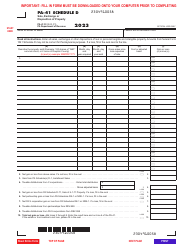

This version of the form is not currently in use and is provided for reference only. Download this version of

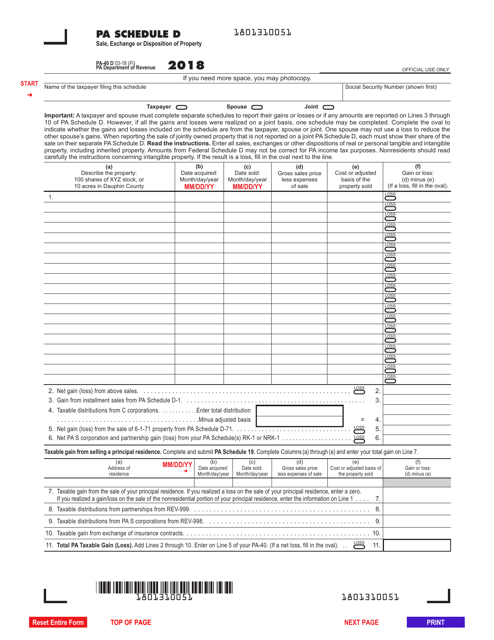

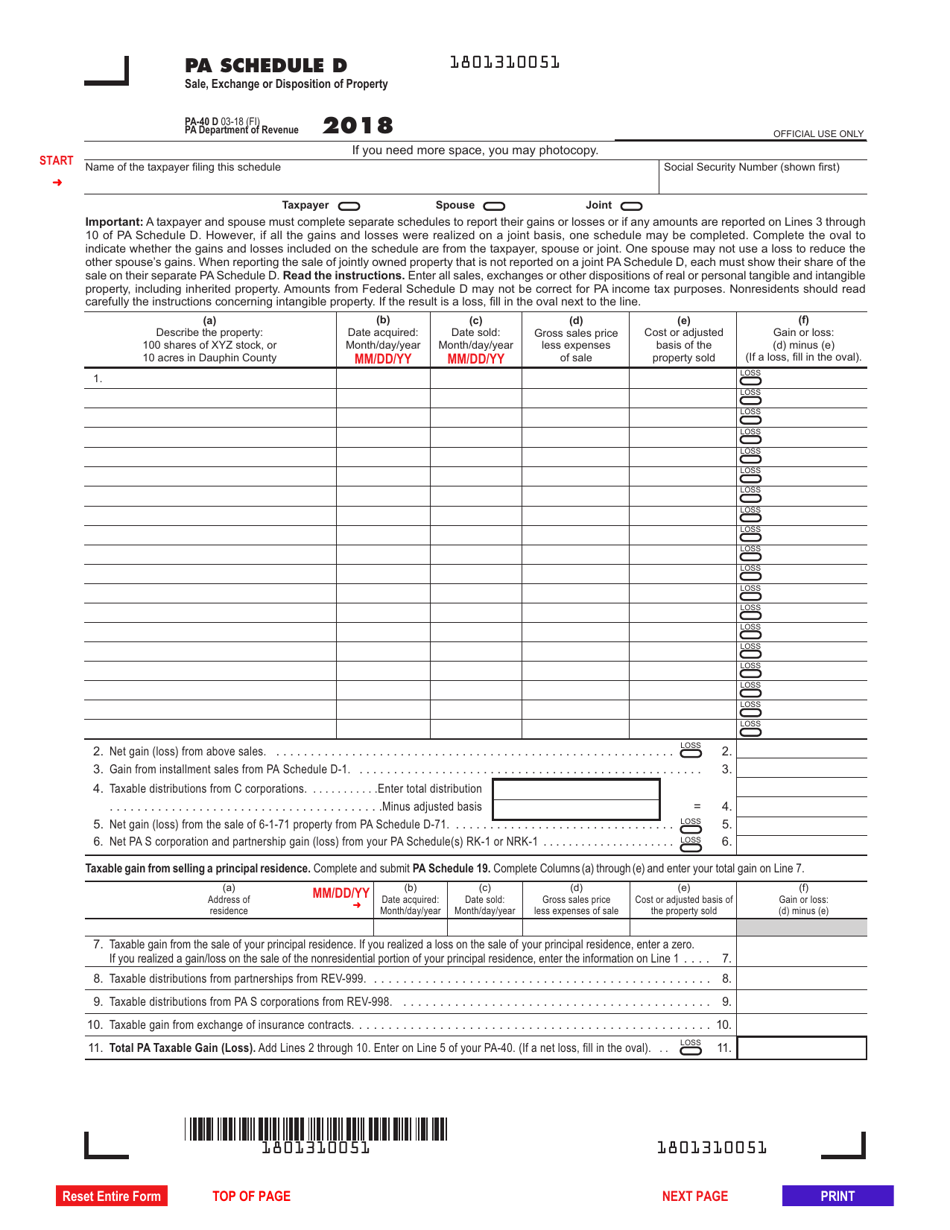

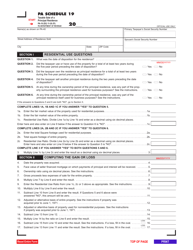

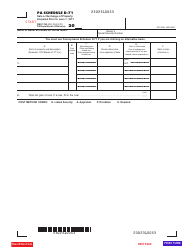

Form PA-40 Schedule D

for the current year.

Form PA-40 Schedule D Sale, Exchange or Disposition of Property - Pennsylvania

What Is Form PA-40 Schedule D?

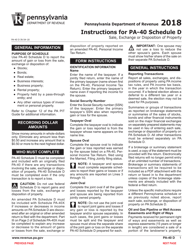

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule D?

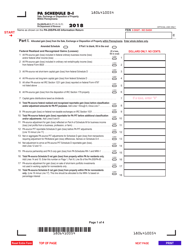

A: Form PA-40 Schedule D is a tax form used in Pennsylvania to report the sale, exchange, or disposition of property.

Q: What should I use Form PA-40 Schedule D for?

A: You should use Form PA-40 Schedule D to report any gains or losses from the sale, exchange, or disposition of property in Pennsylvania.

Q: When is Form PA-40 Schedule D due?

A: Form PA-40 Schedule D is generally due on the same date as your Pennsylvania state tax return, which is April 15th.

Q: Do I need to file Form PA-40 Schedule D if I didn't have any property sales or dispositions?

A: If you didn't have any property sales or dispositions during the tax year, you generally don't need to file Form PA-40 Schedule D.

Form Details:

- Released on March 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule D by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.