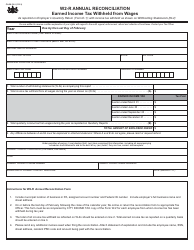

This version of the form is not currently in use and is provided for reference only. Download this version of

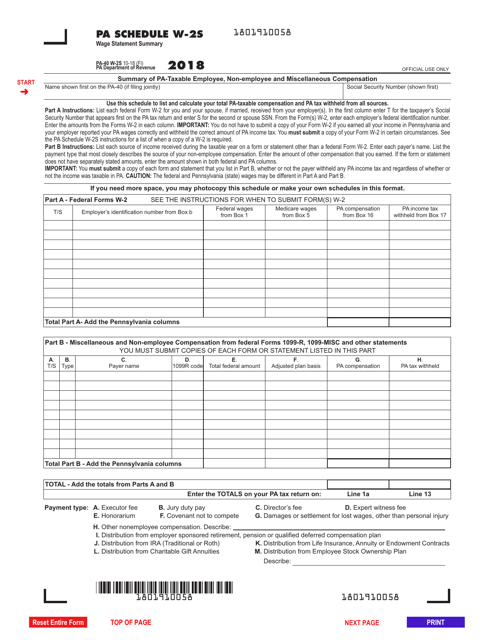

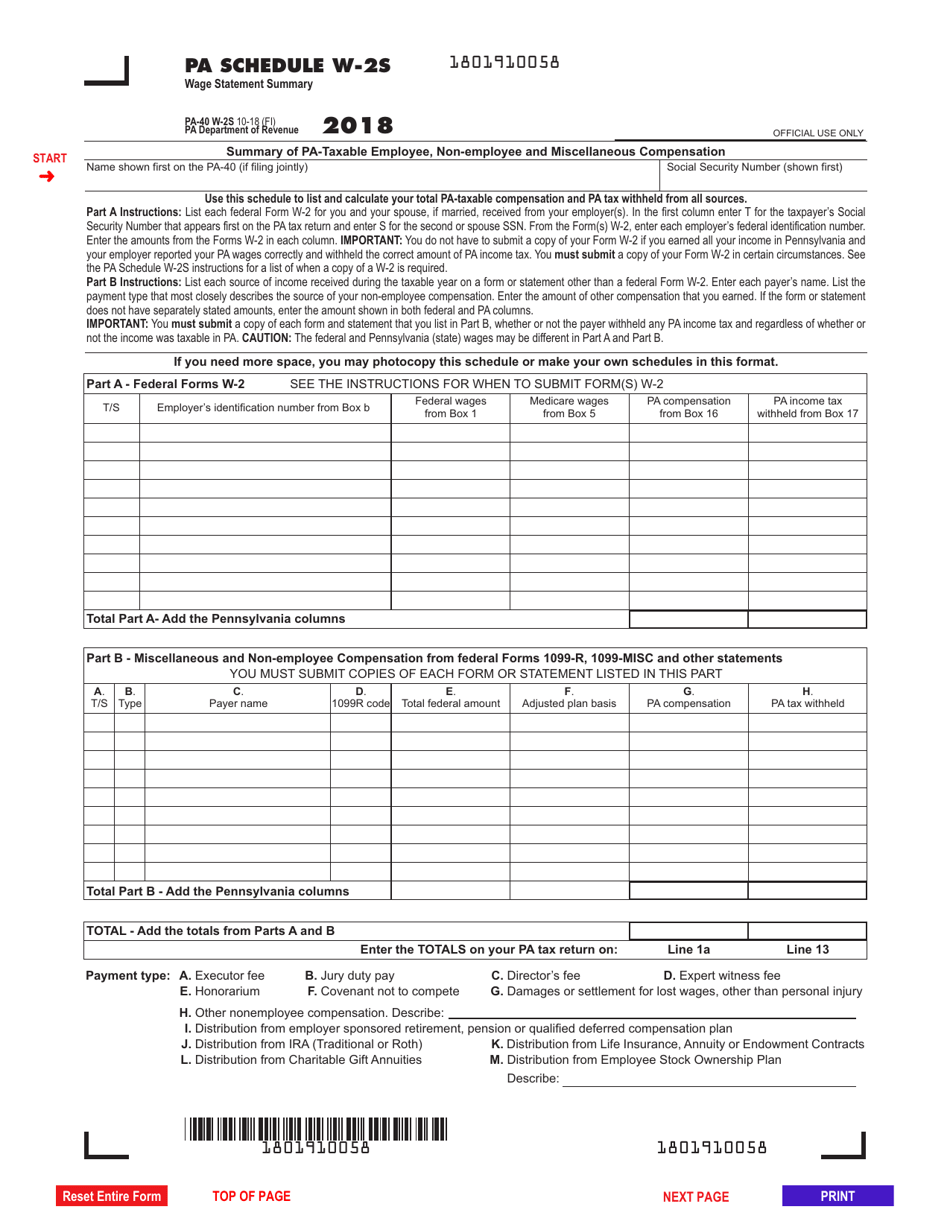

Form PA-40 Schedule W-2S

for the current year.

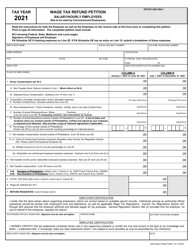

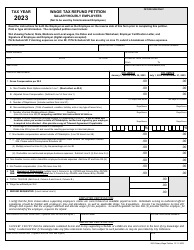

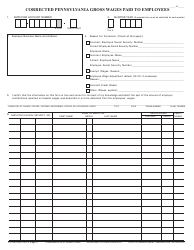

Form PA-40 Schedule W-2S Wage Statement Summary - Pennsylvania

What Is Form PA-40 Schedule W-2S?

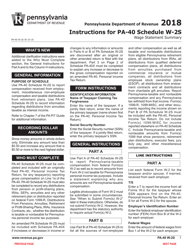

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule W-2S?

A: Form PA-40 Schedule W-2S is a wage statement summary for Pennsylvania.

Q: Who needs to file Form PA-40 Schedule W-2S?

A: Pennsylvania residents who have taxable income from sources outside of Pennsylvania.

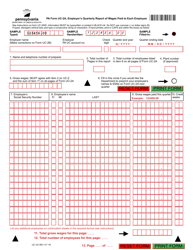

Q: What information is required to complete Form PA-40 Schedule W-2S?

A: You will need to provide your name, social security number, employer information, and details of your out-of-state income.

Q: When is the deadline to file Form PA-40 Schedule W-2S?

A: Form PA-40 Schedule W-2S is due by the same deadline as your Pennsylvania state income tax return, generally April 15th.

Q: Can I e-file Form PA-40 Schedule W-2S?

A: Yes, you can e-file Form PA-40 Schedule W-2S if you are filing your Pennsylvania state income tax return electronically.

Q: Do I need to attach my W-2 forms to Form PA-40 Schedule W-2S?

A: No, you do not need to attach your W-2 forms to Form PA-40 Schedule W-2S, but you should keep them for your records.

Q: Is Form PA-40 Schedule W-2S for residents of Pennsylvania only?

A: Yes, Form PA-40 Schedule W-2S is specifically for Pennsylvania residents.

Q: What happens if I do not file Form PA-40 Schedule W-2S?

A: Failure to file Form PA-40 Schedule W-2S may result in penalties and interest on the unpaid tax.

Q: Can I get an extension to file Form PA-40 Schedule W-2S?

A: Yes, you can request an extension to file Form PA-40 Schedule W-2S, but you must still pay any taxes owed by the original deadline.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule W-2S by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.