This version of the form is not currently in use and is provided for reference only. Download this version of

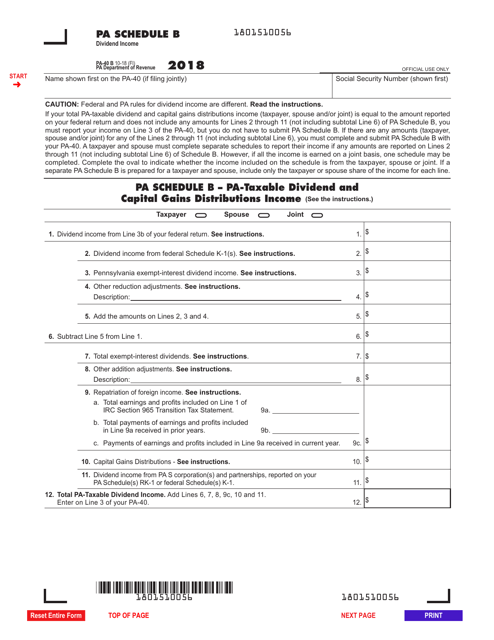

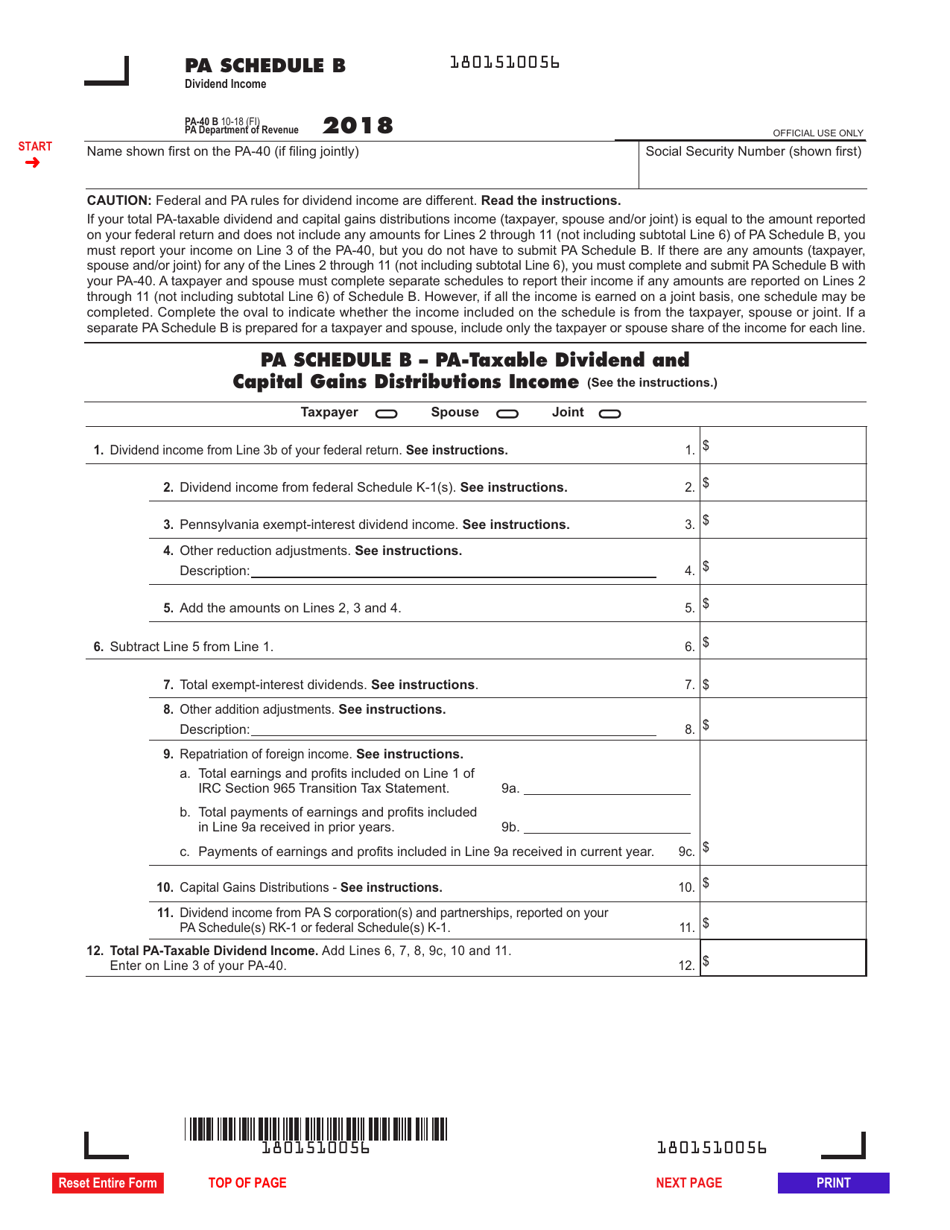

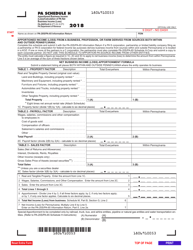

Form PA-40 Schedule B

for the current year.

Form PA-40 Schedule B Dividend Income - Pennsylvania

What Is Form PA-40 Schedule B?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania.The document is a supplement to Form PA-40, Pennsylvania Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40 Schedule B?

A: Form PA-40 Schedule B is a tax form used to report dividend income in the state of Pennsylvania.

Q: Who needs to file Form PA-40 Schedule B?

A: Pennsylvania residents who have received dividend income during the tax year need to file Form PA-40 Schedule B.

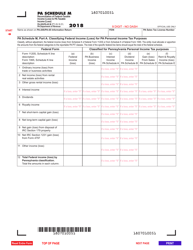

Q: What type of dividend income should be reported on Form PA-40 Schedule B?

A: Any dividend income received from stocks, mutual funds, or other investments should be reported on Form PA-40 Schedule B.

Q: How do I fill out Form PA-40 Schedule B?

A: You will need to provide information about the dividend income you received, such as the name of the company or fund, the amount of dividends received, and any taxes withheld.

Q: When is the deadline to file Form PA-40 Schedule B?

A: Form PA-40 Schedule B is typically filed along with the Pennsylvania state income tax return, which is due on April 15th of each year.

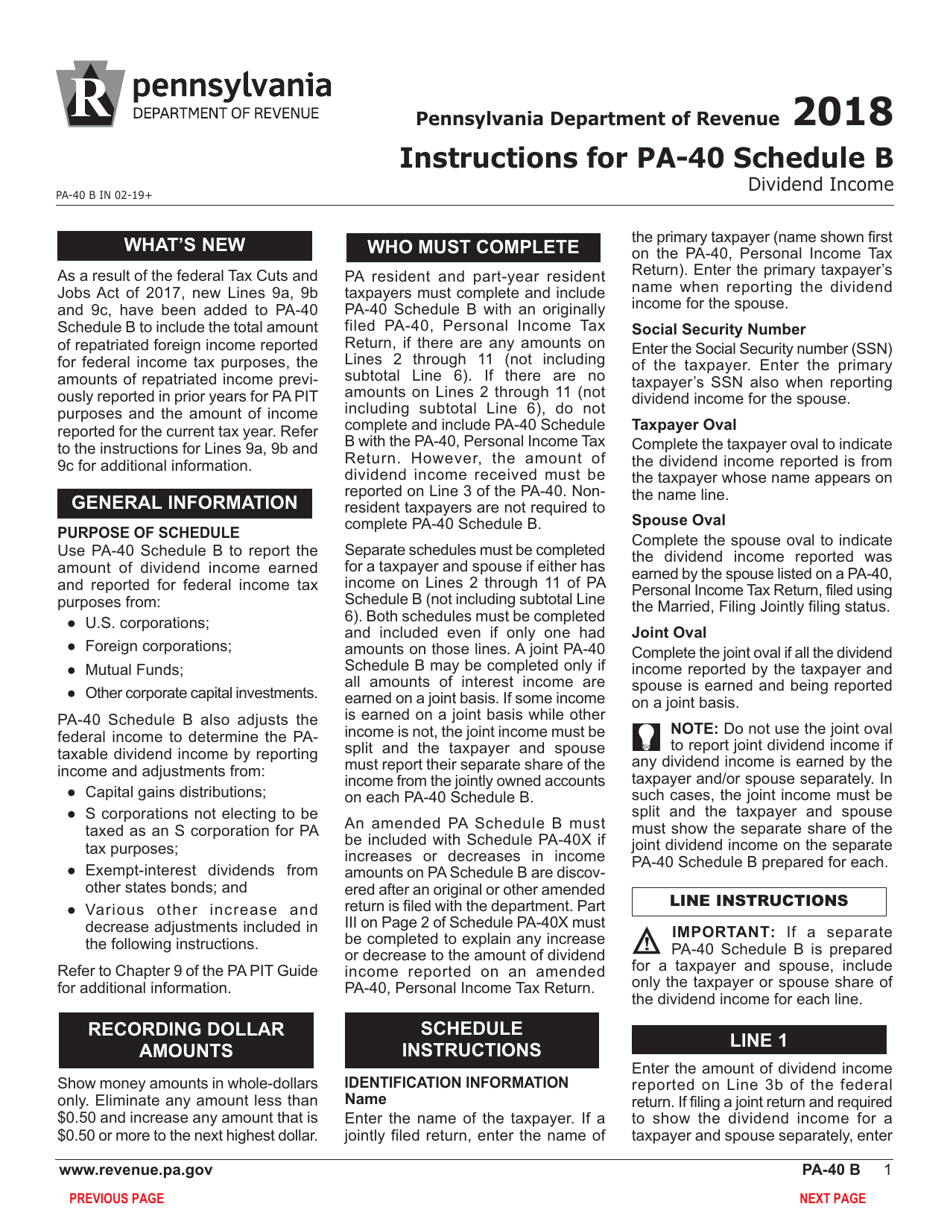

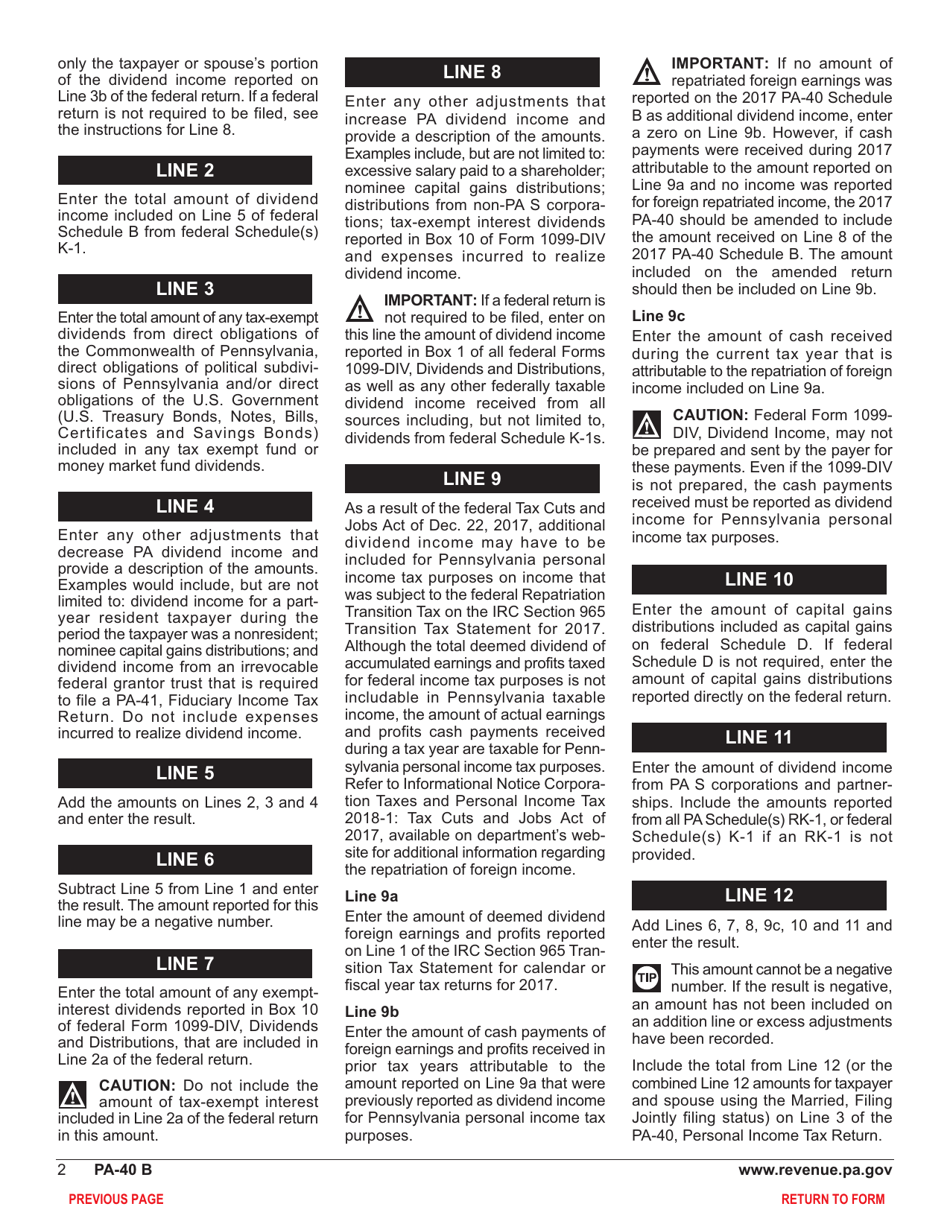

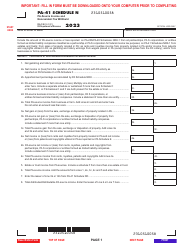

Q: Are there any special instructions for filling out Form PA-40 Schedule B?

A: Yes, make sure to read the instructions provided with the form carefully to ensure that you are including all relevant information and filling out the form correctly.

Q: Can I file Form PA-40 Schedule B electronically?

A: Yes, Pennsylvania residents can file Form PA-40 Schedule B electronically using the state's e-file system or through approved tax software.

Q: What happens if I don't file Form PA-40 Schedule B?

A: If you fail to report dividend income on Form PA-40 Schedule B, you may face penalties or interest charges from the state of Pennsylvania.

Q: Is Form PA-40 Schedule B required for non-residents of Pennsylvania?

A: No, non-residents of Pennsylvania do not need to file Form PA-40 Schedule B unless they have earned dividend income specifically from sources within Pennsylvania.

Form Details:

- Released on October 1, 2018;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40 Schedule B by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.