This version of the form is not currently in use and is provided for reference only. Download this version of

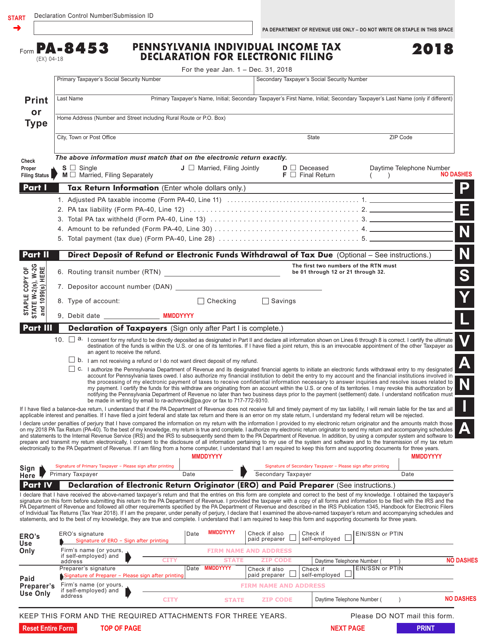

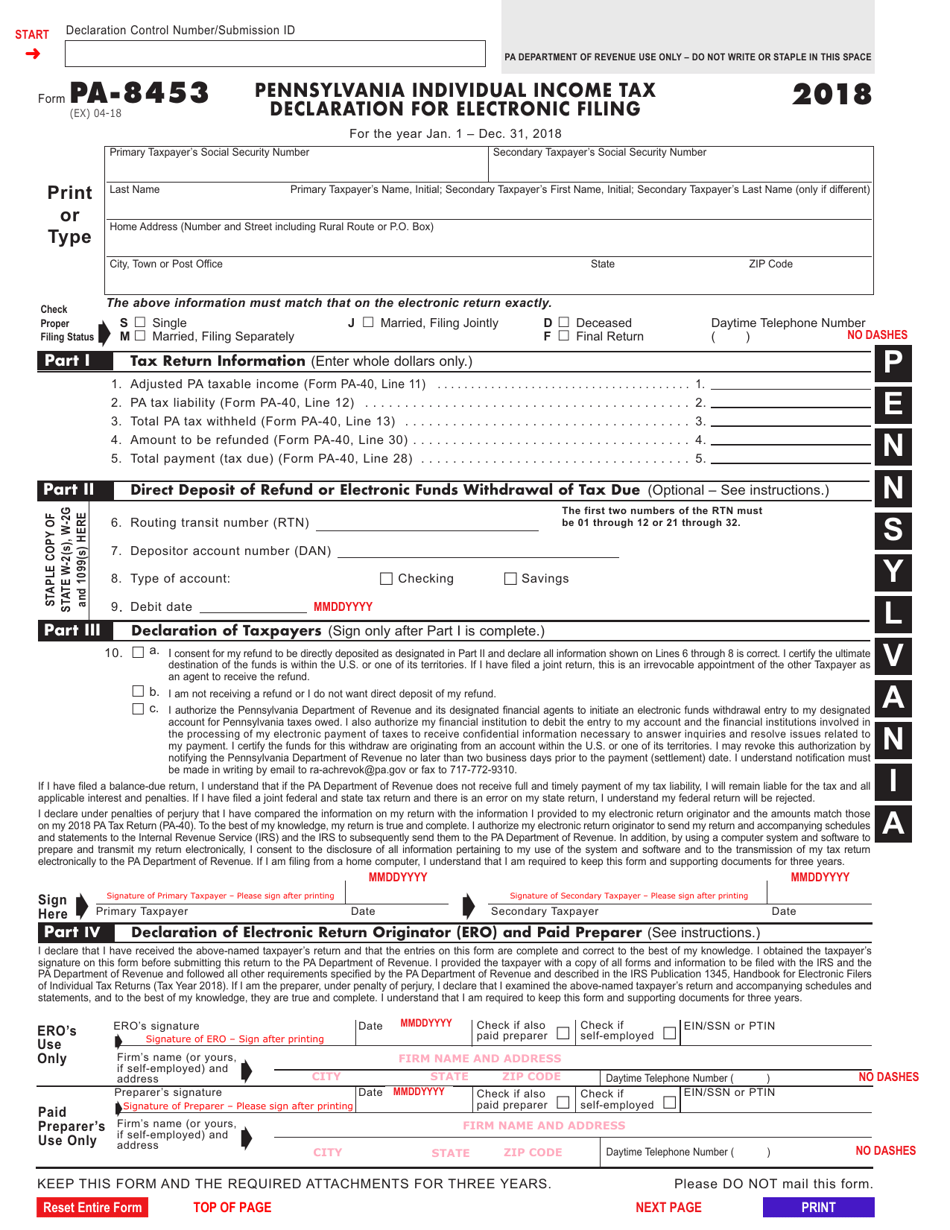

Form PA-8453

for the current year.

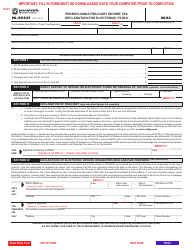

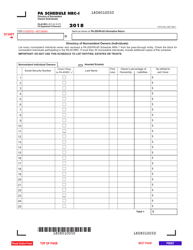

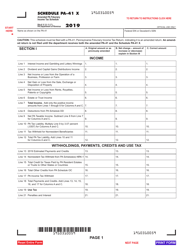

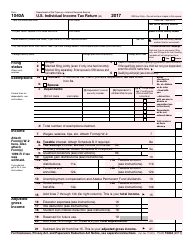

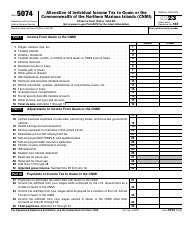

Form PA-8453 Pennsylvania Individual Income Tax Declaration for Electronic Filing - Pennsylvania

What Is Form PA-8453?

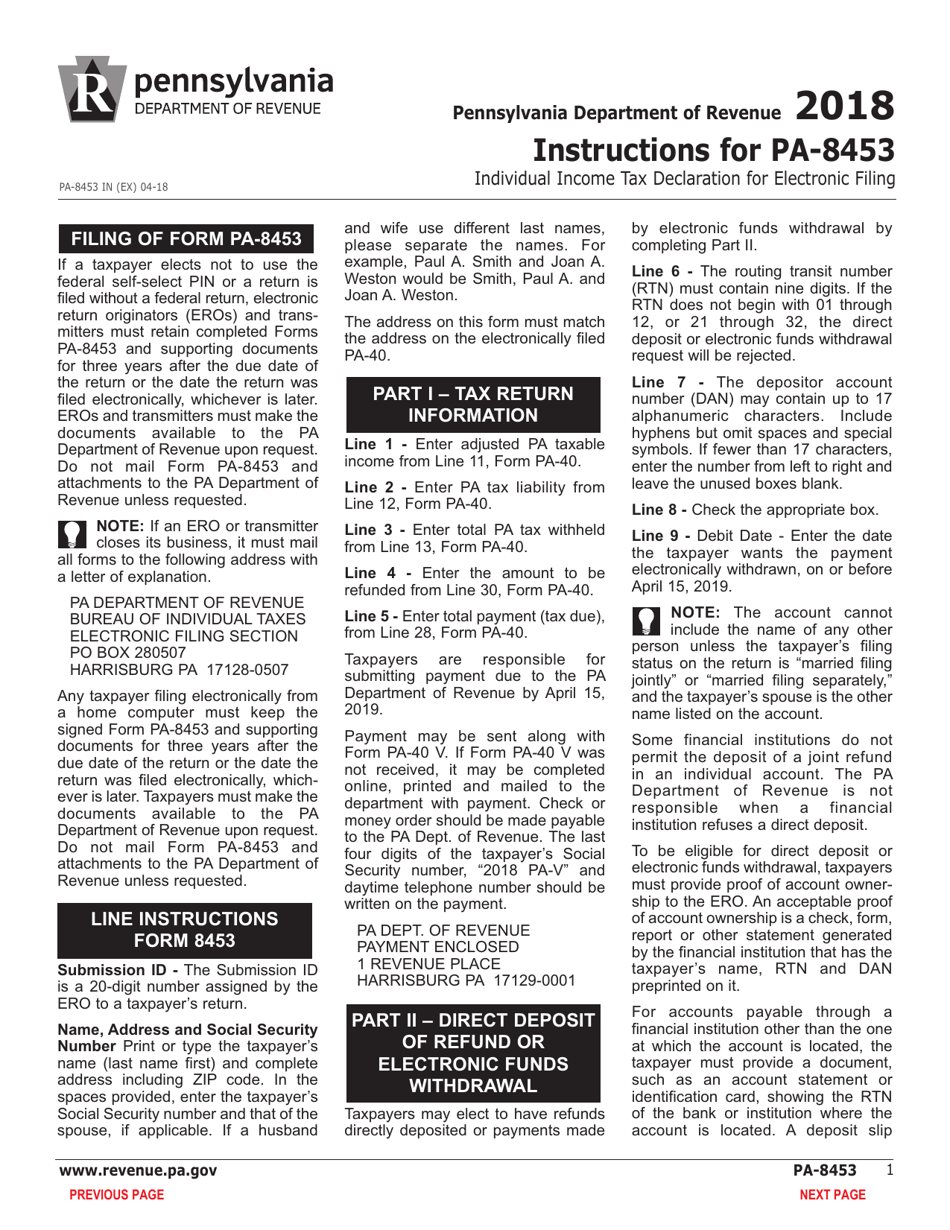

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the PA-8453 form?

A: The PA-8453 form is the Pennsylvania Individual Income Tax Declaration for Electronic Filing.

Q: What is the purpose of the PA-8453 form?

A: The purpose of the PA-8453 form is to declare your Pennsylvania individual income tax for electronic filing.

Q: Who needs to file the PA-8453 form?

A: Anyone who wants to electronically file their Pennsylvania individual income tax needs to file the PA-8453 form.

Q: What information do I need to fill out the PA-8453 form?

A: You will need to provide your personal information, income details, deductions, and any other information required by the form.

Q: When is the deadline for filing the PA-8453 form?

A: The deadline for filing the PA-8453 form is the same as the deadline for filing your Pennsylvania individual income tax return.

Q: Is there a fee for filing the PA-8453 form?

A: There is no fee for filing the PA-8453 form.

Q: Can I file the PA-8453 form if I owe taxes?

A: Yes, you can still file the PA-8453 form even if you owe taxes. However, you will need to pay any taxes owed by the deadline.

Q: What happens after I file the PA-8453 form?

A: After you file the PA-8453 form, the Pennsylvania Department of Revenue will process your information and either issue a refund or send you a notice of any taxes owed.

Q: Is the PA-8453 form the only form I need to file for Pennsylvania income tax?

A: No, the PA-8453 form is used specifically for electronic filing. You may also need to file other forms depending on your individual tax situation.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-8453 by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.