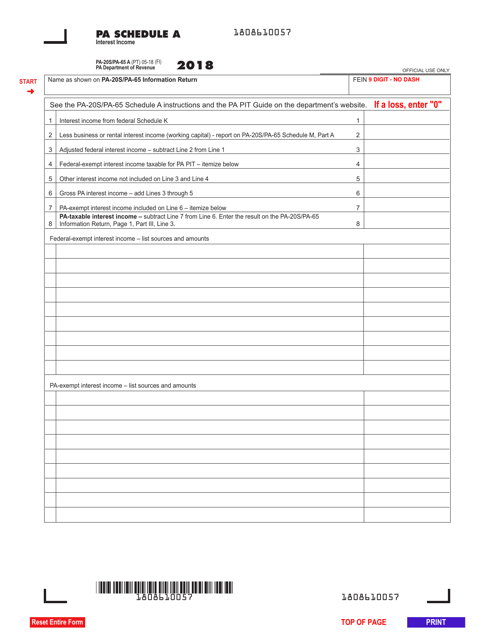

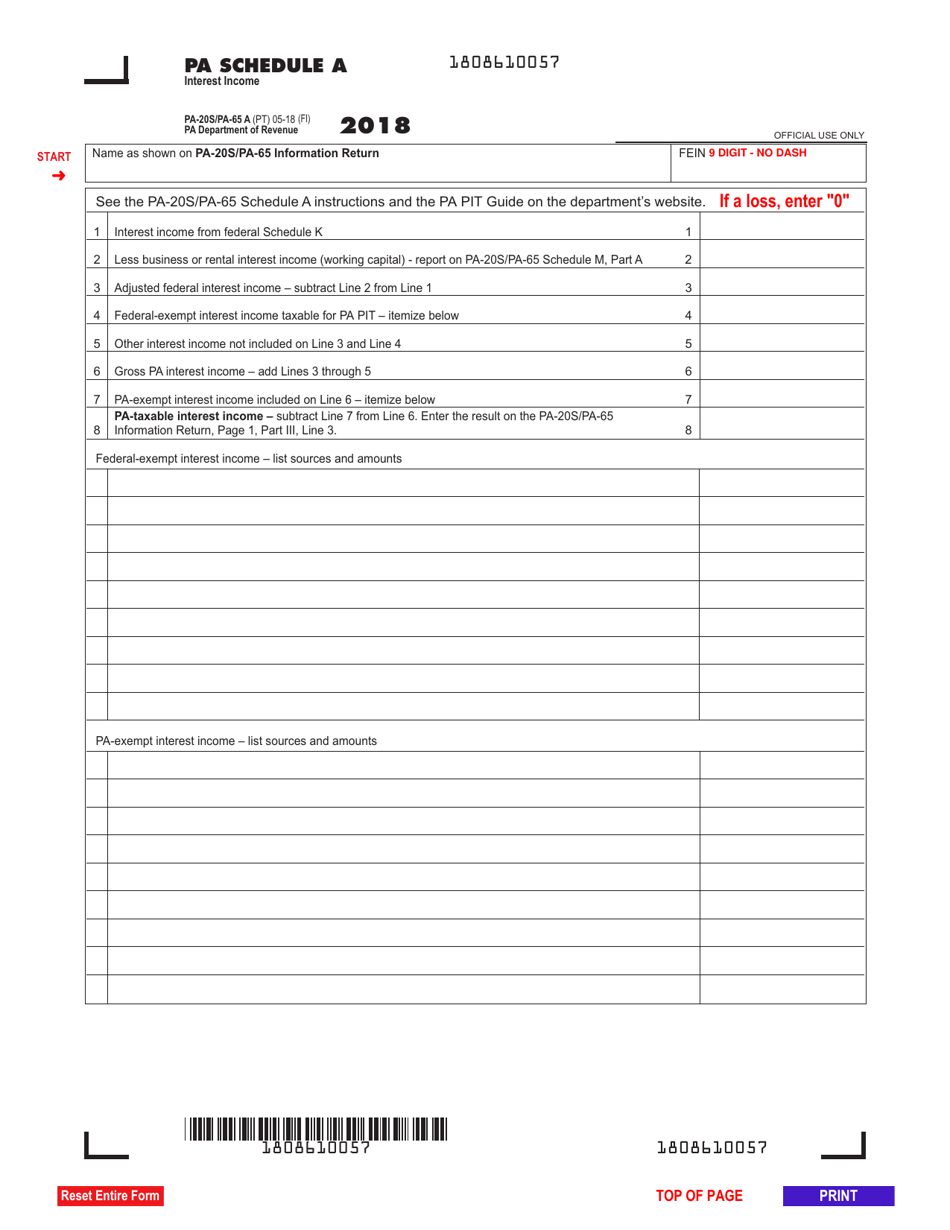

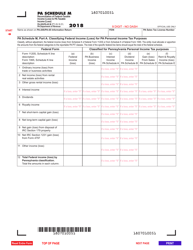

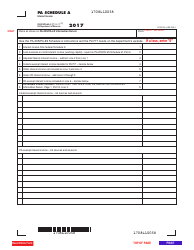

Form PA-20S (PA-65 A) Schedule A Interest Income - Pennsylvania

What Is Form PA-20S (PA-65 A) Schedule A?

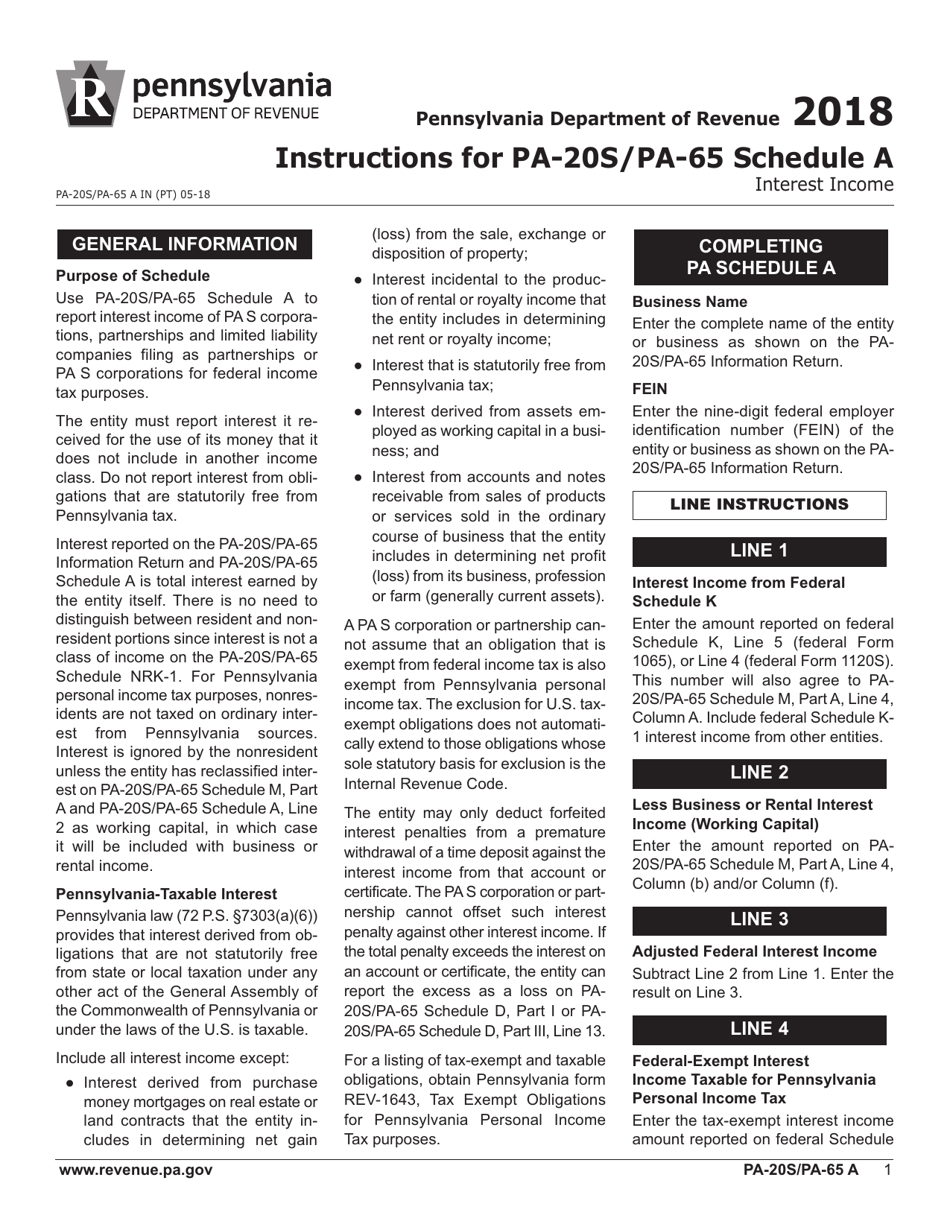

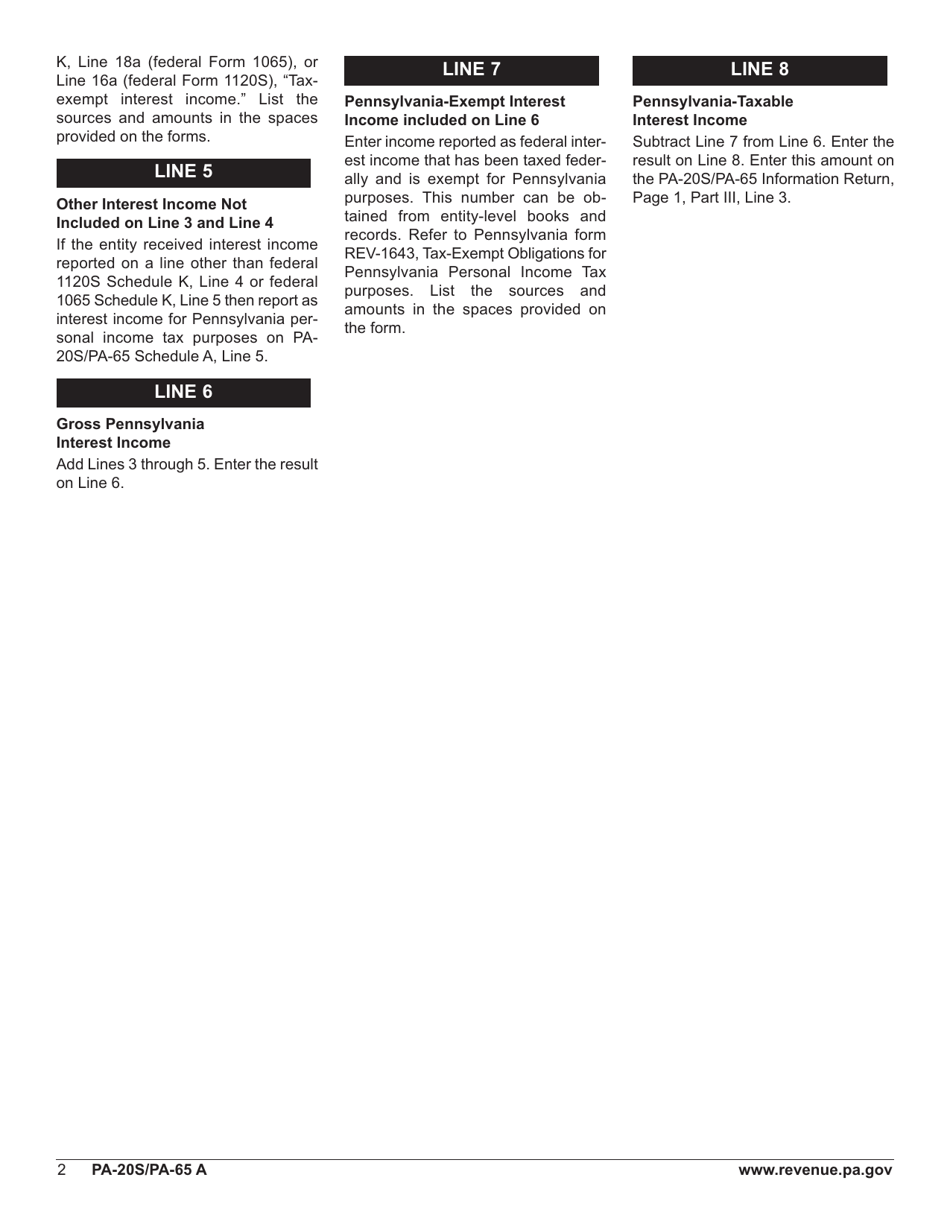

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-20S, Partner/Member/ Shareholder Directory. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-20S (PA-65 A) Schedule A?

A: Form PA-20S (PA-65 A) Schedule A is a tax form used by partnerships and S corporations to report interest income in the state of Pennsylvania.

Q: Who needs to file Form PA-20S (PA-65 A) Schedule A?

A: Partnerships and S corporations that have interest income sourced from Pennsylvania need to file Form PA-20S (PA-65 A) Schedule A.

Q: What is reported on Form PA-20S (PA-65 A) Schedule A?

A: Form PA-20S (PA-65 A) Schedule A is used to report interest income earned within Pennsylvania and any related deductions.

Q: When is the deadline to file Form PA-20S (PA-65 A) Schedule A?

A: The deadline to file Form PA-20S (PA-65 A) Schedule A is typically April 15th, unless an extension has been granted.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-20S (PA-65 A) Schedule A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.