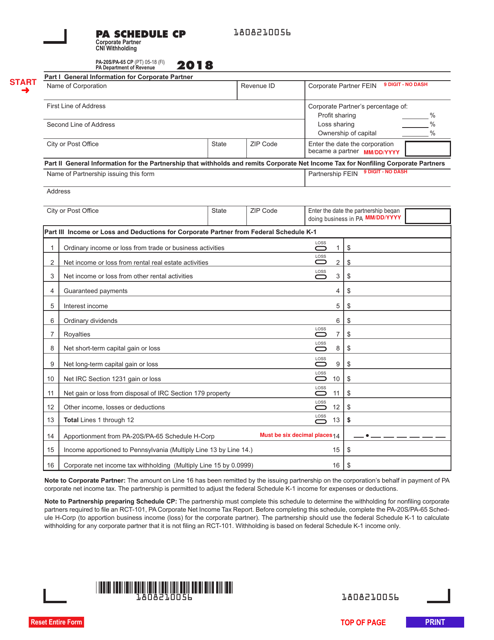

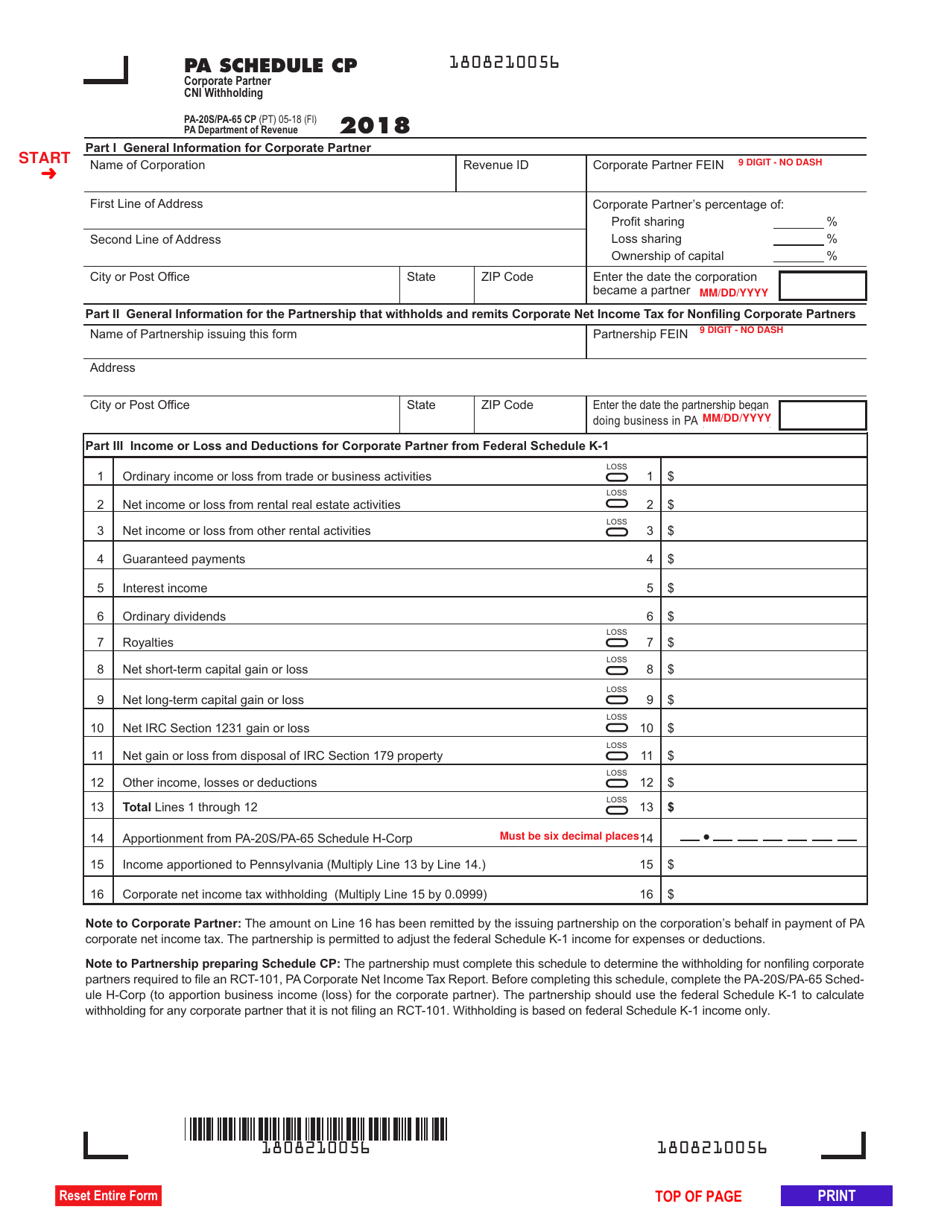

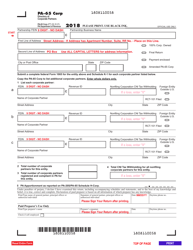

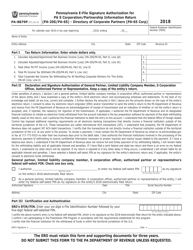

Form PA-20S (PA-65 CP) Schedule CP Corporate Partner Cni Withholding - Pennsylvania

What Is Form PA-20S (PA-65 CP) Schedule CP?

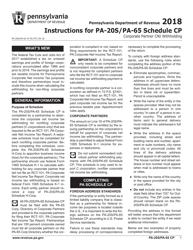

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 CP) Schedule CP?

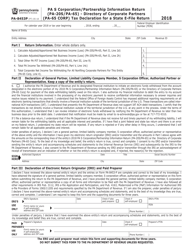

A: Form PA-20S (PA-65 CP) Schedule CP is a tax form used in Pennsylvania for reporting corporate partner CNI withholding.

Q: Who needs to file Form PA-20S (PA-65 CP) Schedule CP?

A: This form is filed by corporations that have partners subject to corporate net income (CNI) withholding in Pennsylvania.

Q: What is CNI withholding?

A: CNI withholding is the amount of taxable income that is withheld by a corporation on behalf of its partners.

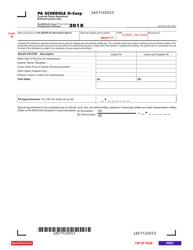

Q: What information does Form PA-20S (PA-65 CP) Schedule CP require?

A: This form requires information such as partner's name, federal identification number, CNI withheld, and a breakdown of the CNI withholding.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 CP) Schedule CP by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.