This version of the form is not currently in use and is provided for reference only. Download this version of

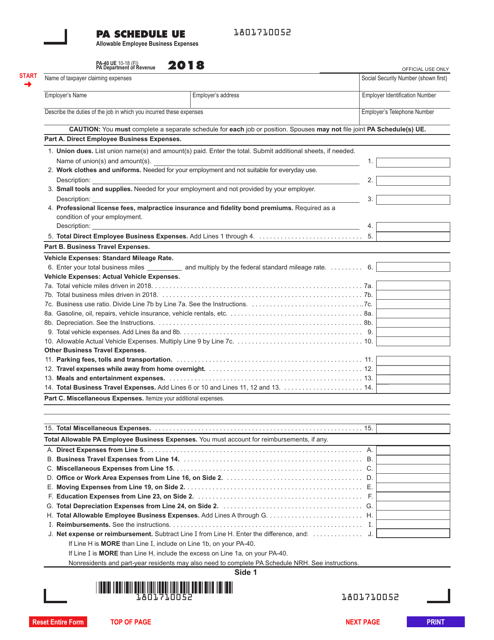

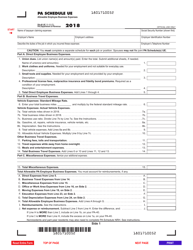

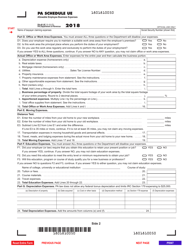

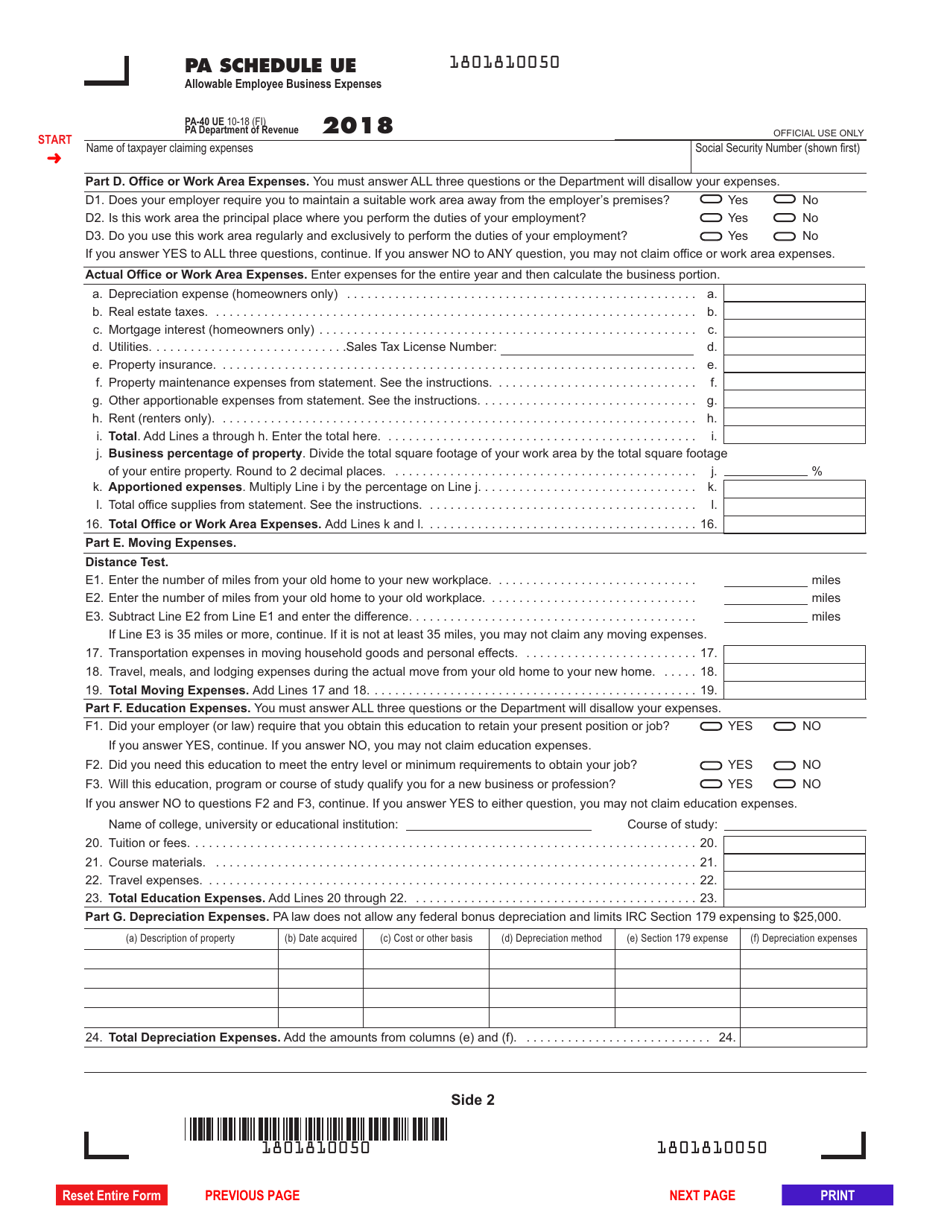

Form PA-40 Schedule UE

for the current year.

Form PA-40 Schedule UE Allowable Employee Business Expenses - Pennsylvania

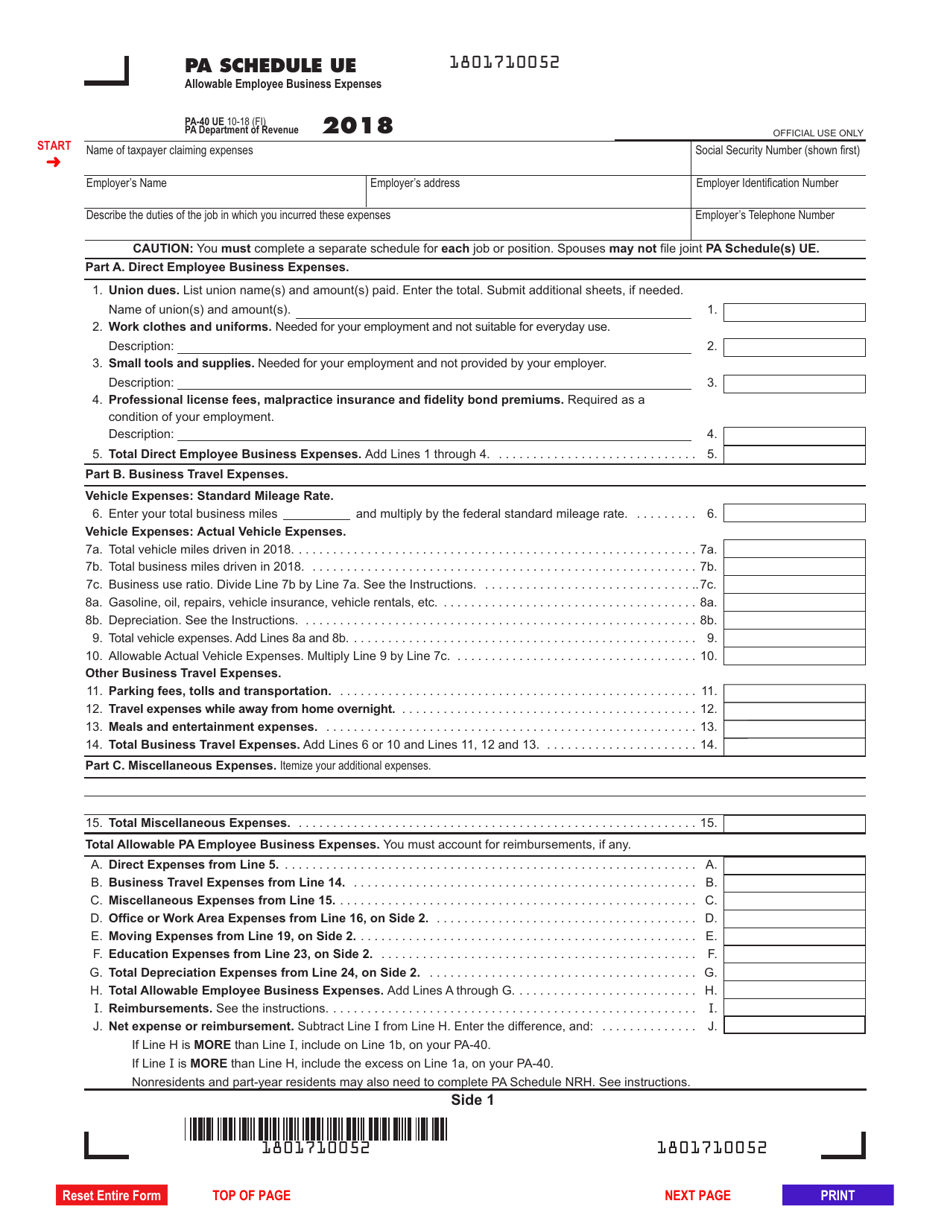

What Is Form PA-40 Schedule UE?

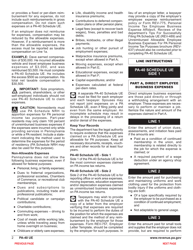

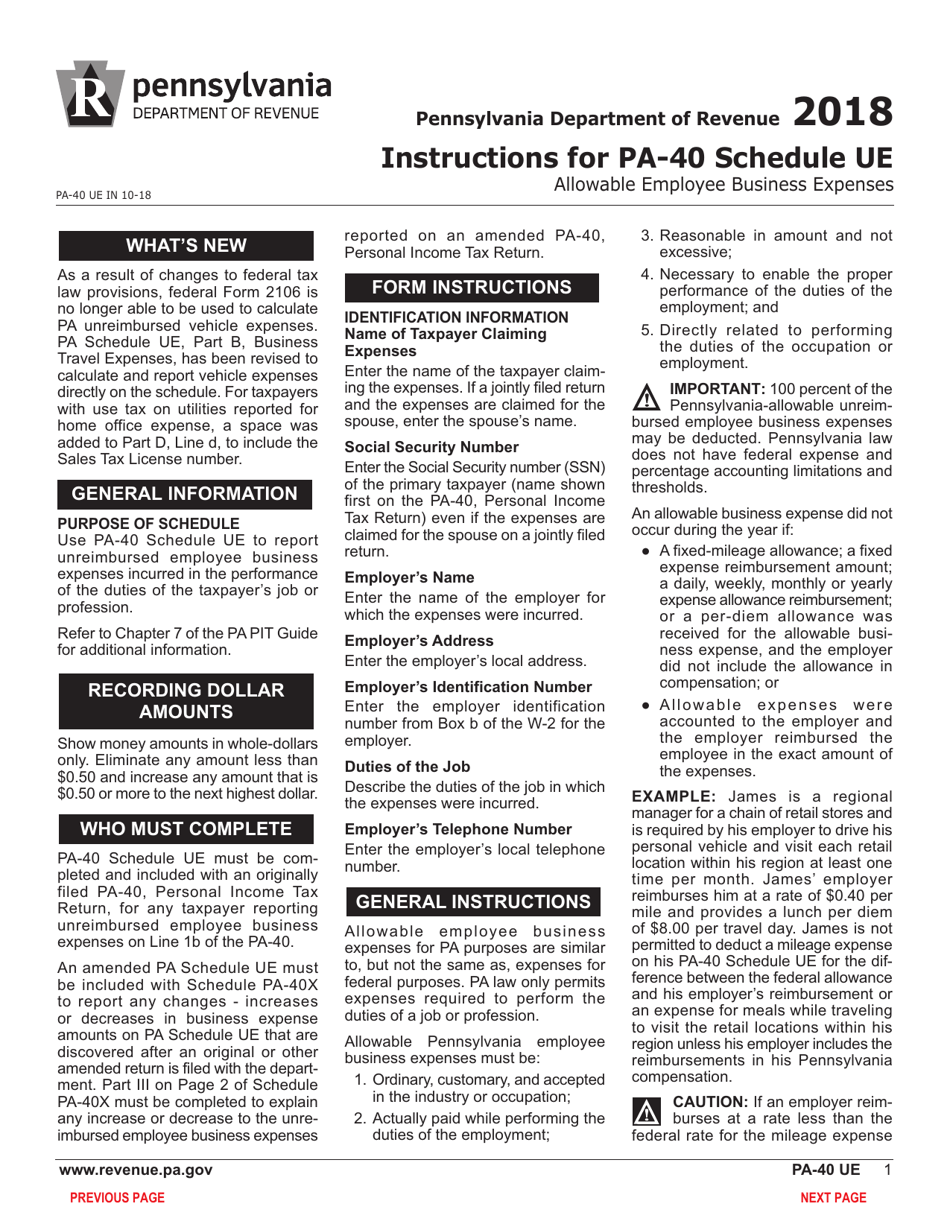

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is PA-40 Schedule UE?

A: PA-40 Schedule UE is a tax form used by residents of Pennsylvania to report their allowable employee business expenses.

Q: What are allowable employee business expenses?

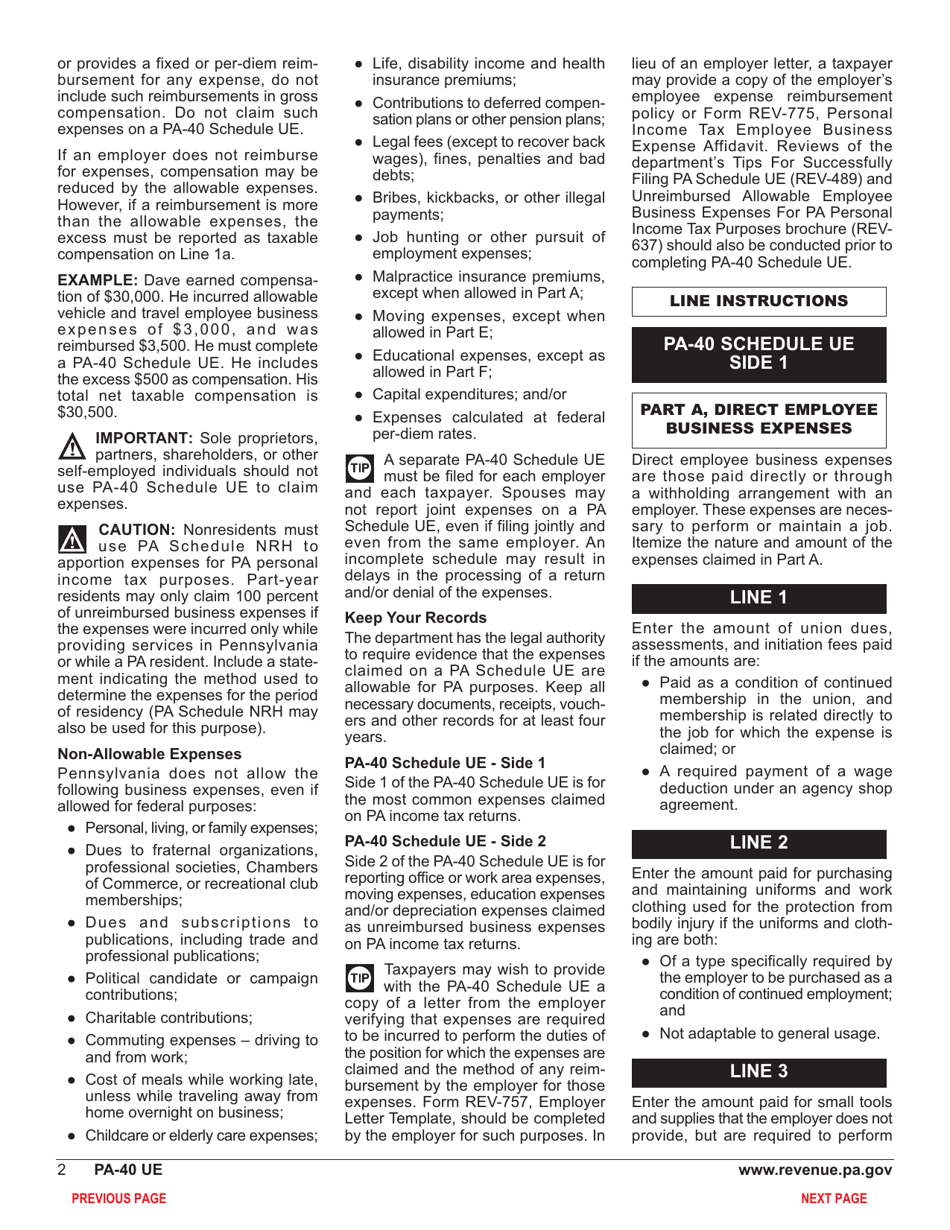

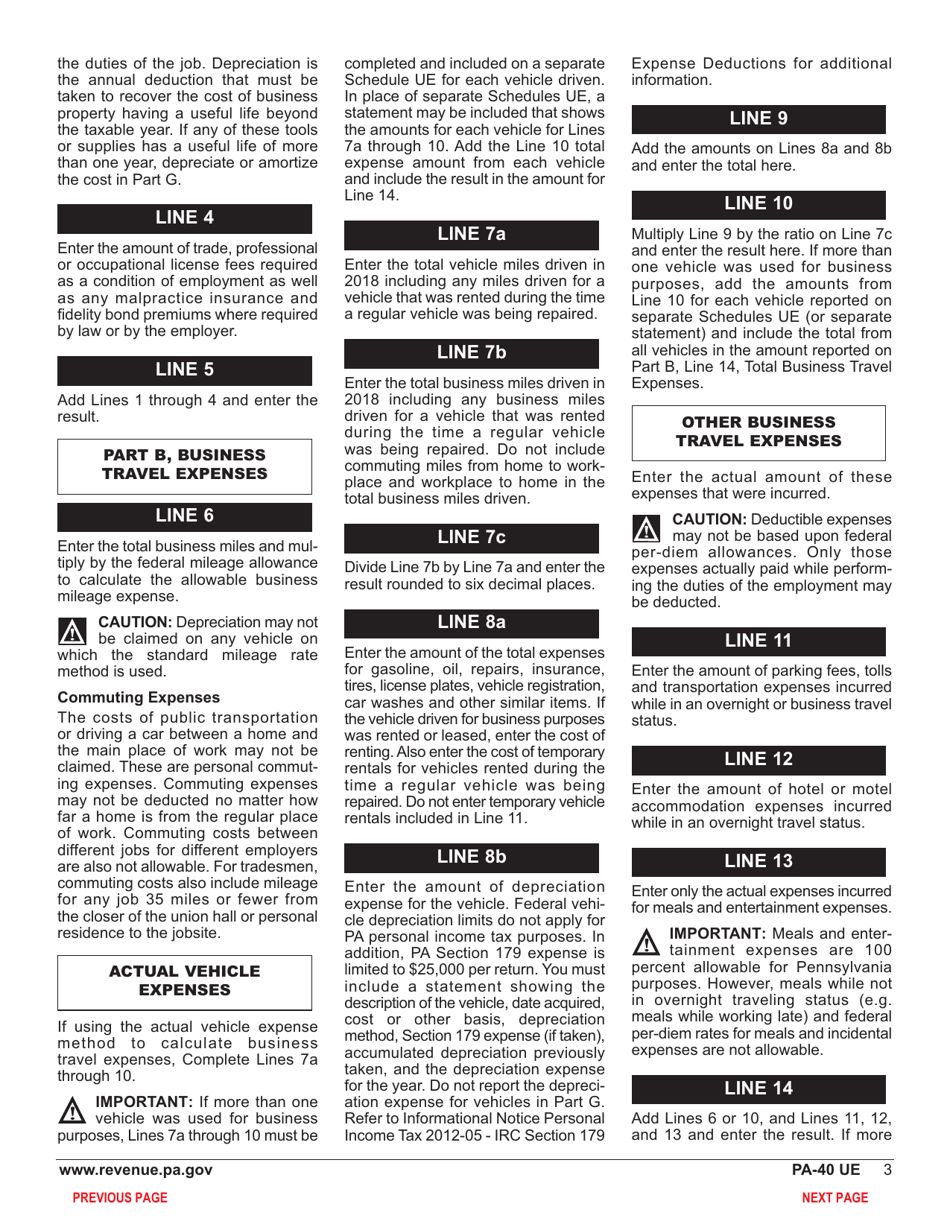

A: Allowable employee business expenses are expenses incurred by employees while performing their job that are eligible for tax deductions.

Q: Who needs to file PA-40 Schedule UE?

A: Residents of Pennsylvania who have incurred allowable employee business expenses need to file PA-40 Schedule UE.

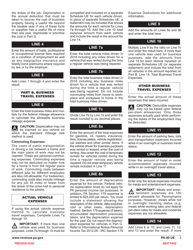

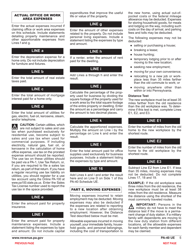

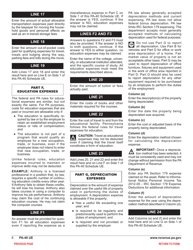

Q: What expenses can be included in PA-40 Schedule UE?

A: Expenses such as travel, meals, entertainment, and home office expenses can be included in PA-40 Schedule UE.

Q: How do I report my allowable employee business expenses?

A: You can report your allowable employee business expenses by filling out the appropriate sections of PA-40 Schedule UE and including it with your Pennsylvania tax return.

Q: Can self-employed individuals use PA-40 Schedule UE?

A: No, PA-40 Schedule UE is specifically for employees to report their allowable business expenses. Self-employed individuals should use other forms, such as Schedule C, to report their expenses.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule UE by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.