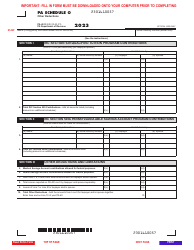

This version of the form is not currently in use and is provided for reference only. Download this version of

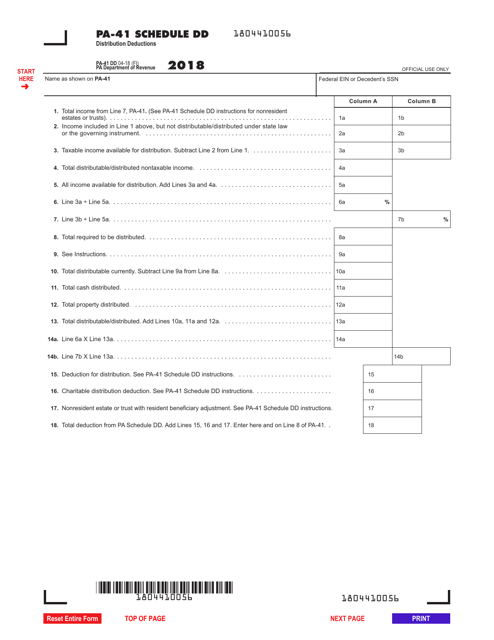

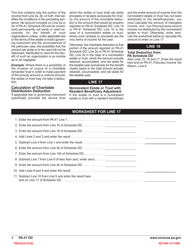

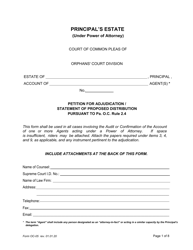

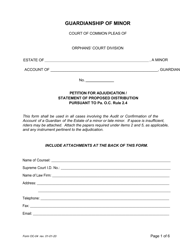

Form PA-41 Schedule DD

for the current year.

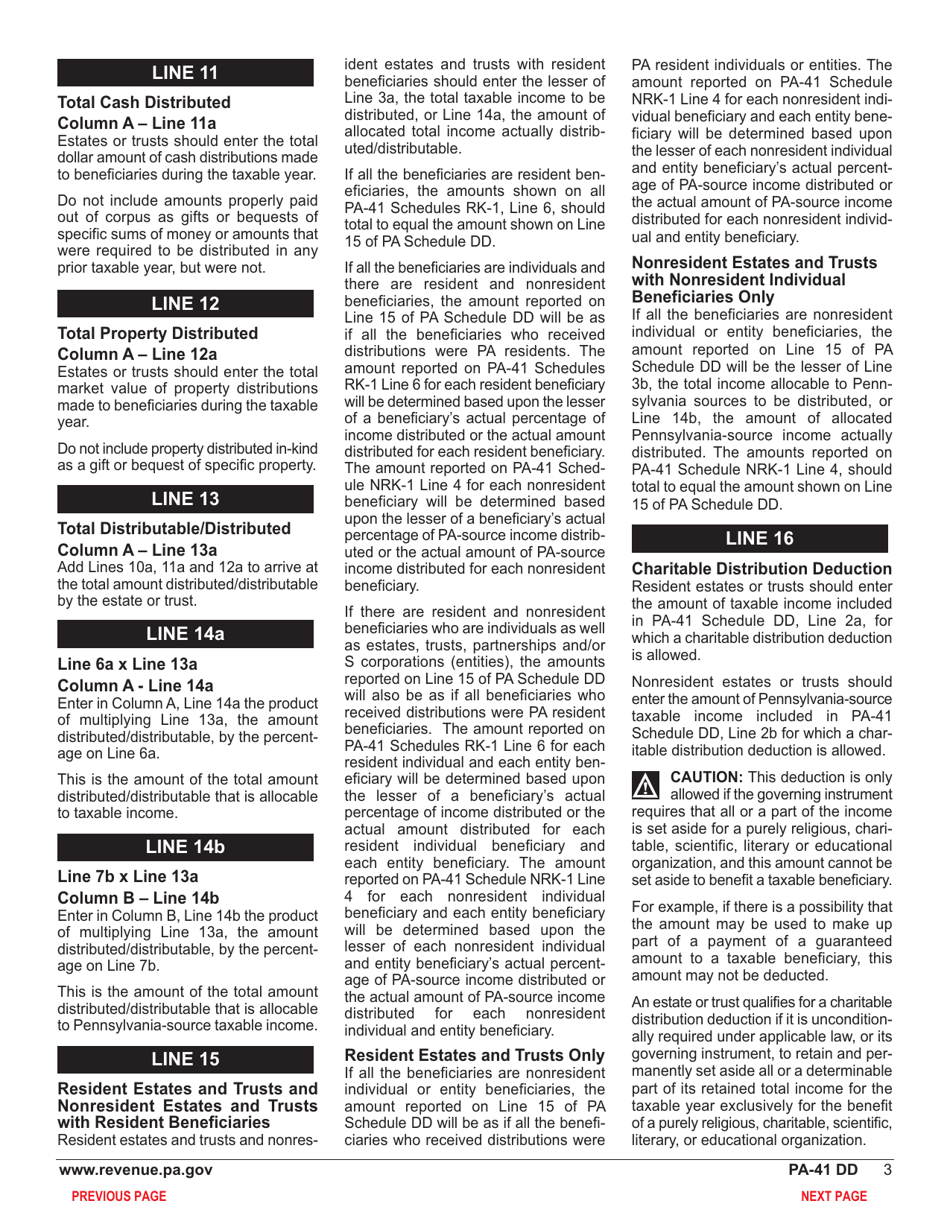

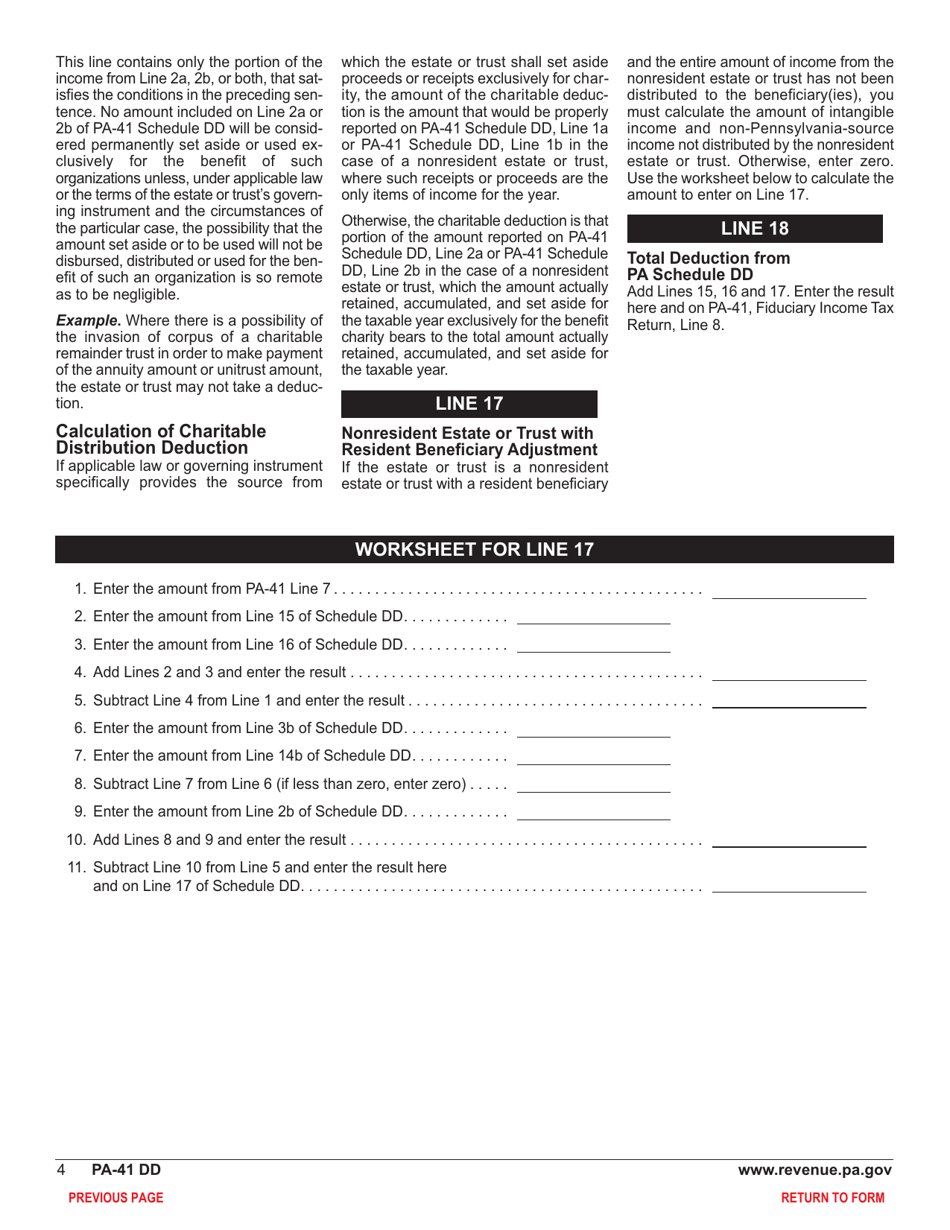

Form PA-41 Schedule DD Distribution Deductions - Pennsylvania

What Is Form PA-41 Schedule DD?

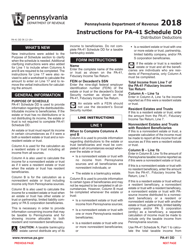

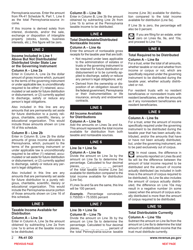

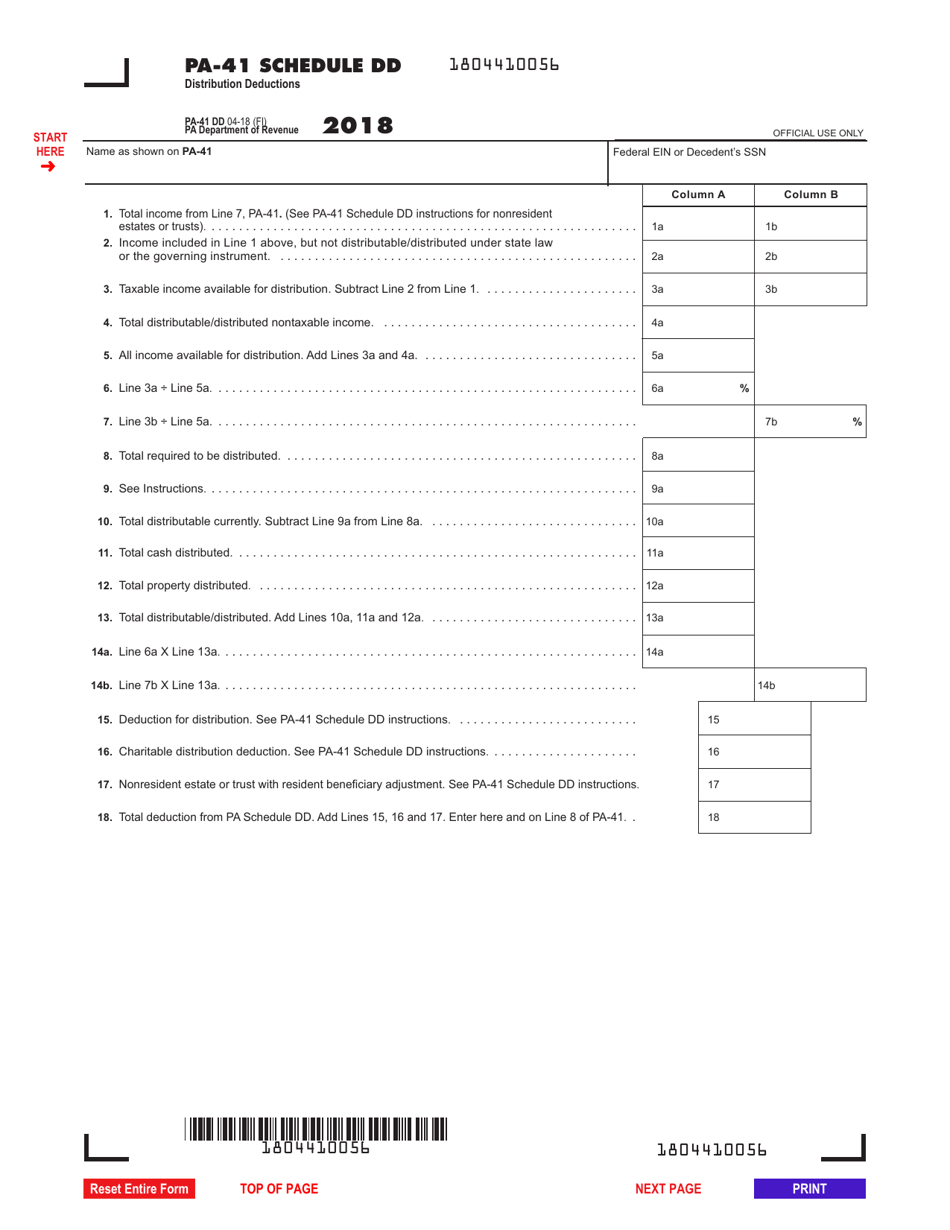

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule DD?

A: Form PA-41 Schedule DD is a tax form used in Pennsylvania to report distribution deductions.

Q: What are distribution deductions?

A: Distribution deductions are deductions that Pennsylvania residents can claim on their state tax returns for certain distributions they receive.

Q: Who needs to file Form PA-41 Schedule DD?

A: Pennsylvania residents who have received qualifying distributions and want to claim distribution deductions on their state tax returns need to file Form PA-41 Schedule DD.

Q: What types of distributions are eligible for deductions?

A: Qualified distributions from pensions, annuities, and certain retirement accounts, such as IRAs, are eligible for deductions.

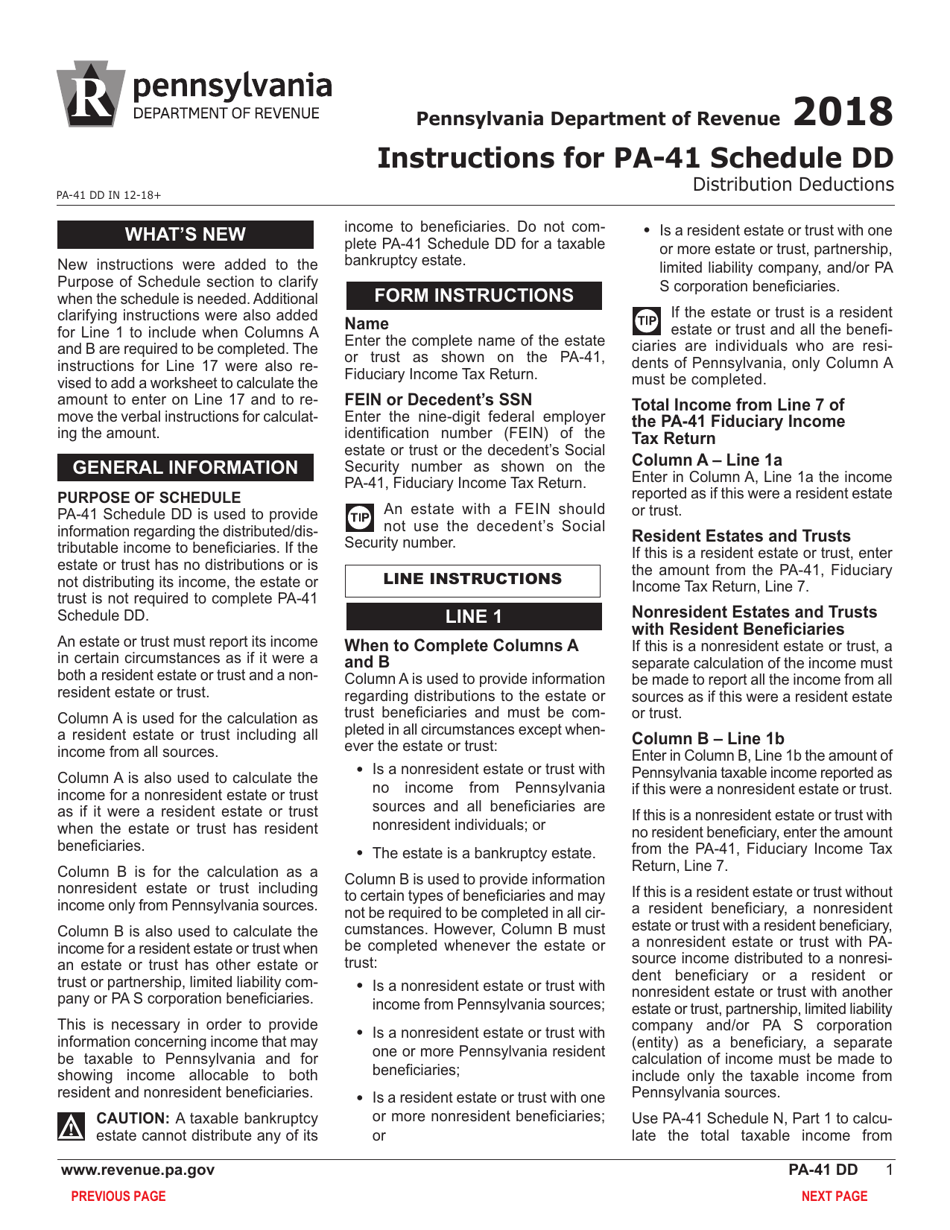

Q: How do I complete Form PA-41 Schedule DD?

A: You need to provide information about the distributions you have received and calculate the amount of deduction you are eligible for. The instructions on the form will guide you through the process.

Q: When is the deadline to file Form PA-41 Schedule DD?

A: The deadline to file Form PA-41 Schedule DD is the same as the deadline for filing your Pennsylvania state tax return, which is usually April 15th.

Q: Can I e-file Form PA-41 Schedule DD?

A: Yes, you can e-file Form PA-41 Schedule DD if you are filing your Pennsylvania state tax return electronically.

Q: Do I need to attach any documents to Form PA-41 Schedule DD?

A: You may need to attach copies of certain documents, such as 1099-R forms, to support your distribution deductions. Refer to the instructions on the form for the specific requirements.

Q: Can I claim distribution deductions on my federal tax return?

A: No, distribution deductions can only be claimed on your Pennsylvania state tax return.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule DD by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.