This version of the form is not currently in use and is provided for reference only. Download this version of

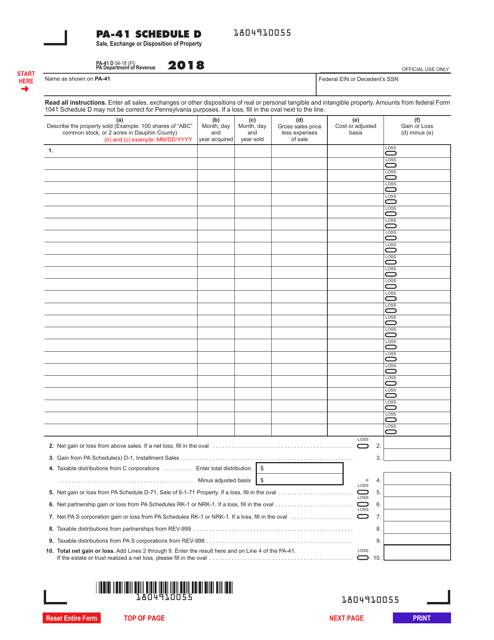

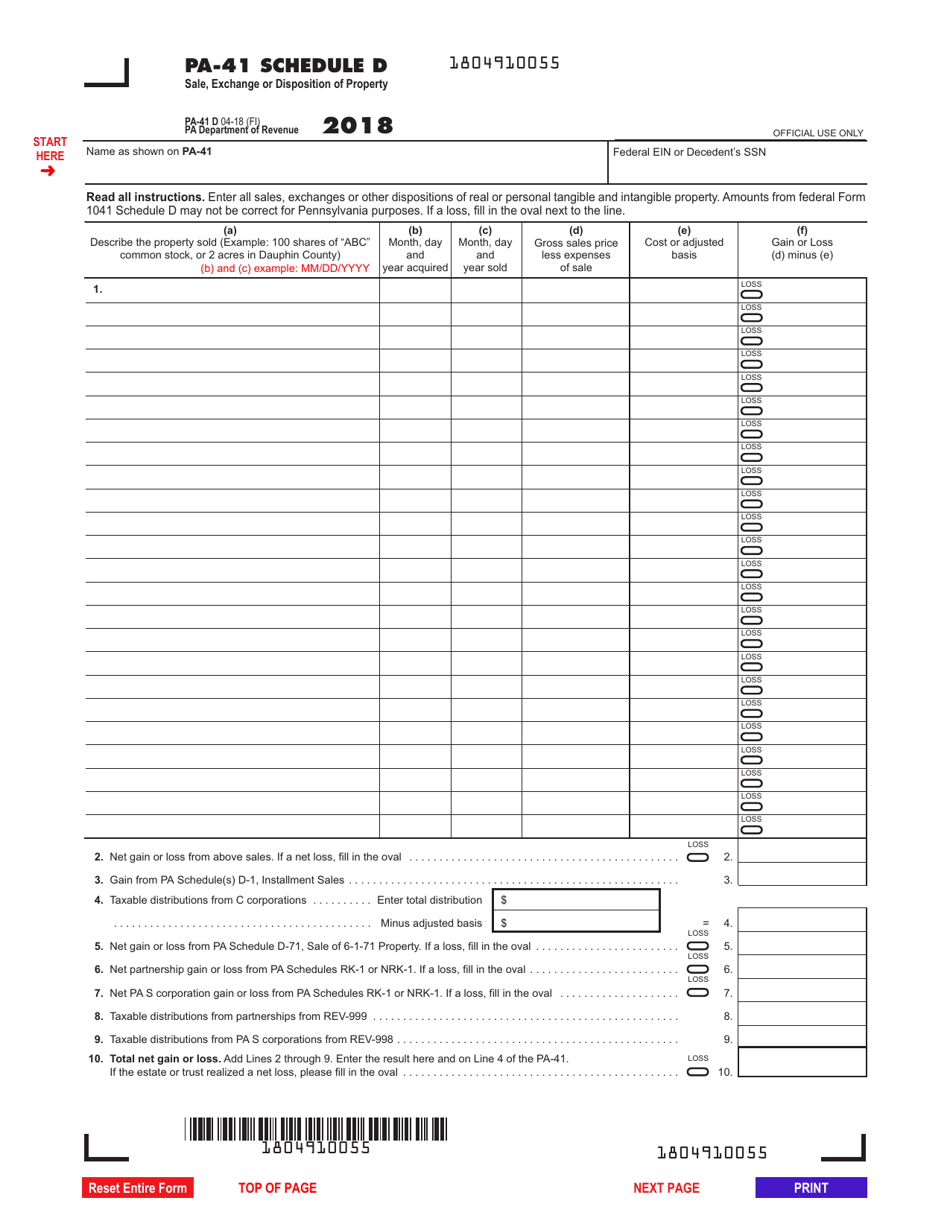

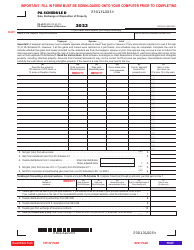

Form PA-41 Schedule D

for the current year.

Form PA-41 Schedule D Sale, Exchange or Disposition of Property - Pennsylvania

What Is Form PA-41 Schedule D?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-41, Pa Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-41 Schedule D?

A: Form PA-41 Schedule D is a tax form used in Pennsylvania to report the sale, exchange, or disposition of property.

Q: Who needs to file Form PA-41 Schedule D?

A: Anyone who has sold, exchanged, or disposed of property in Pennsylvania needs to file Form PA-41 Schedule D.

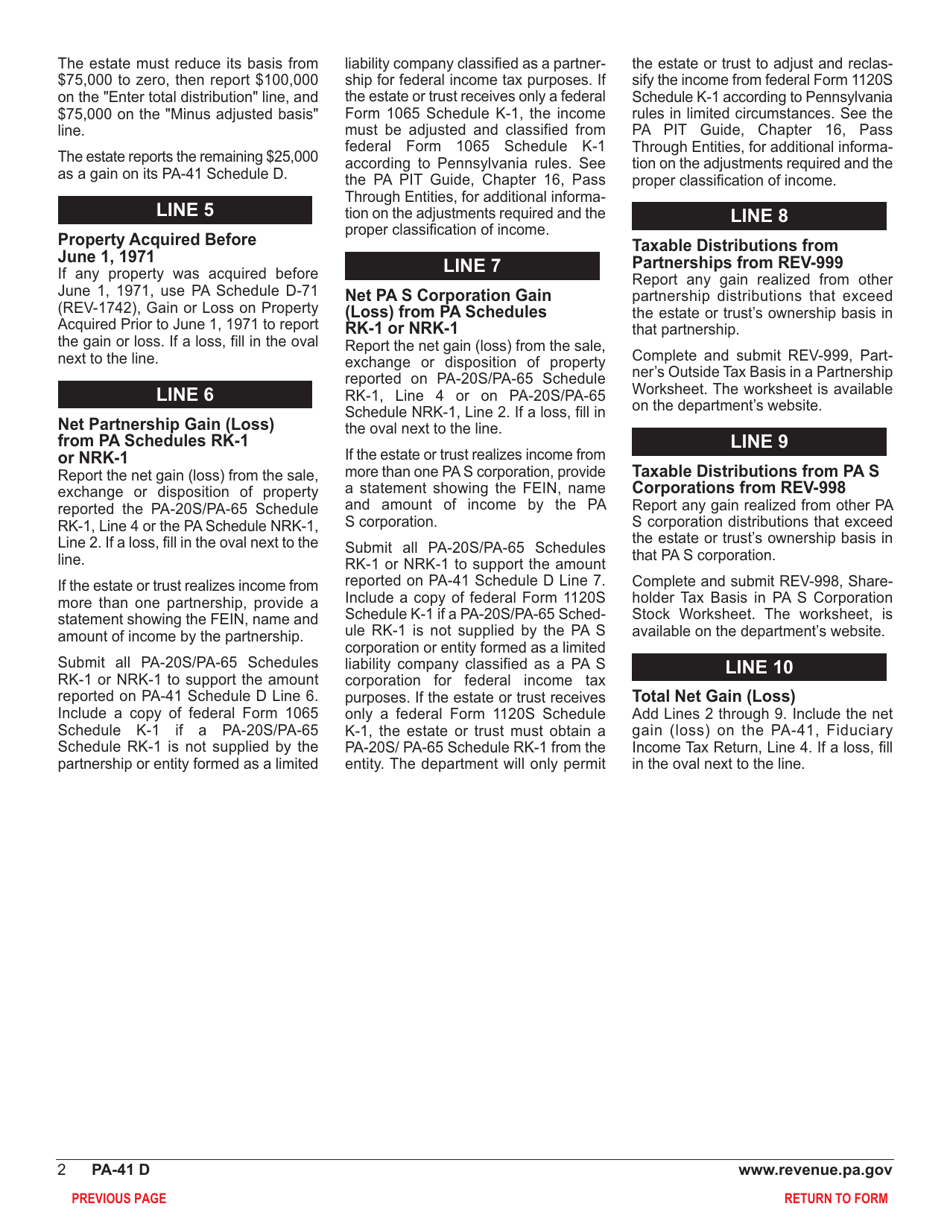

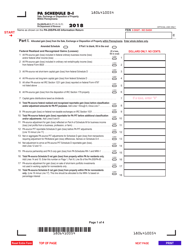

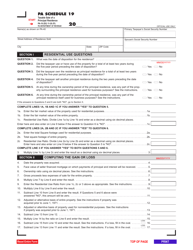

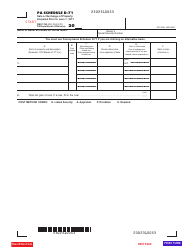

Q: What information is required on Form PA-41 Schedule D?

A: On Form PA-41 Schedule D, you need to provide details about the property, such as the date of sale, sales price, and any expenses or losses incurred.

Q: When is the deadline to file Form PA-41 Schedule D?

A: The deadline to file Form PA-41 Schedule D is the same as the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Are there any penalties for not filing Form PA-41 Schedule D?

A: Yes, there may be penalties for failing to file Form PA-41 Schedule D, including interest and potential additional taxes owed.

Q: Is Form PA-41 Schedule D required for non-residents of Pennsylvania?

A: No, Form PA-41 Schedule D is only required for residents of Pennsylvania who have sold, exchanged, or disposed of property in the state.

Q: Can I file Form PA-41 Schedule D electronically?

A: Yes, you can file Form PA-41 Schedule D electronically through the Pennsylvania Department of Revenue's e-file system.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-41 Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.