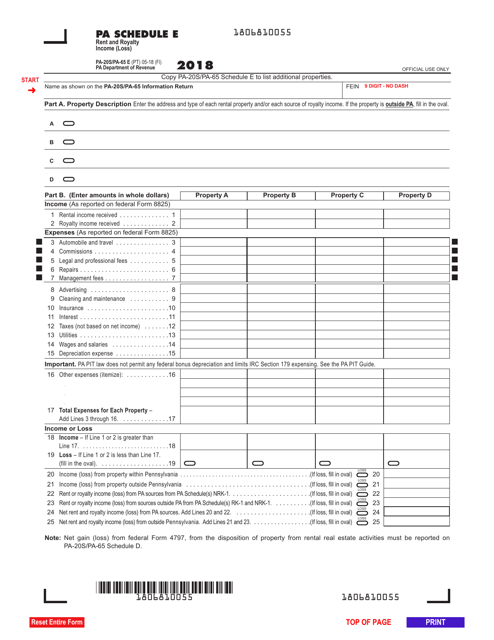

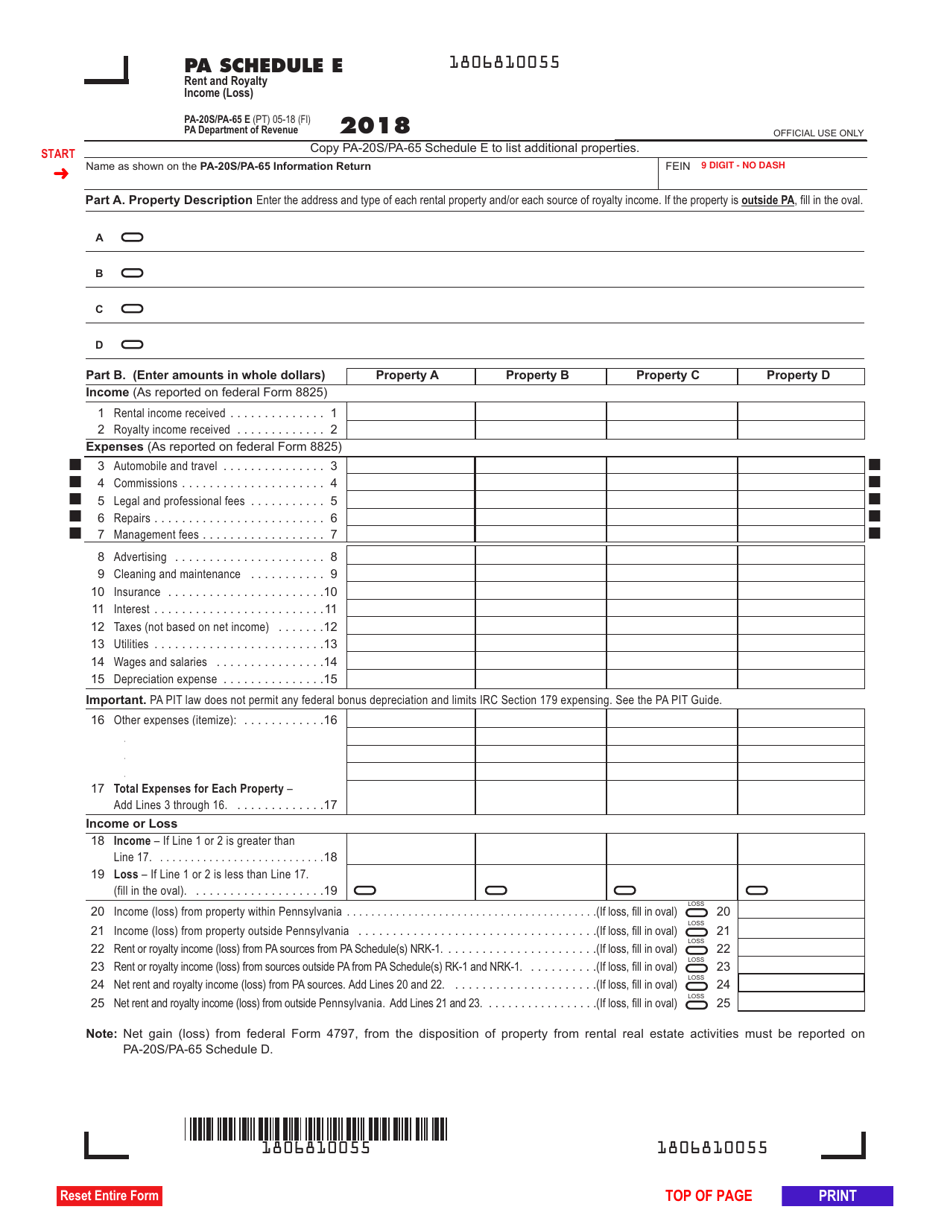

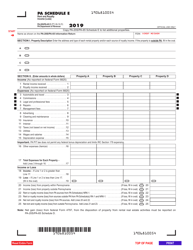

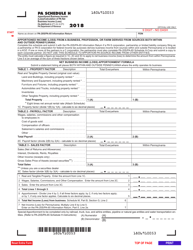

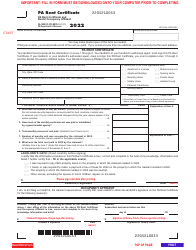

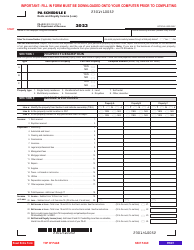

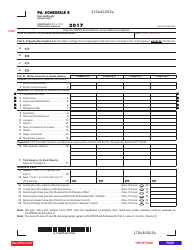

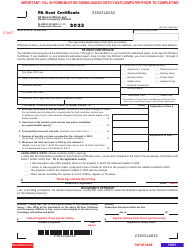

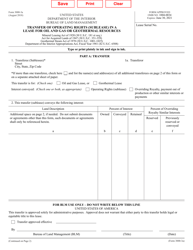

Form PA-20S (PA-65 E) Schedule E Rent and Royalty Income (Loss) - Pennsylvania

What Is Form PA-20S (PA-65 E) Schedule E?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 E) Schedule E?

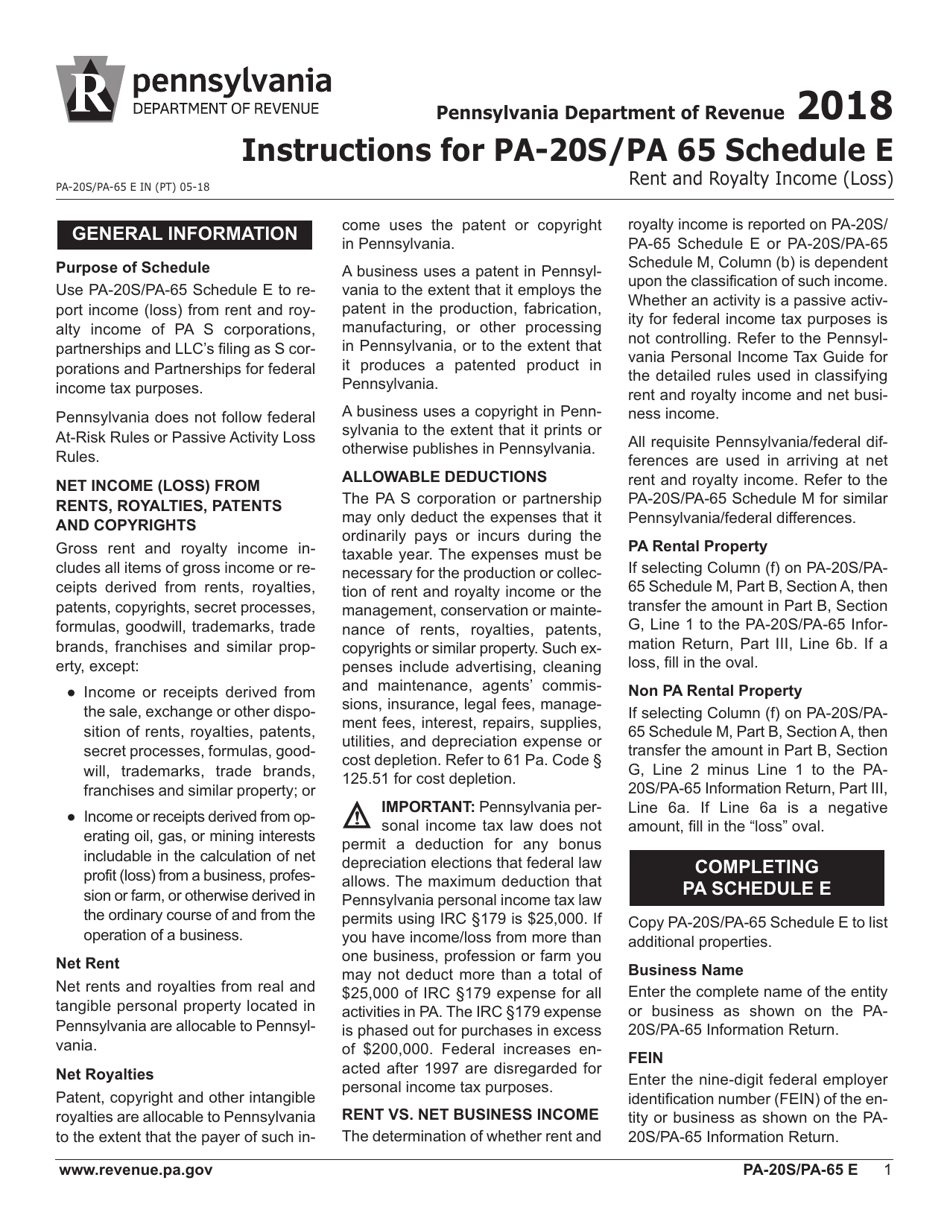

A: Form PA-20S (PA-65 E) Schedule E is a tax form used in Pennsylvania to report rental and royalty income or losses.

Q: What types of income or losses does Schedule E cover?

A: Schedule E covers rental income or losses from real estate, as well as royalty income or losses from intellectual property.

Q: Who needs to file Schedule E?

A: You need to file Schedule E if you have rental or royalty income or losses in Pennsylvania.

Q: Do I need to file Schedule E if I only have rental income or losses?

A: Yes, if you have rental income or losses in Pennsylvania, you need to file Schedule E.

Q: How do I fill out Schedule E?

A: You will need to provide information about your rental or royalty income and expenses, such as property address, rental income received, and deductible expenses incurred.

Q: When is the deadline to file Schedule E?

A: The deadline to file Schedule E is the same as the deadline for your Pennsylvania tax return, which is typically April 15th, or the next business day if it falls on a weekend or holiday.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 E) Schedule E by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.