This version of the form is not currently in use and is provided for reference only. Download this version of

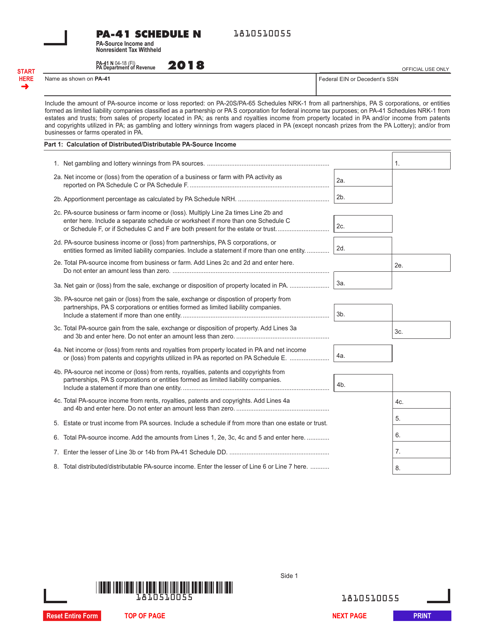

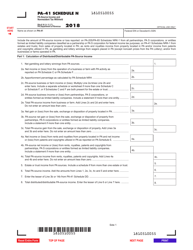

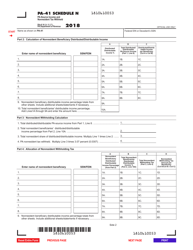

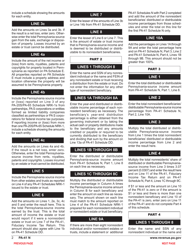

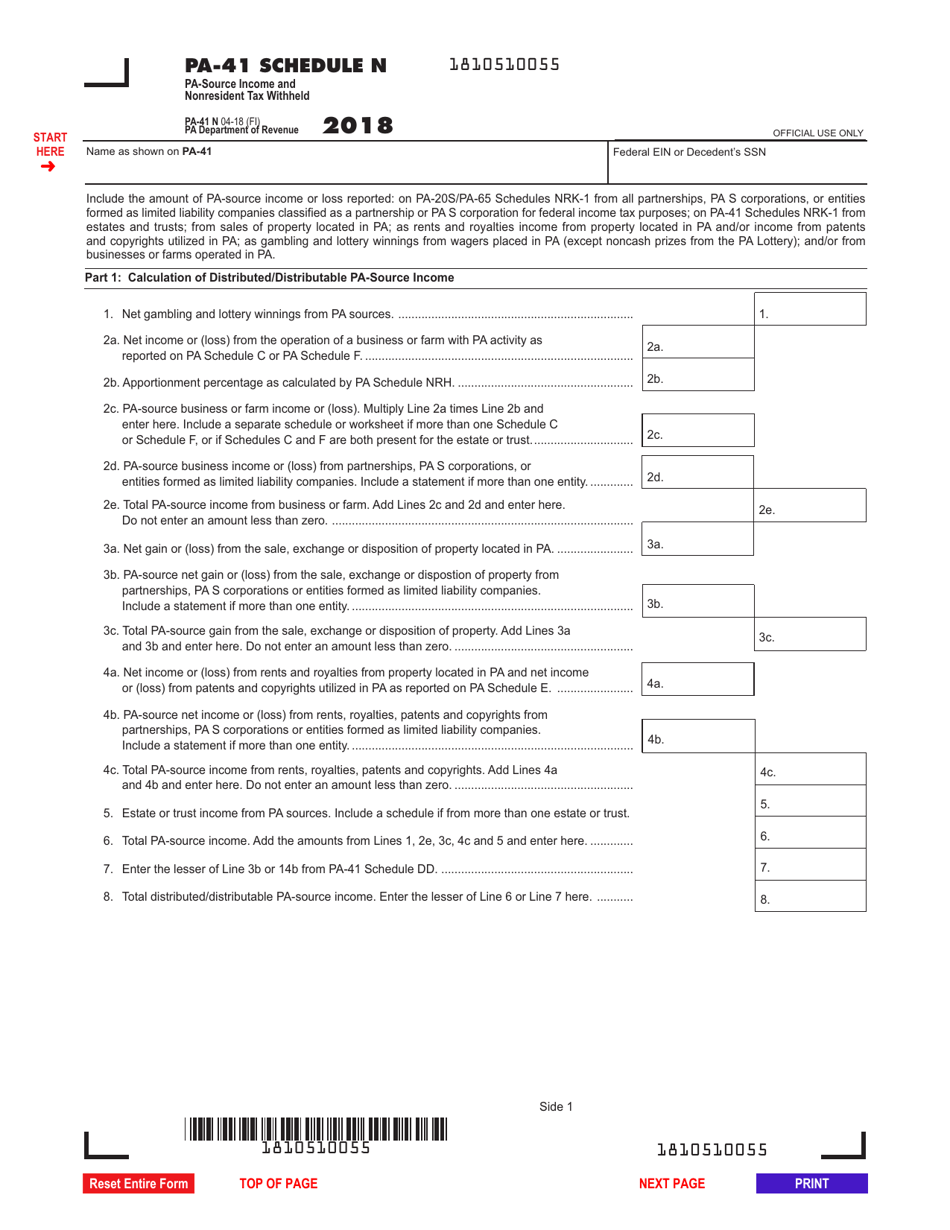

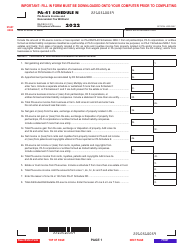

Form PA-41 Schedule N

for the current year.

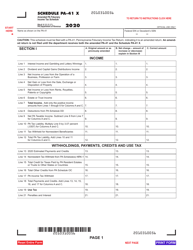

Form PA-41 Schedule N Source Income and Nonresident Tax Withheld - Pennsylvania

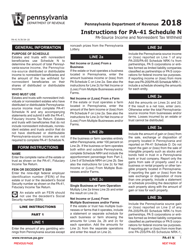

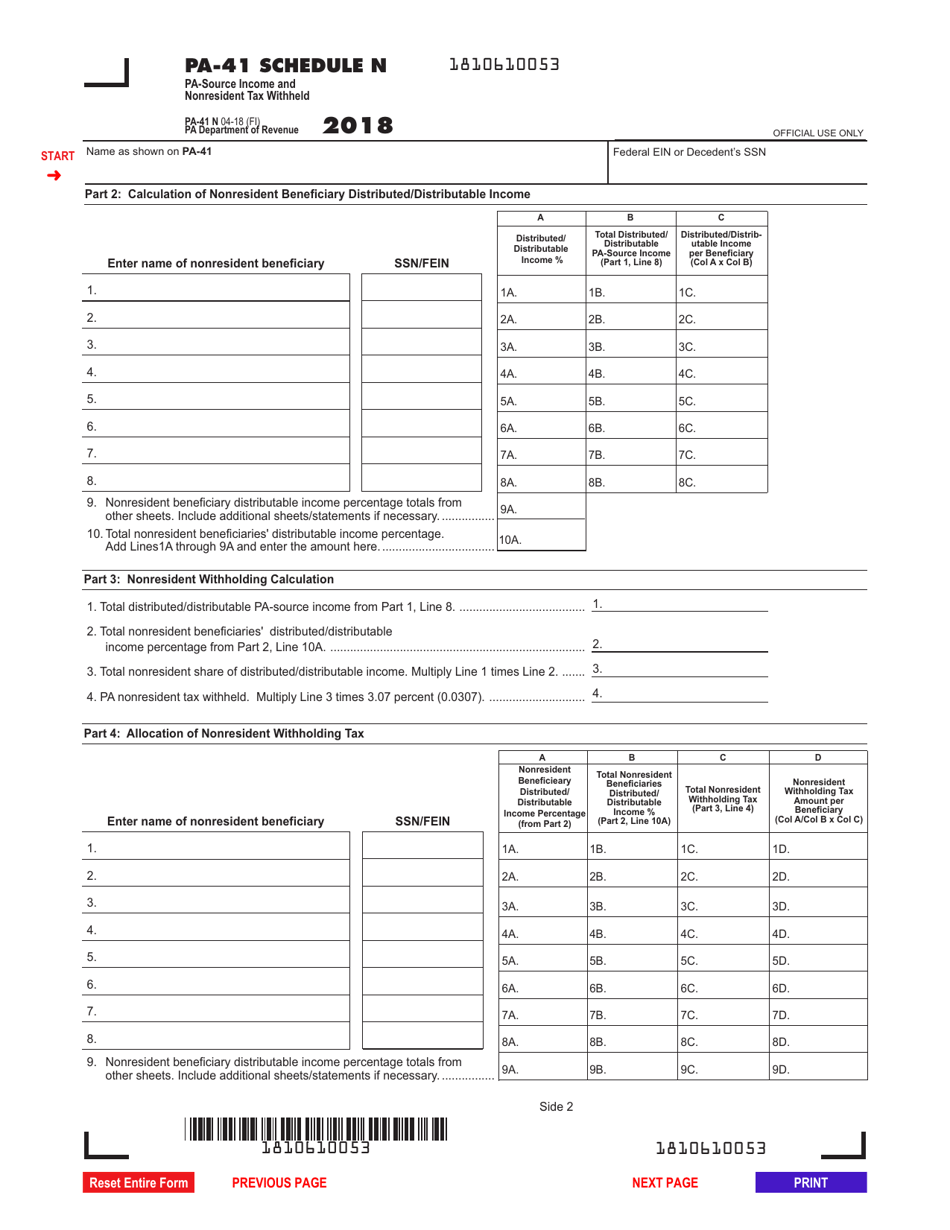

What Is Form PA-41 Schedule N?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule N?

A: Form PA-41 Schedule N is a tax form used by individuals in Pennsylvania to report their source income and nonresident tax withheld.

Q: Who needs to file Form PA-41 Schedule N?

A: Anyone who has source income from Pennsylvania and nonresident tax withheld needs to file Form PA-41 Schedule N.

Q: What is source income?

A: Source income refers to income earned within the state of Pennsylvania.

Q: What is nonresident tax withheld?

A: Nonresident tax withheld is when tax is deducted from your income by a Pennsylvania payer, even if you are not a resident of Pennsylvania.

Q: When is the deadline to file Form PA-41 Schedule N?

A: The deadline to file Form PA-41 Schedule N is usually the same as the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Do I need to file Form PA-41 Schedule N if I am a resident of Pennsylvania?

A: No, you only need to file Form PA-41 Schedule N if you have source income from Pennsylvania and nonresident tax withheld.

Q: What information do I need to complete Form PA-41 Schedule N?

A: You will need information about your source income from Pennsylvania, as well as any nonresident tax withheld.

Q: Can I file Form PA-41 Schedule N electronically?

A: Yes, you can file Form PA-41 Schedule N electronically if you choose to e-file your Pennsylvania state tax return.

Q: What happens if I don't file Form PA-41 Schedule N?

A: If you have source income from Pennsylvania and nonresident tax withheld, it is important to file Form PA-41 Schedule N to accurately report your tax liability. Failure to do so may result in penalties or an audit.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule N by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.