This version of the form is not currently in use and is provided for reference only. Download this version of

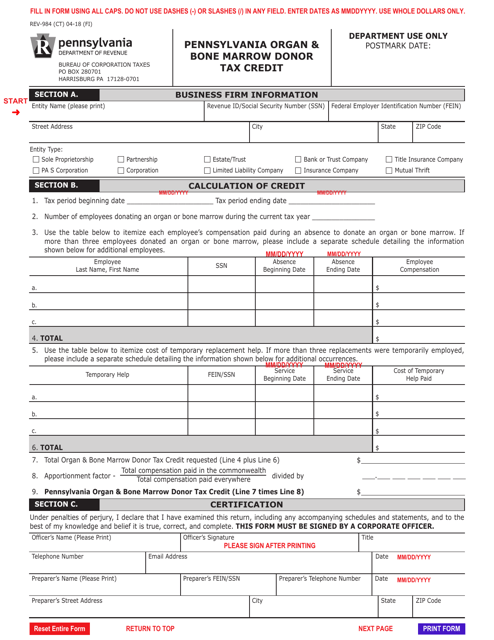

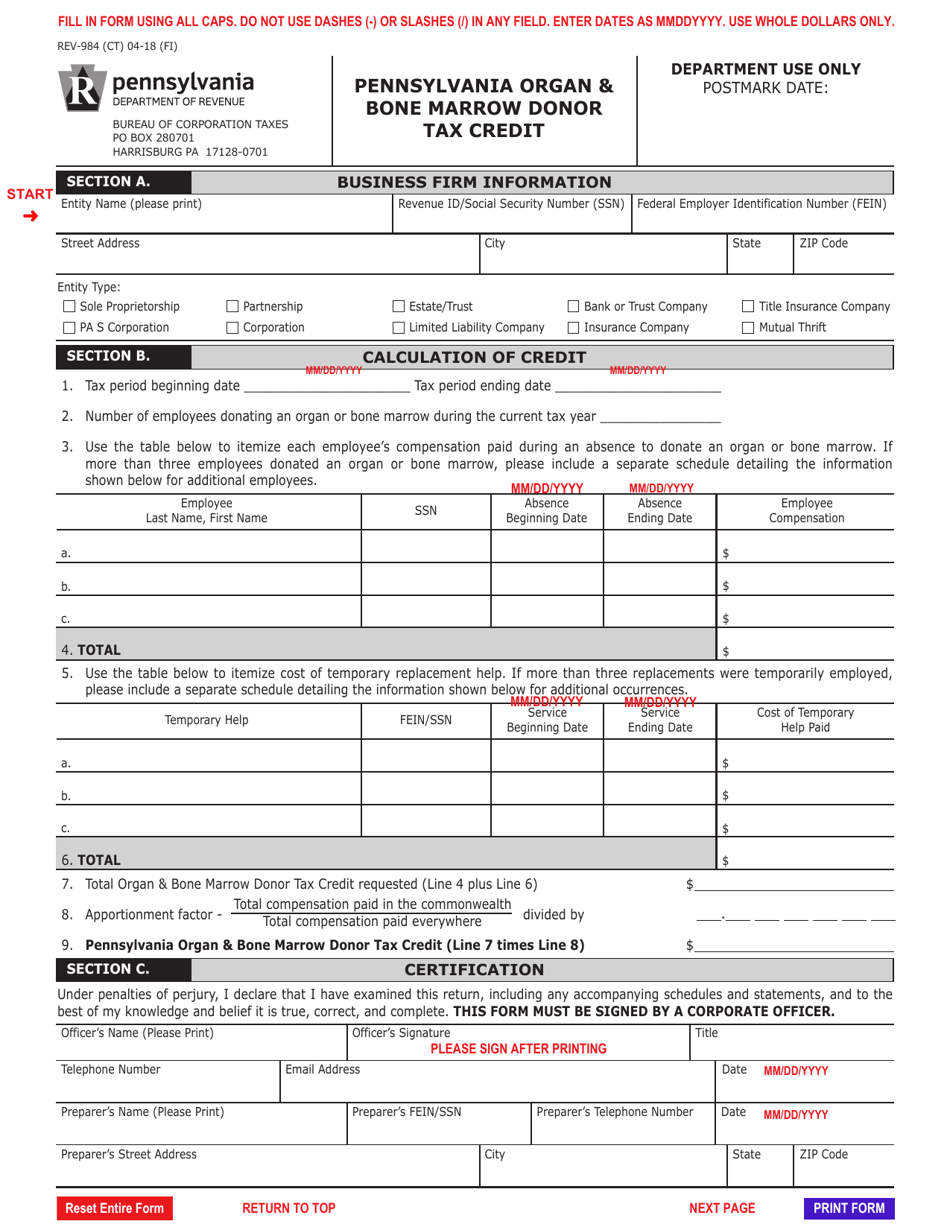

Form REV-984

for the current year.

Form REV-984 Pennsylvania Organ & Bone Marrow Donor Tax Credit - Pennsylvania

What Is Form REV-984?

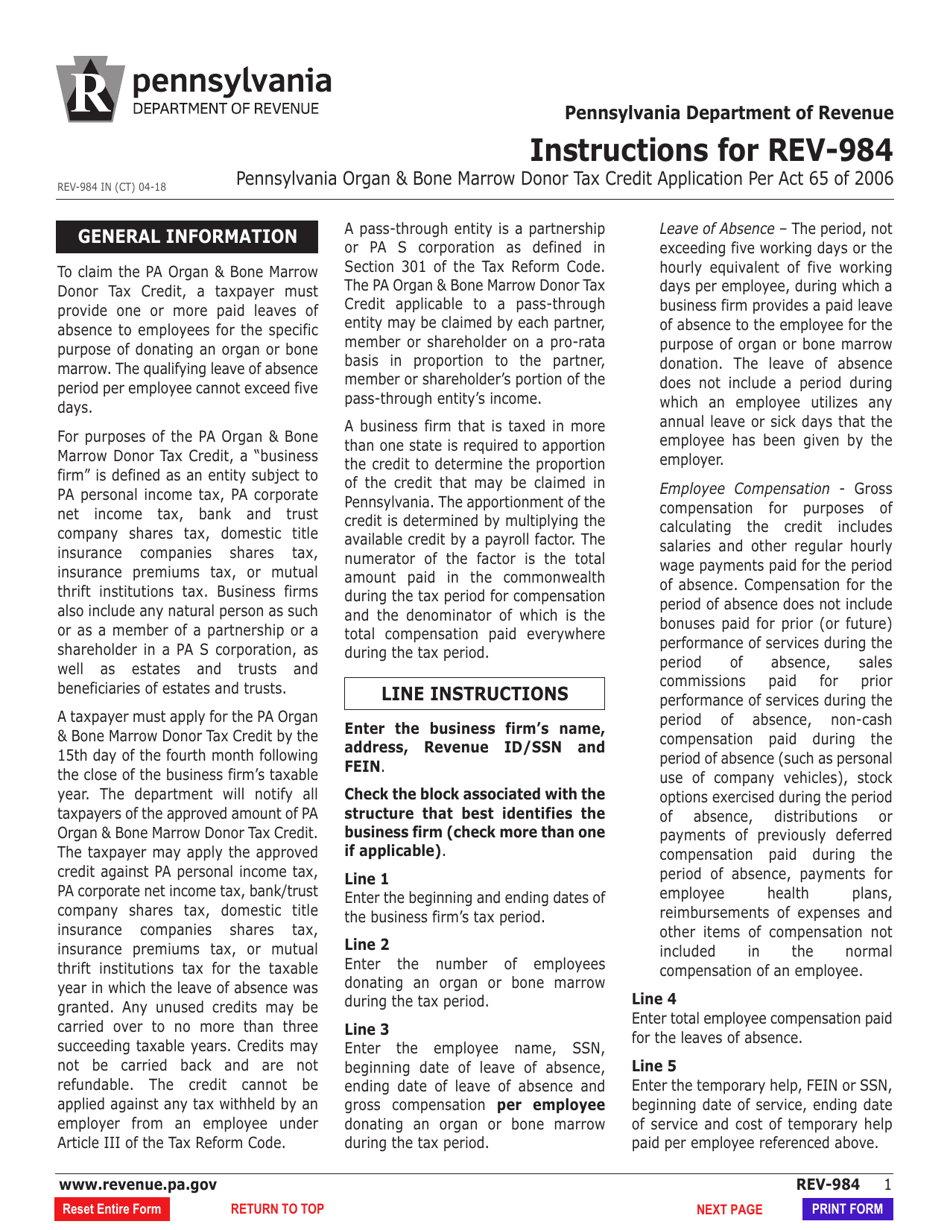

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form REV-984?

A: Form REV-984 is the Pennsylvania Organ & Bone Marrow Donor Tax Credit form.

Q: What is the purpose of Form REV-984?

A: The purpose of Form REV-984 is to claim a tax credit for organ and bone marrow donors in Pennsylvania.

Q: Who is eligible to claim the Organ & Bone Marrow Donor Tax Credit?

A: Individuals who donate organs or bone marrow in Pennsylvania within the tax year are eligible to claim the tax credit.

Q: How much is the tax credit for organ and bone marrow donation in Pennsylvania?

A: The tax credit amount varies each year and is determined by the Pennsylvania Department of Revenue.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-984 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.