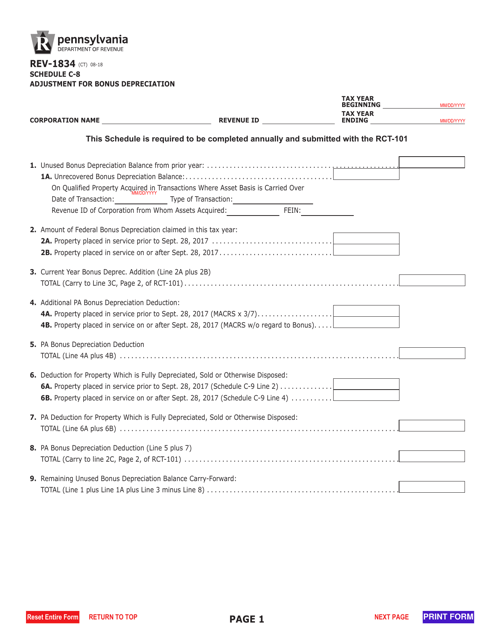

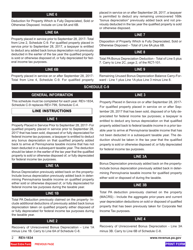

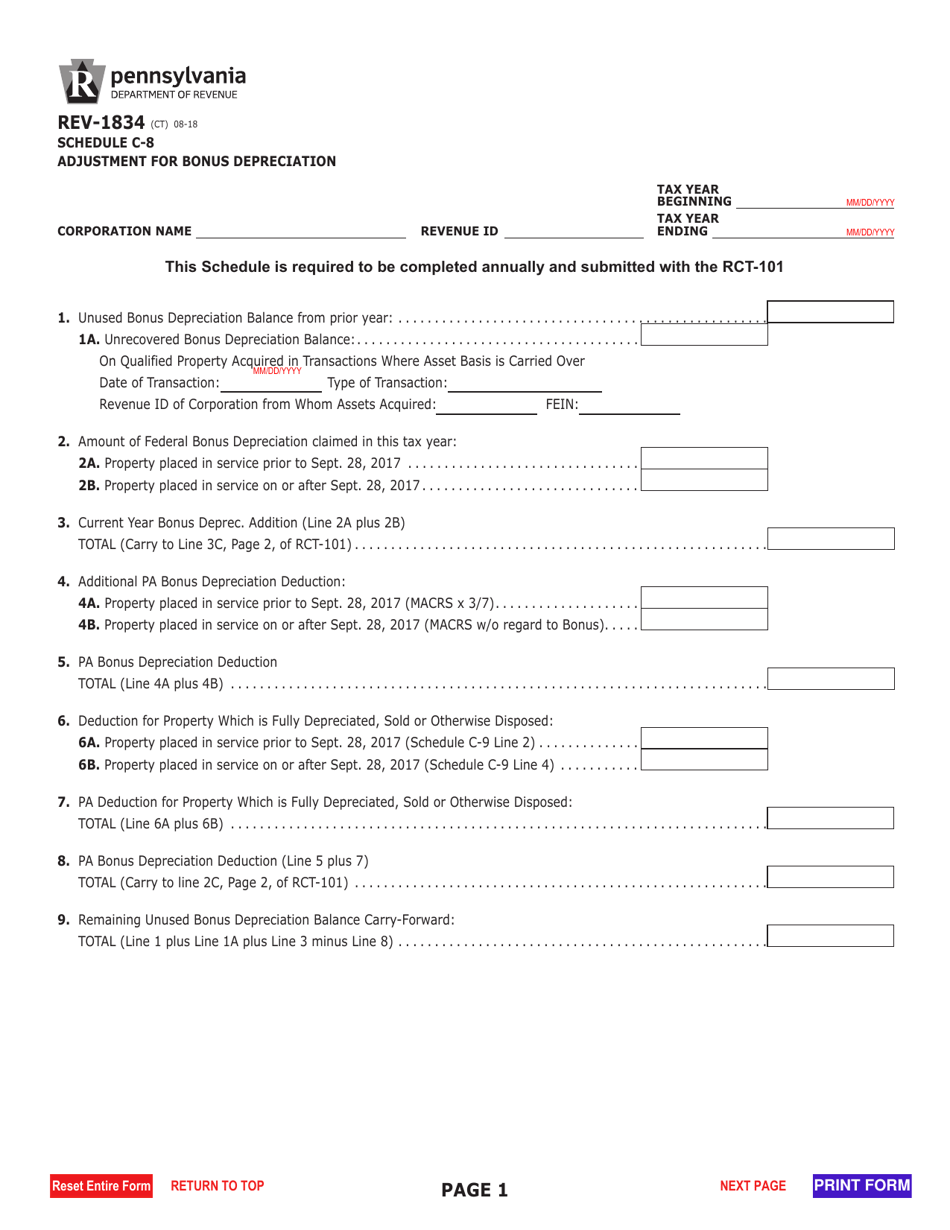

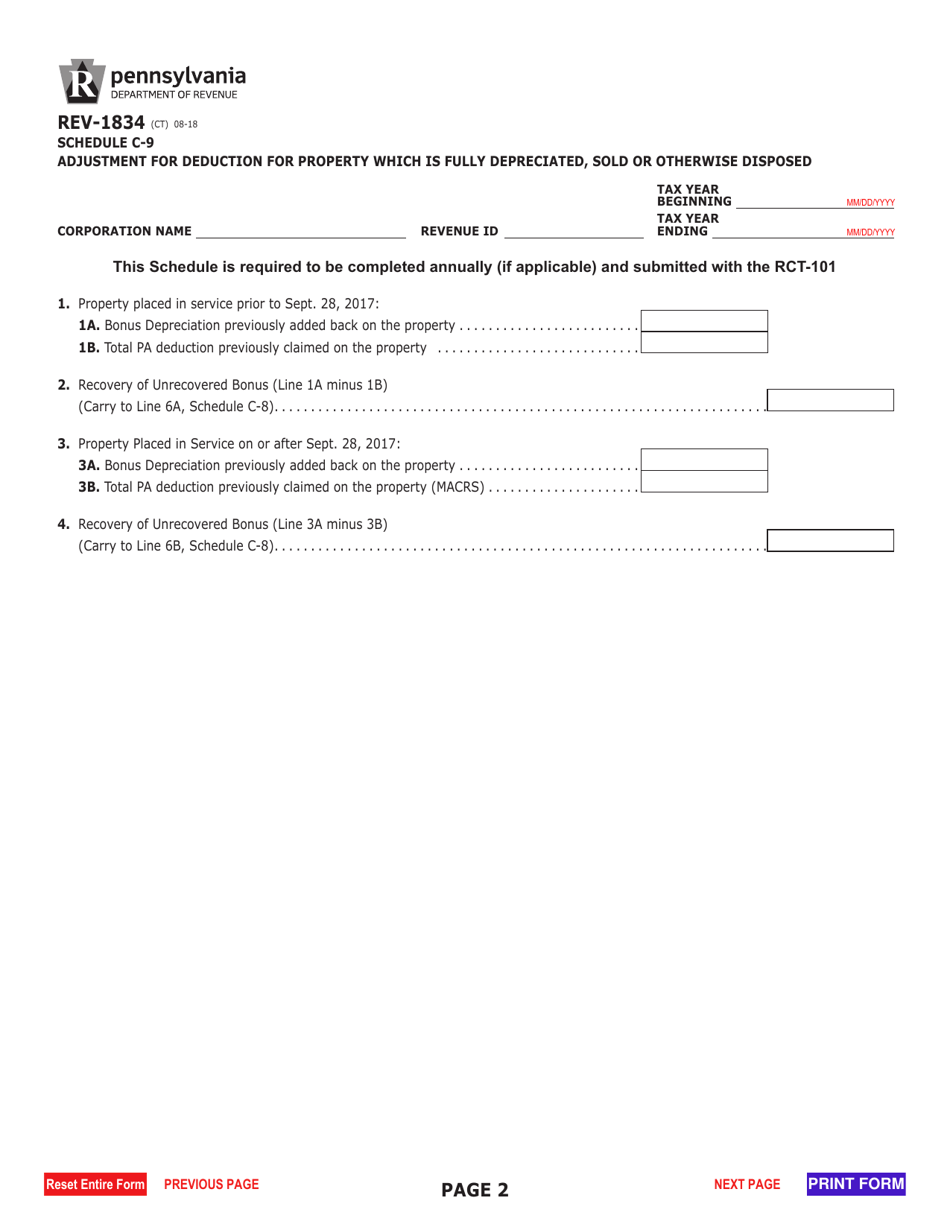

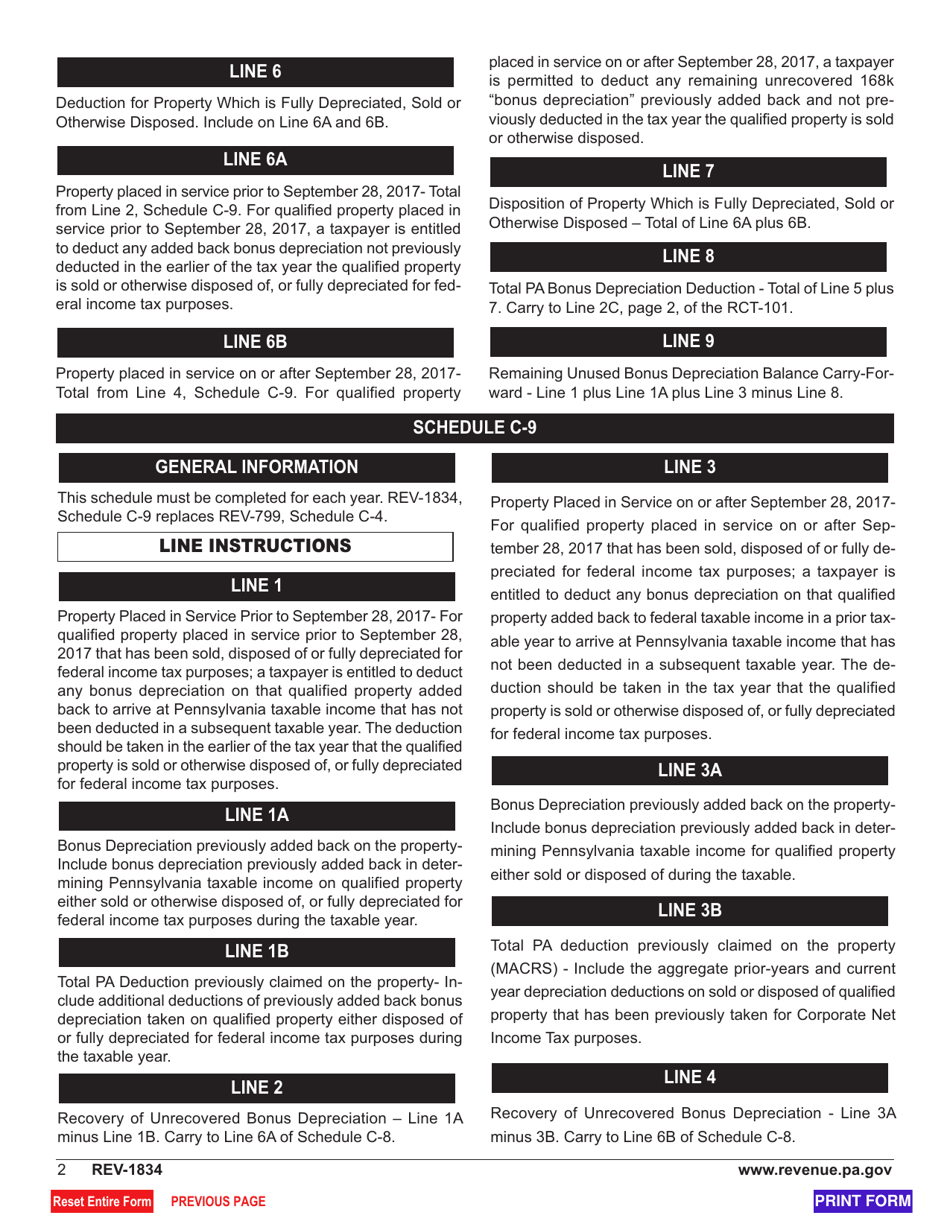

Form REV-1834 Schedule C-8 Adjustment for Bonus Depreciation - Pennsylvania

What Is Form REV-1834 Schedule C-8?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1834?

A: Form REV-1834 is a Pennsylvania tax form used to report adjustments for bonus depreciation.

Q: What is Schedule C-8?

A: Schedule C-8 is a specific schedule within Form REV-1834 that is used to report bonus depreciation adjustments.

Q: What is bonus depreciation?

A: Bonus depreciation is a tax incentive that allows businesses to write off a larger portion of the cost of qualifying assets in the year they are acquired.

Q: Who needs to file Form REV-1834 Schedule C-8?

A: Businesses that have made adjustments for bonus depreciation in Pennsylvania need to file Form REV-1834 Schedule C-8.

Q: Are there any specific requirements for completing Form REV-1834 Schedule C-8?

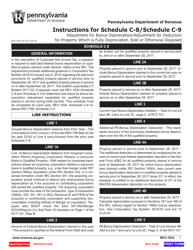

A: Yes, businesses must follow the instructions provided on the form and include all required information and documentation.

Q: Is there a deadline for filing Form REV-1834 Schedule C-8?

A: Yes, the deadline for filing Form REV-1834 Schedule C-8 is generally the same as the deadline for filing your Pennsylvania tax return.

Q: What happens if I don't file Form REV-1834 Schedule C-8?

A: Failure to file Form REV-1834 Schedule C-8 or reporting incorrect information may result in penalties or additional taxes owed.

Q: Can I file Form REV-1834 Schedule C-8 electronically?

A: Yes, Pennsylvania allows electronic filing of Form REV-1834 Schedule C-8.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1834 Schedule C-8 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.