This version of the form is not currently in use and is provided for reference only. Download this version of

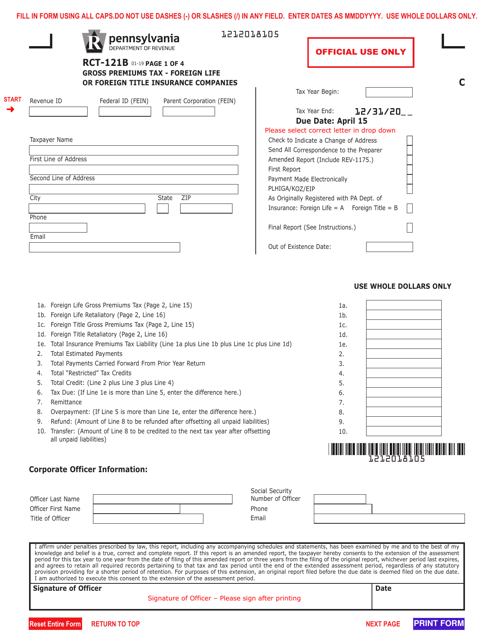

Form RCT-121B

for the current year.

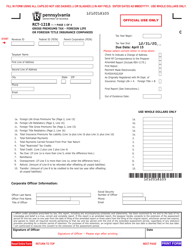

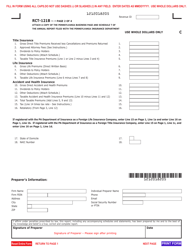

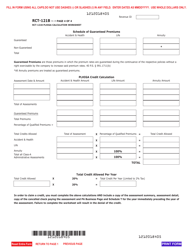

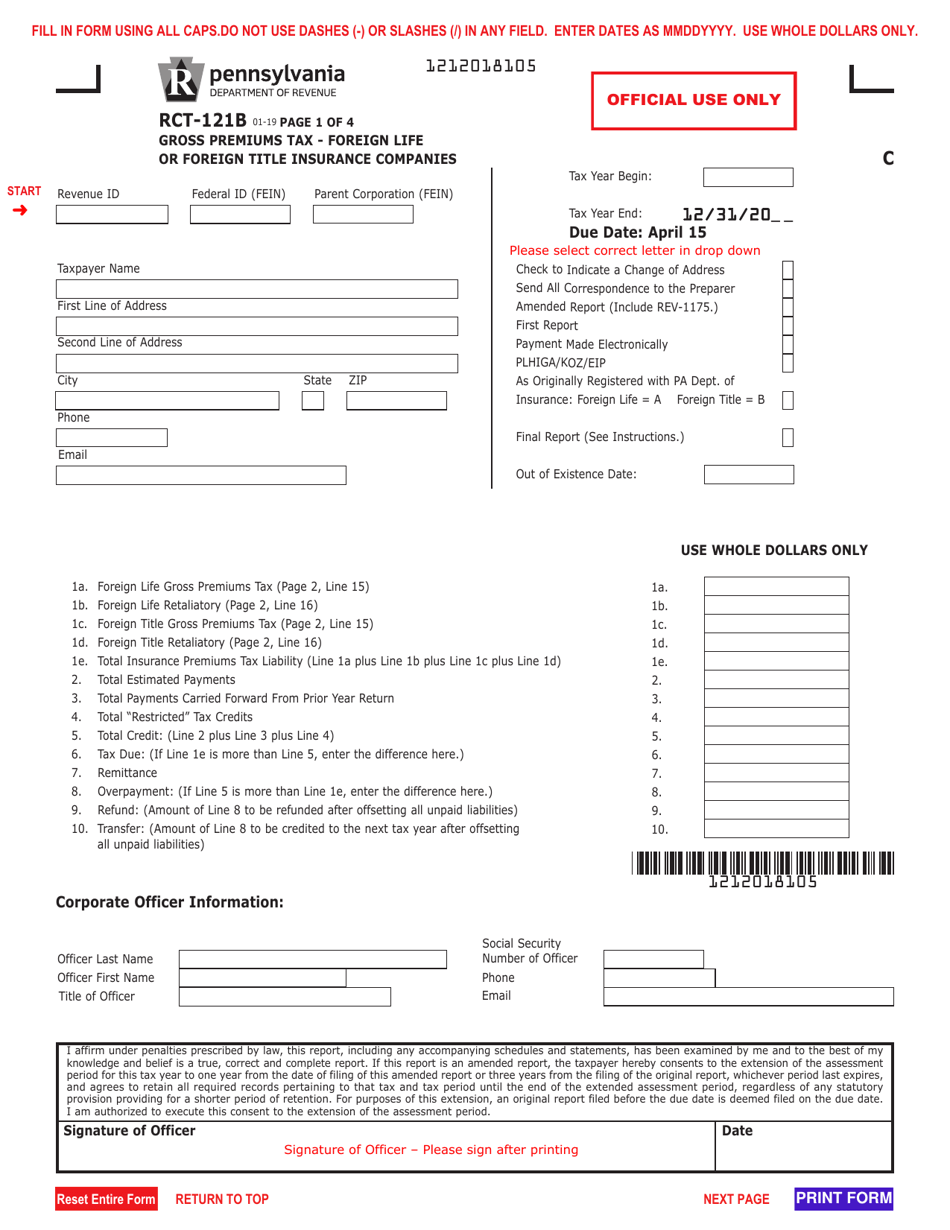

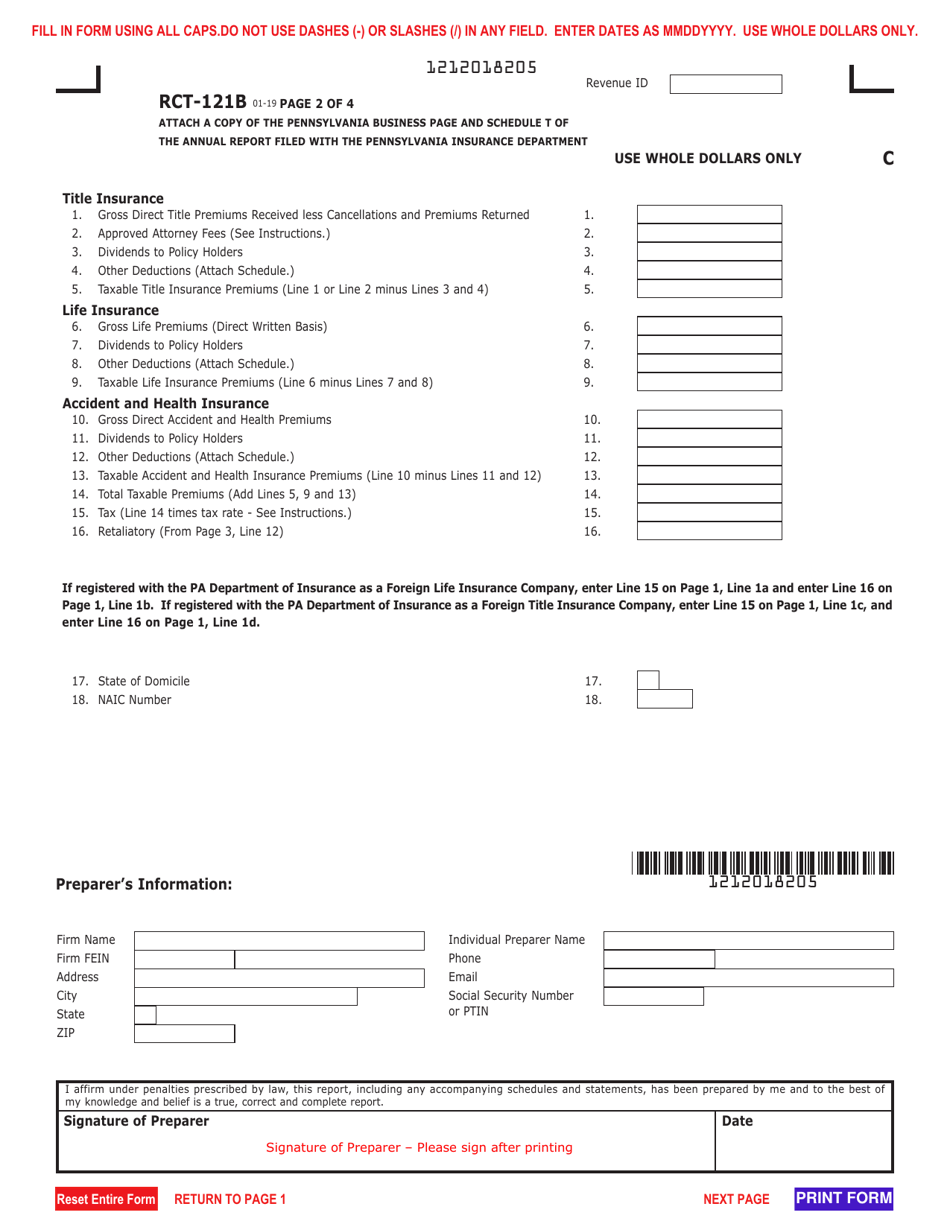

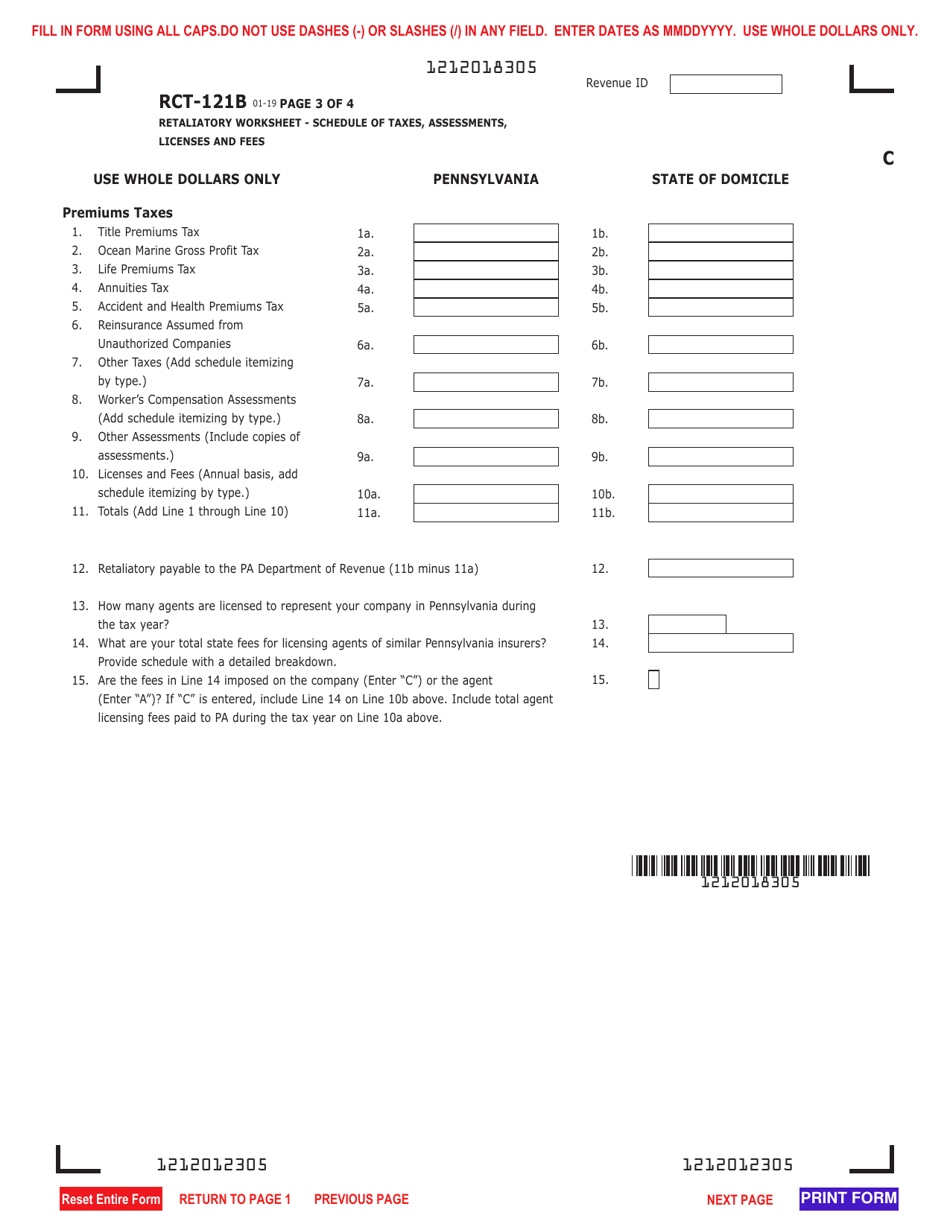

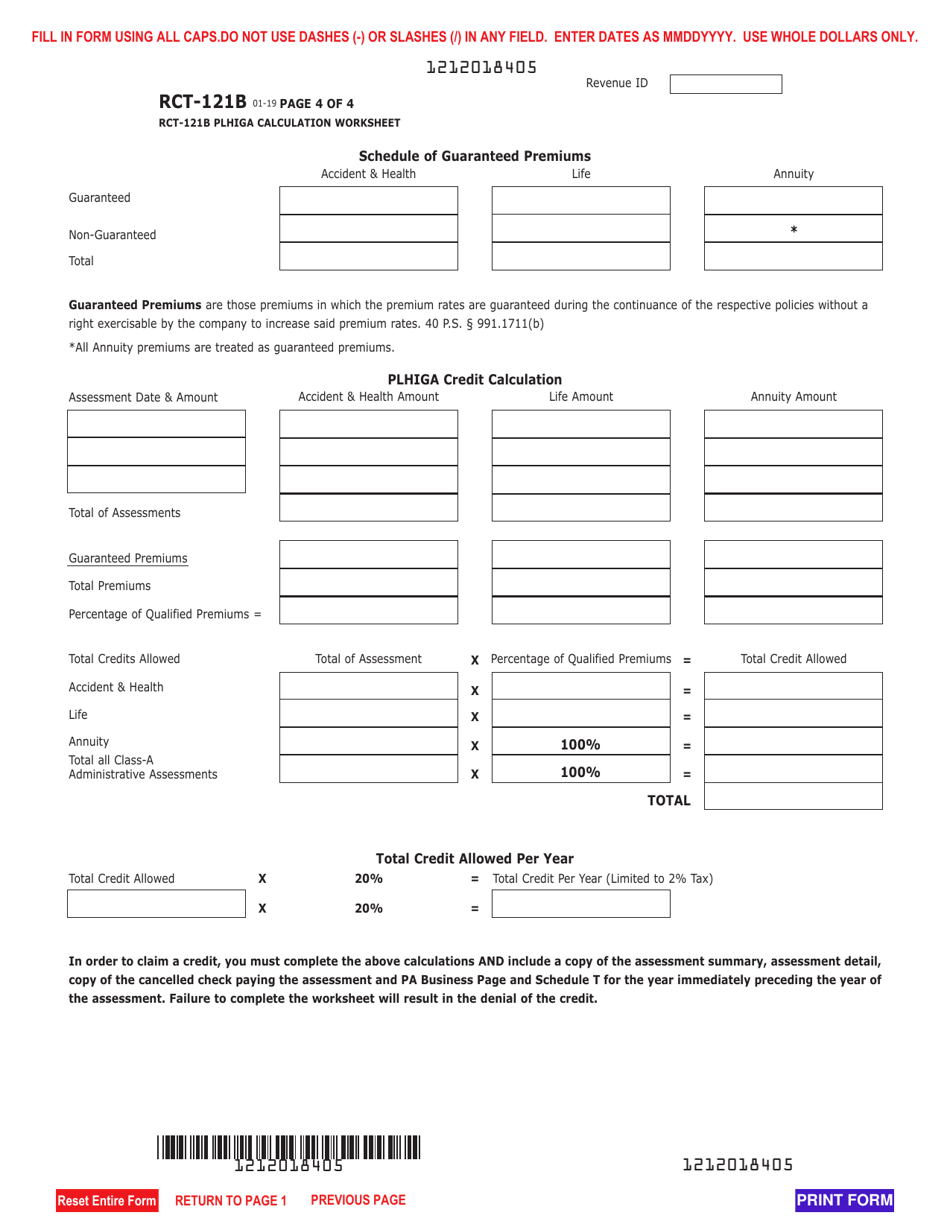

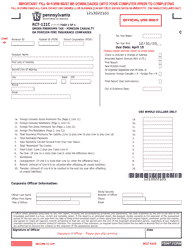

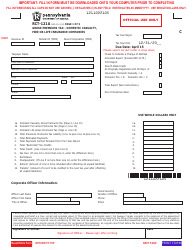

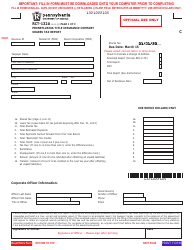

Form RCT-121B Gross Premiums Tax - Foreign Life or Foreign Title Insurance Companies - Pennsylvania

What Is Form RCT-121B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RCT-121B?

A: Form RCT-121B is a tax form used by foreign life or foreign title insurance companies to report gross premiums tax in Pennsylvania.

Q: Who must file Form RCT-121B?

A: Foreign life or foreign title insurance companies operating in Pennsylvania must file Form RCT-121B.

Q: What is the purpose of Form RCT-121B?

A: The purpose of Form RCT-121B is to report gross premiums tax for foreign life or foreign title insurance companies in Pennsylvania.

Q: What information is required on Form RCT-121B?

A: Form RCT-121B requires the company's name, address, FEIN, and details of the gross premiums received in Pennsylvania.

Q: When is Form RCT-121B due?

A: Form RCT-121B is due on or before March 1 each year.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.