This version of the form is not currently in use and is provided for reference only. Download this version of

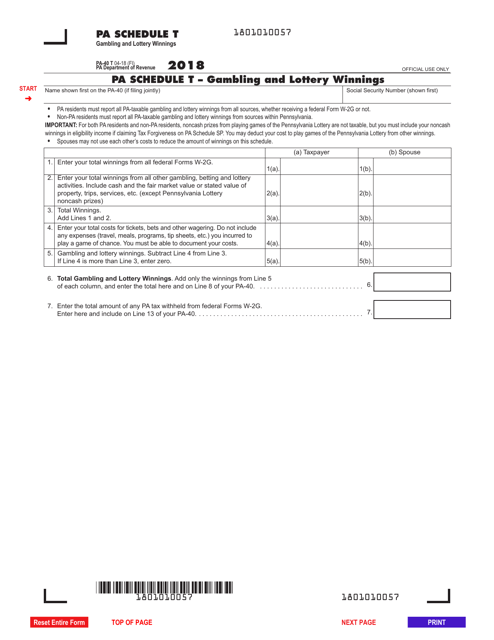

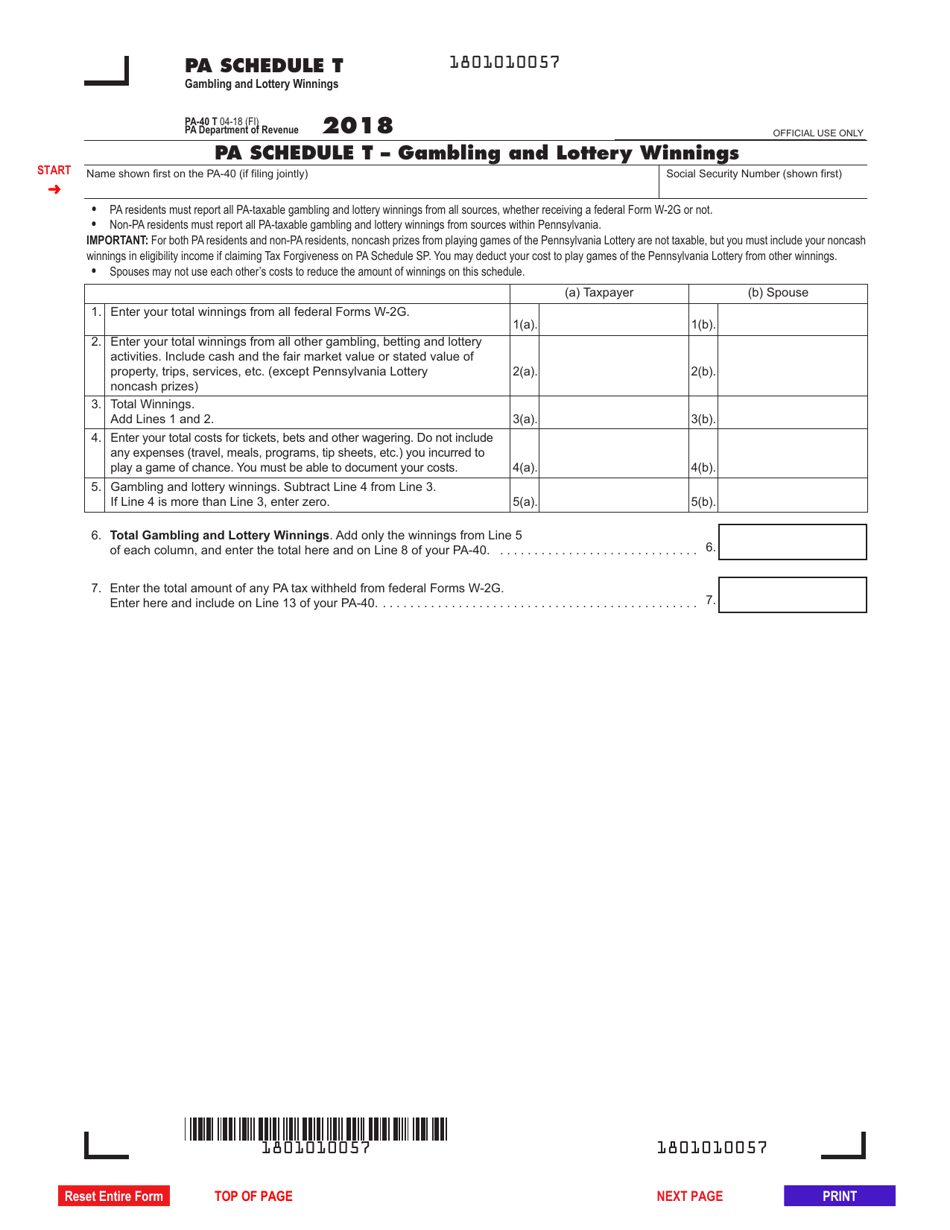

Form PA-40 Schedule T

for the current year.

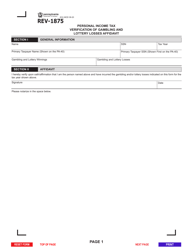

Form PA-40 Schedule T Gambling and Lottery Winnings - Pennsylvania

What Is Form PA-40 Schedule T?

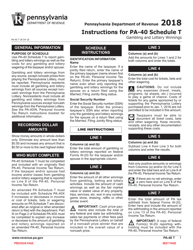

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule T?

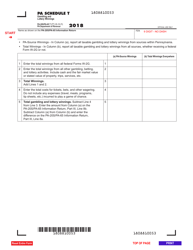

A: Form PA-40 Schedule T is a tax form used by residents of Pennsylvania to report gambling and lottery winnings.

Q: Who needs to file Form PA-40 Schedule T?

A: Residents of Pennsylvania who have gambling and lottery winnings to report need to file Form PA-40 Schedule T.

Q: What kind of winnings should be reported on Form PA-40 Schedule T?

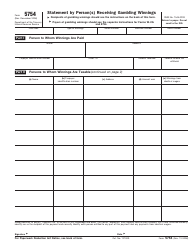

A: Any gambling or lottery winnings that are subject to federal income tax should be reported on Form PA-40 Schedule T.

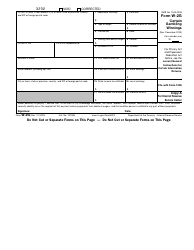

Q: What information is required on Form PA-40 Schedule T?

A: Form PA-40 Schedule T requires the taxpayer to provide information about the gambling and lottery winnings, as well as any losses and expenses related to the winnings.

Q: Is there a deadline for filing Form PA-40 Schedule T?

A: Yes, Form PA-40 Schedule T must be filed by the same deadline as the Pennsylvania state income tax return, which is usually April 15th.

Q: Do I need to include copies of my gambling and lottery tickets with Form PA-40 Schedule T?

A: No, you do not need to include copies of your tickets with Form PA-40 Schedule T. However, you should keep them for your records in case of an audit.

Form Details:

- Released on April 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule T by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.