This version of the form is not currently in use and is provided for reference only. Download this version of

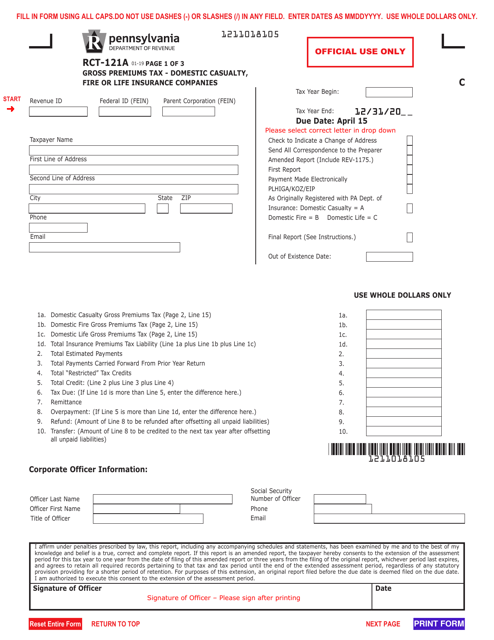

Form RCT-121A

for the current year.

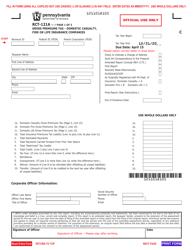

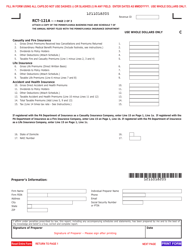

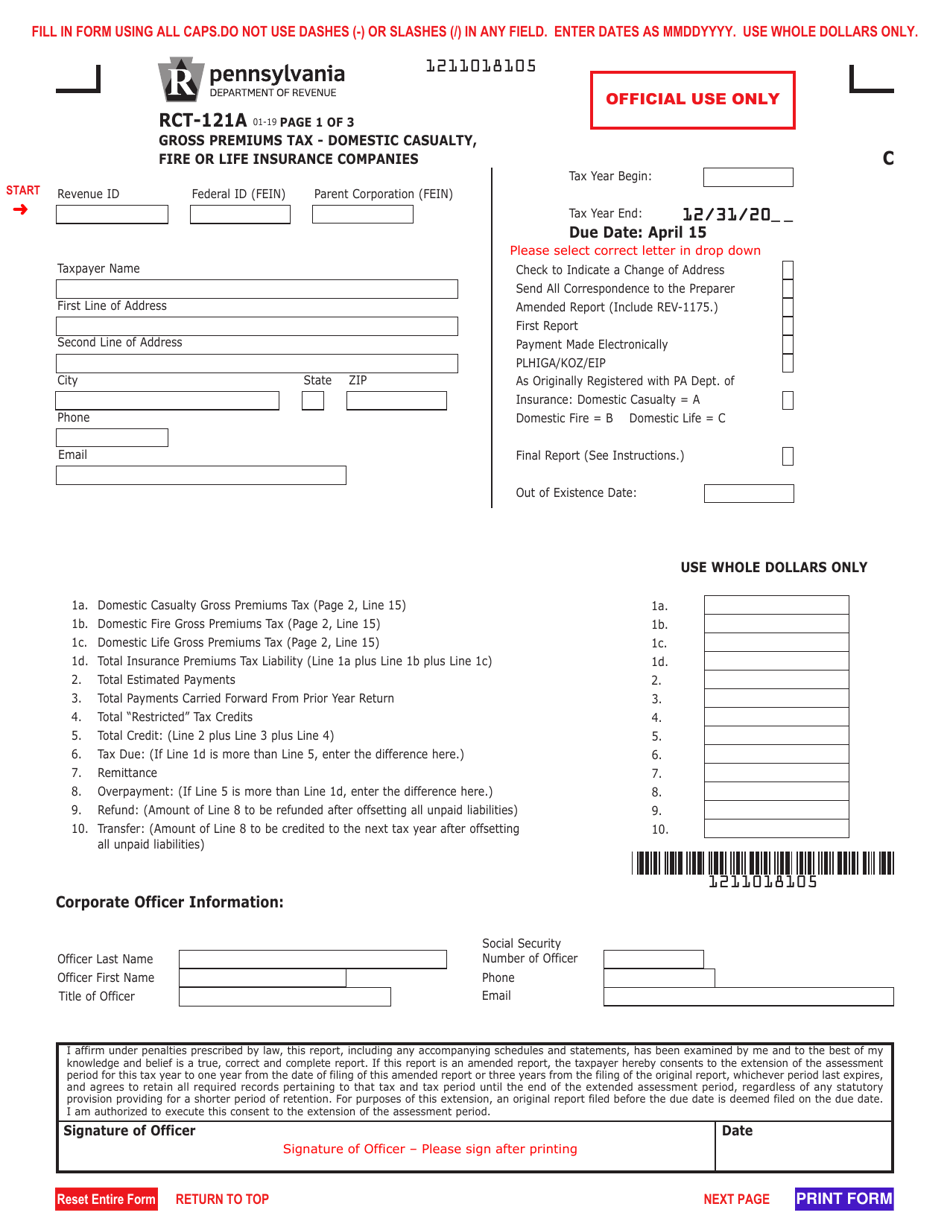

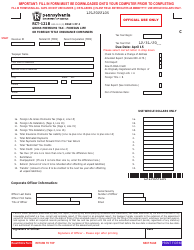

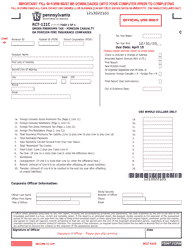

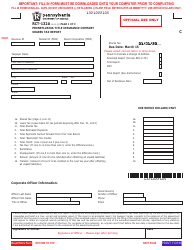

Form RCT-121A Gross Premiums Tax - Domestic Casualty, Fire or Life Insurance Companies - Pennsylvania

What Is Form RCT-121A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RCT-121A?

A: Form RCT-121A is a tax form for domestic casualty, fire, or life insurance companies in Pennsylvania.

Q: Who needs to file Form RCT-121A?

A: Domestic casualty, fire, or life insurance companies in Pennsylvania need to file Form RCT-121A.

Q: What is the purpose of Form RCT-121A?

A: The purpose of Form RCT-121A is to report gross premiums tax for domestic casualty, fire, or life insurance companies in Pennsylvania.

Q: When is Form RCT-121A due?

A: Form RCT-121A is due on March 1st following the close of each calendar year.

Q: Are there any penalties for late filing of Form RCT-121A?

A: Yes, there are penalties for late filing of Form RCT-121A. It is important to file the form on time to avoid penalties.

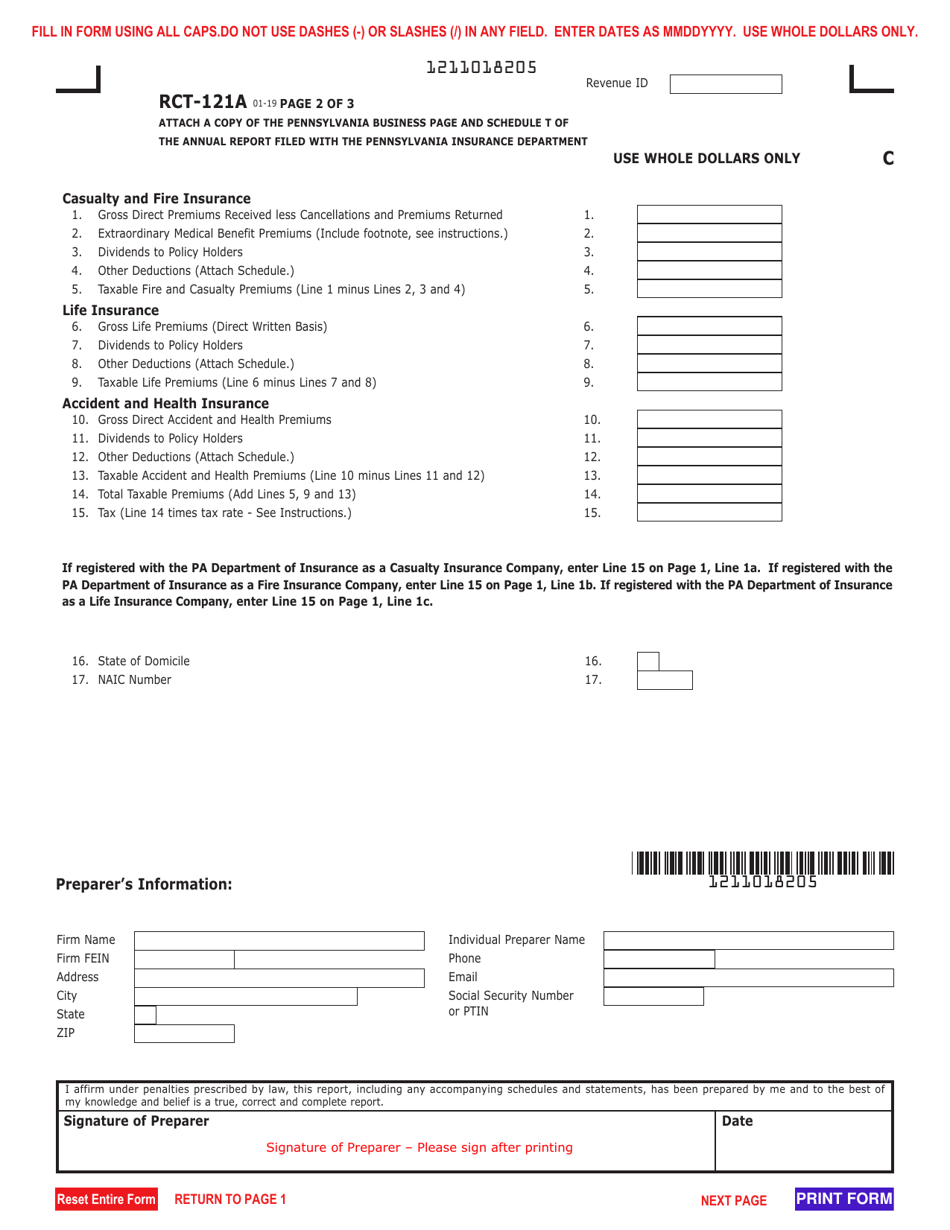

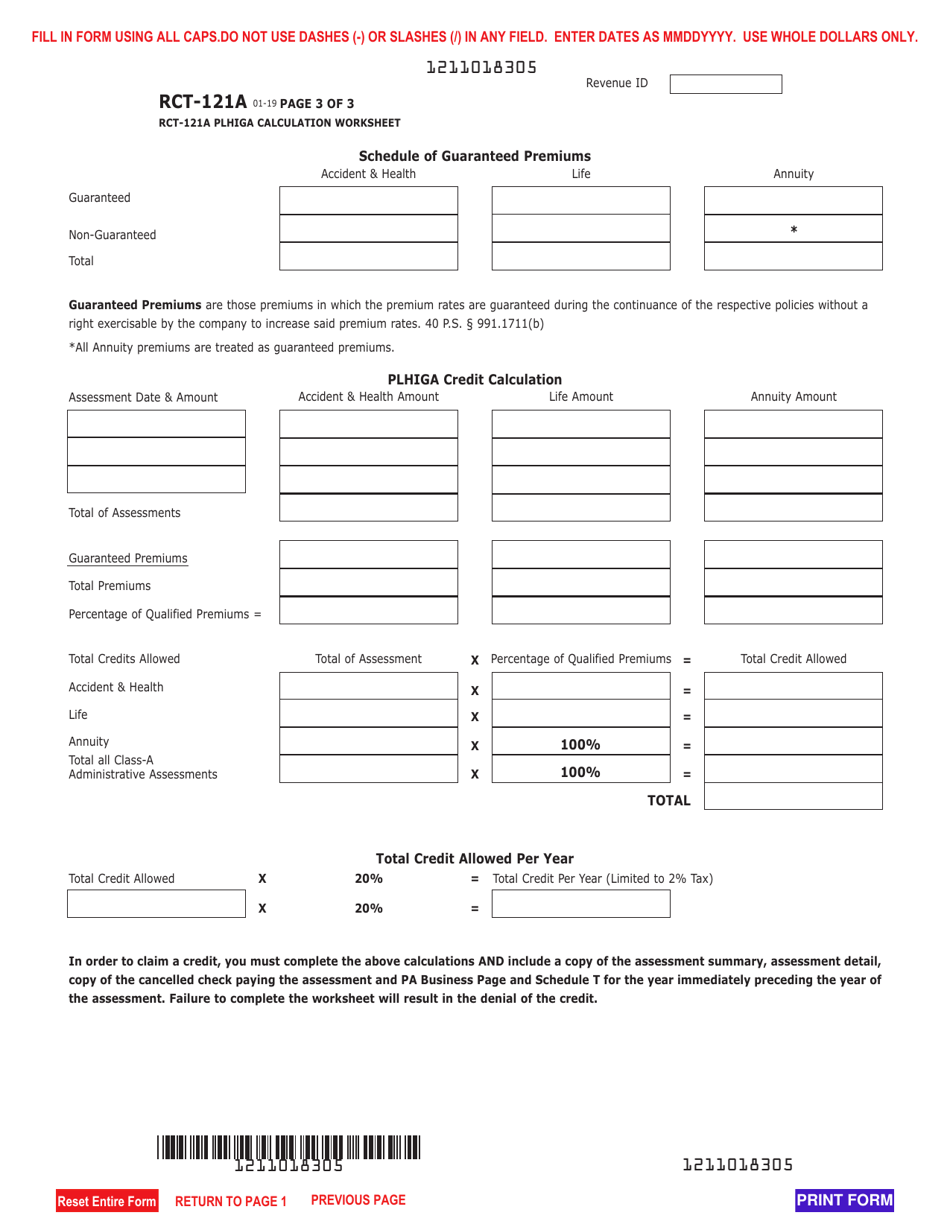

Q: What information do I need to complete Form RCT-121A?

A: To complete Form RCT-121A, you will need information such as your company's gross premiums, deductions, and other relevant financial data.

Q: Do I need to include supporting documents with Form RCT-121A?

A: No, you do not need to include supporting documents with Form RCT-121A. However, you should keep them for your records in case of an audit.

Q: Who can I contact for help with Form RCT-121A?

A: You can contact the Pennsylvania Department of Revenue for assistance with Form RCT-121A.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RCT-121A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.