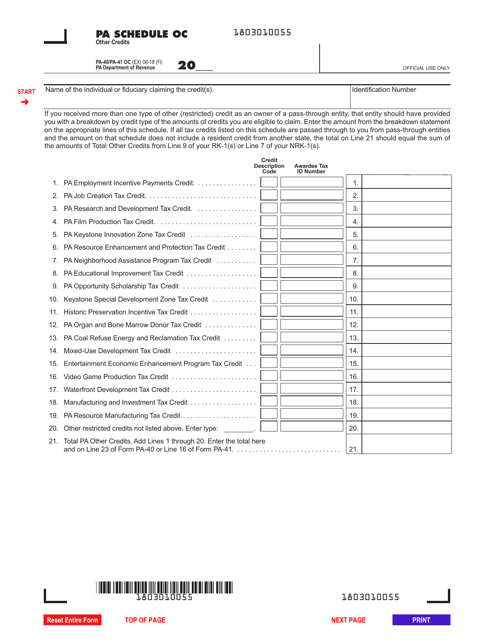

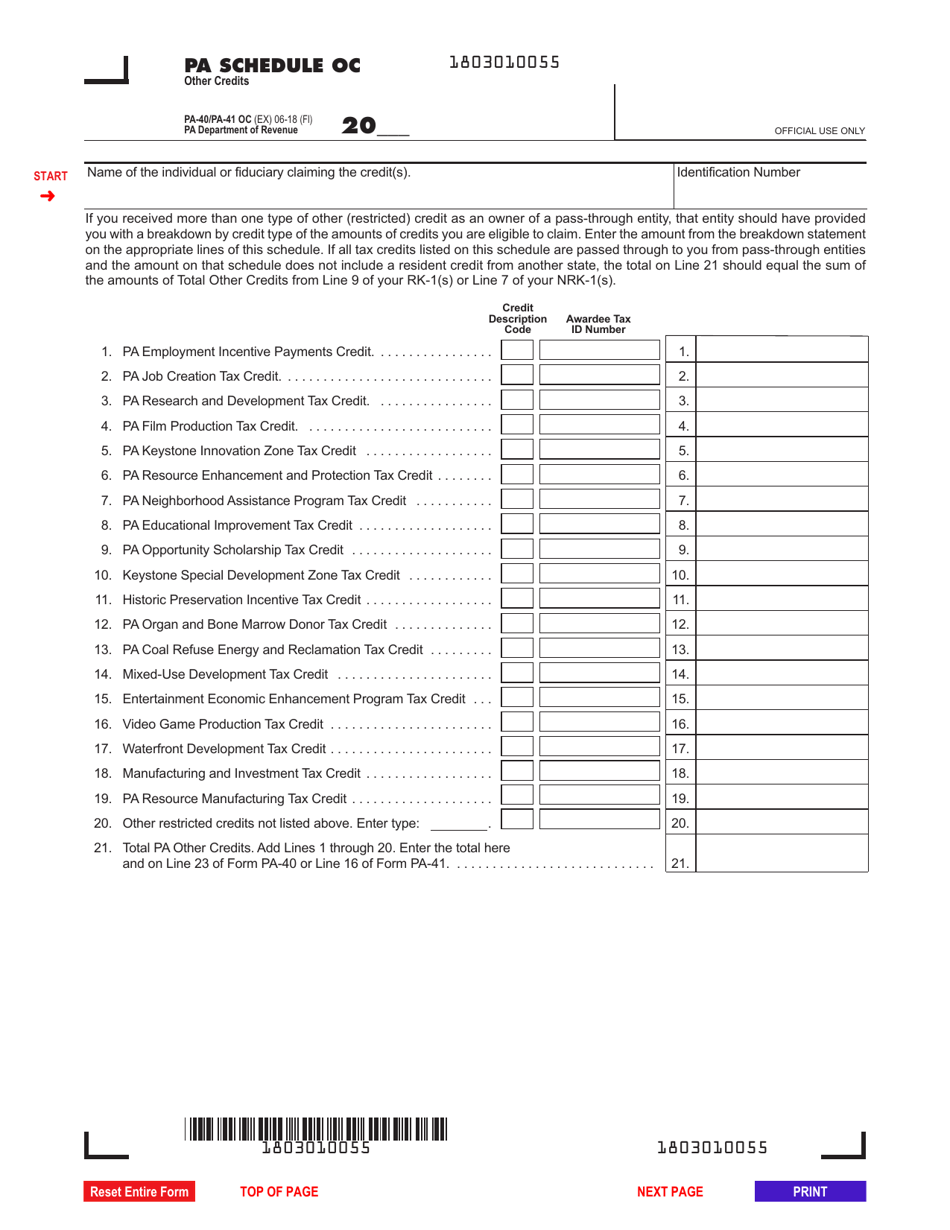

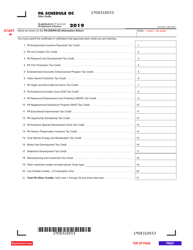

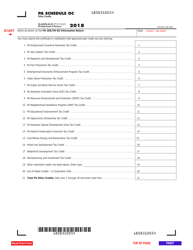

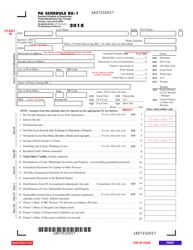

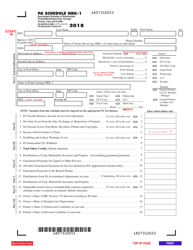

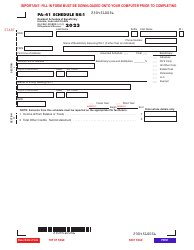

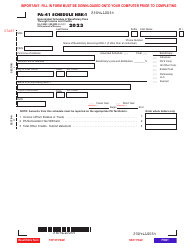

Form PA-40 (PA-41 OC) Schedule OC Other Credits - Pennsylvania

What Is Form PA-40 (PA-41 OC) Schedule OC?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pa Schedule F - Farm Income and Expenses. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

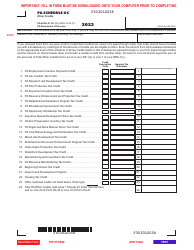

Q: What is Form PA-40 (PA-41 OC) Schedule OC?

A: Form PA-40 (PA-41 OC) Schedule OC is a tax form used in Pennsylvania to report other credits that are not covered by the standard PA-40 form.

Q: Who needs to file Form PA-40 (PA-41 OC) Schedule OC?

A: Anyone who has eligible other credits to claim in Pennsylvania must file Form PA-40 (PA-41 OC) Schedule OC.

Q: What are other credits?

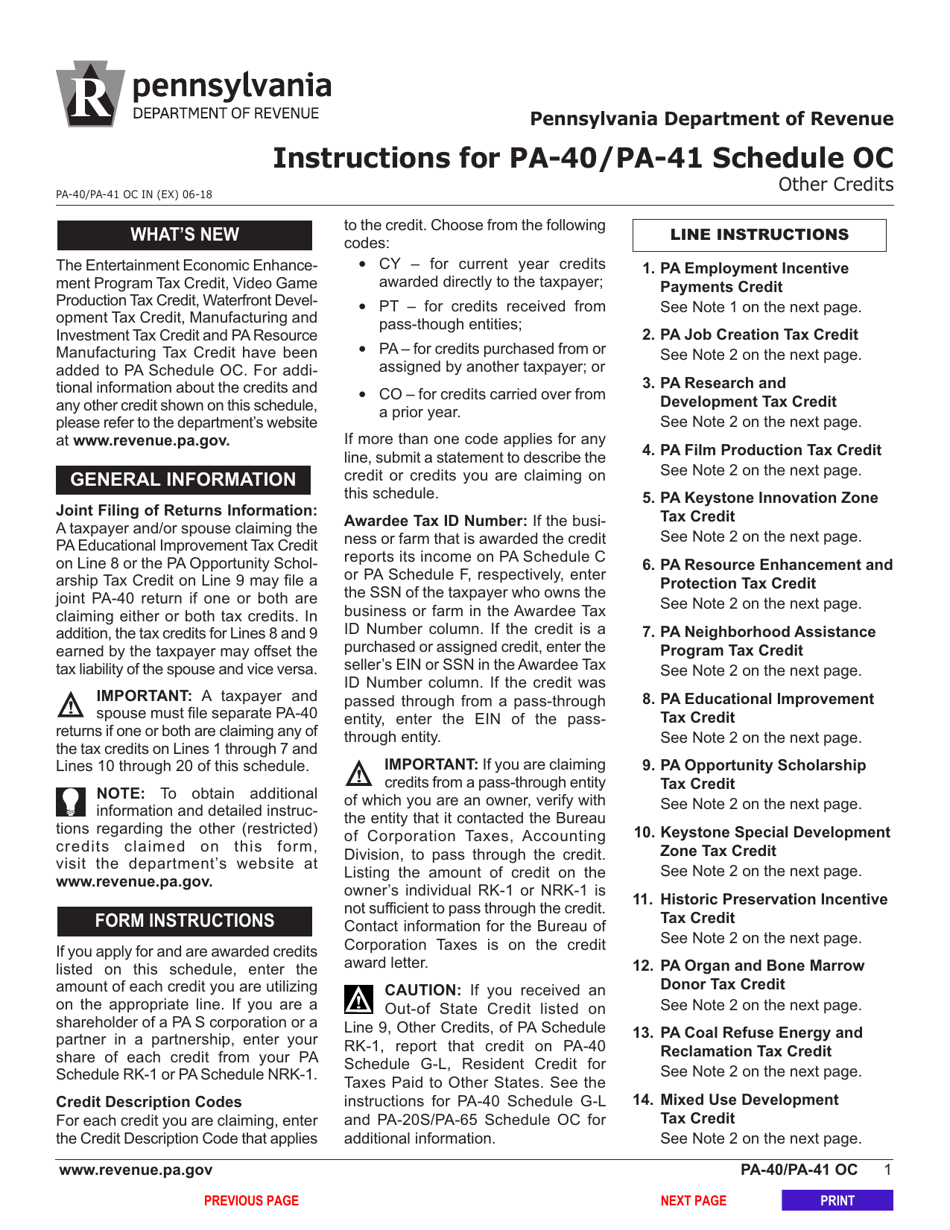

A: Other credits are tax credits that are not accounted for on the standard PA-40 form. Examples include the Educational Improvement Tax Credit and the Film Production Tax Credit.

Q: How do I fill out Form PA-40 (PA-41 OC) Schedule OC?

A: You must provide the required information about the other credits you are claiming, such as the name of the credit, the amount, and any supporting documentation.

Q: When is the deadline to file Form PA-40 (PA-41 OC) Schedule OC?

A: The deadline to file Form PA-40 (PA-41 OC) Schedule OC is the same as the deadline for filing your Pennsylvania state income tax return, which is usually April 15th.

Q: Can I file Form PA-40 (PA-41 OC) Schedule OC electronically?

A: Yes, you can file Form PA-40 (PA-41 OC) Schedule OC electronically using the Pennsylvania Department of Revenue's e-file system.

Q: Is there a fee to file Form PA-40 (PA-41 OC) Schedule OC?

A: There is no fee to file Form PA-40 (PA-41 OC) Schedule OC.

Q: What should I do if I made a mistake on Form PA-40 (PA-41 OC) Schedule OC?

A: If you made a mistake on Form PA-40 (PA-41 OC) Schedule OC, you should correct it as soon as possible by filing an amended Schedule OC form.

Q: Are other credits refundable?

A: Some other credits in Pennsylvania may be refundable, meaning you can receive a refund for any excess credit that exceeds your tax liability.

Form Details:

- Released on June 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 (PA-41 OC) Schedule OC by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.