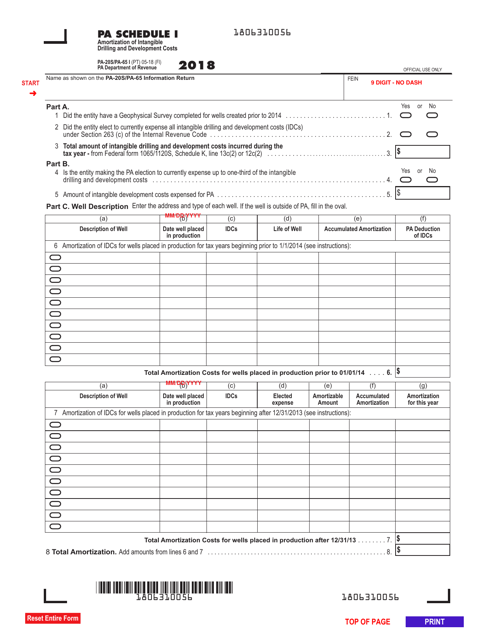

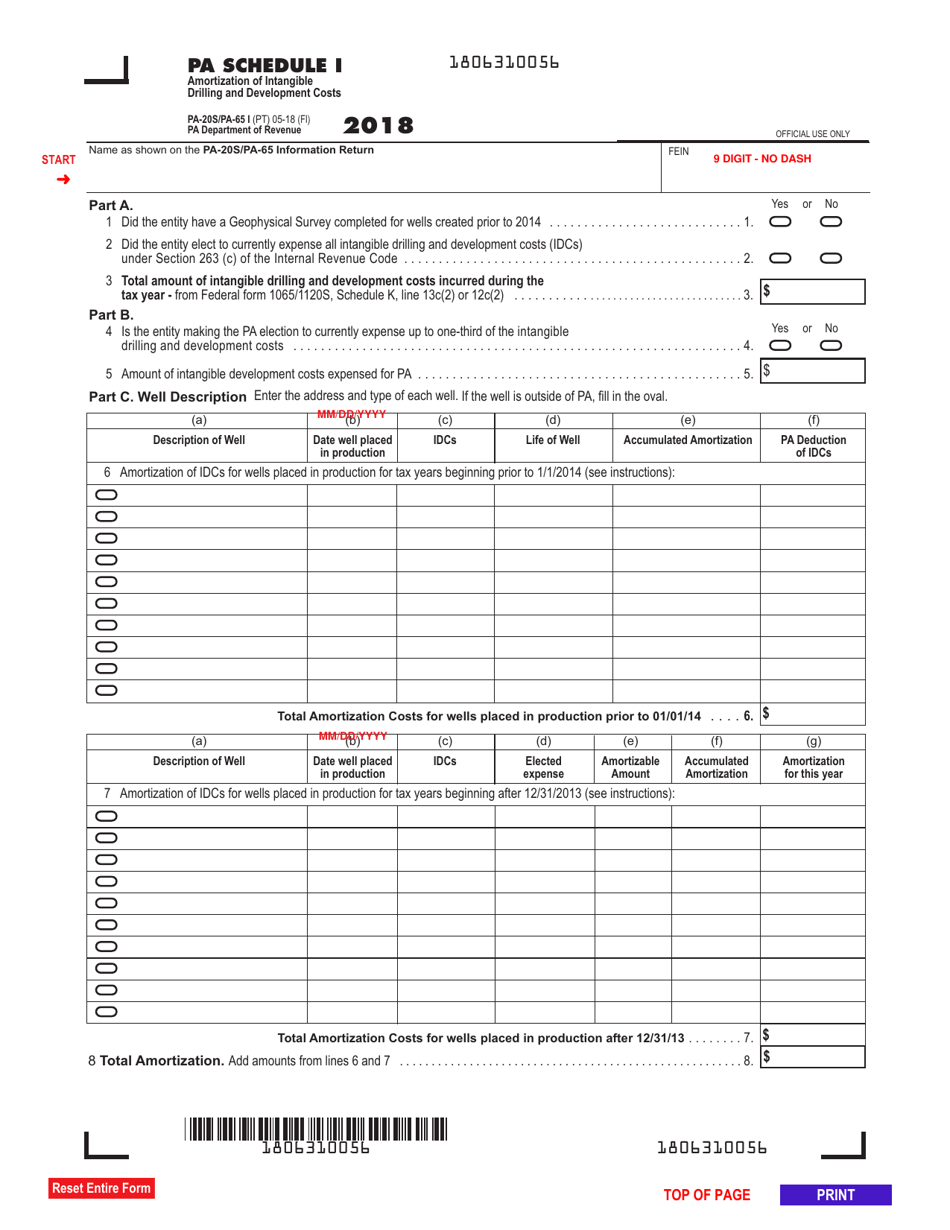

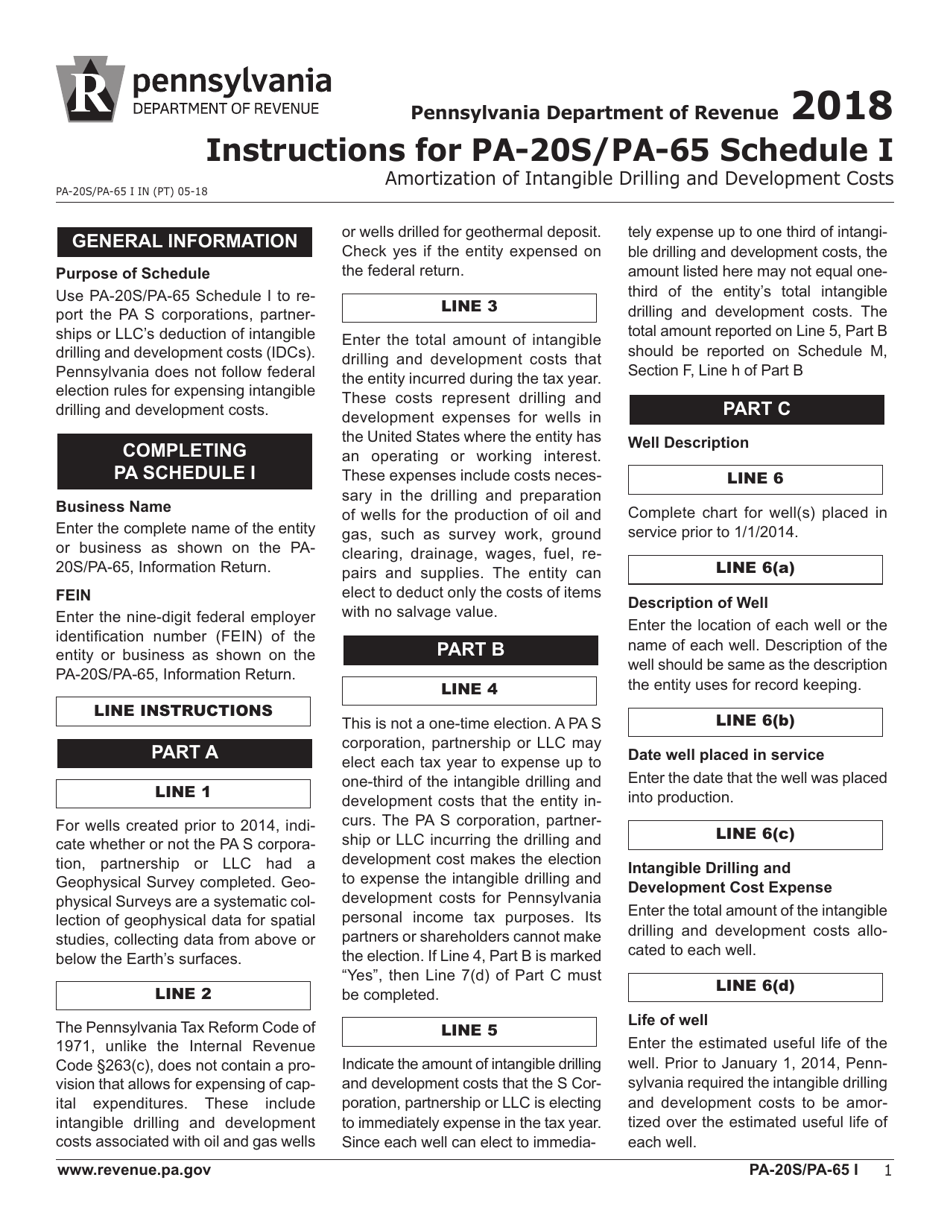

Form PA-20S (PA-65 I) Schedule I Amortization of Intangible Drilling and Development Cost - Pennsylvania

What Is Form PA-20S (PA-65 I) Schedule I?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 I)?

A: Form PA-20S (PA-65 I) is a tax form used in Pennsylvania.

Q: What is Schedule I?

A: Schedule I is a section of Form PA-20S (PA-65 I) which relates to the amortization of intangible drilling and development costs.

Q: What are intangible drilling and development costs?

A: Intangible drilling and development costs refer to expenses incurred in the process of exploring and developing oil and gas wells.

Q: Why is amortization of these costs important?

A: Amortization allows businesses to deduct a portion of these costs over time, reducing their taxable income.

Q: Who needs to file Form PA-20S (PA-65 I) Schedule I?

A: This form is typically filed by businesses operating in Pennsylvania that incur intangible drilling and development costs.

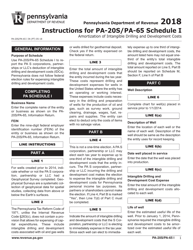

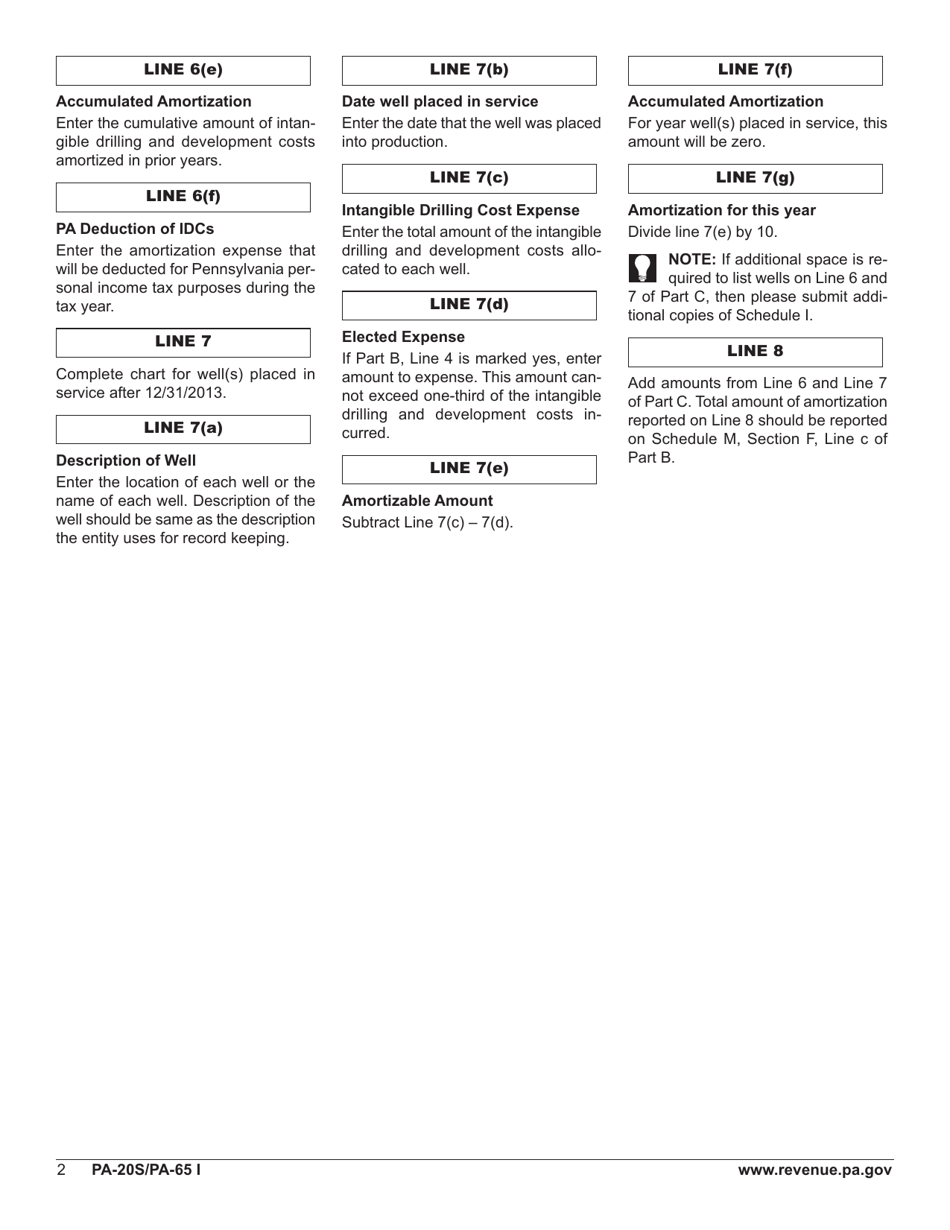

Q: What information is required to complete Schedule I?

A: The form requires information about the taxpayer, the amount of costs incurred, and the method of amortization used.

Q: When is the deadline for filing Form PA-20S (PA-65 I) Schedule I?

A: The form is typically due on the same date as the business's annual tax return, which is usually April 15th.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 I) Schedule I by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.