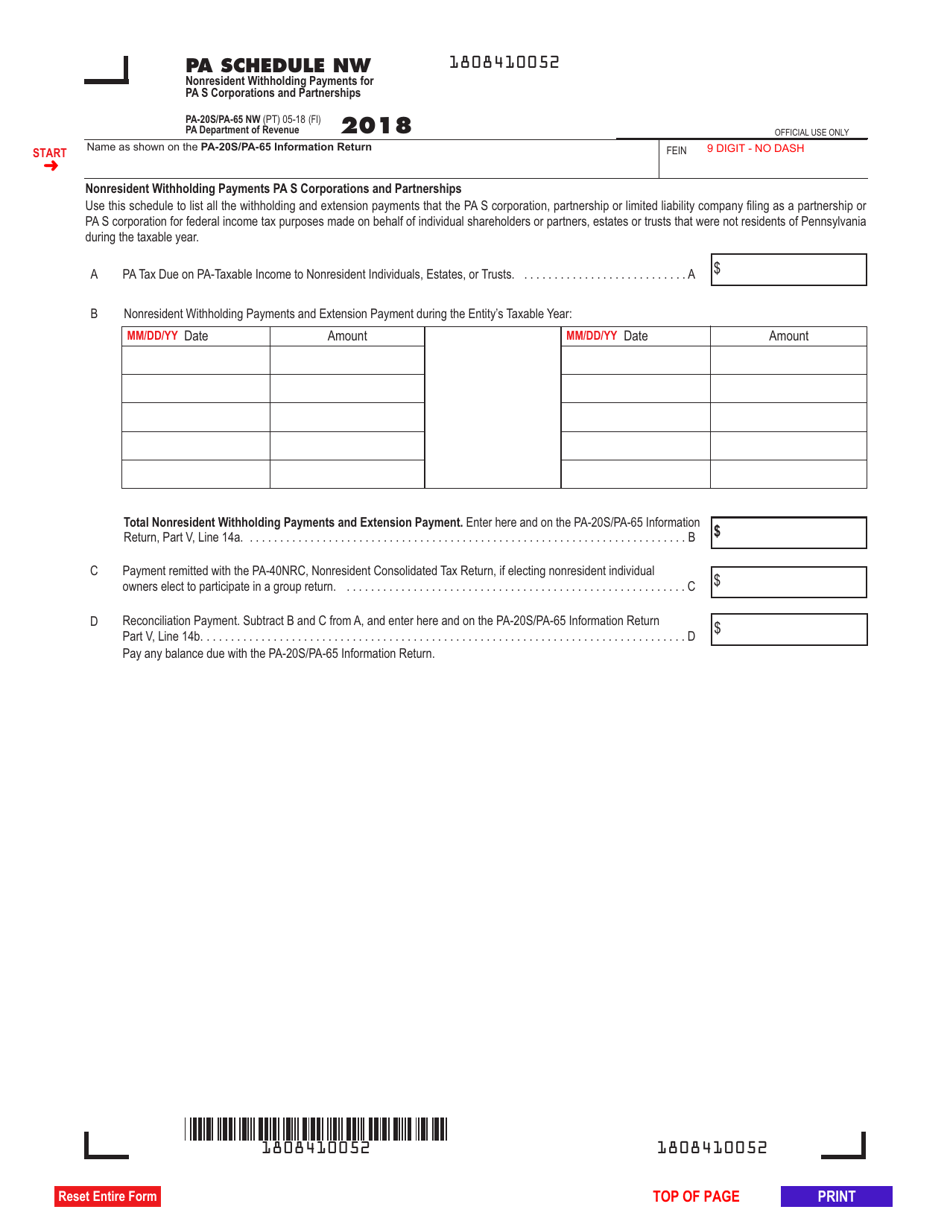

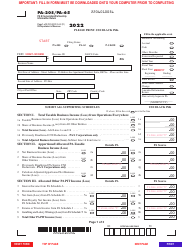

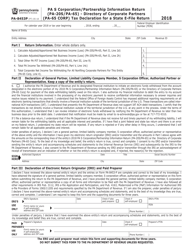

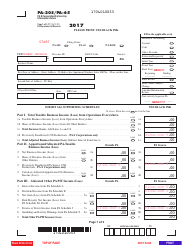

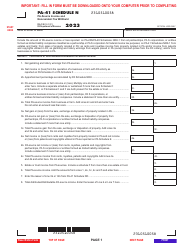

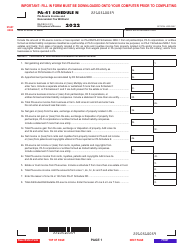

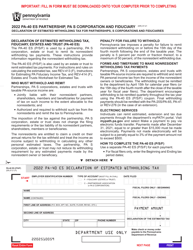

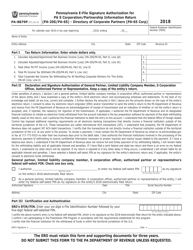

Form PA-20S (PA-65 NW) Schedule NW Nonresident Withholding Payments for Pa S Corporations and Partnerships - Pennsylvania

What Is Form PA-20S (PA-65 NW) Schedule NW?

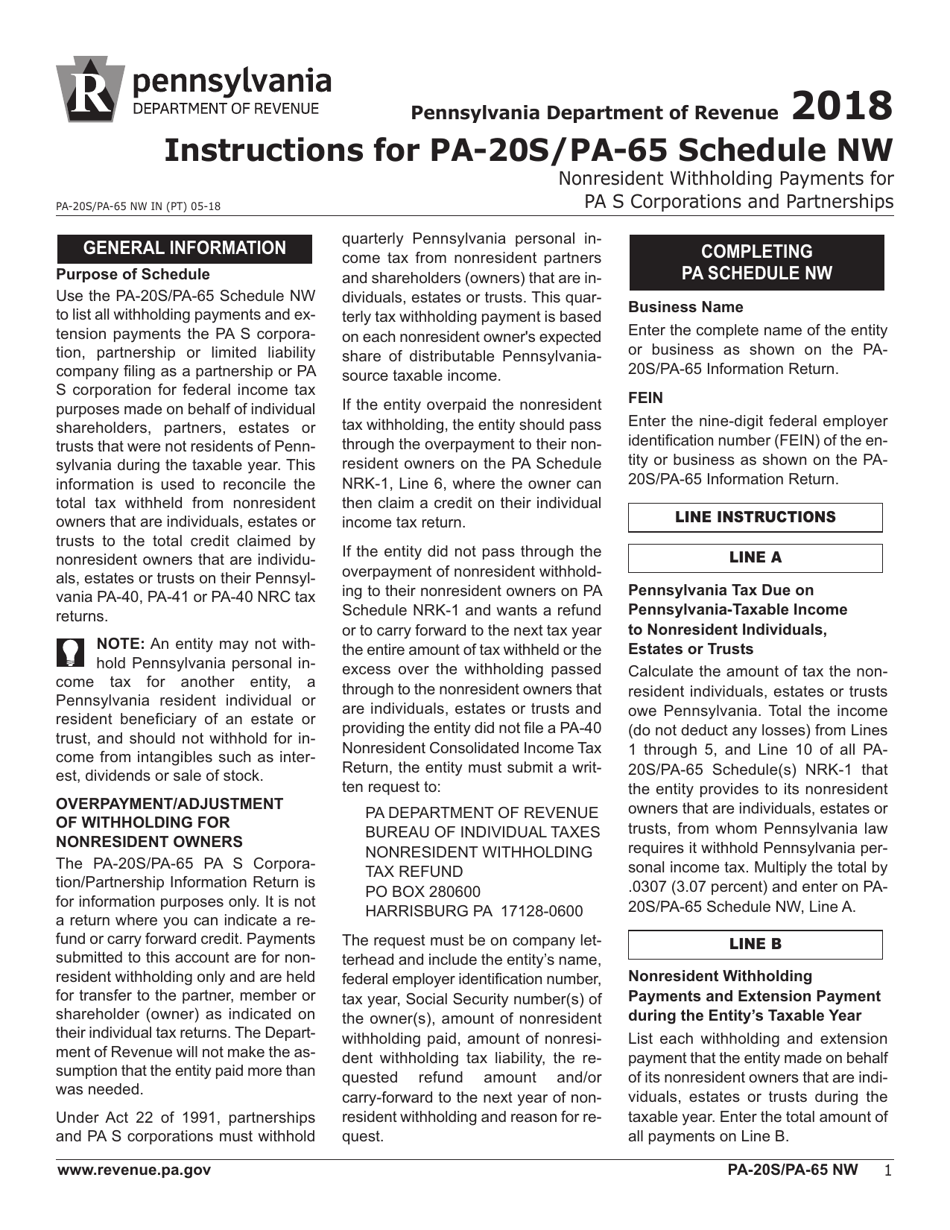

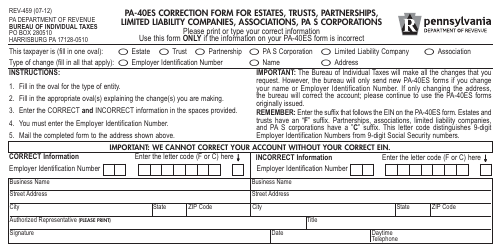

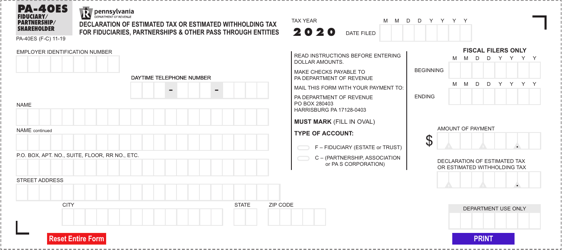

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 NW)?

A: Form PA-20S (PA-65 NW) is a schedule used by Pennsylvania S corporations and partnerships to report nonresident withholding payments.

Q: What is the purpose of Schedule NW?

A: The purpose of Schedule NW is to report nonresident withholding payments made by Pennsylvania S corporations and partnerships.

Q: Who needs to file Schedule NW?

A: Pennsylvania S corporations and partnerships that made nonresident withholding payments need to file Schedule NW.

Q: What information is required on Schedule NW?

A: Schedule NW requires information about the recipient of the payment, the amount of the payment, and the tax withheld.

Q: When is the deadline to file Schedule NW?

A: The deadline to file Schedule NW is generally the same as the deadline to file the corresponding Pennsylvania S corporation or partnership tax return.

Q: Are there any penalties for not filing Schedule NW?

A: Yes, failure to file Schedule NW or filing it late may result in penalties and interest.

Q: Can Schedule NW be filed electronically?

A: Yes, Schedule NW can be filed electronically using the Pennsylvania Department of Revenue's e-Services system or through approved tax software.

Q: Do I need to include copies of Form 1099 with Schedule NW?

A: No, you do not need to include copies of Form 1099 with Schedule NW. However, you should keep them for your records in case of an audit.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 NW) Schedule NW by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.