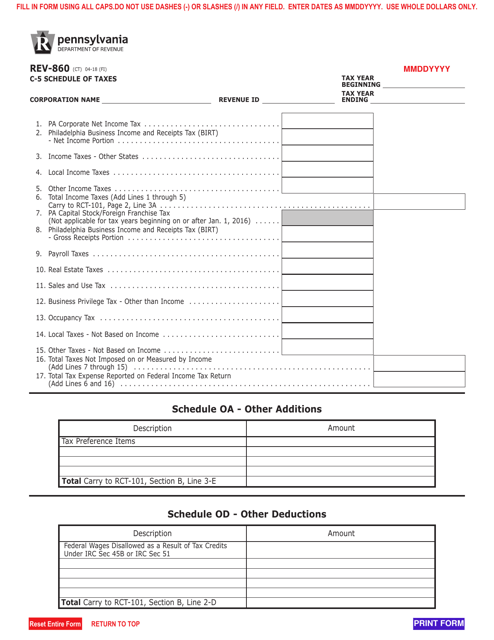

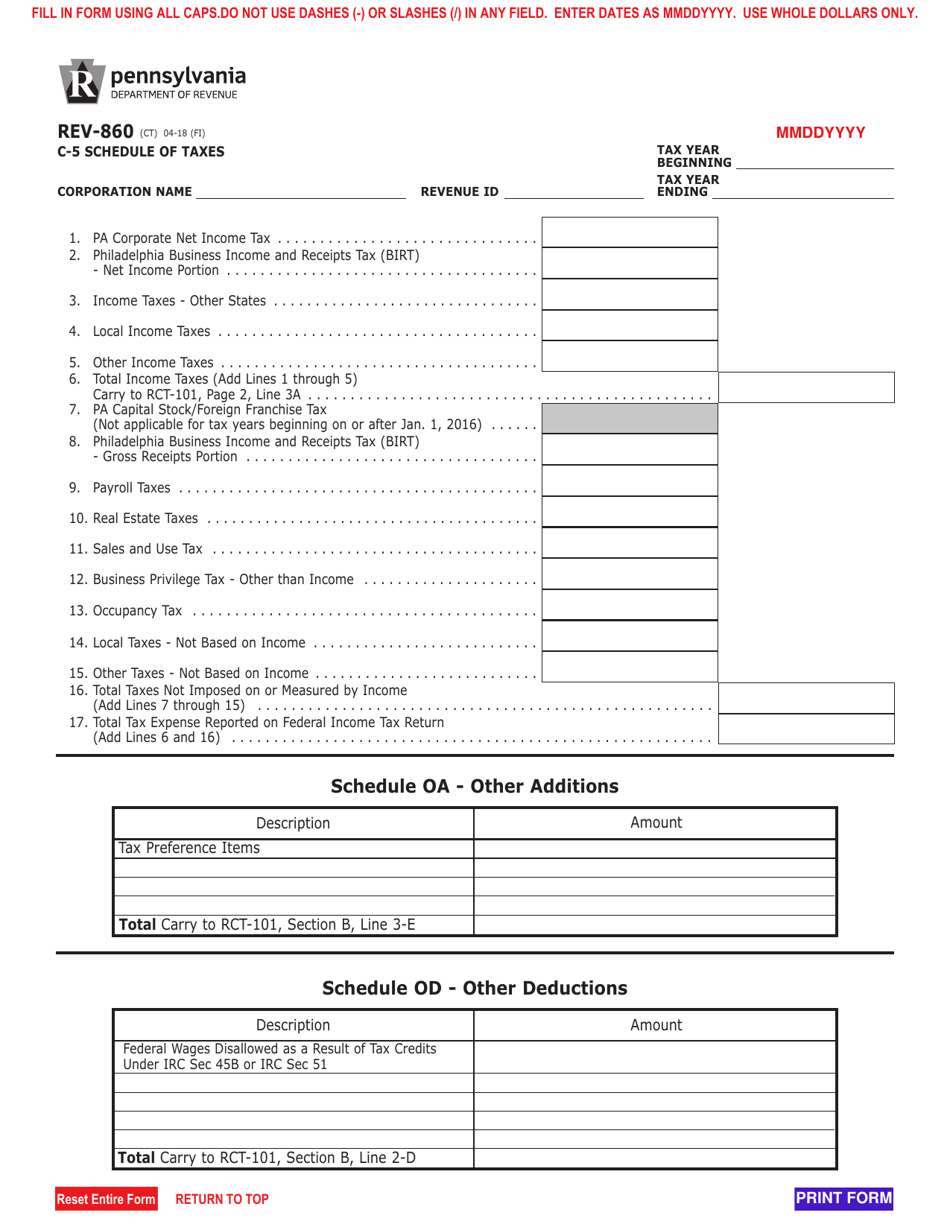

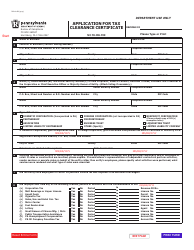

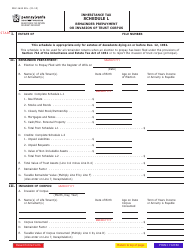

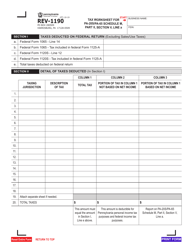

Form REV-860 C-5 Schedule of Taxes - Pennsylvania

What Is Form REV-860?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-860 C-5?

A: Form REV-860 C-5 is the Schedule of Taxes for the state of Pennsylvania.

Q: What is the purpose of Form REV-860 C-5?

A: The purpose of Form REV-860 C-5 is to report various types of taxes owed to the state of Pennsylvania.

Q: What taxes are reported on Form REV-860 C-5?

A: Form REV-860 C-5 reports taxes such as personal income tax, sales and use tax, corporate net income tax, and other taxes imposed by the state of Pennsylvania.

Q: Who needs to file Form REV-860 C-5?

A: Individuals and businesses that owe taxes to the state of Pennsylvania may need to file Form REV-860 C-5.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-860 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.