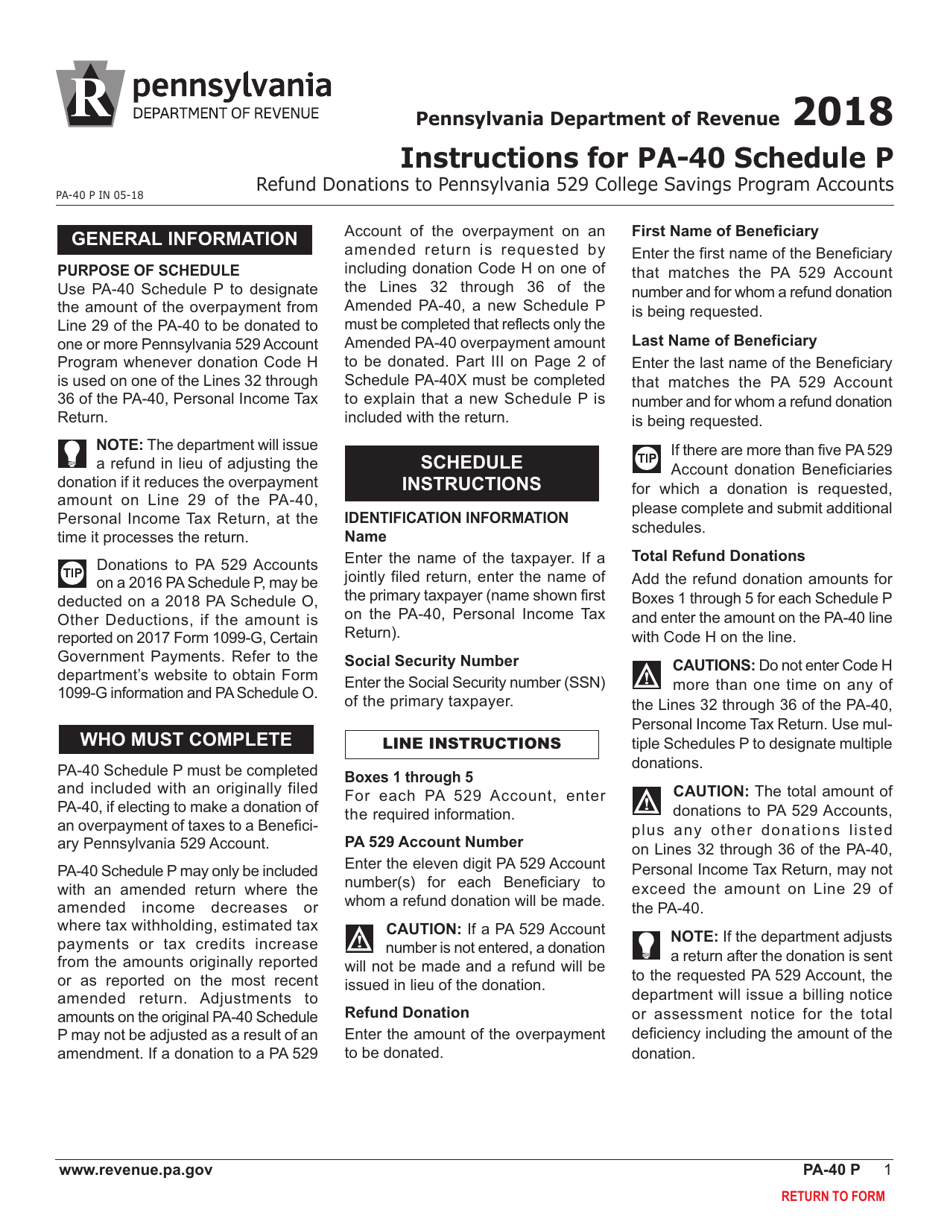

This version of the form is not currently in use and is provided for reference only. Download this version of

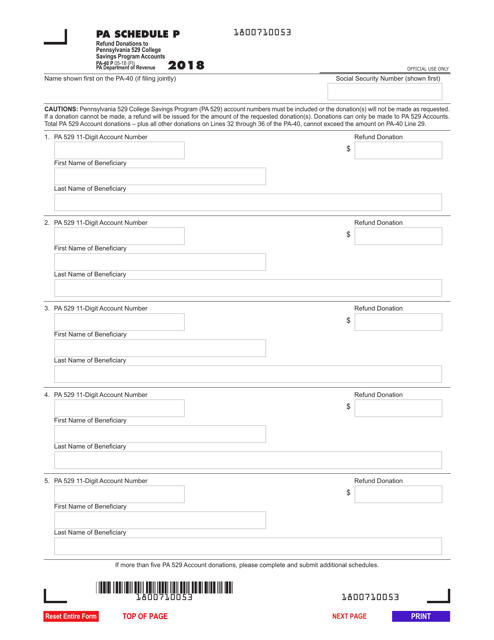

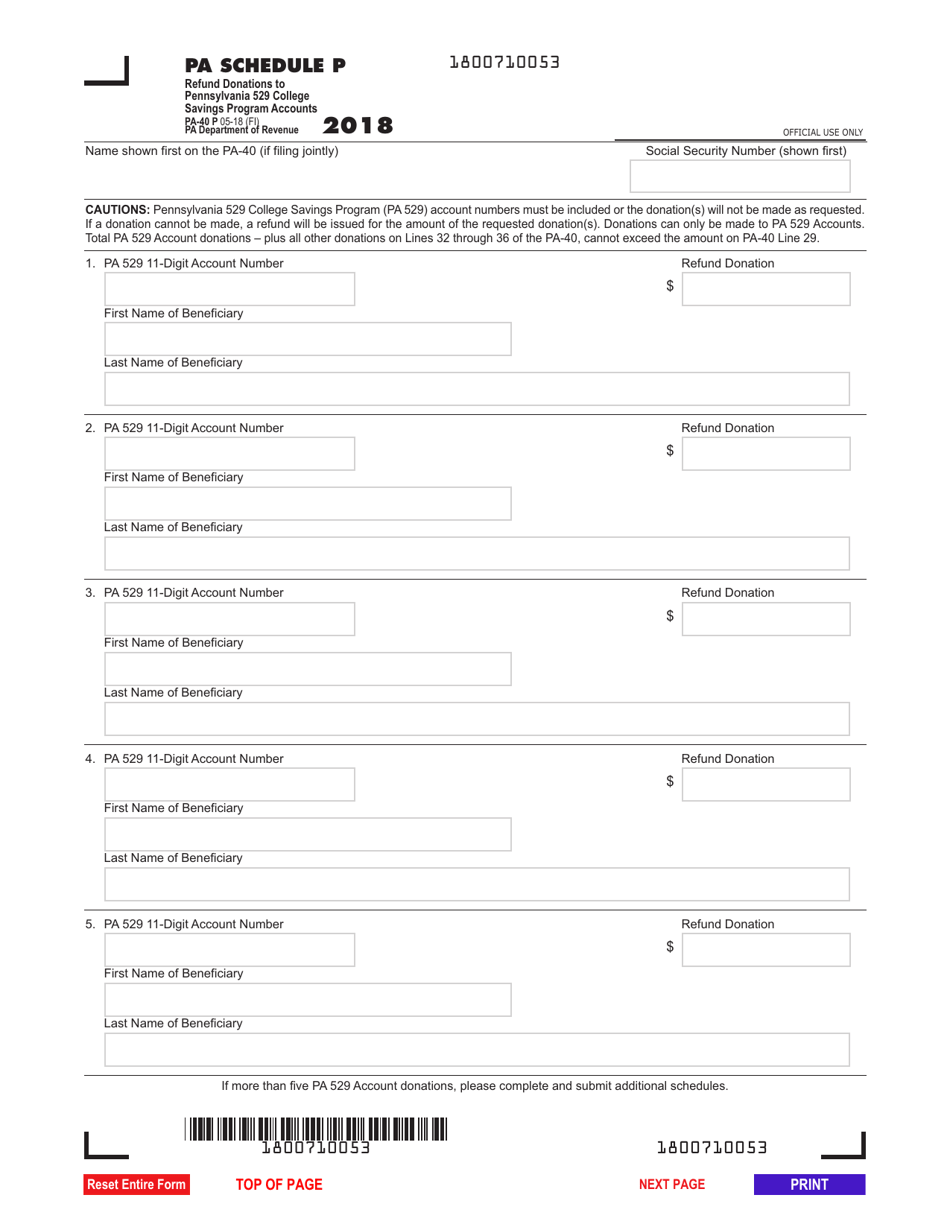

Form PA-40 Schedule P

for the current year.

Form PA-40 Schedule P Refund Donations to Pennsylvania 529 College Savings Program Accounts - Pennsylvania

What Is Form PA-40 Schedule P?

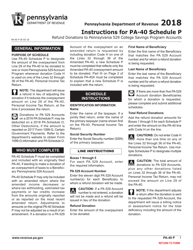

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule P?

A: Form PA-40 Schedule P is a form used by taxpayers in Pennsylvania to report donations to Pennsylvania 529 College Savings Program Accounts.

Q: What are Pennsylvania 529 College Savings Program Accounts?

A: Pennsylvania 529 College Savings Program Accounts are tax-advantaged investment accounts designed to help families save for college expenses.

Q: Why would someone donate to a Pennsylvania 529 College Savings Program Account?

A: People may donate to these accounts to support educational savings goals and potentially benefit from state tax deductions or credits.

Q: What is the purpose of Form PA-40 Schedule P?

A: The purpose of Form PA-40 Schedule P is to report and claim a tax deduction or credit for donations made to Pennsylvania 529 College Savings Program Accounts.

Q: Who should use Form PA-40 Schedule P?

A: Taxpayers who have made donations to Pennsylvania 529 College Savings Program Accounts and want to claim a tax deduction or credit should use this form.

Q: Is there a deadline to submit Form PA-40 Schedule P?

A: Yes, the deadline to submit Form PA-40 Schedule P is the same as the deadline for filing your Pennsylvania state tax return, which is typically April 15th.

Q: Are there any requirements or limitations for claiming a tax deduction or credit for donations to Pennsylvania 529 College Savings Program Accounts?

A: Yes, there may be specific requirements and limitations for claiming a tax deduction or credit, such as income limits and contribution limits. It is recommended to consult the instructions or a tax professional for more information.

Q: Can I claim a tax deduction or credit for donations to other college savings programs?

A: The availability of tax deductions or credits for donations to college savings programs may vary by state. It is best to check the rules and regulations of your specific state's program.

Q: Is there any penalty for not filing Form PA-40 Schedule P?

A: Failure to file Form PA-40 Schedule P when required may result in the loss of any tax deduction or credit that would have been available for the donations made to Pennsylvania 529 College Savings Program Accounts.

Form Details:

- Released on May 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule P by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.