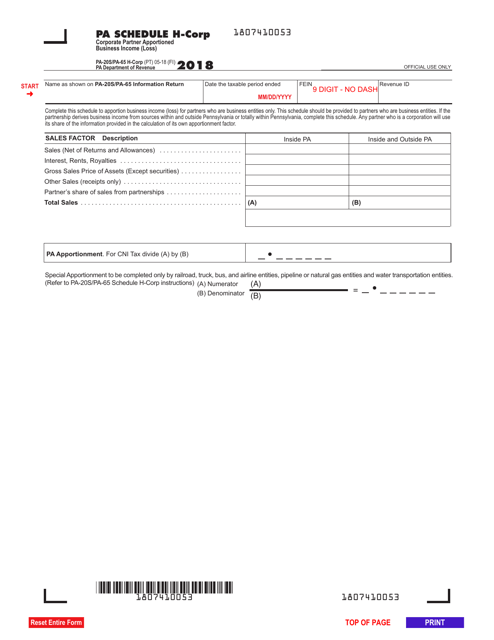

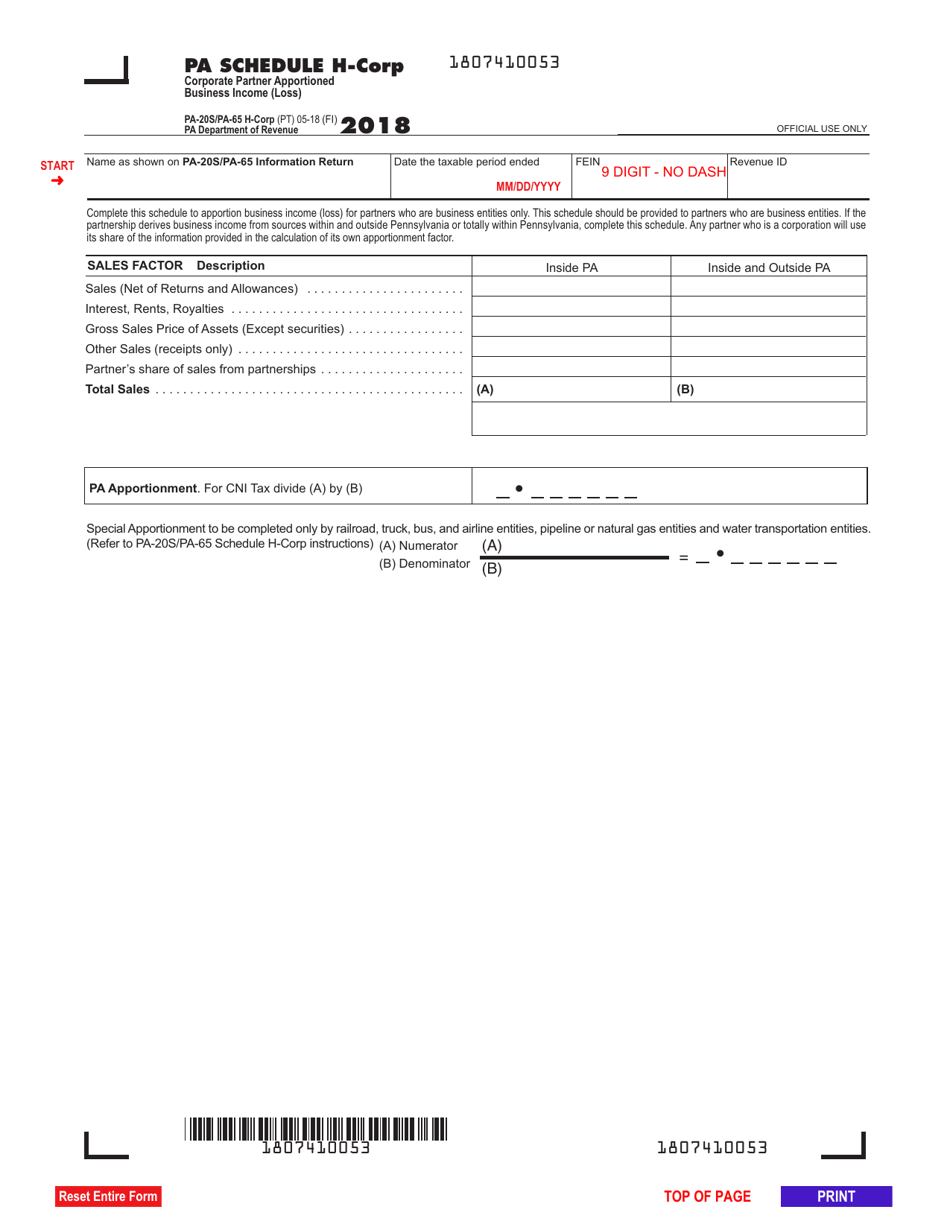

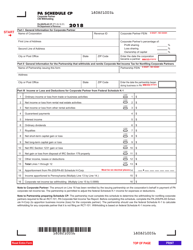

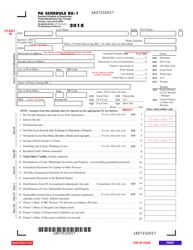

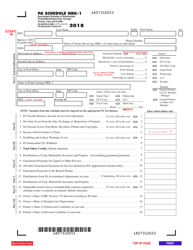

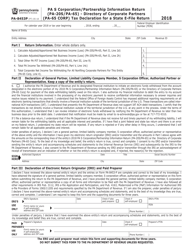

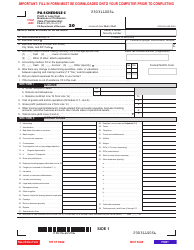

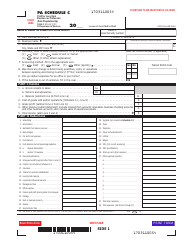

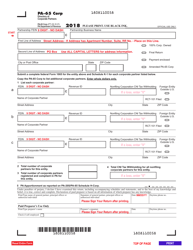

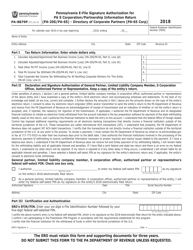

Form PA-20S (PA-65 H-CORP) Schedule H-CORP Corporate Partner Apportioned Business Income (Loss) - Pennsylvania

What Is Form PA-20S (PA-65 H-CORP) Schedule H-CORP?

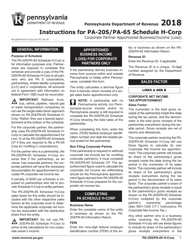

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 H-CORP)?

A: Form PA-20S (PA-65 H-CORP) is a schedule used to report the apportioned business income or loss of a corporate partner in Pennsylvania.

Q: What is Schedule H-CORP?

A: Schedule H-CORP is a specific section within Form PA-20S (PA-65 H-CORP) used to report the corporate partner's apportioned business income or loss.

Q: What is apportioned business income (loss)?

A: Apportioned business income or loss refers to the portion of a business's income or loss that is allocated to a specific state based on various factors such as sales, property, and payroll in that state.

Q: Who needs to file Form PA-20S (PA-65 H-CORP) Schedule H-CORP?

A: Form PA-20S (PA-65 H-CORP) Schedule H-CORP needs to be filed by corporate partners who have apportioned business income or loss in Pennsylvania.

Q: When is the deadline for filing Form PA-20S (PA-65 H-CORP) Schedule H-CORP?

A: The deadline for filing Form PA-20S (PA-65 H-CORP) Schedule H-CORP is usually the same as the deadline for filing the Pennsylvania corporation's tax return, which is generally on or before April 15th.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 H-CORP) Schedule H-CORP by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.