This version of the form is not currently in use and is provided for reference only. Download this version of

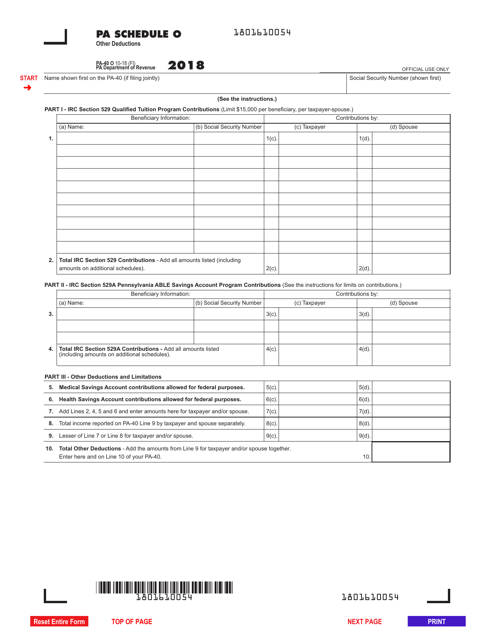

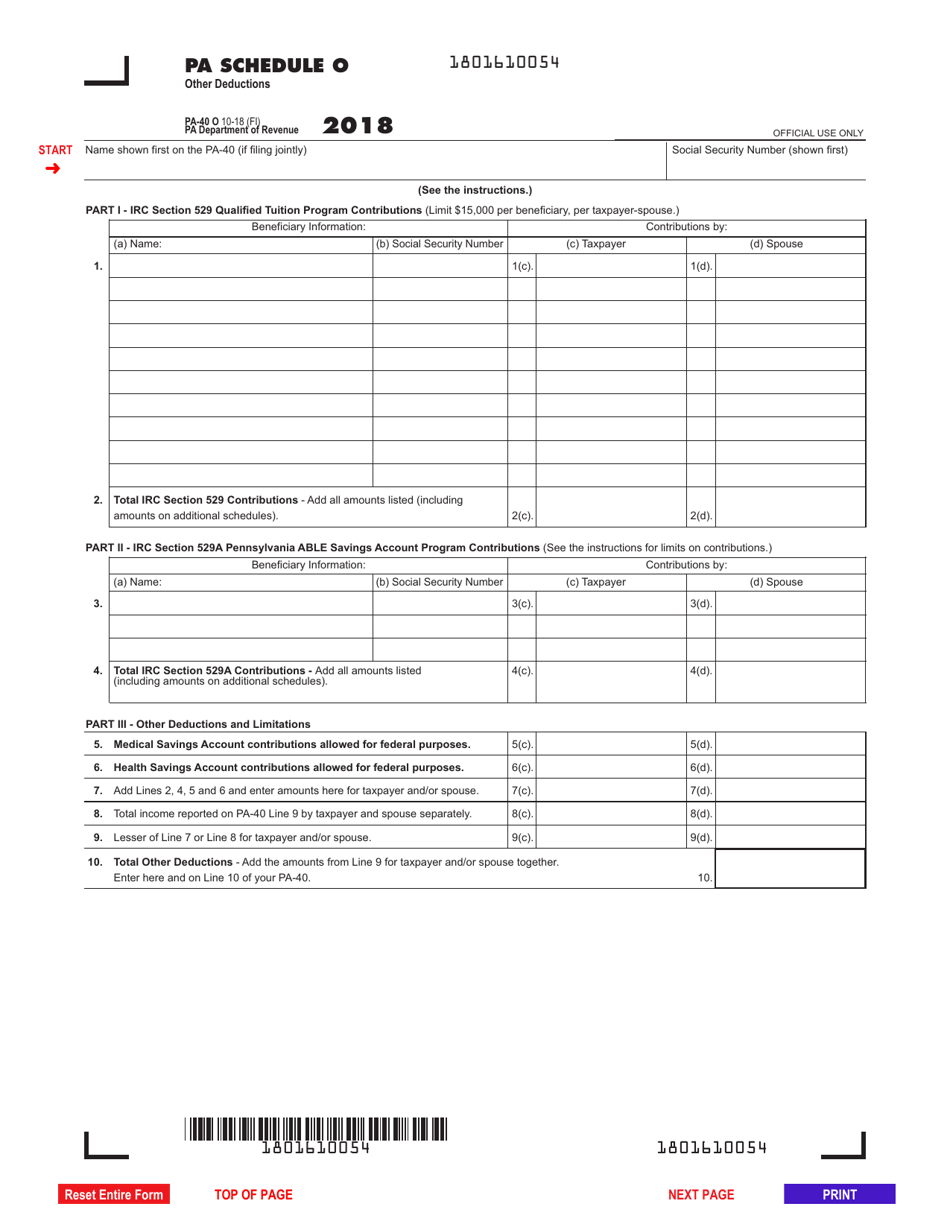

Form PA-40 Schedule O

for the current year.

Form PA-40 Schedule O Other Deductions - Pennsylvania

What Is Form PA-40 Schedule O?

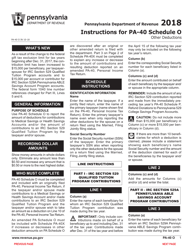

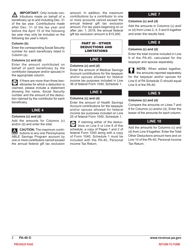

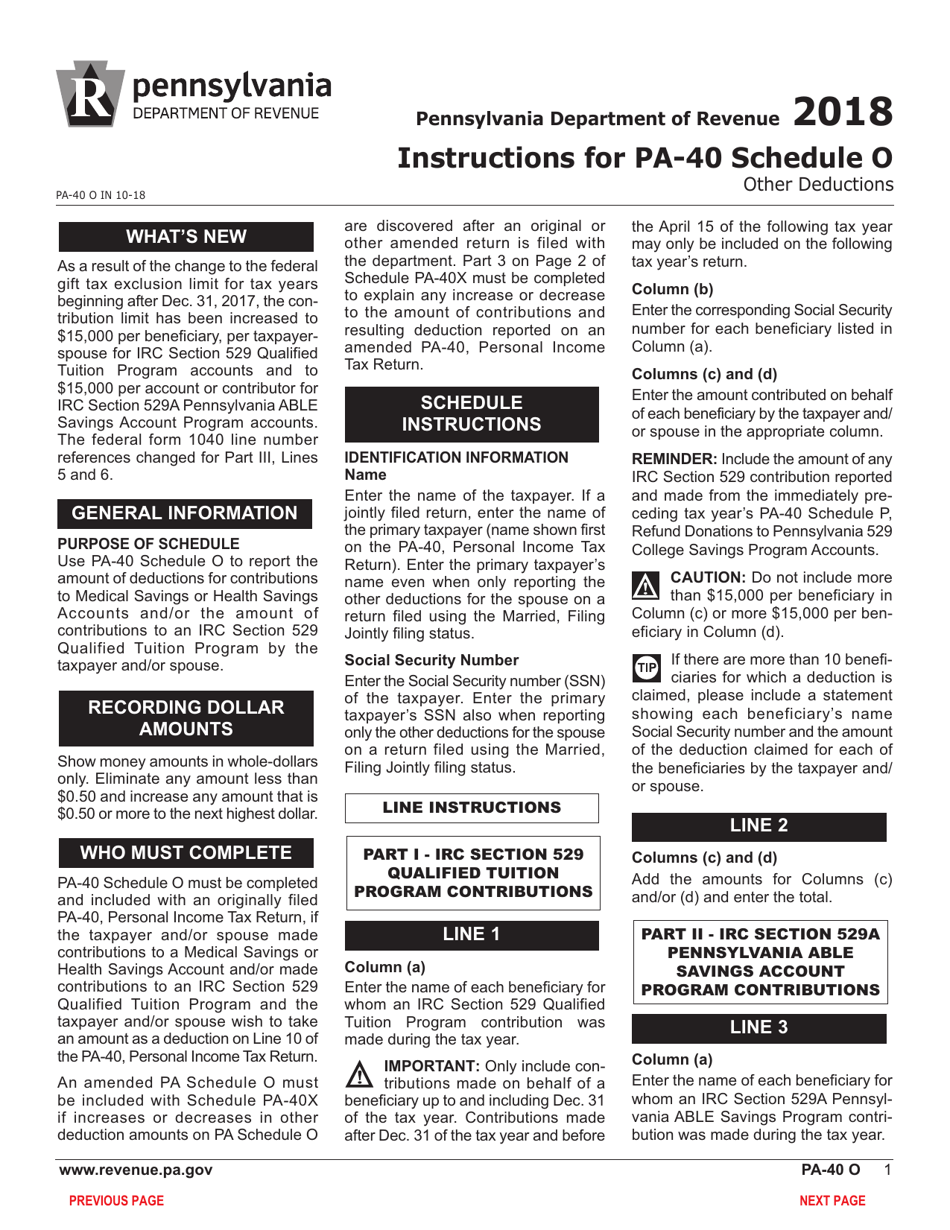

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule O?

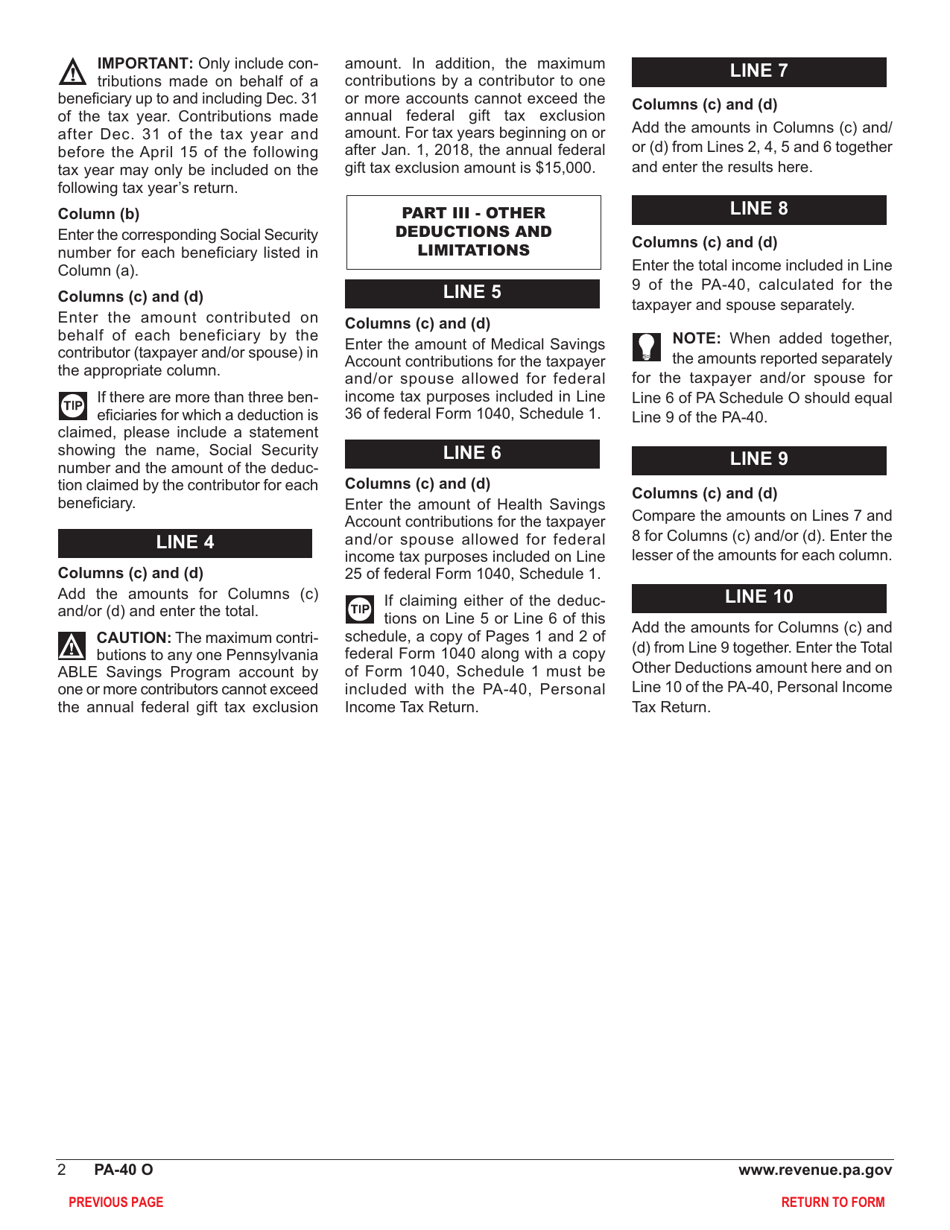

A: Form PA-40 Schedule O is an attachment to the Pennsylvania Personal Income Tax Return (Form PA-40) that is used to report other deductions not directly listed on the main form.

Q: What are some examples of other deductions reported on Form PA-40 Schedule O?

A: Some examples of other deductions that may be reported on Form PA-40 Schedule O include unreimbursed employee business expenses, deductible portion of educator expenses, and certain other itemized deductions.

Q: Who needs to file Form PA-40 Schedule O?

A: You may need to file Form PA-40 Schedule O if you have other deductions to report that are not directly included on the main Form PA-40.

Q: Is there a deadline for filing Form PA-40 Schedule O?

A: The deadline for filing Form PA-40 Schedule O is the same as the deadline for filing the Pennsylvania Personal Income Tax Return (Form PA-40), which is typically April 15th.

Q: Is there a penalty for not filing Form PA-40 Schedule O?

A: If you are required to file Form PA-40 Schedule O and fail to do so, you may be subject to penalties and interest on any unpaid taxes.

Q: Can I e-file Form PA-40 Schedule O?

A: Yes, you can e-file Form PA-40 Schedule O along with your Pennsylvania Personal Income Tax Return (Form PA-40) using approved tax software or through a tax professional who offers e-filing services.

Q: Do I need to keep a copy of Form PA-40 Schedule O?

A: Yes, it is recommended to keep a copy of Form PA-40 Schedule O and any supporting documentation for your records in case of future audits or inquiries from the Pennsylvania Department of Revenue.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule O by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.