This version of the form is not currently in use and is provided for reference only. Download this version of

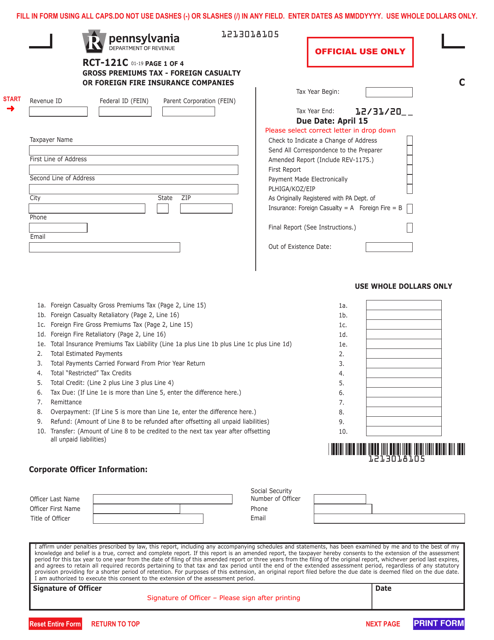

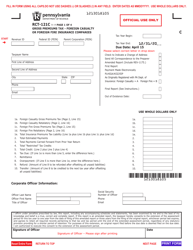

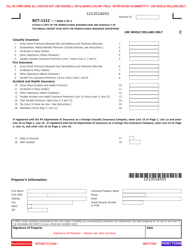

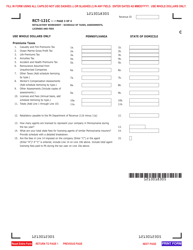

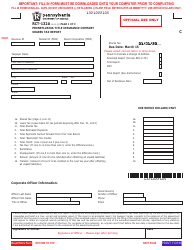

Form RCT-121C

for the current year.

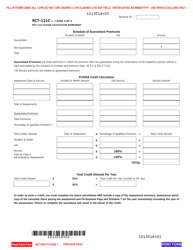

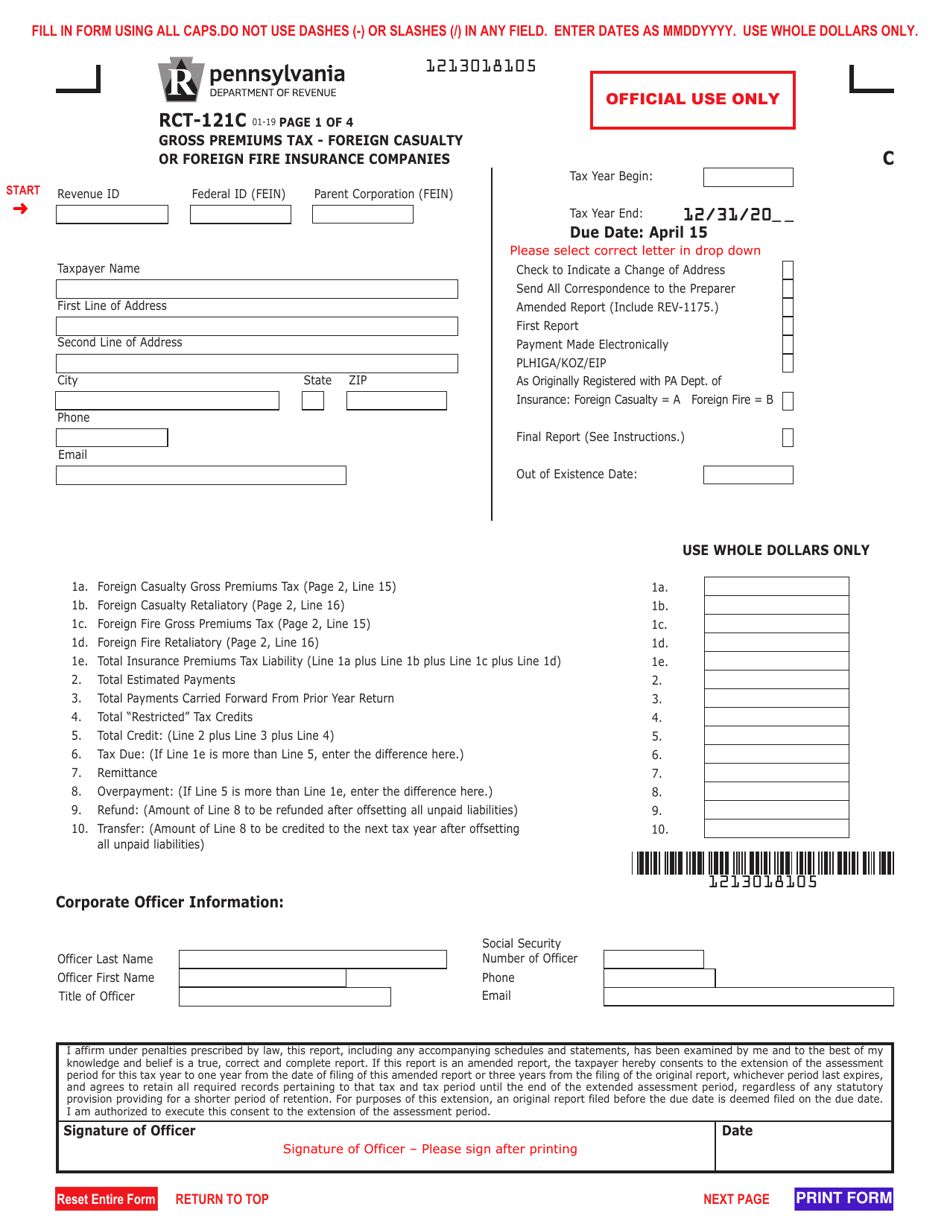

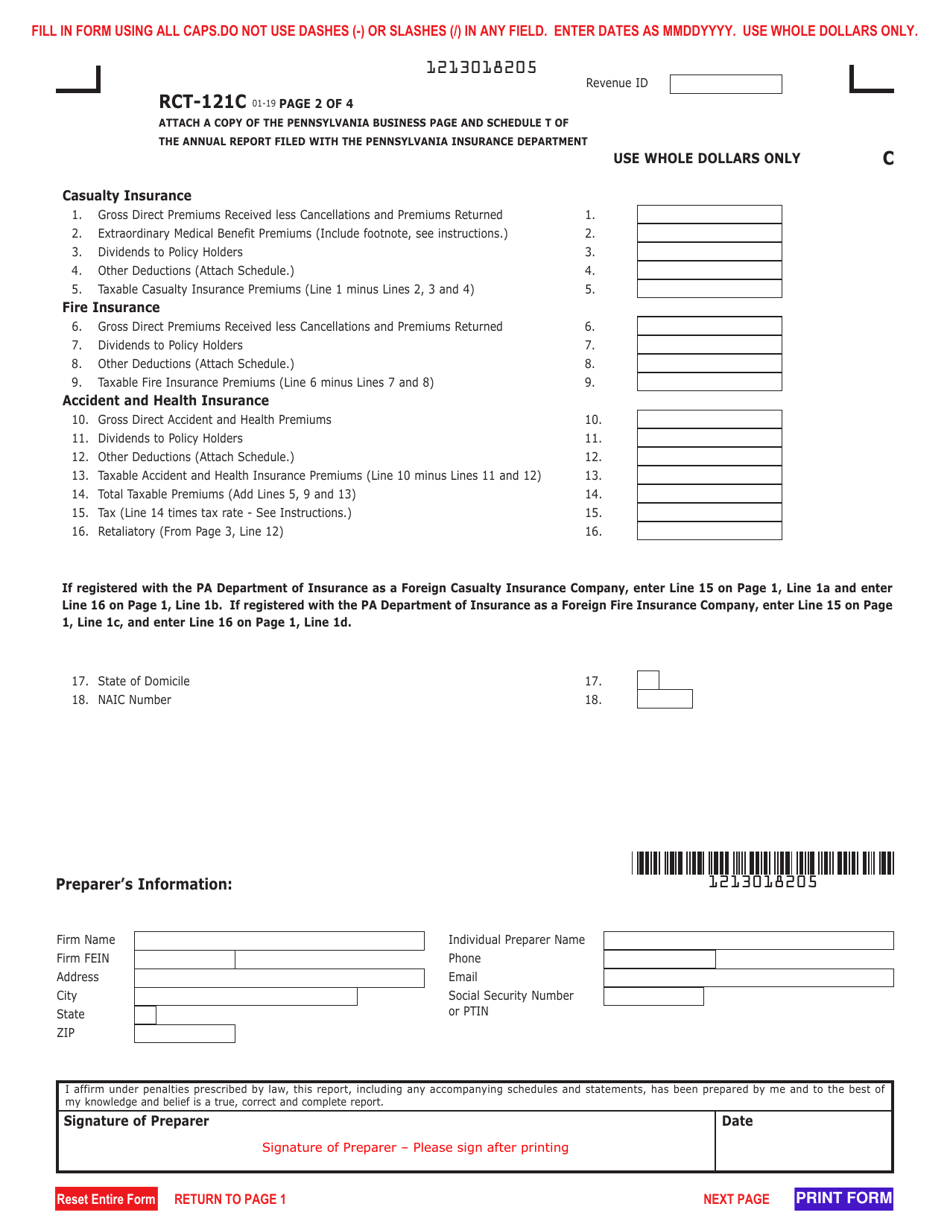

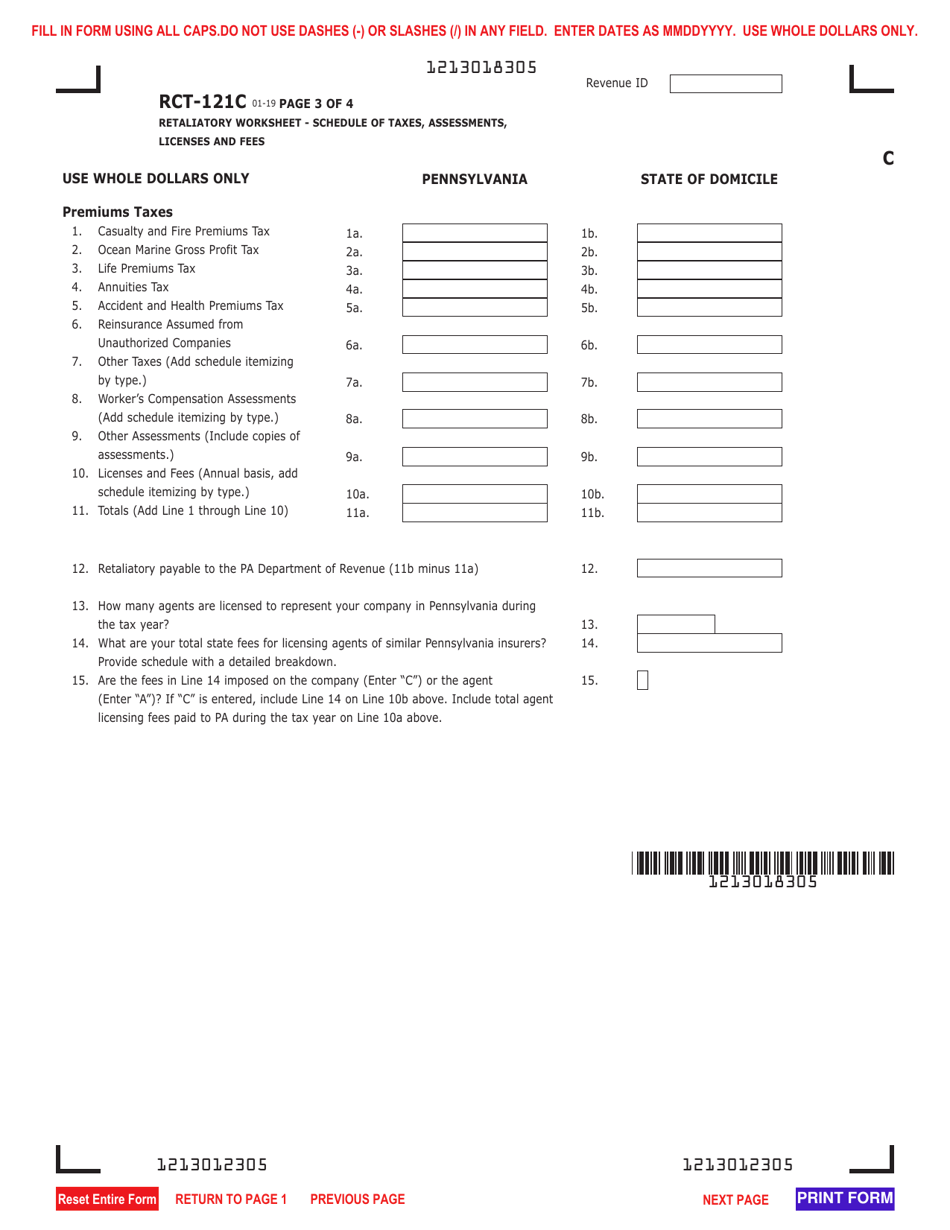

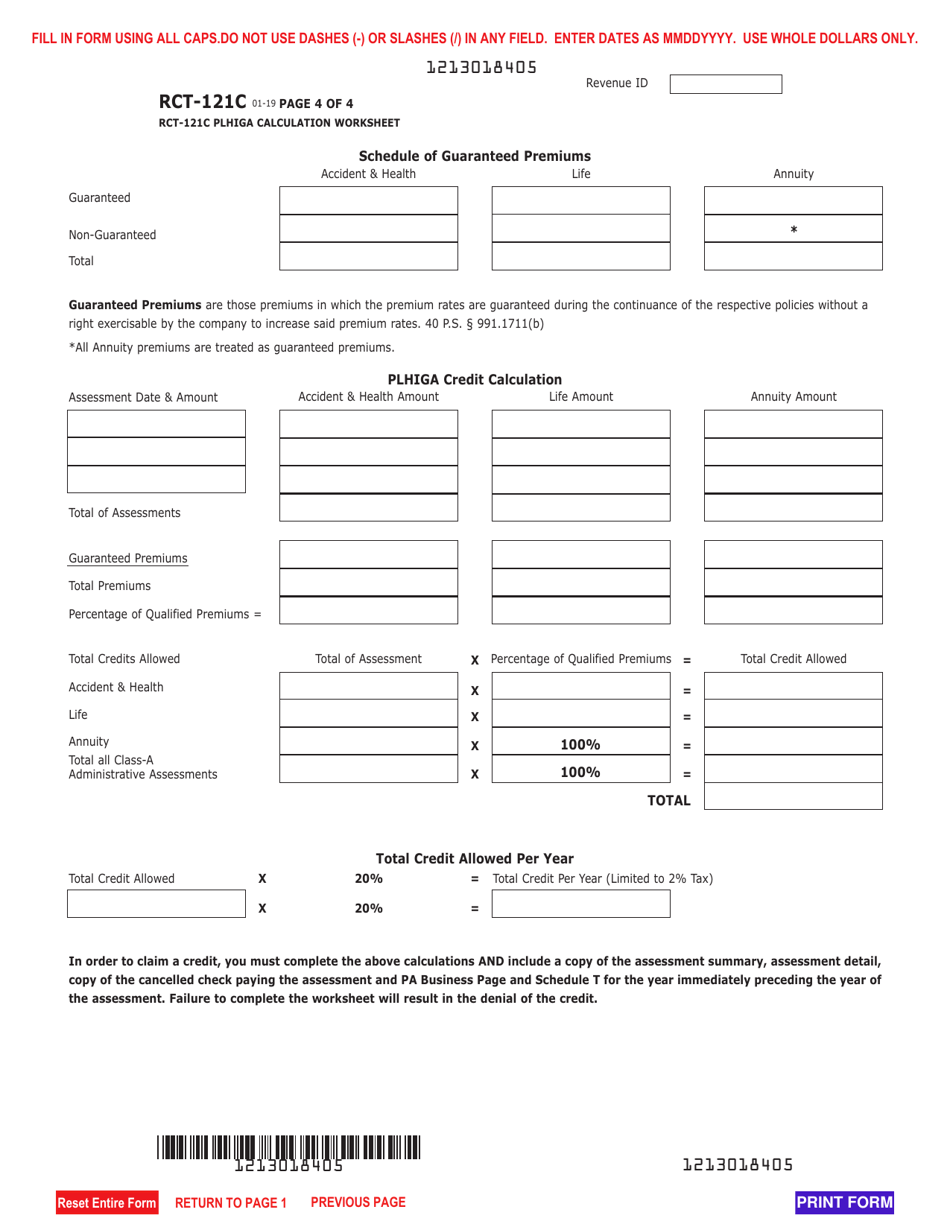

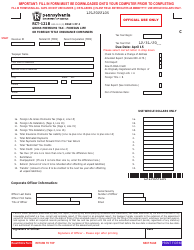

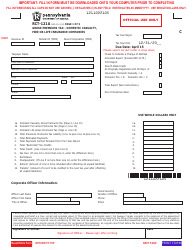

Form RCT-121C Gross Premiums Tax - Foreign Casualty or Foreign Fire Insurance Companies - Pennsylvania

What Is Form RCT-121C?

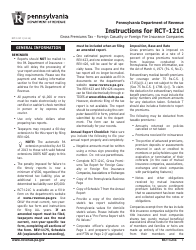

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form RCT-121C?

A: Form RCT-121C is a tax form used in Pennsylvania for foreign casualty or foreign fire insurance companies.

Q: Who needs to file Form RCT-121C?

A: Foreign casualty or foreign fire insurance companiesdoing business in Pennsylvania need to file Form RCT-121C.

Q: What is the purpose of Form RCT-121C?

A: The purpose of Form RCT-121C is to report and calculate the gross premiums tax owed by foreign casualty or foreign fire insurance companies.

Q: What information is required on Form RCT-121C?

A: Form RCT-121C requires the company's name, address, taxpayer identification number, and details about the premiums received from Pennsylvania residents.

Q: How often do companies need to file Form RCT-121C?

A: Companies need to file Form RCT-121C annually by April 15th of each year.

Q: Are there any exceptions to filing Form RCT-121C?

A: Yes, there are exceptions. Companies that receive less than $100,000 in premiums from Pennsylvania residents are not required to file Form RCT-121C.

Q: Is there a penalty for not filing Form RCT-121C?

A: Yes, there is a penalty for not filing Form RCT-121C. The penalty is 1% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121C by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.