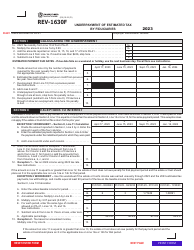

This version of the form is not currently in use and is provided for reference only. Download this version of

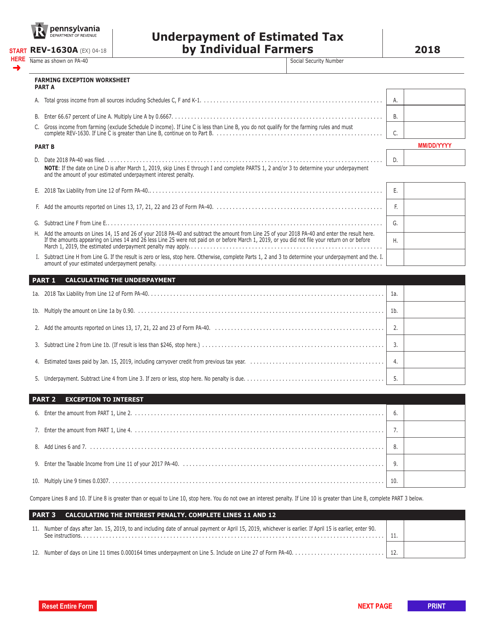

Form REV-1630A

for the current year.

Form REV-1630A Underpayment of Estimated Tax by Individual Farmers - Pennsylvania

What Is Form REV-1630A?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REV-1630A?

A: Form REV-1630A is a tax form for underpayment of estimated tax by individual farmers in Pennsylvania.

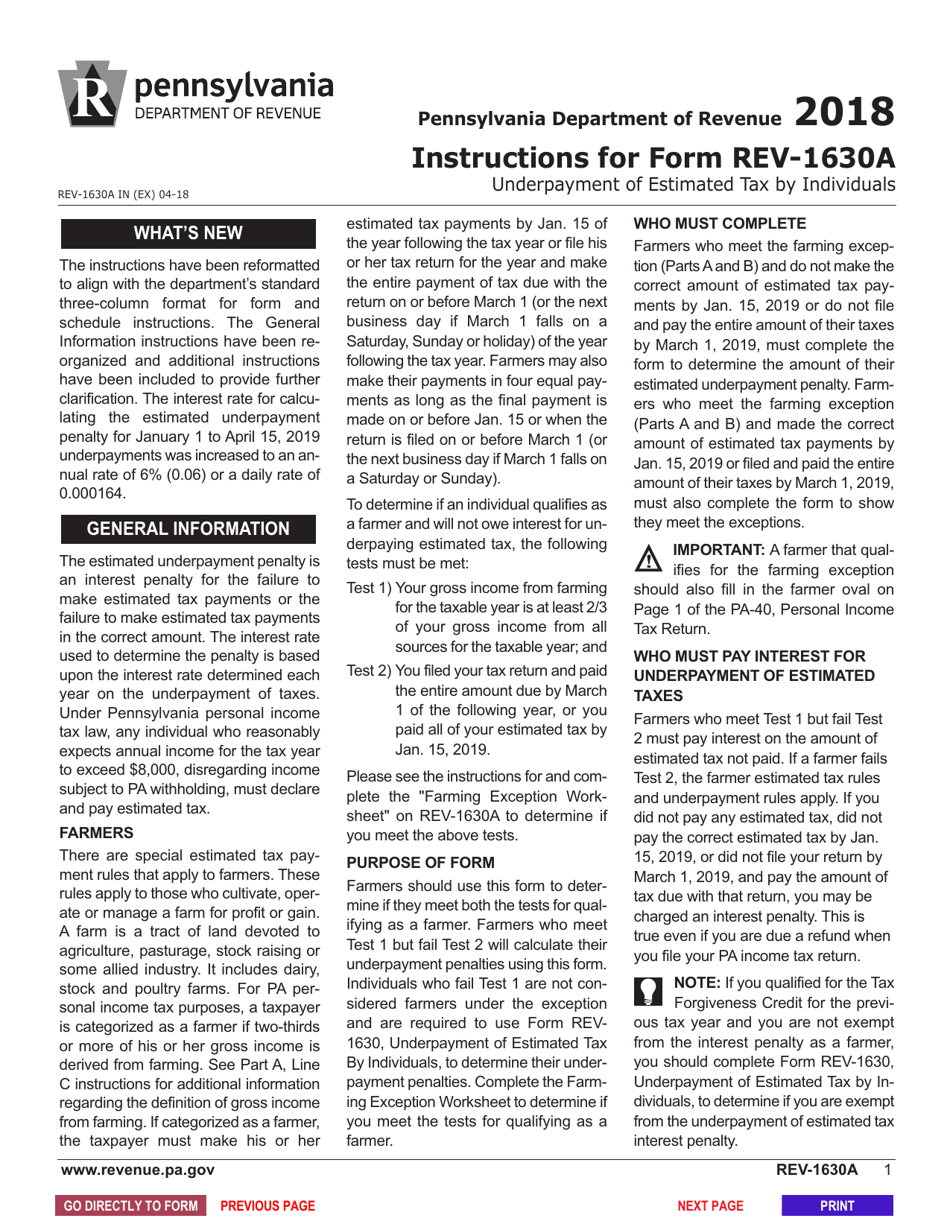

Q: Who needs to file Form REV-1630A?

A: Individual farmers in Pennsylvania who have underpaid their estimated tax must file Form REV-1630A.

Q: What is the purpose of Form REV-1630A?

A: The purpose of Form REV-1630A is to report and calculate the underpayment of estimated tax by individual farmers in Pennsylvania.

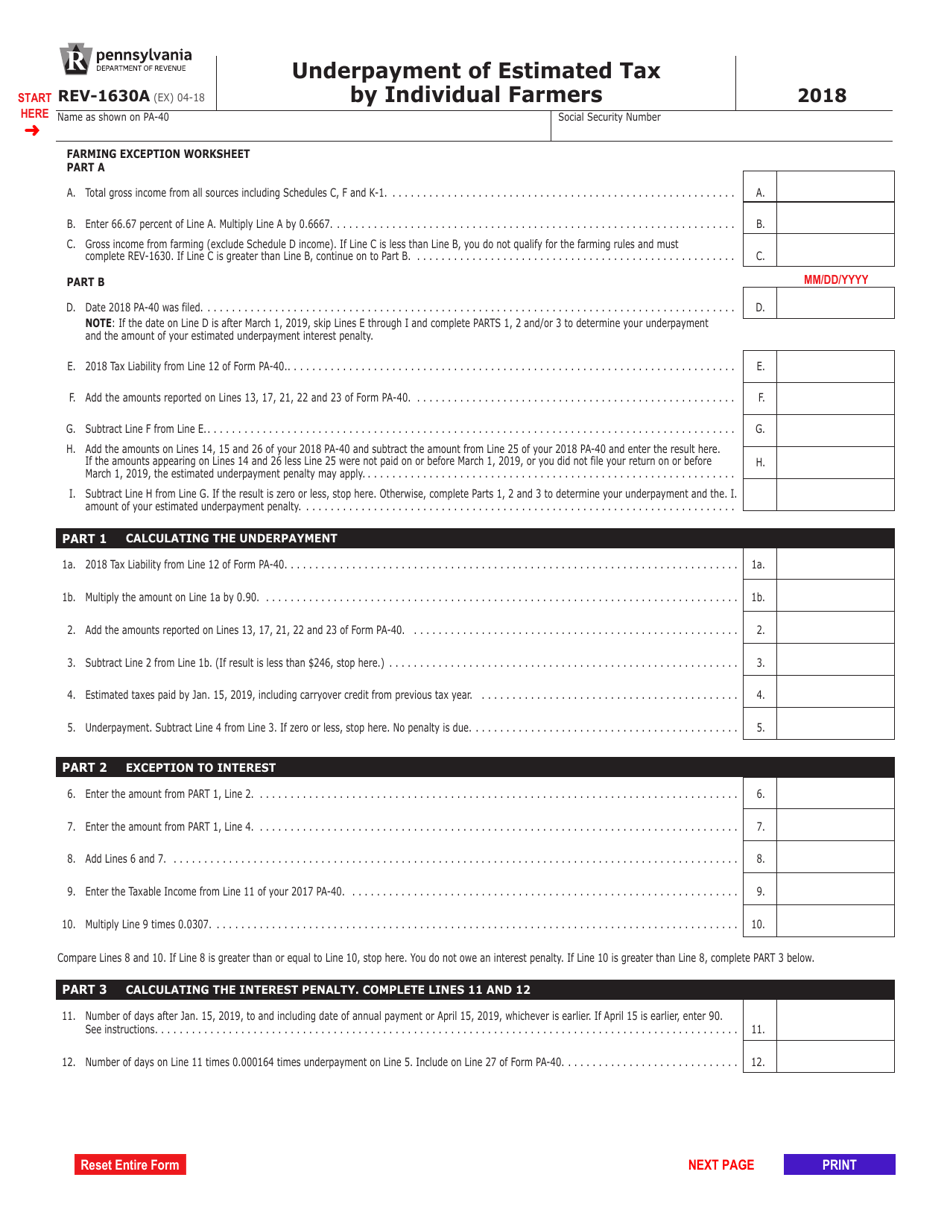

Q: How do I fill out Form REV-1630A?

A: To fill out Form REV-1630A, you need to provide information about your estimated income, tax, and payments made. You must also calculate the underpayment penalty and include it on the form.

Q: When is the deadline to file Form REV-1630A?

A: The deadline to file Form REV-1630A is the same as the deadline for filing your Pennsylvania individual income tax return, which is usually April 15th.

Q: Are there any penalties for late or incomplete filing of Form REV-1630A?

A: Yes, if you file Form REV-1630A late or don't include all the required information, you may be subject to penalties and interest charges.

Q: Can I e-file Form REV-1630A?

A: As of now, Form REV-1630A cannot be e-filed. You must submit a paper copy to the Pennsylvania Department of Revenue.

Q: Can I get an extension to file Form REV-1630A?

A: Yes, you can request an extension to file Form REV-1630A by filing Form REV-276, Application for Extension of Time to File.

Q: Do I need to attach any supporting documents with Form REV-1630A?

A: Yes, you should include any necessary schedules or documentation to support the information provided on Form REV-1630A.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REV-1630A by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.