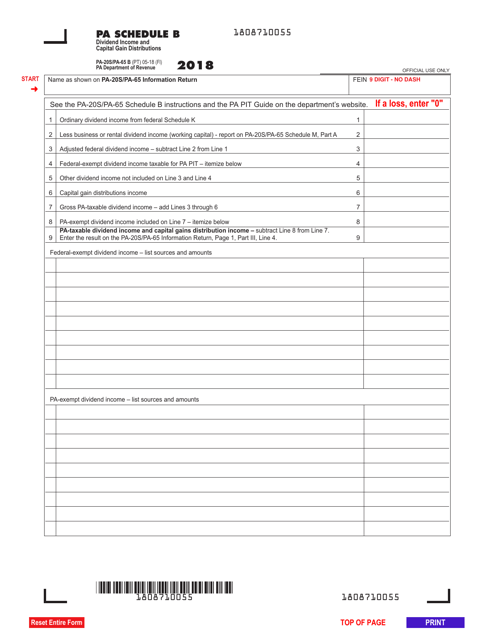

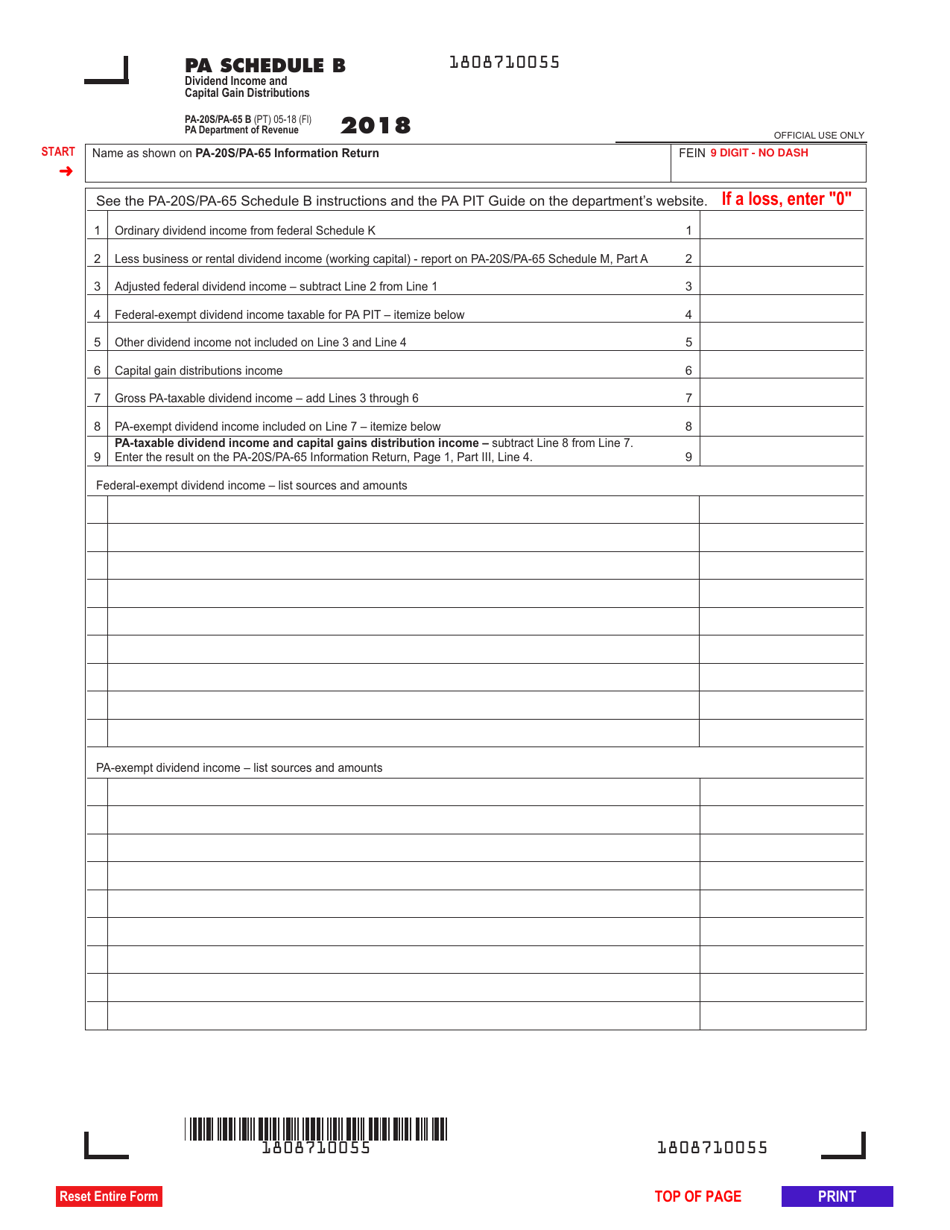

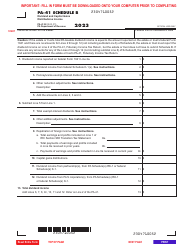

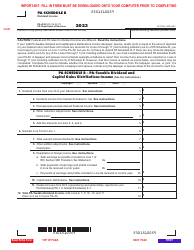

Form PA-20S (PA-65 B) Schedule B Dividend Income and Capital Gain Distributions - Pennsylvania

What Is Form PA-20S (PA-65 B) Schedule B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 B) Schedule B?

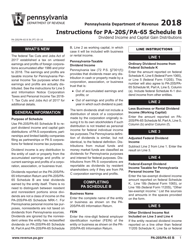

A: Form PA-20S (PA-65 B) Schedule B is a tax form used in Pennsylvania to report dividend income and capital gain distributions.

Q: What does Schedule B on Form PA-20S (PA-65 B) cover?

A: Schedule B on Form PA-20S (PA-65 B) covers dividend income and capital gain distributions.

Q: Who needs to file Form PA-20S (PA-65 B) Schedule B?

A: Taxpayers in Pennsylvania who have dividend income and capital gain distributions need to file Form PA-20S (PA-65 B) Schedule B.

Q: What information is required to complete Schedule B?

A: To complete Schedule B, you will need information about your dividend income and capital gain distributions, including the amounts and any applicable tax withholding.

Q: When is the deadline to file Form PA-20S (PA-65 B) Schedule B?

A: The deadline to file Form PA-20S (PA-65 B) Schedule B is usually the same as the deadline for filing your Pennsylvania state tax return, which is April 15th of each year.

Q: Do I need to include any supporting documents with Schedule B?

A: You may need to include copies of your dividend income statements and capital gain distribution statements with Schedule B as supporting documentation.

Q: What if I make a mistake on Form PA-20S (PA-65 B) Schedule B?

A: If you make a mistake on Form PA-20S (PA-65 B) Schedule B, you should correct it as soon as possible by filing an amended return.

Q: Can I file Form PA-20S (PA-65 B) Schedule B electronically?

A: Yes, you can file Form PA-20S (PA-65 B) Schedule B electronically through the Pennsylvania Department of Revenue's e-file system.

Q: Is there a fee to file Form PA-20S (PA-65 B) Schedule B?

A: There is no fee to file Form PA-20S (PA-65 B) Schedule B.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 B) Schedule B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.